Are you wondering how to navigate the tricky waters of acknowledging a bad debt write-off? You're not alone, as many businesses face this challenge. Writing a clear and concise acknowledgment letter can help maintain professionalism while keeping your records straight. If you're interested in learning more about this process and sample templates, keep reading!

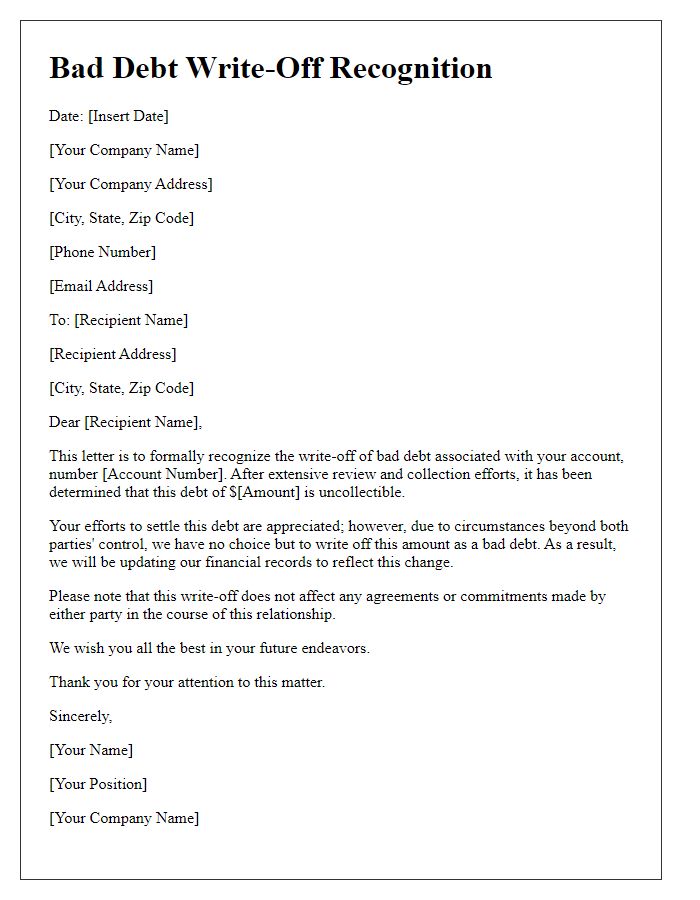

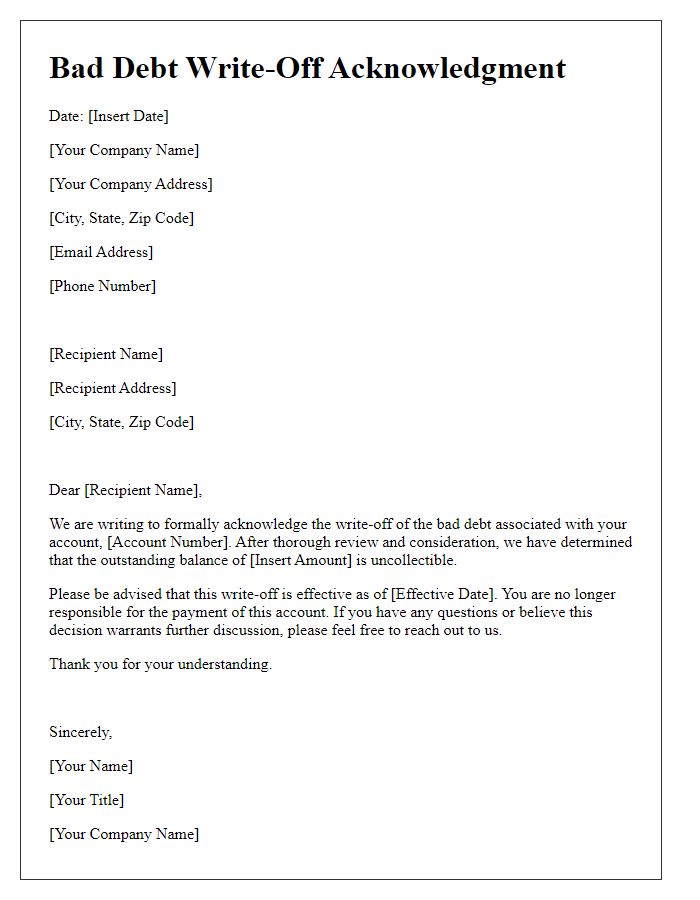

Creditor and Debtor Information

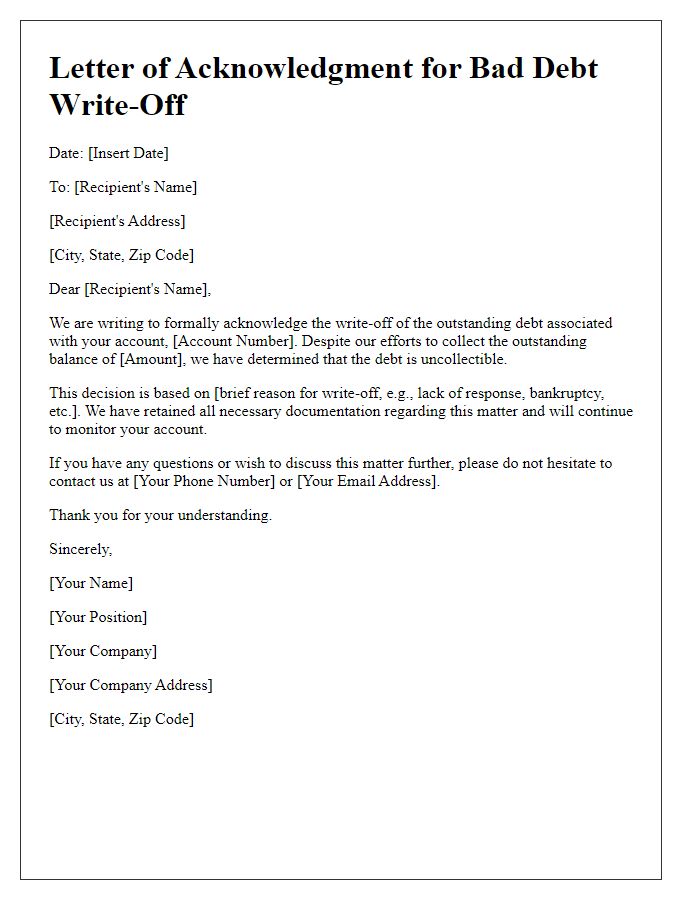

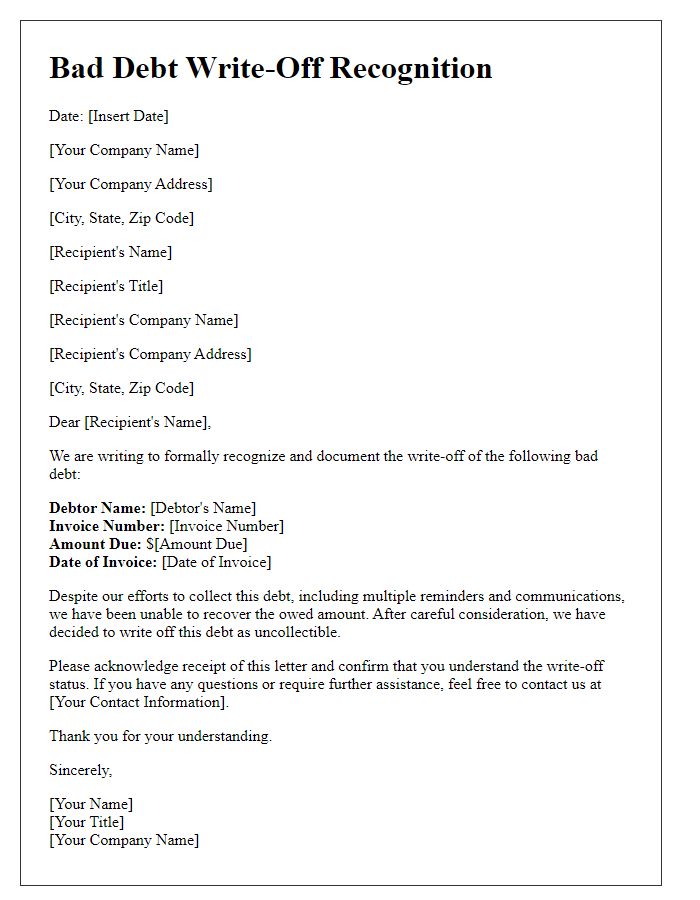

Acknowledgment of bad debt write-off refers to the formal recognition that an account receivable is unlikely to be collected. This process often involves documenting key information about both the creditor and debtor to provide a clear record. The creditor is the business or individual that is owed money, while the debtor is the one who has defaulted on their financial obligation. Essential details include the creditor's name (like ABC Corp), the debtor's name (such as John Doe Enterprises), the original amount owed (for instance, $10,000), the date of the original transaction (maybe January 15, 2022), and the reason for the write-off (e.g., bankruptcy filing by the debtor on September 1, 2023). Recording this information is vital for accounting and tax purposes, as well as for maintaining an accurate financial ledger.

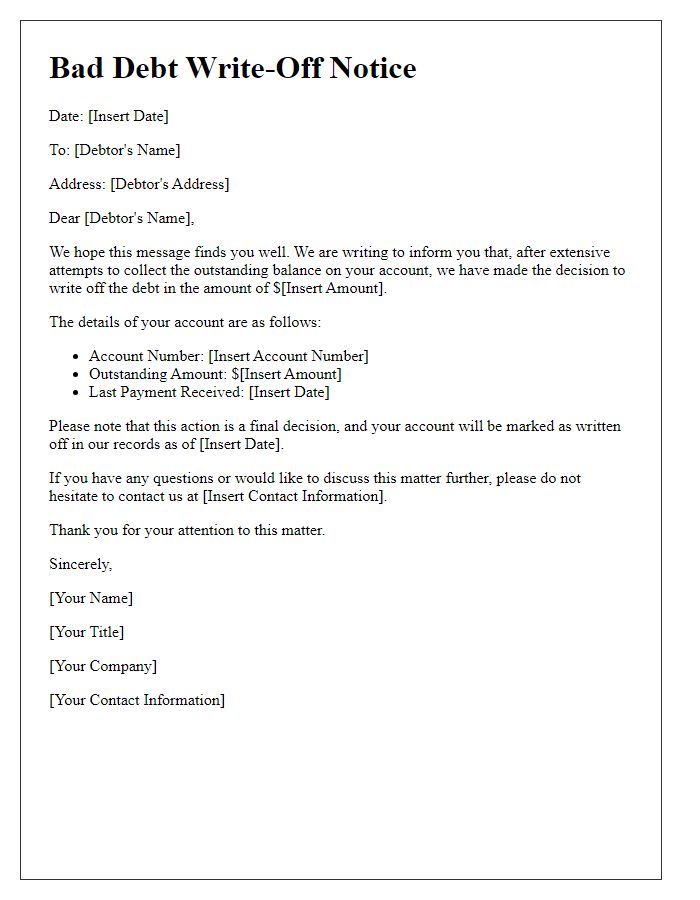

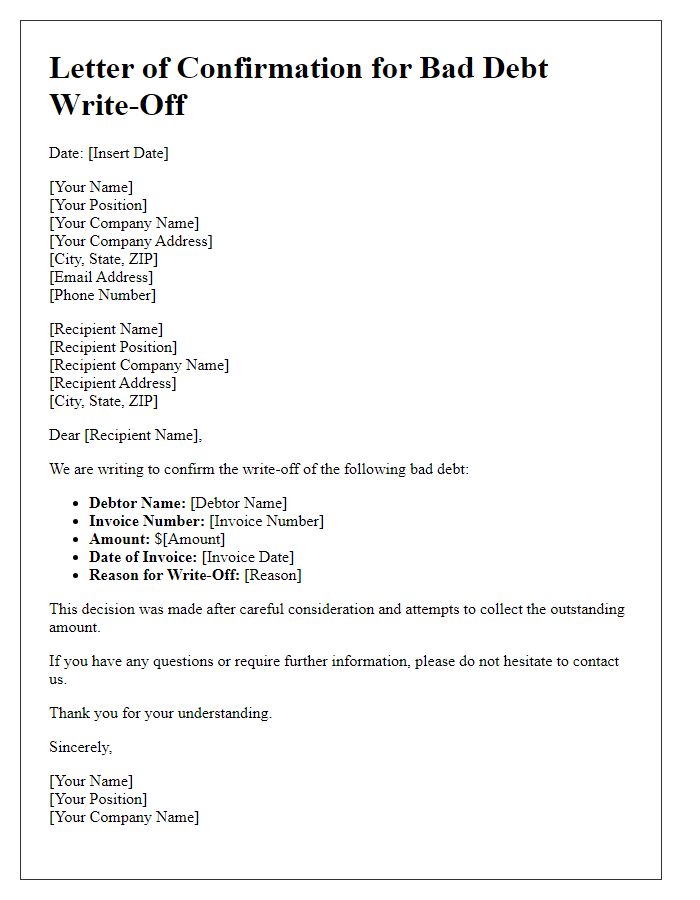

Debt Details (amount, original date)

A bad debt write-off acknowledgment formally recognizes the cancellation of an outstanding debt, often necessary for accounting and financial record keeping. For instance, a company may have a bad debt of $5,000 from a customer account established on January 15, 2020. This acknowledgment serves to document the decision made after multiple collection attempts and discussions with the client. It highlights the financial responsibility and maintains transparency in the company's books. By noting such details, the company can manage its assets effectively and report accurate figures in its financial statements, especially when preparing for audits or investor relations.

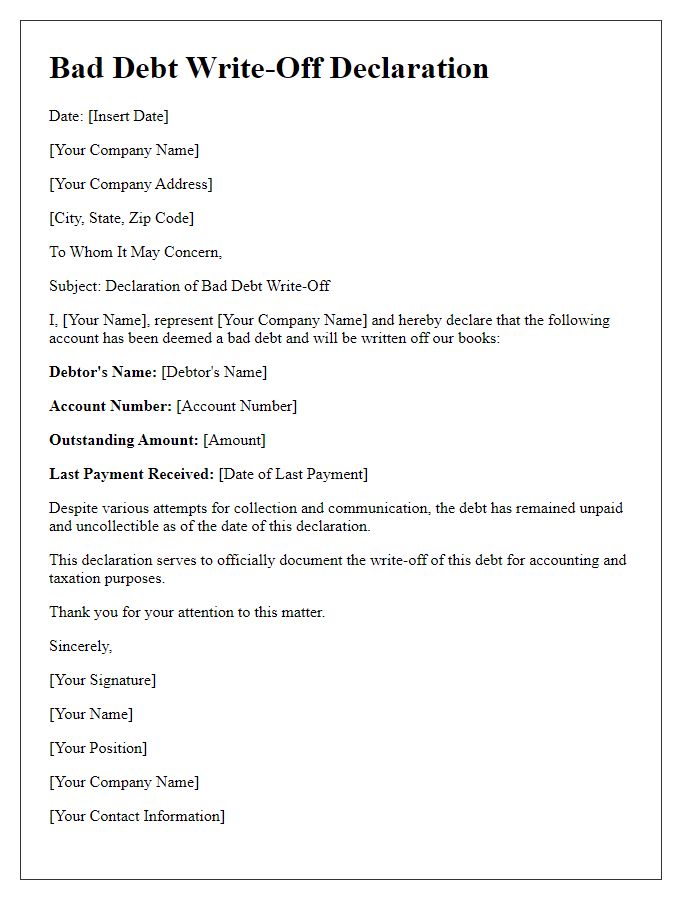

Write-off Justification

A bad debt write-off acknowledgment is a formal statement confirming the decision to categorize a previously recorded receivable as uncollectible. In accounting, a write-off is typically categorized under the allowance method, where accounts receivable (the money owed to a business) are assessed periodically to determine potential losses due to customers' insolvency. Factors contributing to this adjustment may include prolonged non-payment beyond the standard collection period of 60 to 90 days, bankruptcy filings by the debtor, or significant changes in the debtor's financial status noticed through credit reports. Proper documentation of these circumstances is crucial for accurate financial reporting and maintaining adherence to Generally Accepted Accounting Principles (GAAP). The write-off directly impacts financial statements, reducing the accounts receivable balance and reflecting diminished assets while simultaneously acknowledging an expense in the income statement, highlighting the financial risk of the debtor's failure to pay.

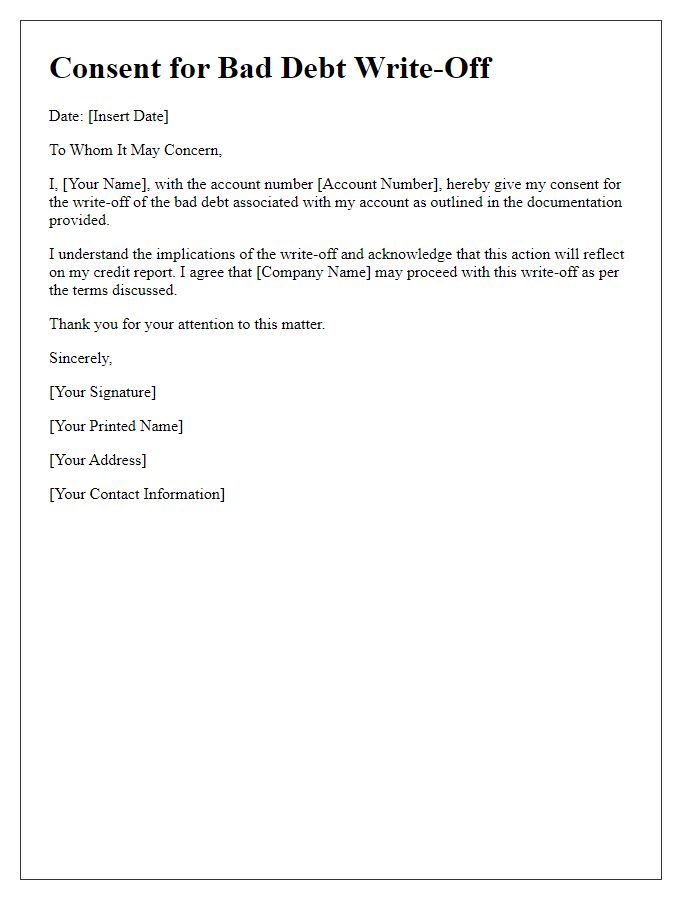

Legal Disclaimer and Acknowledgment

A bad debt write-off acknowledgment typically involves recognizing the loss of an uncollectible account, often due to non-payment after extensive collection efforts. The acknowledgment serves as an official record for accounting purposes, reflecting the decision to remove a specific debtor's outstanding balance from the financial statements. This documentation is crucial in maintaining accurate financial records and complying with legal and tax regulations. Businesses must also be aware of the potential impacts on credit reporting and future dealings with the debtor. A legal disclaimer included in the acknowledgment asserts the company's right to take necessary actions in the future if circumstances change.

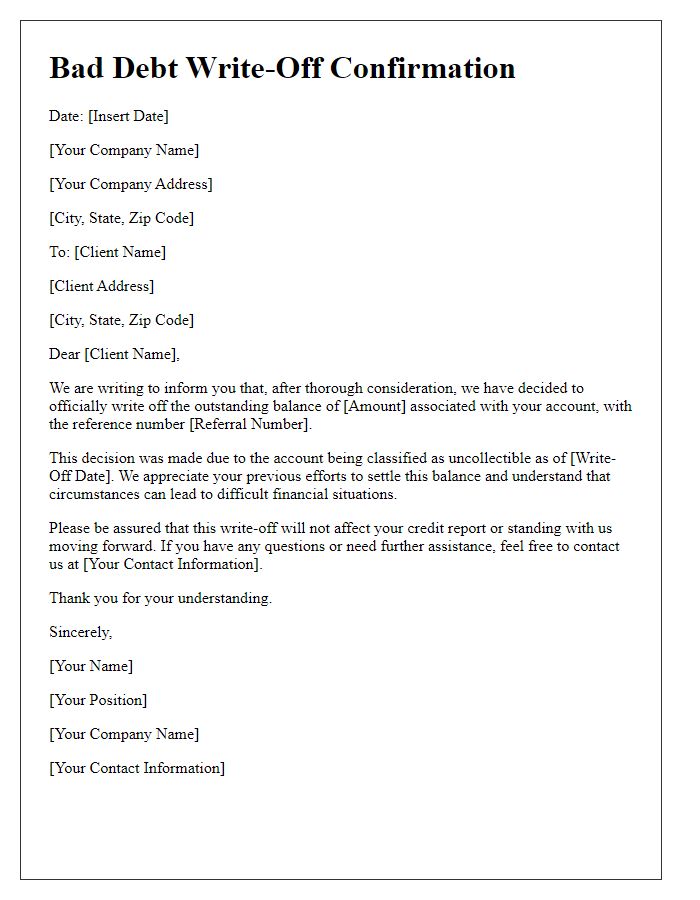

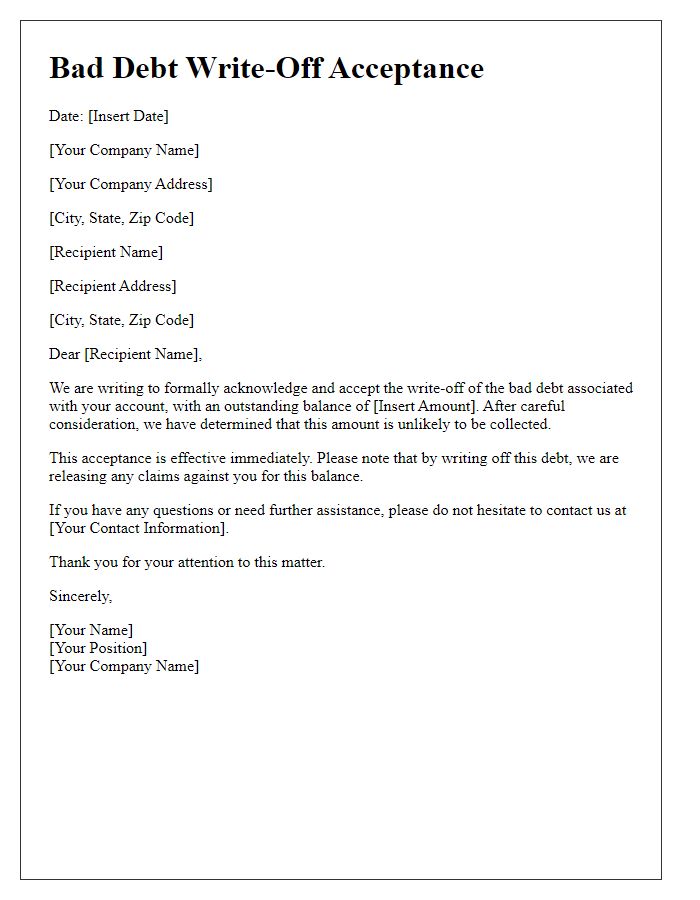

Closing Statements and Contact Information

Businesses often encounter situations requiring bad debt write-off acknowledgment as part of their financial management process. In such cases, it is essential to prepare thorough closing statements outlining the outstanding amounts, dates of transactions, and the reasons for the write-off. Accurate documentation should detail specific accounts impacted, ensuring compliance with accounting standards. Clear contact information for customer service or debt management teams must also be provided, facilitating any necessary communication regarding the status of the debt. This transparency helps maintain professional relationships and aids in potential future transactions.

Comments