Are you ready to take control of your financial future? In our upcoming financial goal-setting session, we'll explore practical strategies to help you define and achieve your monetary aspirations. Whether you're aiming to save for a dream vacation, pay off debt, or invest for retirement, this session is designed to empower you with the tools and knowledge you need. Join us as we embark on this exciting journey to financial freedomâread on to learn more!

Clear objective definition

Setting clear financial objectives is crucial for achieving long-term fiscal stability and growth. Specific goals, such as saving $20,000 for a home down payment within three years, create a concrete target to focus on. An objective like reducing monthly expenses by 15% helps in budgeting effectively, while increasing retirement contributions by 10% ensures better long-term security. Tracking progress regularly against these defined objectives can highlight successes or areas needing adjustment. Tools such as financial apps or budget spreadsheets often aid in monitoring these objectives and maintaining motivation.

Participant details and roles

In a financial goal-setting session, participant details may include names, roles, and contact information of each attendee. Roles could be outlined as follows: Financial Advisor with expertise in investment strategies, Budget Analyst focused on expenditure tracking, and Client Liaison responsible for communication between stakeholders. Additionally, attendees could include a Tax Consultant who specializes in optimizing tax liabilities and a Portfolio Manager adept at asset allocation. Each participant plays a crucial role in ensuring the effectiveness of the session, contributing insights to establish and refine short-term and long-term financial objectives. Detailed notes on their previous experiences with financial planning can enhance the session's productivity.

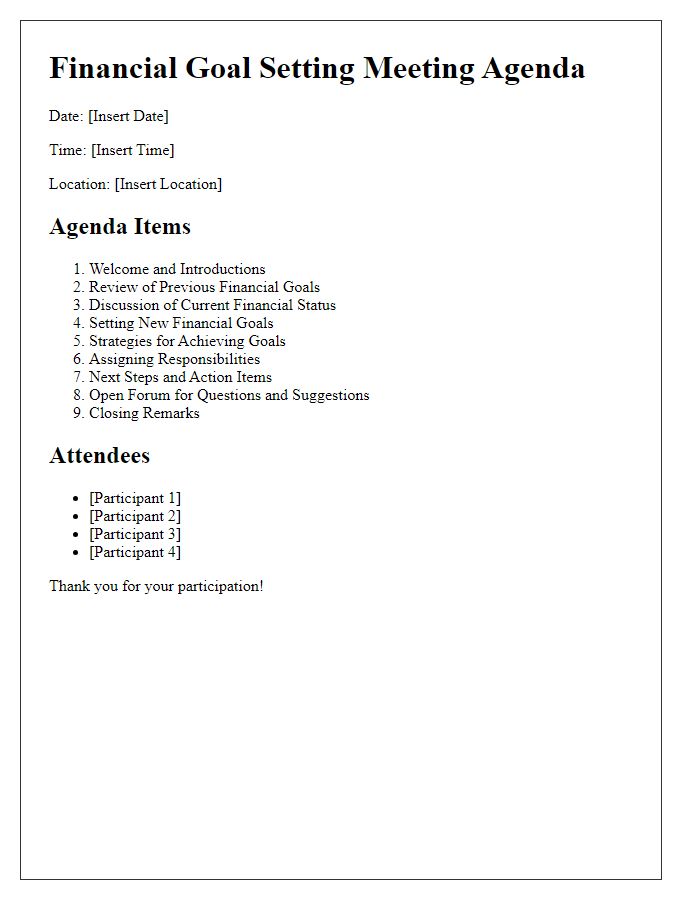

Agenda and schedule

The Financial Goal Setting Session focuses on establishing clear financial objectives, strategies for achieving them, and tracking progress, typically spanning over a two-hour timeframe. Participants will gather in the conference room at XYZ Corporate Headquarters, located at 123 Finance Avenue, New York City, on November 15, 2023. The session begins with an introduction to financial literacy concepts, highlighting the importance of budgeting, saving, and investing. Following this, there will be a presentation outlining SMART goal-setting techniques (Specific, Measurable, Achievable, Relevant, Time-bound). Participants will then engage in breakout discussions, setting individual and group financial goals. The session concludes with a Q&A segment, allowing for clarification and sharing insights. A follow-up meeting is scheduled for December 20, 2023, to assess progress and recalibrate goals as necessary.

Resources and materials needed

For a successful financial goal-setting session, essential resources include a comprehensive budget planner, which helps track income and expenditures; a variety of worksheets for defining short-term and long-term financial objectives, such as house purchasing or retirement funding; visual aids like charts that illustrate investment growth over time and savings projections; calculators specifically for budgeting or forecasting returns on investments; and a selection of financial literacy books or guides, detailing concepts like compound interest or debt management. Additionally, ensure access to digital tools or apps like Mint or YNAB (You Need A Budget) that streamline the budgeting process. A quiet, distraction-free setting such as a conference room or home office can foster focused discussions, making the session more productive. Finally, having whiteboards or flip charts can facilitate brainstorming and mapping out actionable steps towards achieving financial goals.

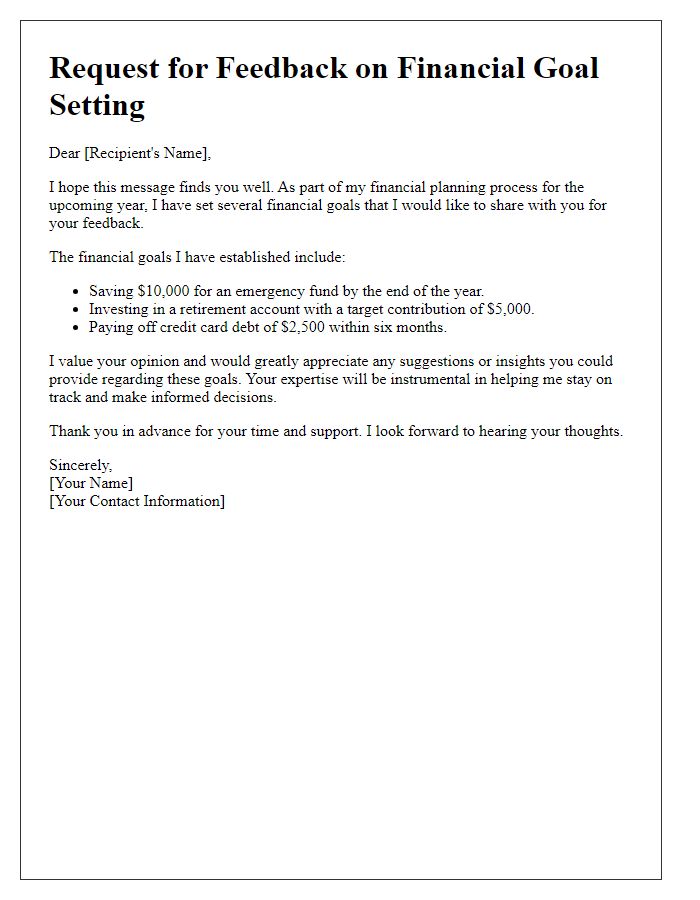

Follow-up actions and accountability

During financial goal-setting sessions, participants often outline specific objectives, such as saving $10,000 by the end of the fiscal year, reducing debt by 15% within six months, or increasing investment contributions by 20% per quarter. Follow-up actions may include establishing a monthly budget review process, utilizing financial tracking apps like Mint or YNAB (You Need A Budget), and scheduling regular meetings, possibly every four weeks, to assess progress and adjust strategies. Accountability measures could involve setting up a peer accountability group or partnering with a financial coach for guidance. Participants may also consider documenting goals and actions in a shared online workspace, such as Google Docs, to ensure transparency and facilitate ongoing support.

Comments