Are you looking to streamline your accounts payable cash allocation process? In today's fast-paced business environment, managing payments efficiently is crucial for maintaining healthy cash flow and vendor relationships. Optimizing your cash allocation not only reduces errors but also improves overall financial clarity. Dive into our article to discover a comprehensive letter template that will simplify your accounts payable operations!

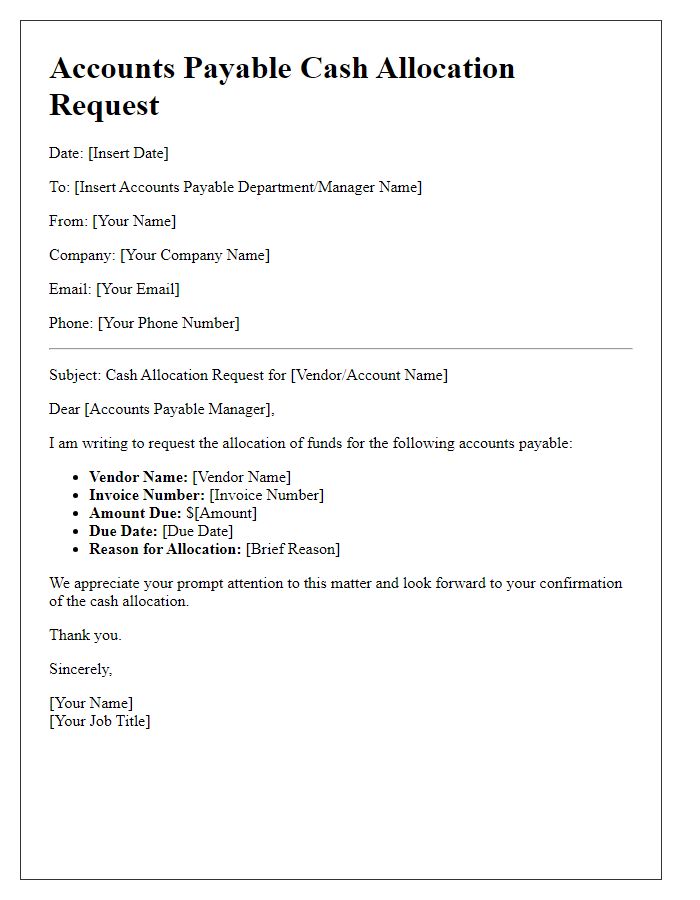

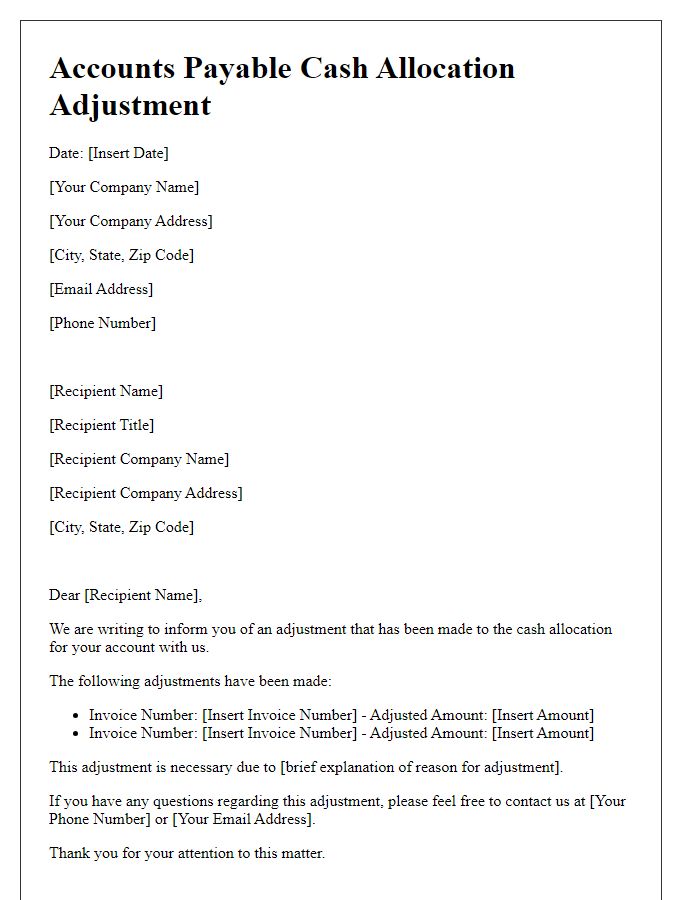

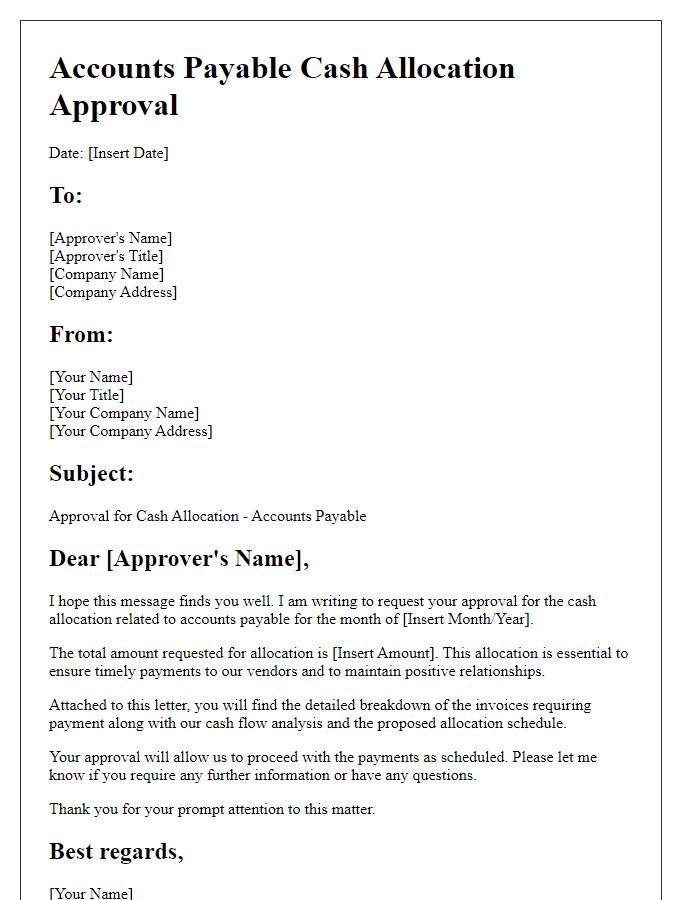

Company Information

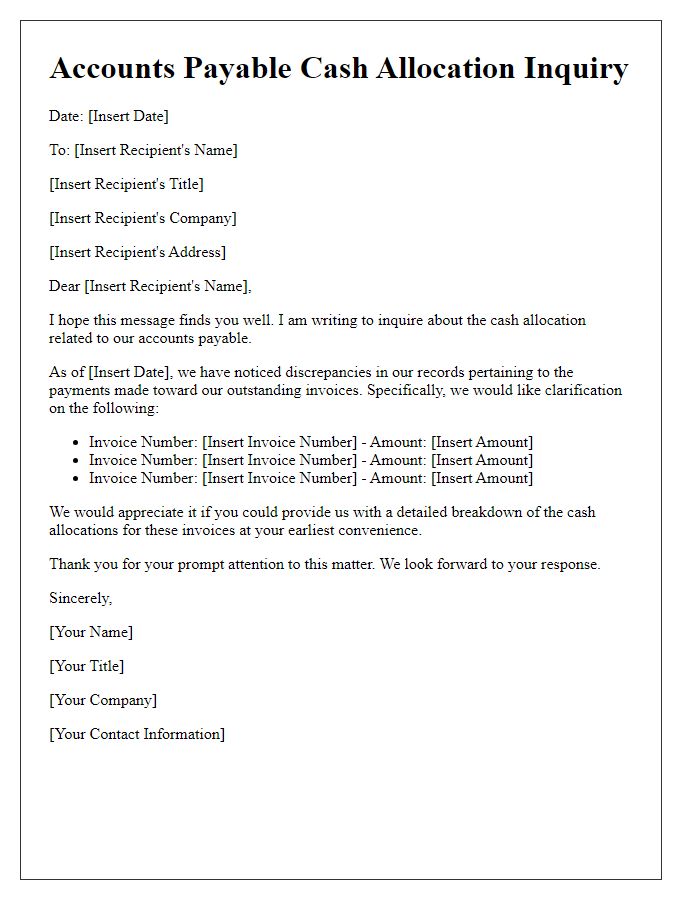

Accounts payable cash allocation is a critical financial process for organizations, such as corporations or small businesses, managing their expenditures. Accurate cash allocation helps ensure that invoices from vendors, suppliers, and service providers are paid timely. This process involves reviewing accounts payable reports, which track outstanding payments, and matching them against available cash reserves, ensuring that funds align with scheduled payables. Effective allocation strategies can improve cash flow management, prevent late fees, and maintain strong relationships with creditors. In various industries, such as manufacturing or retail, precise cash allocation processes are essential for operational efficiency and financial health. Proper documentation, such as bank statements and payment confirmations, enhances transparency in financial reporting.

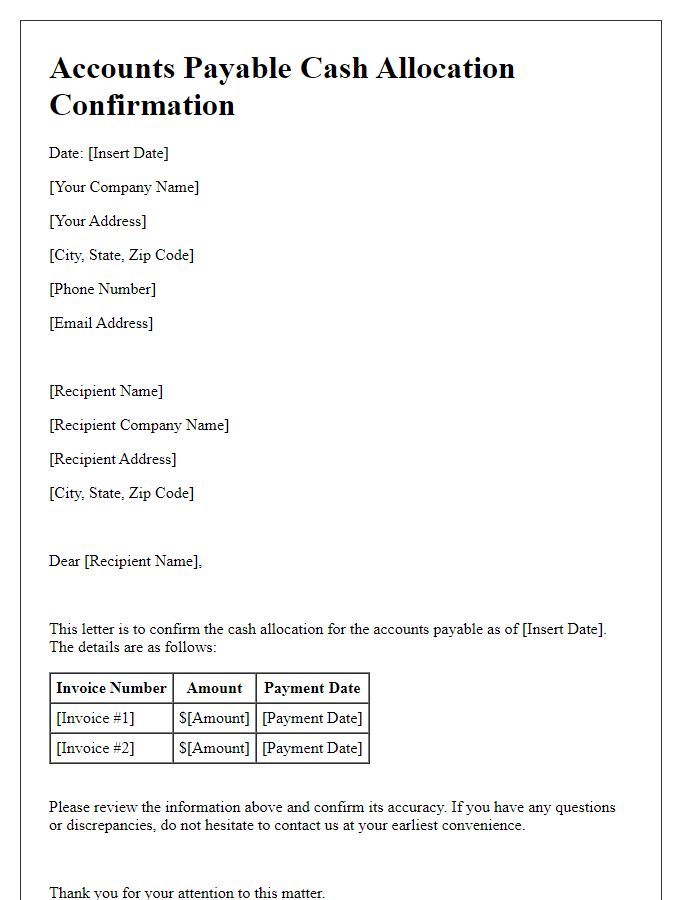

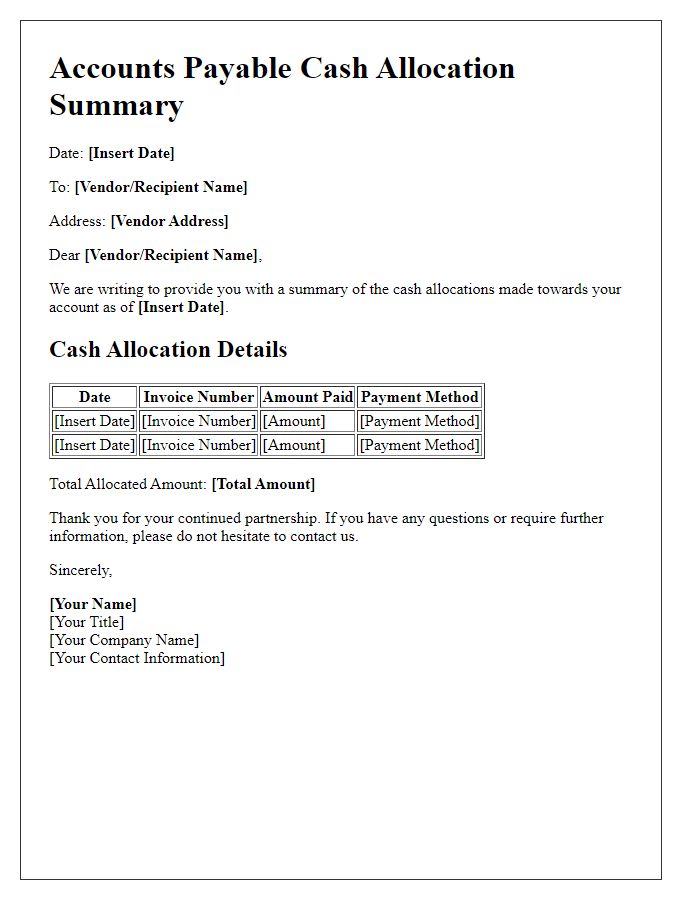

Invoice Details

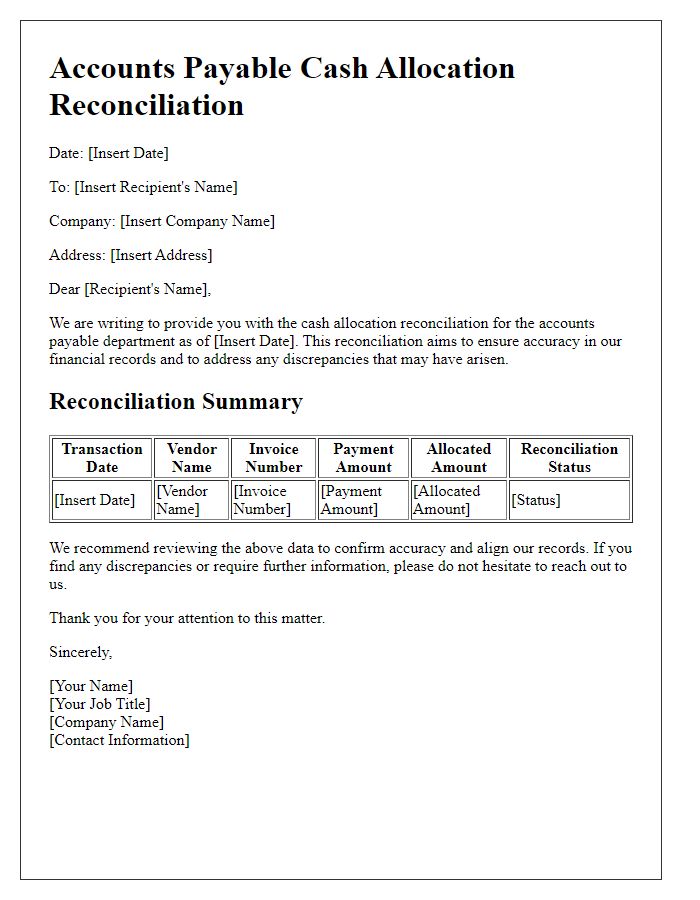

Accounts payable processes involve the allocation of cash towards invoices received from vendors. Each invoice, categorized by a unique identifier (invoice number), represents a specific transaction for goods or services provided. The due date usually ranges from 30 to 90 days, indicating when payment is expected. Payment terms, such as Net 30 or Net 60, outline the period allowed for payment without penalty. Accurate cash allocation requires referencing purchase orders, which correspond to specific invoices, ensuring that funds are applied correctly. A completed reconciliation process helps maintain transparency in financial records, tracking all applied payments against outstanding invoices to manage cash flow effectively. Invoices might also include tax details, such as sales tax or VAT, impacting the total amount due. Proper handling of cash allocation can enhance supplier relationships and maintain favorable credit terms.

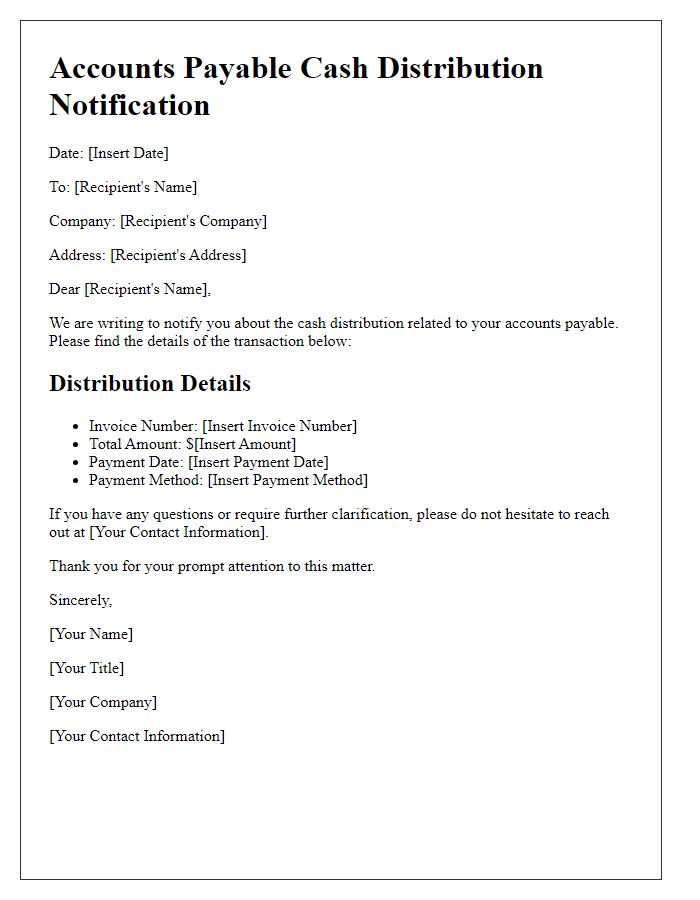

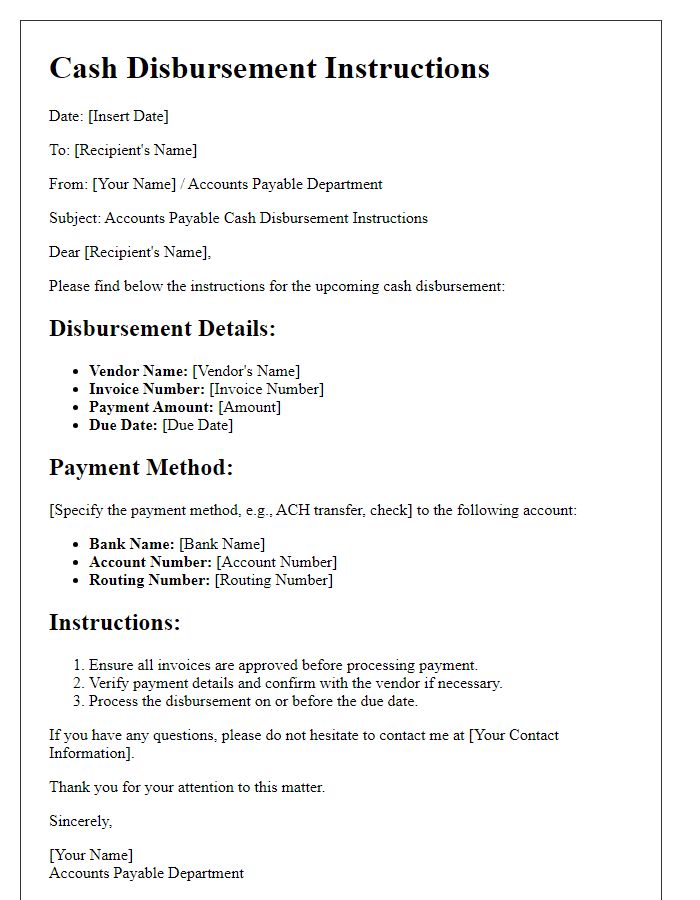

Payment Instructions

Payment instructions for accounts payable cash allocation require clear and precise information to ensure timely processing. Various methods such as wire transfers or ACH (Automated Clearing House) must be indicated for transferring funds. Include essential details like bank account numbers, bank names (e.g., Bank of America, JPMorgan Chase), and the payment amount. Specify due dates, typically the last day of the month (e.g., November 30, 2023), to avoid late fees. Additionally, mention any relevant invoice numbers to facilitate easy identification of payments, ensuring that all allocated cash corresponds accurately to the intended accounts.

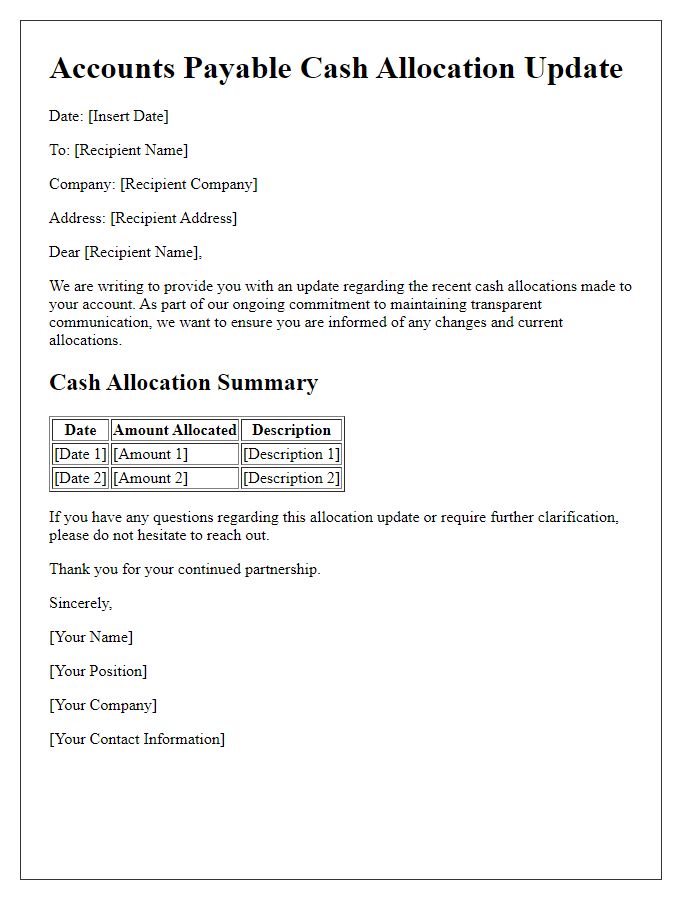

Allocation Breakdown

In accounts payable processes, efficient cash allocation is crucial for managing financial operations. Various allocation breakdown models assist in distributing payments accurately to ensure proper tracking of liabilities. The allocation breakdown might include several categories such as vendor payments, which contribute to maintaining supplier relationships, utility expenses for resource management, and tax liabilities to comply with governmental regulations. Typically, relevant software like ERP systems may aid in automating these allocations, enhancing accuracy while reducing human error. Detailed reconciliation processes can validate these allocations monthly or quarterly, ensuring cash flow remains balanced and liabilities are accurately reported in financial statements, thus optimizing overall cash management strategies.

Contact Information

Efficient cash allocation in accounts payable requires accurate contact information for resolving payment inquiries. Key data includes vendor names, such as Global Supplies Inc. and Tech Solutions LLC, along with their relevant contact persons like John Smith (Accounts Manager) or Lisa Johnson (Billing Specialist). Essential details encompass phone numbers (such as 555-123-4567), email addresses (like john.smith@globalsupplies.com), and physical addresses (e.g., 123 Market Street, Suite 100, New York, NY 10001). Maintaining an updated directory aids in ensuring timely and accurate disbursements, minimizing disputes and enhancing supplier relationships. Regular reviews of this information are crucial for optimal cash flow management, supporting operational efficiency in financial transactions.

Comments