Have you ever checked your bank statement only to discover unexpected service charges that you didn't authorize? It's a frustrating experience that many of us can relate to, and it's essential to know how to address these unauthorized fees effectively. Understanding your rights and the steps you can take to dispute these charges can empower you to reclaim your hard-earned money. Ready to dive deeper into how to handle unauthorized service charges? Let's explore the ins and outs together!

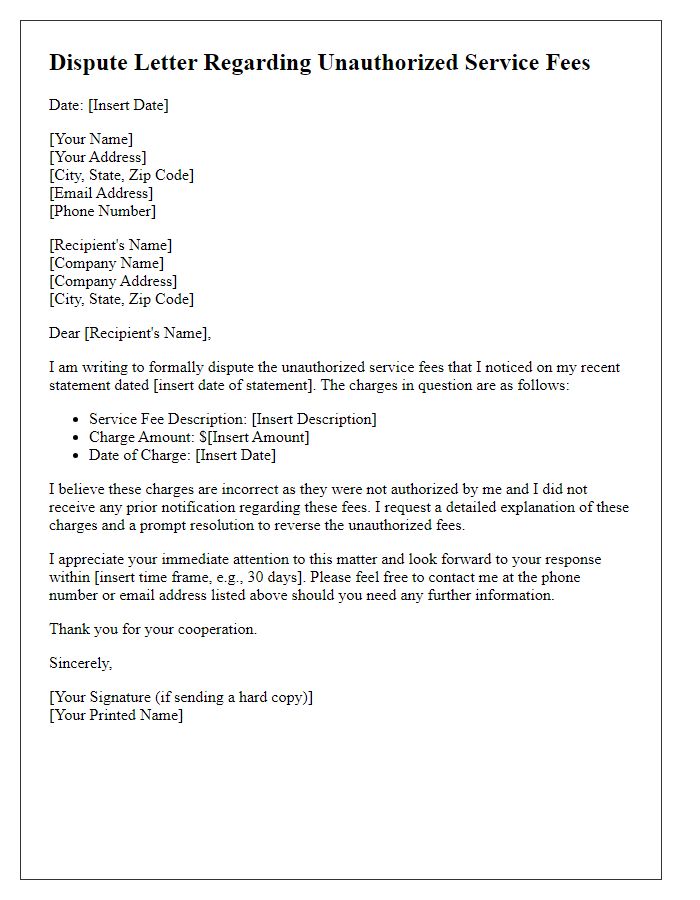

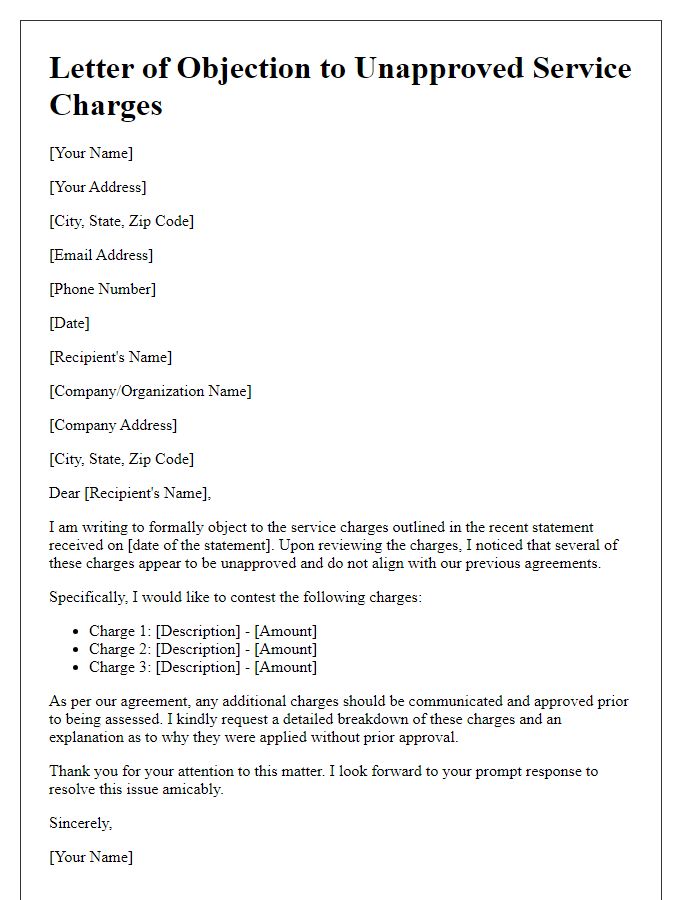

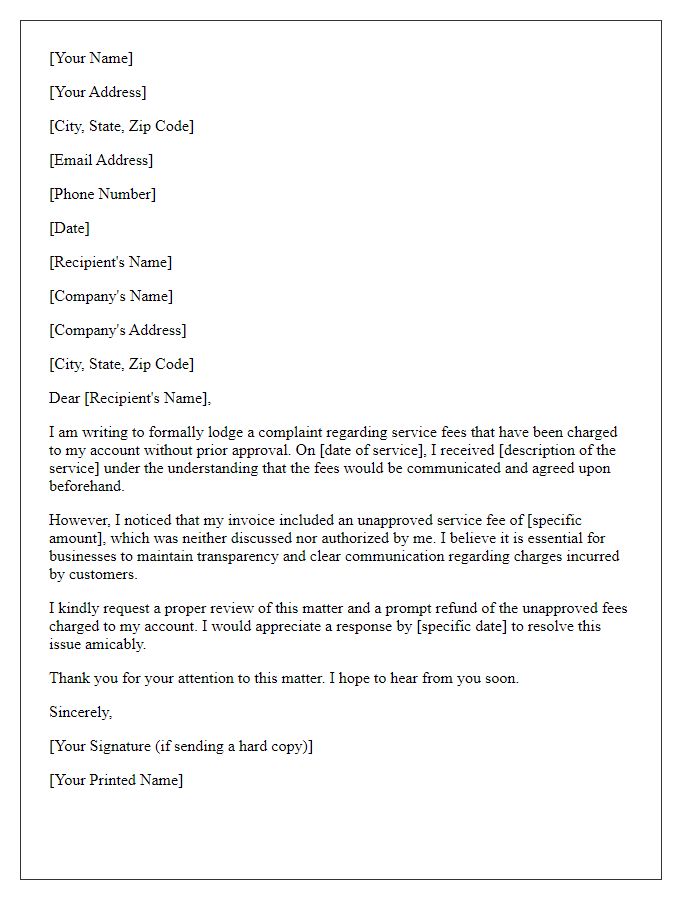

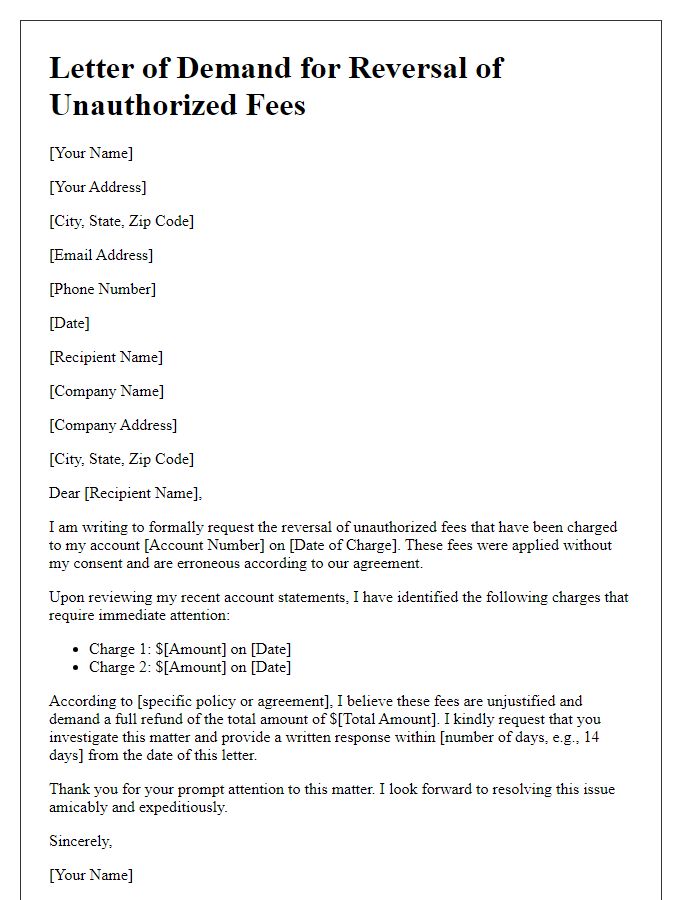

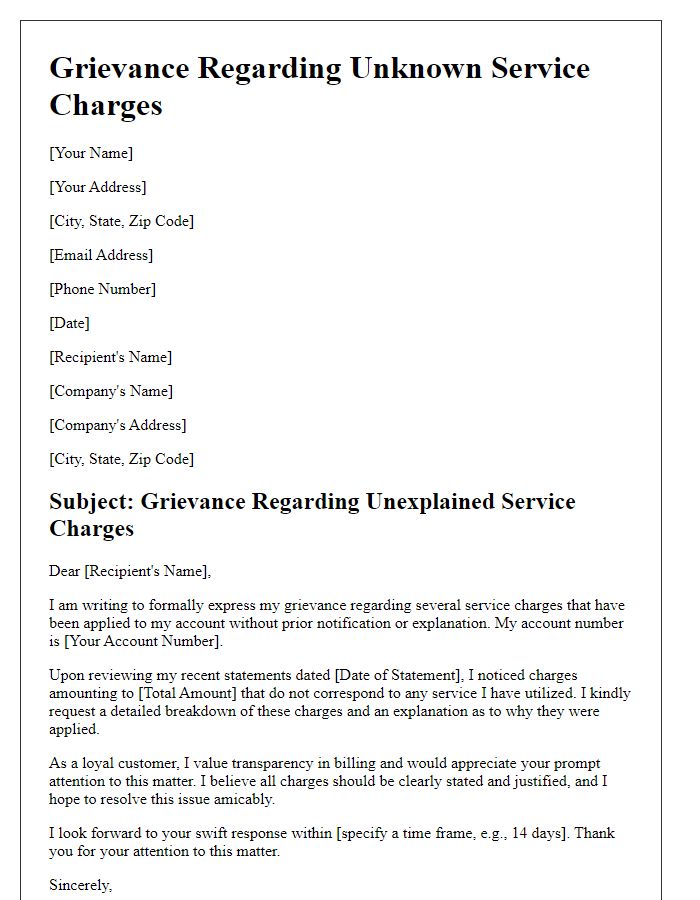

Clear subject line

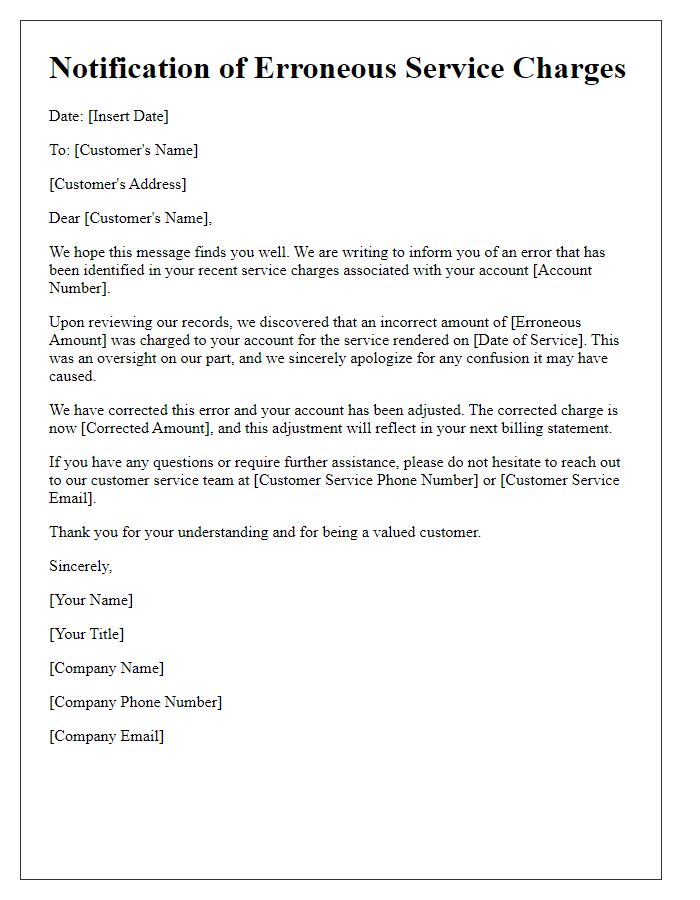

Unauthorized service charges on invoices can create significant confusion for consumers. Such charges often appear unexpectedly on monthly bills, sometimes ranging from $5 to over $100, depending on the service provider. For instance, telecommunications companies, including Verizon and AT&T, may include fees for services not explicitly agreed upon in the contract, leading to disputes. Consumers frequently report these issues to the Better Business Bureau or state consumer protection agencies, prompting investigations. Additionally, unauthorized charges can damage customer trust, resulting in increased complaints and potential loss of business for companies involved. Addressing these charges promptly is crucial for maintaining reputation and customer satisfaction.

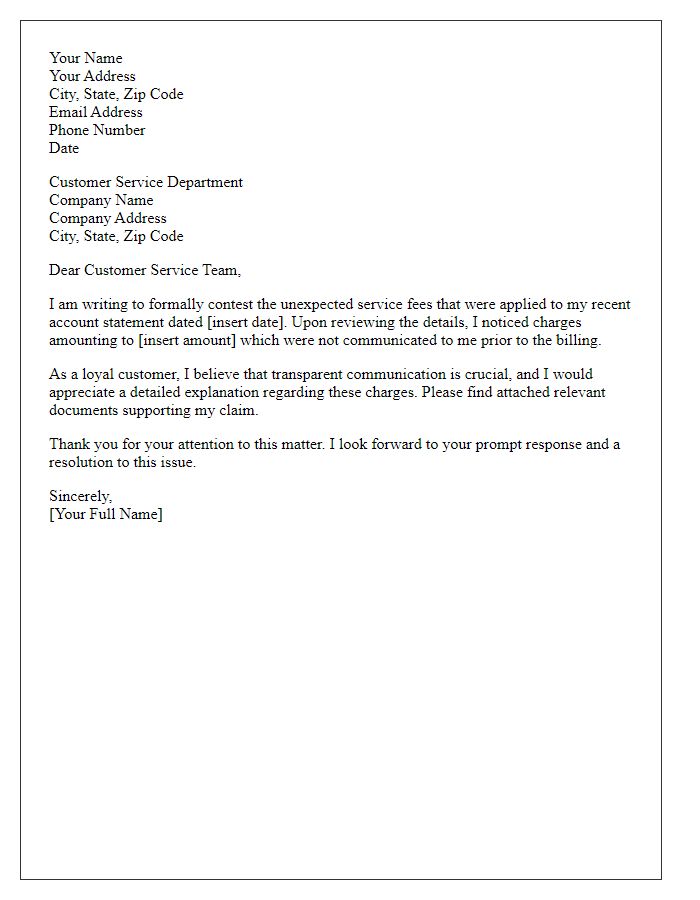

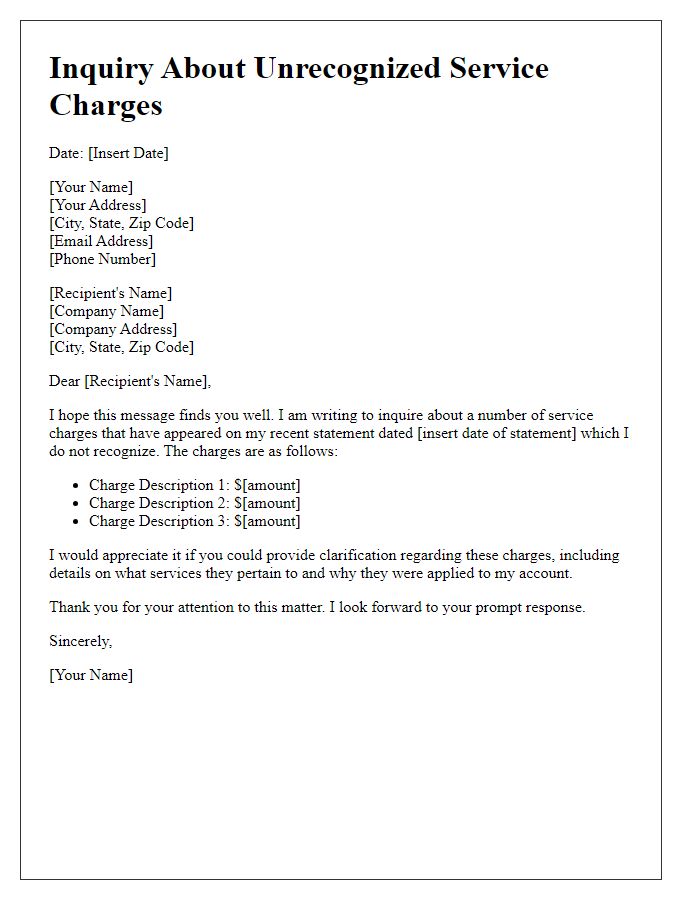

Concise statement of unauthorized charges

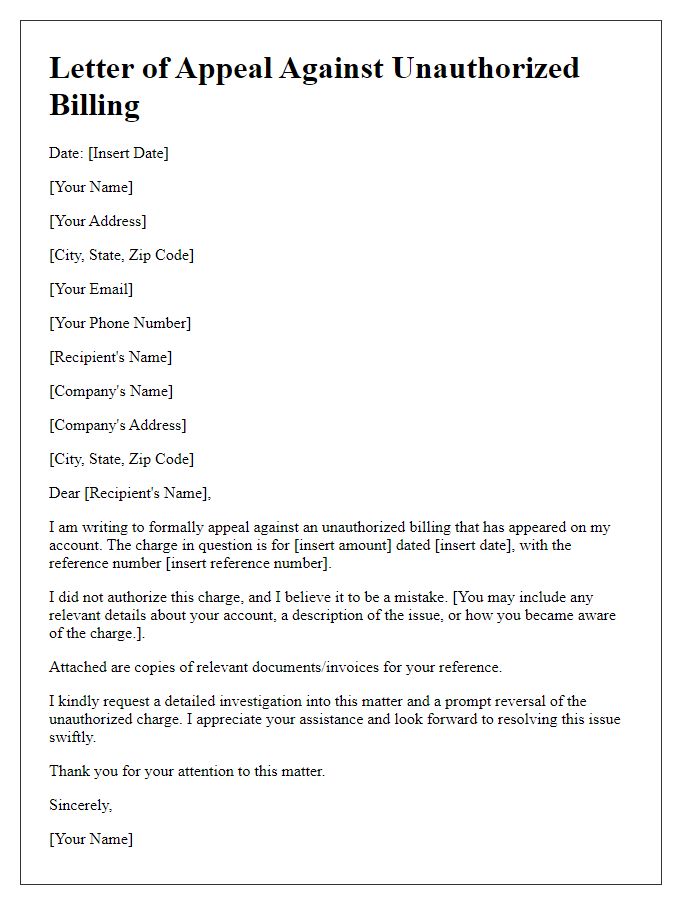

Unauthorized service charges can significantly impact bank accounts, often totaling unexpected fees. These charges, frequently stemming from subscription services or late payments, can range from $10 to $35, depending on the provider. For example, telecommunication companies may impose fees for services that were not requested, leading to confusion among consumers. Tracking these charges is crucial; reviewing monthly statements can reveal discrepancies. Promptly disputing unauthorized charges can protect financial well-being and maintain transparency in personal budgeting practices.

Account and transaction details

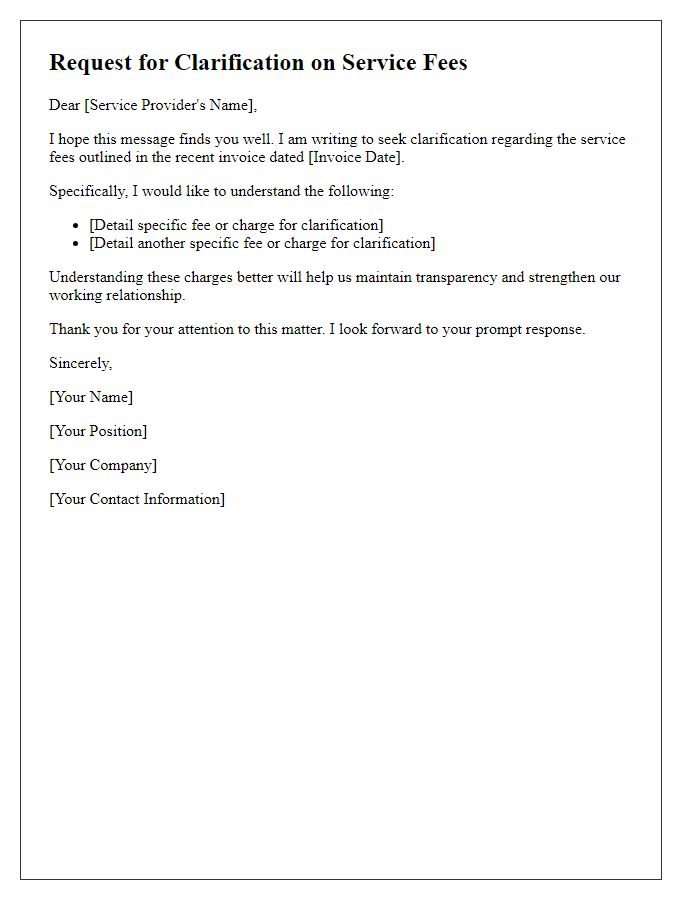

Unauthorized service charges can significantly impact a customer's financial well-being. For instance, users may observe unexpected deductions on their bank statements, especially on accounts associated with services such as monthly subscriptions, credit card fees, or internet service providers. Customers often notice these unauthorized charges during routine reviews, typically on a statement from platforms like PayPal or the Bank of America. If observed, account details including transaction dates, amounts, and merchant names become essential for disputing these charges. In order to investigate further, customers should gather relevant documentation that illustrates the irregularities, including transaction IDs and any previous communication with customer support. This proactive approach aids in addressing discrepancies, ensuring consumer rights are upheld.

Request for prompt resolution

Unauthorized service charges can lead to significant customer dissatisfaction, particularly in industries like telecommunications or utilities. In April 2023, a consumer discovered an unexpected $150 service charge on their monthly bill from a major service provider, XYZ Telecom. This markup, labeled as "service enhancement fee", was not disclosed during the initial contract agreement, which typically outlines all potential fees and charges incurred. Customers often expect transparency, especially considering regulatory frameworks established by agencies like the Federal Communications Commission (FCC) that aim to protect consumer rights. Prompt resolution of such discrepancies is crucial for maintaining trust in the provider's services and ensuring compliance with legal standards. Customers are encouraged to submit formal disputes within 30 days to rectify mischarges effectively.

Contact information for follow-up

Unauthorized service charges often catch consumers off guard, leading to financial discrepancies. In the case of mobile service providers, for instance, a subscription might show unexpected fees totaling $50 for premium services. Customers discovering such charges should clearly document transaction details, including the date of charge, service description, and account number. It's advisable to reach out directly to the customer support department via official websites or hotline numbers to resolve disputes effectively. Maintaining communication records, such as call reference numbers or email confirmations, can streamline follow-up and ensure accountability from the service provider's end.

Comments