Are you tired of managing multiple billing cycles and wondering when payments are due? A recurring billing preference can simplify your life by automating payments and eliminating unnecessary stress. With just a few clicks, you can streamline your monthly expenses while ensuring that your bills are paid on time without any hassle. Ready to discover how easy it is to set up your own recurring billing preferences? Read on to learn more!

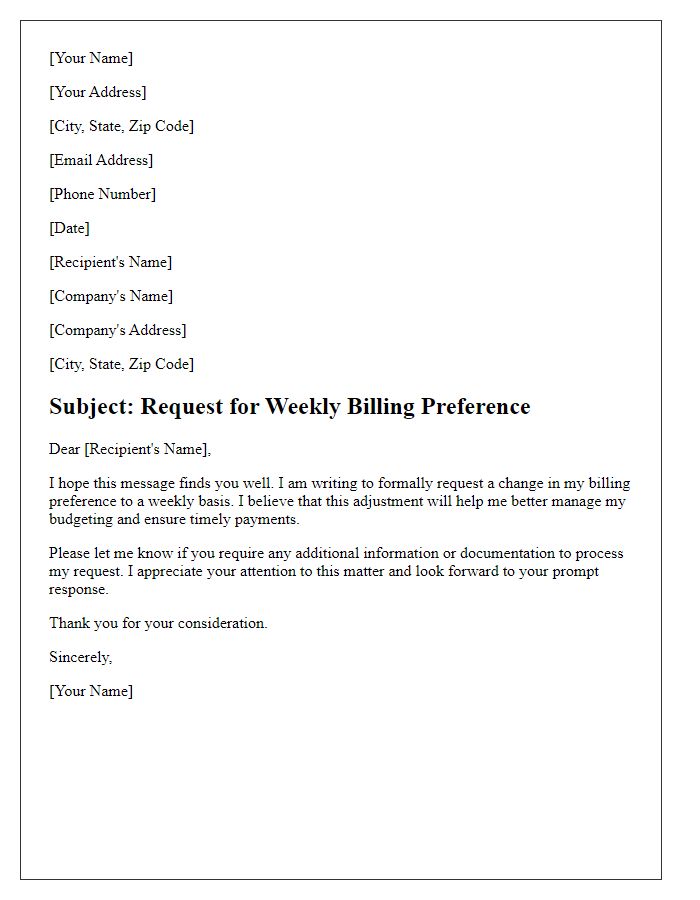

Personalization and Recipient Details

Recurring billing preferences can significantly enhance user experience for subscription services, such as streaming platforms or gym memberships. Personalization often includes specifying billing frequency (monthly, quarterly, yearly) and payment method (credit card, bank transfer) while considering customer preferences. For instance, a user may select a monthly subscription for a software service, needing reminders for payments due on the first of each month. Recipient details include the customer's full name, email address, and billing address, crucial for accurate invoicing and compliance with financial regulations. Clear communication of these preferences can reduce payment issues and enhance customer satisfaction.

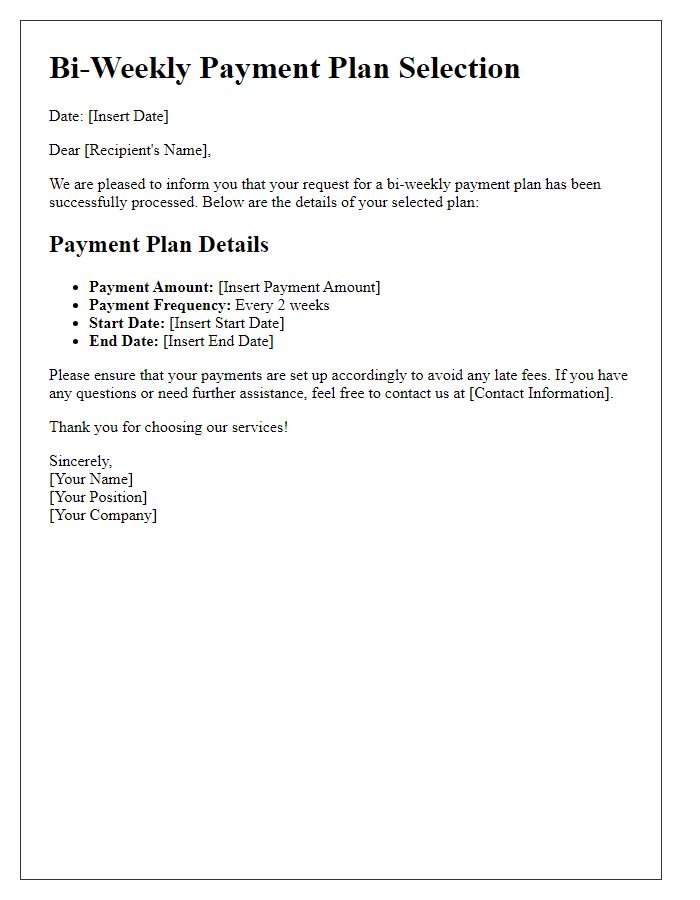

Clear Explanation of Recurring Billing

Recurring billing is a payment model commonly used by subscription services, allowing customers to authorize automatic deductions from their bank accounts or credit cards at specified intervals, for example, monthly or annually. This system streamlines payment processes, ensuring uninterrupted access to services like streaming platforms (e.g., Netflix), software subscriptions (e.g., Adobe Creative Cloud), and membership fees (e.g., gym memberships). Customers receive notifications prior to each billing date, ensuring transparency in financial transactions, while businesses benefit from predictable revenue streams and improved cash flow for planning and operations. Each recurring transaction is usually accompanied by a detailed receipt, outlining the service period, payment amount, and any applicable taxes or fees, providing clarity and accountability in the billing process.

Benefits and Convenience

Recurring billing offers significant benefits and unparalleled convenience for customers. Automatic deductions occur on predetermined dates, simplifying payment management, particularly for subscriptions or monthly services. Users experience fewer missed payments, thereby avoiding late fees and service interruptions. Services like streaming platforms, such as Netflix, or gym memberships, provide continuous access without the hassle of manual payments. Recurring billing fosters a sense of stability, allowing budgeting with predictable expenses. Furthermore, businesses benefit from improved cash flow and customer retention, as clients are more likely to maintain ongoing subscriptions. The seamless nature of this payment method enhances the overall user experience, making transactions worry-free.

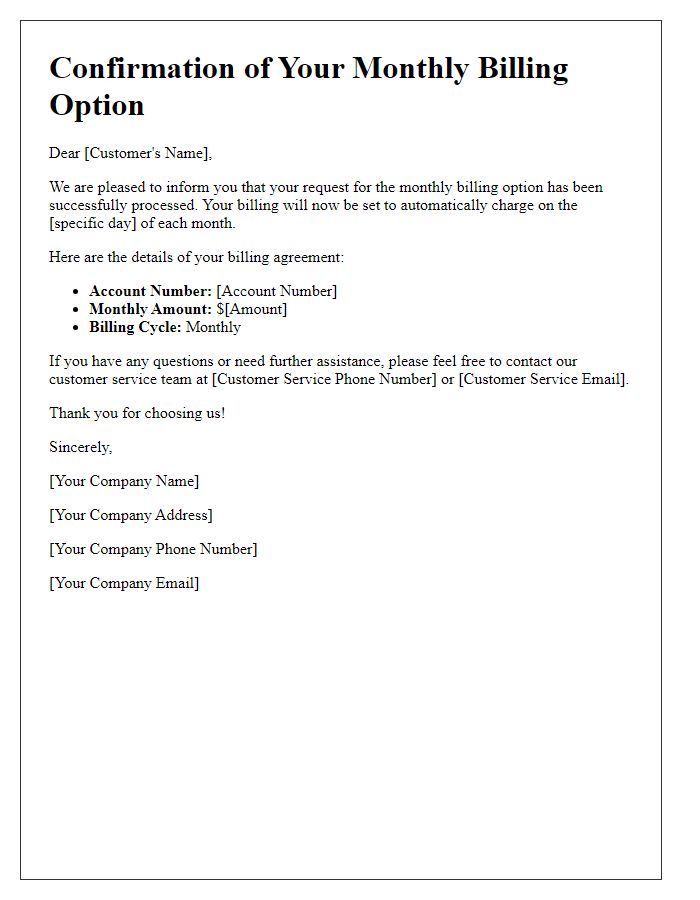

Billing Schedule and Amount

Recurring billing preferences, such as the billing schedule and amount, play an essential role in subscription services. Regular billing cycles, typically monthly or annually, help manage customer expectations and cash flow for businesses. A common billing amount, for example, $29.99 per month, provides predictability for budgeting purposes. Clear communication regarding the renewal date, which can fall on the first of each month or the anniversary of the original subscription date, is vital to maintaining customer trust. Additionally, providing options for adjusting the billing frequency or amount can enhance customer satisfaction and retention, allowing for flexibility in accordance with individual needs or financial circumstances.

Contact Information and Support

Recurring billing preferences enable customers to manage their subscriptions effectively, simplifying the payment process for services such as streaming platforms, subscription boxes, or software tools. Customers typically provide essential contact information, including email addresses and phone numbers, allowing companies to send billing reminders or updates. Customer support plays a crucial role in resolving any billing issues or discrepancies, offering assistance through various channels like live chat, email, or phone support, operational 24/7 in many cases. Companies often use secure billing systems, ensuring sensitive information such as credit card details is encrypted to protect users from fraud. Regular notifications regarding payment dates and amounts help maintain transparency and enhance the overall customer experience.

Comments