Are you looking to apply for a government subsidy but not sure where to start? Crafting the perfect letter can make all the difference in your application's success. In this article, we'll provide you with a friendly and easy-to-follow template that outlines the essential components of a compelling letter. So, grab a cup of coffee and let's dive into the details to help you secure that much-needed support!

Clear Applicant Information

Applicant information plays a crucial role in government subsidy applications by establishing identity and eligibility. It typically includes key personal details such as Full Name (required for official documentation), Address (providing geographical context including state and zip code), Date of Birth (to ascertain age-related qualifications), and Social Security Number (important for verifying identity and financial history). Additional factors might include Employment Status (indicating economic activity), Contact Information (such as phone number and email for communication), and any relevant identification numbers (like Tax Identification Number or Business Registration Number for businesses) that facilitate the processing of applications efficiently. Providing accurate and thorough applicant information ensures smoother processing and adherence to government protocols.

Detailed Project Description

A comprehensive project description for a government subsidy application should include the project's objectives, financial projections, target audience, and expected outcomes. This project aims to enhance renewable energy adoption in urban areas, focusing on solar power implementation. The initiative will target residential homeowners in cities such as San Francisco and New York, aiming to reduce energy costs by 30% over the next five years. The project budget is projected at $1.5 million, with expected funding from the government subsidy covering 40% of the costs. Anticipated outcomes include a carbon footprint reduction of approximately 500 tons annually and the creation of 20 new jobs in solar panel installation and maintenance. Data collection throughout the project will help measure the effectiveness of renewable energy in urban settings.

Benefit and Impact Analysis

The government subsidy program aims to foster economic growth and support local businesses through financial assistance. This initiative is designed to provide funding that can be used for purchasing equipment, expanding operations, or launching new projects, which may result in increased employment opportunities, particularly in economically disadvantaged regions. For example, community development initiatives in areas like rural Texas may generate a significant number of jobs, estimated at 200 positions over five years, targeting sectors such as renewable energy or agriculture. Similarly, small businesses receiving grants of up to $50,000 can leverage these funds to invest in technology upgrades, enhancing productivity and competitiveness in the market. Ultimately, the positive impact on local communities includes not only job creation but also improved infrastructure and increased consumer spending, contributing to overall economic resilience.

Compliance with Eligibility Criteria

Applications for government subsidies, particularly for sectors like agriculture or renewable energy, must thoroughly address compliance with specified eligibility criteria. Applicants should detail business operations, such as farming practices or energy production methods, evidencing alignment with regulatory standards established by governing bodies like the Department of Agriculture or the Environmental Protection Agency. Clear documentation, including financial records from the previous three fiscal years, should be submitted to demonstrate fiscal responsibility and operational viability. Additionally, applicants must highlight sustainable practices, such as water conservation methods or carbon footprint reduction strategies, showcasing commitment to regulatory goals. Familiarity with the specific subsidy program's guidelines, such as the USDA's Farm Service Agency requirements or the Department of Energy's funding regulations, ensures alignment and strengthens the application.

Supporting Documentation

Supporting documentation is essential for a successful government subsidy application, ensuring transparency and accountability. Required documents typically include financial statements, such as profit and loss statements from the previous fiscal year, which provide insight into the economic status of the applicant. Tax returns, including Form 1040 or corporate tax filings, demonstrate compliance with federal regulations. Additionally, project proposals detailing objectives, budgets, and timelines outline plans for utilizing the funds effectively. Licenses and permits relevant to the business operations may be necessary, validating legal compliance. Lastly, letters of recommendation from industry leaders can endorse the credibility of the applicant organization, increasing the likelihood of approval for the subsidy request.

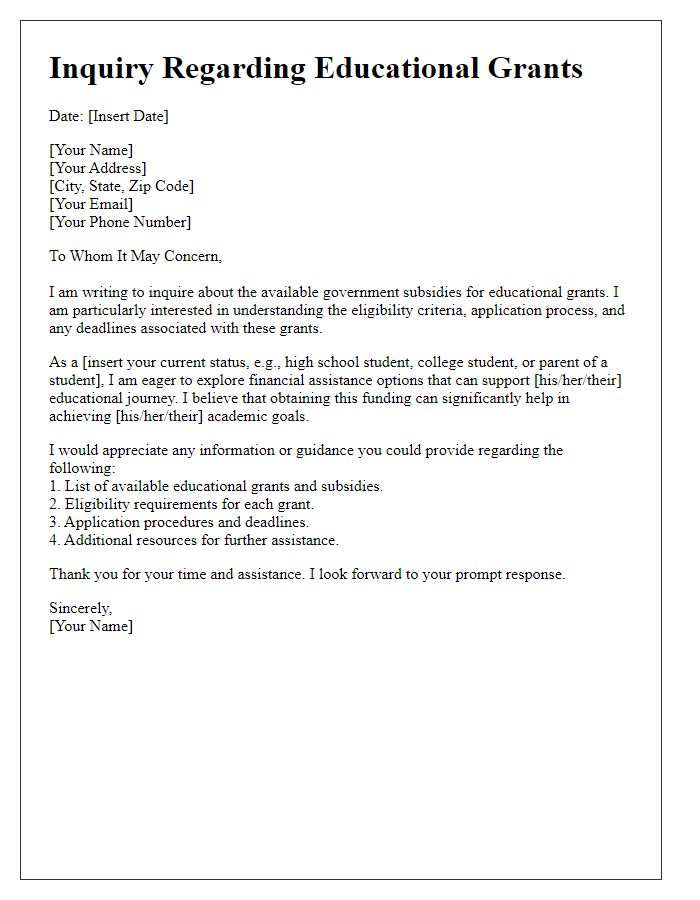

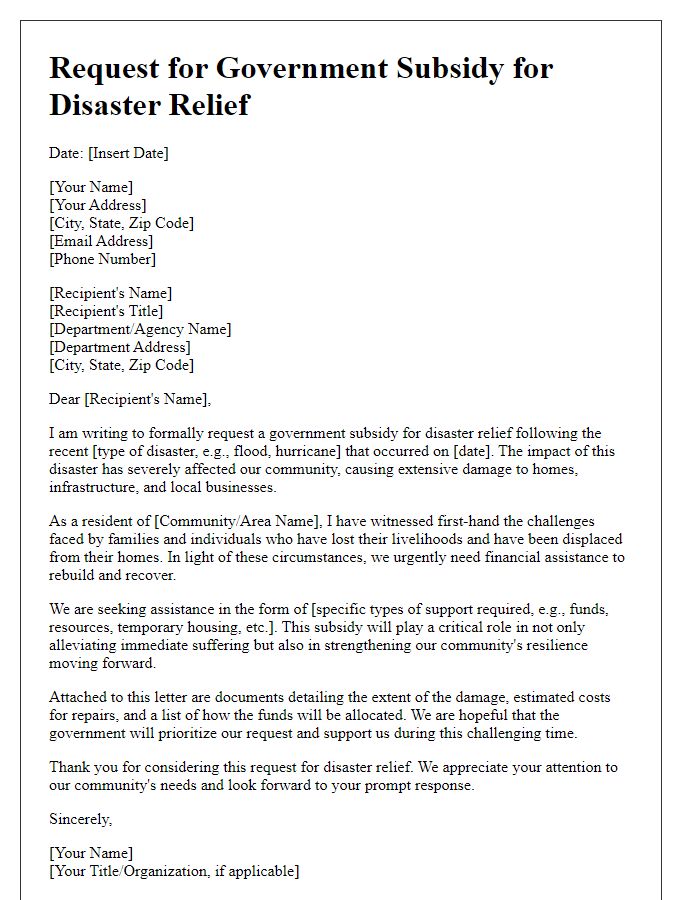

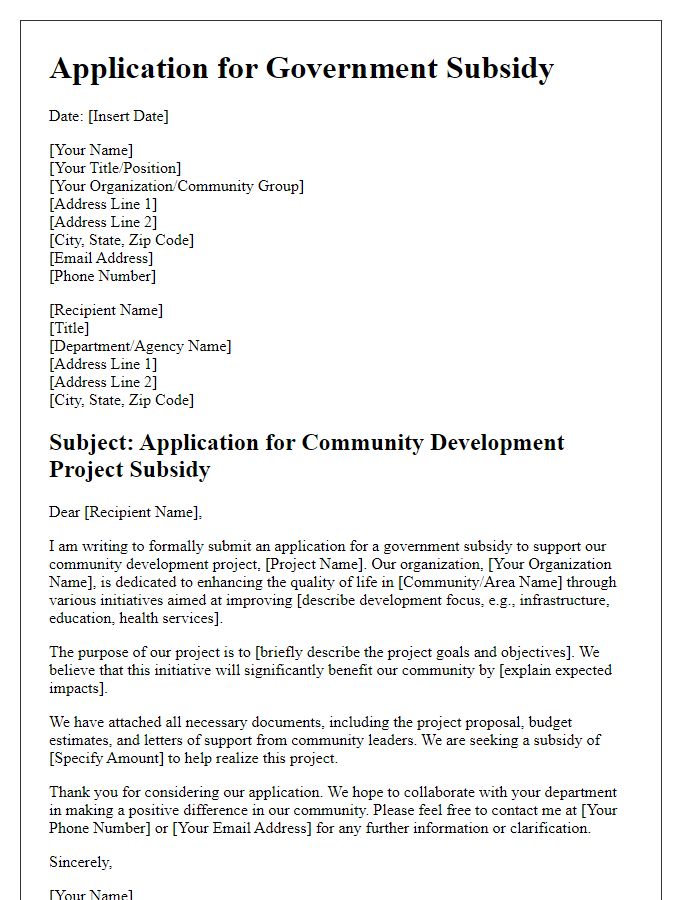

Letter Template For Government Subsidy Application Samples

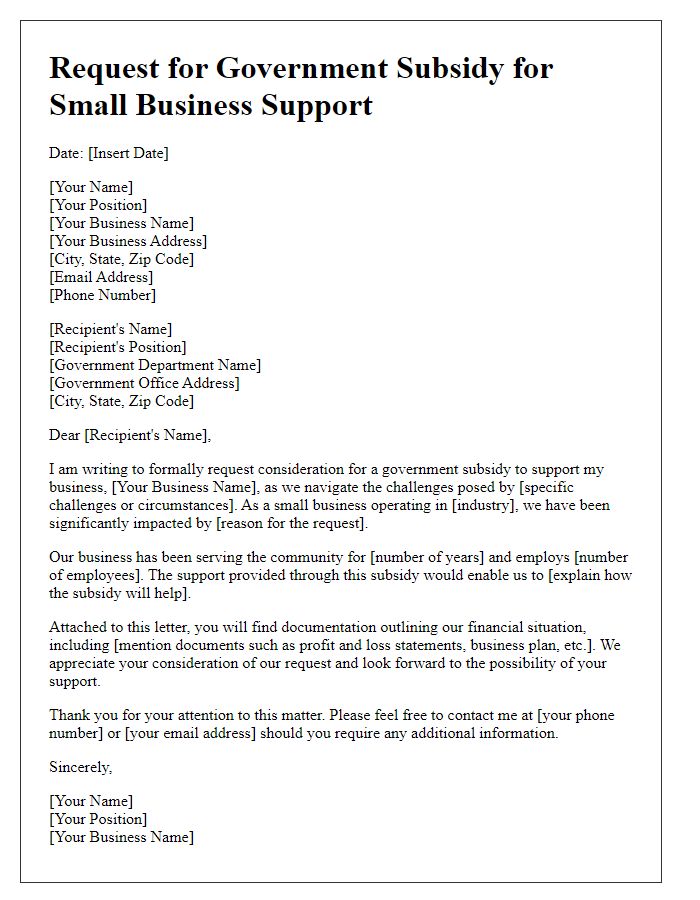

Letter template of government subsidy request for small business support

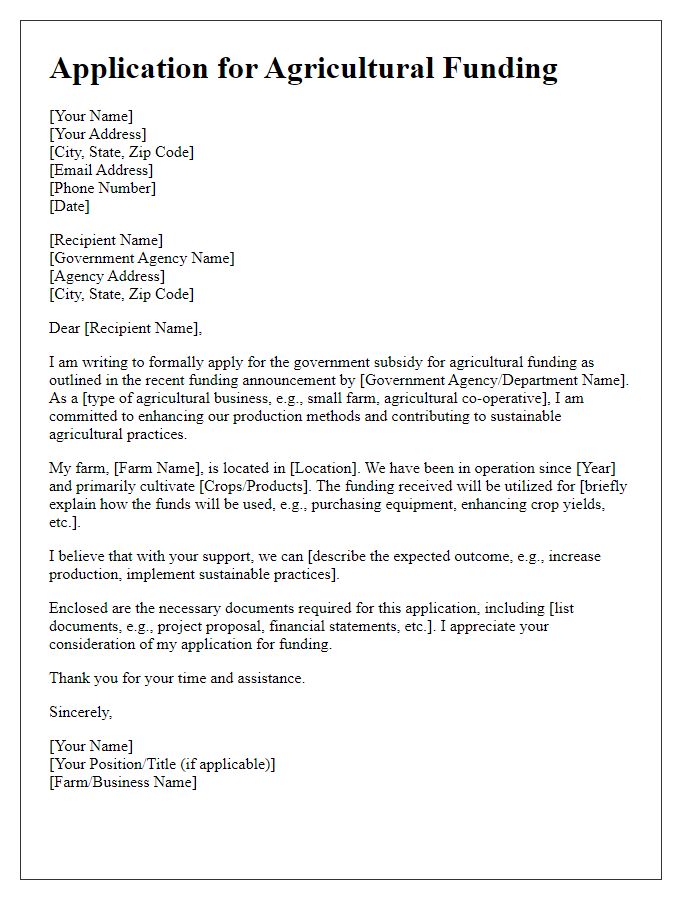

Letter template of government subsidy application for agricultural funding

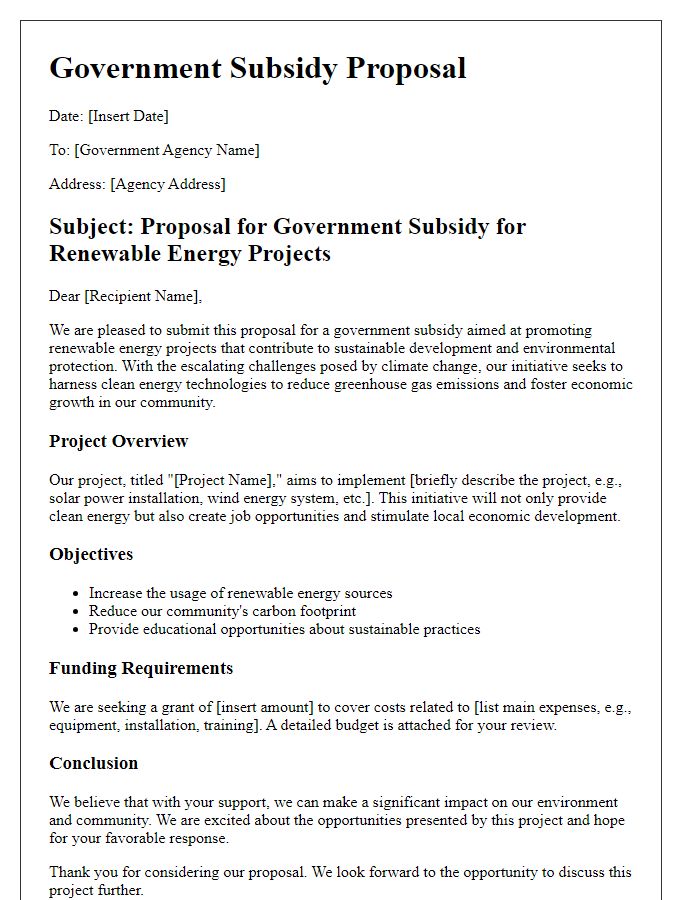

Letter template of government subsidy proposal for renewable energy projects

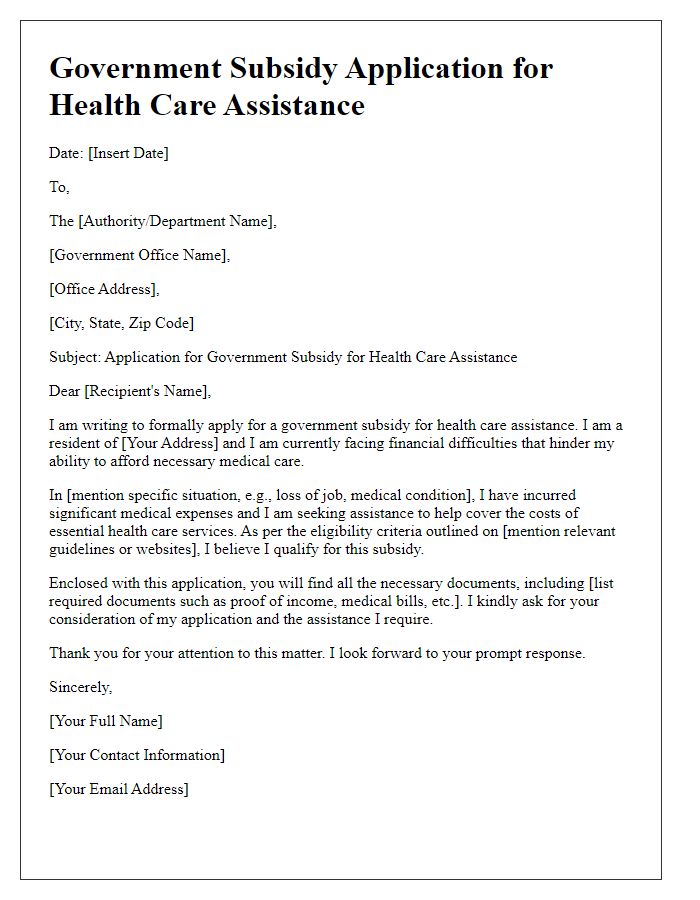

Letter template of government subsidy application for health care assistance

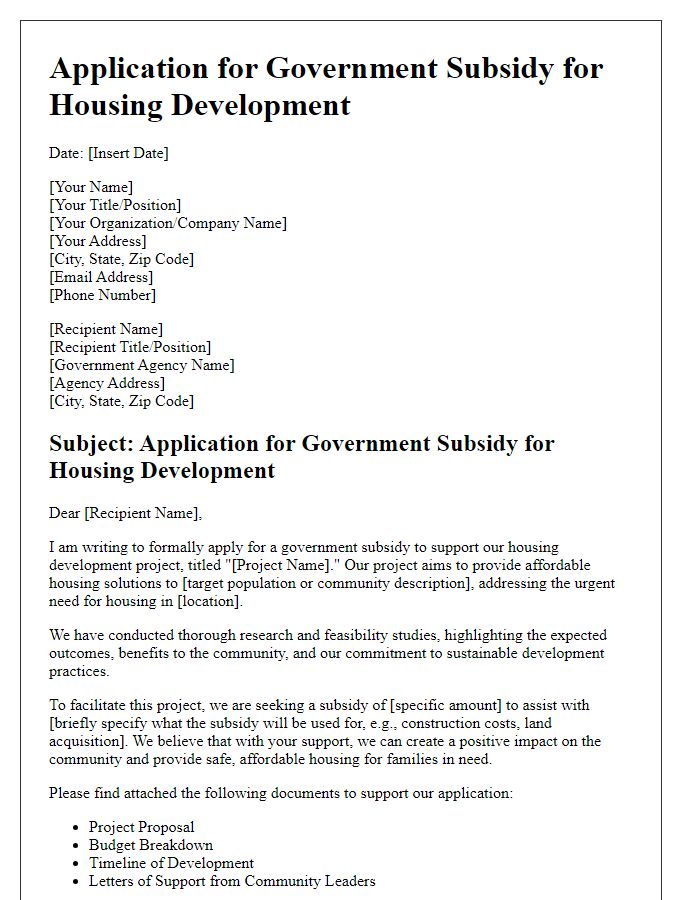

Letter template of government subsidy application for housing development

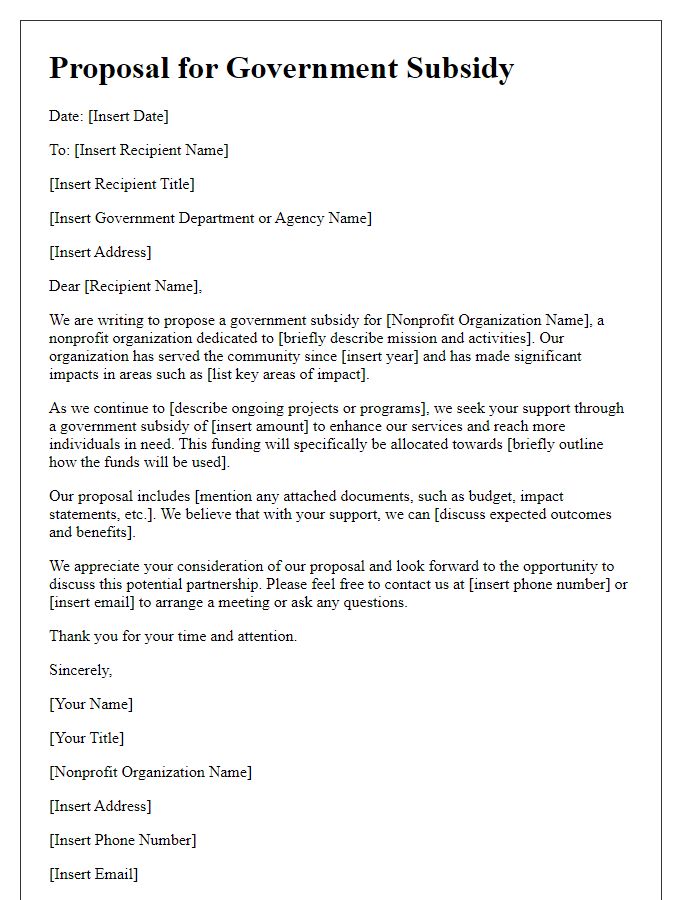

Letter template of government subsidy proposal for nonprofit organizations

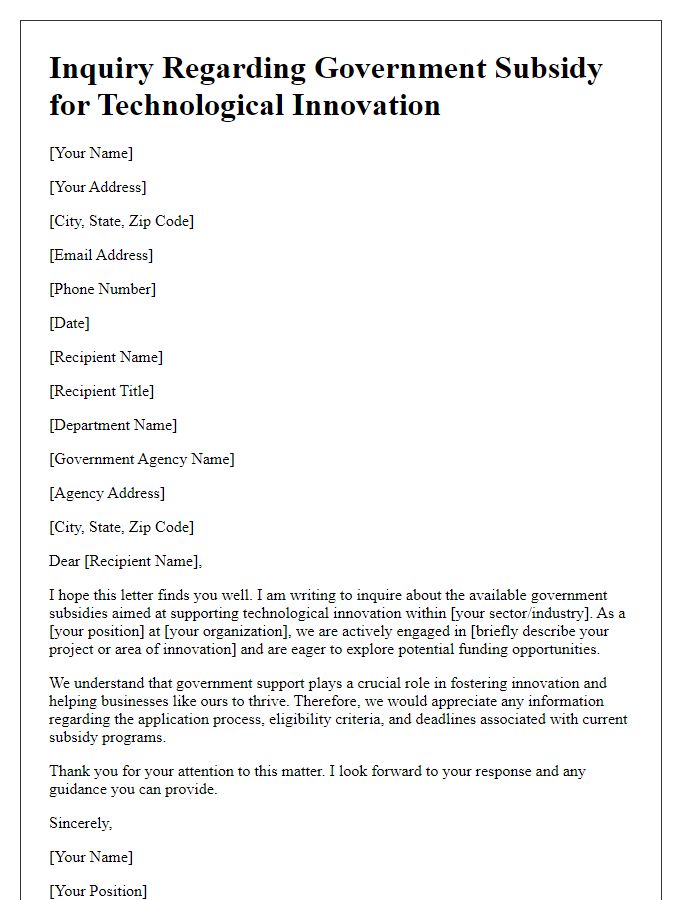

Letter template of government subsidy inquiry for technological innovation support

Comments