Are you looking to navigate the often complex world of utility tax credits? Understanding your eligibility and application process can be daunting, but it doesn't have to be. This article breaks down everything you need to know, making it easier for you to take full advantage of available benefits. So grab a cup of coffee and join us as we explore how you can maximize your savingsâread on to discover all the details!

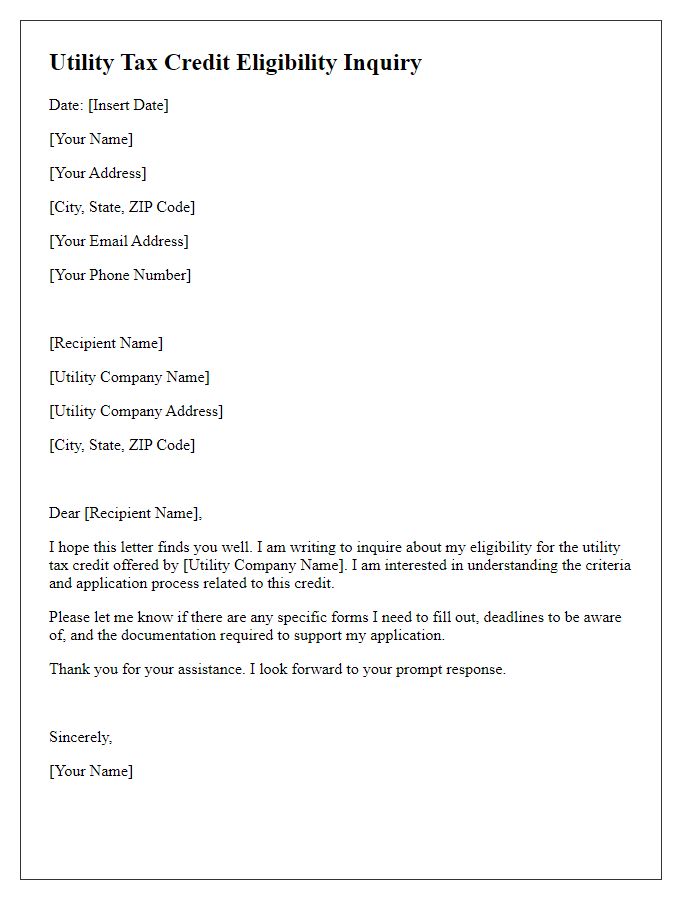

Accurate Recipient Information

Utility tax credits, such as those offered by state governments, can significantly alleviate financial burdens for low-income households. Accurate recipient information, including full name, address, and Social Security number, is essential to ensure effective processing of applications. In many states, eligibility requirements may vary, but typically involve income thresholds (such as 200% of the federal poverty level). Deadlines for application submissions often fall around late spring, reflecting fiscal year considerations. Additional details might include utility account numbers and service provider names, ensuring that the credits are directly applied to the correct accounts and not delayed due to administrative glitches.

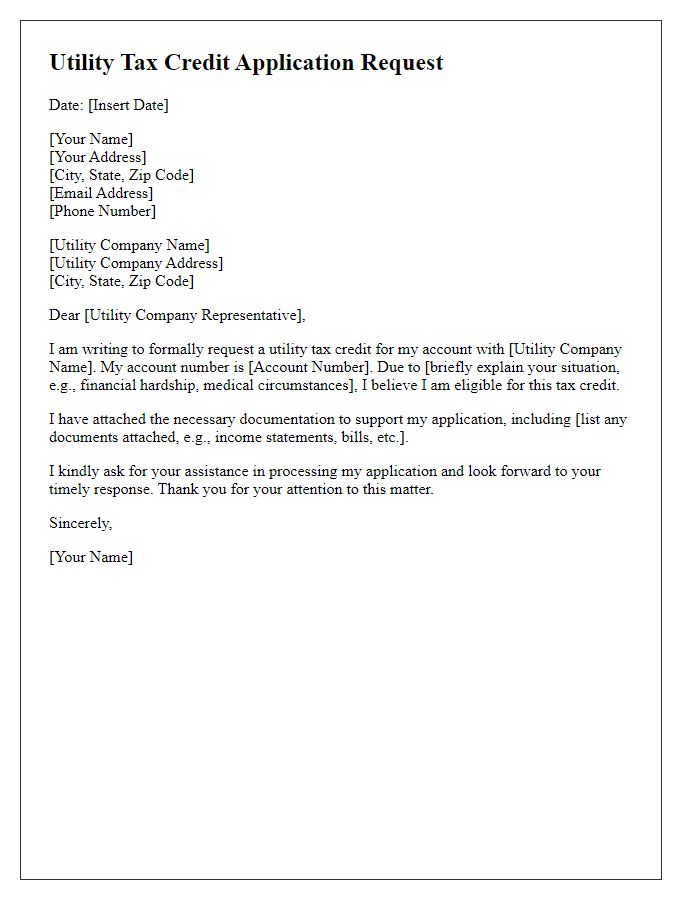

Purpose and Explanation of Credit

Utility tax credits provide financial relief to eligible households, especially those with low to moderate incomes, helping to mitigate the burden of utility expenses, such as electricity, gas, and water bills. These credits directly reduce the amount owed to utility providers, ensuring that qualifying individuals and families can allocate their limited resources toward essential needs like food, housing, and healthcare. The program is typically managed by local governments or state agencies, often requiring proof of income, residency, and utility expenses to determine eligibility. For instance, individuals residing in urban areas like Chicago (Illinois) may apply for credits aimed specifically at easing the financial strain of rising utility costs during extreme weather conditions, particularly in winter months when heating demands increase significantly.

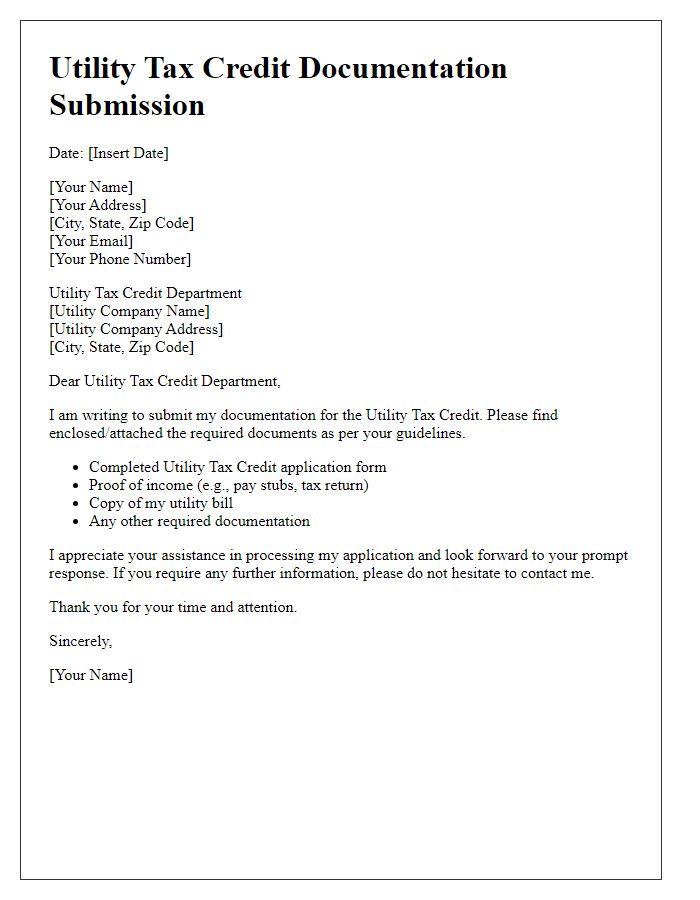

Required Documentation and Eligibility Criteria

Utility tax credits provide financial relief for eligible residents, assisting with energy bills and promoting energy efficiency. Applicants must submit documentation, including proof of income (pay stubs or tax returns), utility bills (from providers like Pacific Gas and Electric Company or Constellation Energy), and identification (such as a driver's license or state ID) to confirm residency. Eligibility is typically based on income levels relative to federal poverty guidelines, with thresholds varying by household size. Certain programs, like the Low-Income Home Energy Assistance Program (LIHEAP), offer additional support during extreme weather events, ensuring vulnerable populations maintain access to essential utilities. Applications typically require renewal annually to verify ongoing eligibility and address any changes in financial circumstances.

Contact Information for Assistance

Utility tax credits play a significant role in alleviating financial burdens for eligible households, often aimed at low-income families and senior citizens. Many states offer programs that provide financial assistance with essential services such as electricity, gas, or water, varying by eligibility requirements. For instance, the Low Income Home Energy Assistance Program (LIHEAP) operates across the United States, offering funds to help families manage energy costs (with income limits typically around 150% of the federal poverty level). Applicants often need to provide income verification, household size, and utility bills to qualify for the credit. Nonprofit organizations and government agencies often assist in navigating application processes, ensuring residents receive critical support to maintain utility services during challenging financial times. Contact information for local assistance centers can be found on state government websites or through community service organizations, providing a valuable resource for those seeking help.

Deadline for Application Submission

Utility tax credits offer financial relief to eligible residents, potentially reducing costs related to essential services such as electricity, gas, and water. The specific deadline for application submission varies by state but typically falls within the first quarter of the year, often around March 31st. For example, in California, applicants must submit their forms to the California Department of Tax and Fee Administration to qualify for credits that could reach up to $300 per household annually. Timely submission ensures that homeowners and renters can benefit from these savings; therefore, individuals should gather necessary documentation, including proof of income and utility bills, well ahead of the deadline to prevent missing out on vital tax relief.

Comments