Are you feeling overwhelmed by your utility bills and searching for a manageable way to pay them off? You're not aloneâmany people find themselves in similar situations, and there's a practical solution that can ease your stress: a utility payment installment agreement. This arrangement allows you to break down your total bill into smaller, more manageable payments, making it easier to keep your finances in check. If you're curious about how to set this up and the potential benefits, keep reading to discover the essential steps and tips for navigating this process.

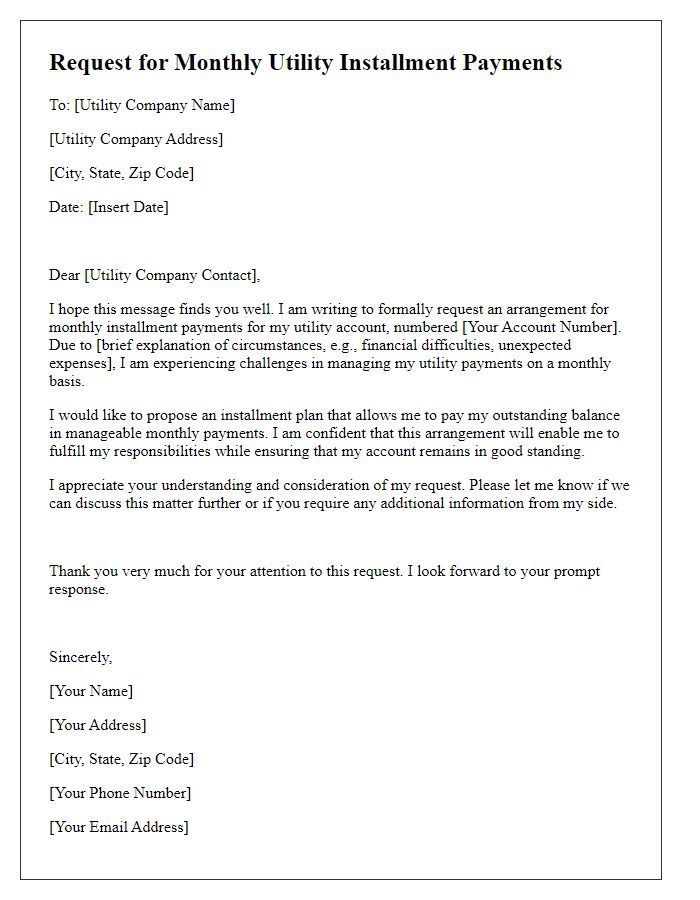

Include customer details and account information.

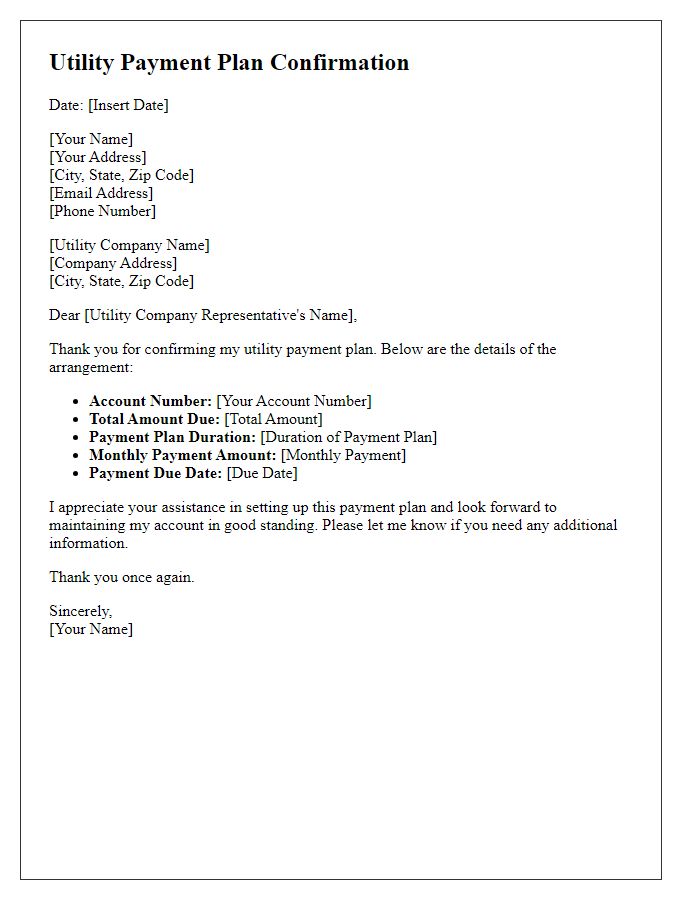

Utility payment installment agreements provide customers with a structured approach to manage outstanding bills while ensuring continued service. The account holder (name) linked to account number (account number) at (utility company name) in (service location) is eligible for an installment plan due to an outstanding balance of (amount due). This plan allows the customer to repay the balance over (number of months) months, with monthly installments of (monthly payment amount). Payments are due on (due date) each month, ensuring that the customer remains in good standing while gradually settling their account. The utility company aims to assist in maintaining uninterrupted service during this repayment period. Clear communication regarding payment schedules and any potential late fees is outlined in the agreement to avoid misunderstandings and ensure compliance.

Clearly outline the payment plan terms.

Utility payment installment agreements provide a structured method for customers to manage outstanding balances. Typical terms may include a total outstanding balance of $500, to be repaid over a period of six months. Monthly installment payments of approximately $83.33 are due on the 15th of each month, starting January 15, 2023. A late fee of $15 applies if payments are not received by the specified due date. Customers must maintain their current utility payments alongside the installment agreement to avoid service interruption. Additionally, this agreement remains valid until all payments are completed or until the customer fails to comply with the outlined terms.

Specify due dates and payment amounts.

Utility payment installment agreements can help manage financial obligations, especially when dealing with recurring expenses like electricity, water, or gas bills. Typically, these agreements specify payment amounts, often broken down into manageable monthly installments. For instance, a payment plan might require a total outstanding balance of $600 to be paid over six months. This would translate to monthly payments of $100, due on the 15th of each month. Additionally, including specifics such as the utility provider's name (e.g., Pacific Gas and Electric in California) and account number enhances clarity. Ensuring that all due dates align with the billing cycle and payment capabilities can foster commitment and improve the chances of full payment completion.

Include contact information for queries.

Utility payment installment agreements provide customers with a structured payment plan for outstanding utility bills, enabling them to manage their finances effectively. Customers facing challenges with full payments can contact their utility provider's customer service department, typically reachable at a dedicated helpline number, such as 1-800-123-4567. Customers may also access service information through the provider's website, where detailed FAQs and support options are available. These agreements often require customers to adhere to a specified payment schedule, ensuring timely payments while potentially avoiding service disconnection. It is crucial to review specific terms and conditions to understand any service fees or penalties associated with missed payments.

Detail consequences of non-compliance.

Failure to adhere to the utility payment installment agreement can lead to severe consequences for the account holder. Disconnection of service may occur after a 30-day delinquency period, impacting access to essential utilities such as electricity, water, or gas. Accumulation of late fees can increase the total outstanding balance, with fees potentially ranging from $10 to $50, depending on the utility provider's policies. Credit score deterioration may result from reported delinquencies to credit bureaus after 60 days, affecting future borrowing capacity. Legal action could be pursued for collection, leading to additional court costs and attorney fees. The customer may also lose eligibility for future payment plans or financial assistance programs, as documented compliance is often required for such options.

Comments