Hey there! If you're curious about how the utility billing cycle works, you've come to the right place. Understanding your billing schedule can help you manage your finances more effectively, ensuring that you never miss a payment or surprise yourself with unexpected charges. In this article, we'll break down the key components of the utility billing cycle and provide tips to make the process smoother for you, so keep reading to learn more!

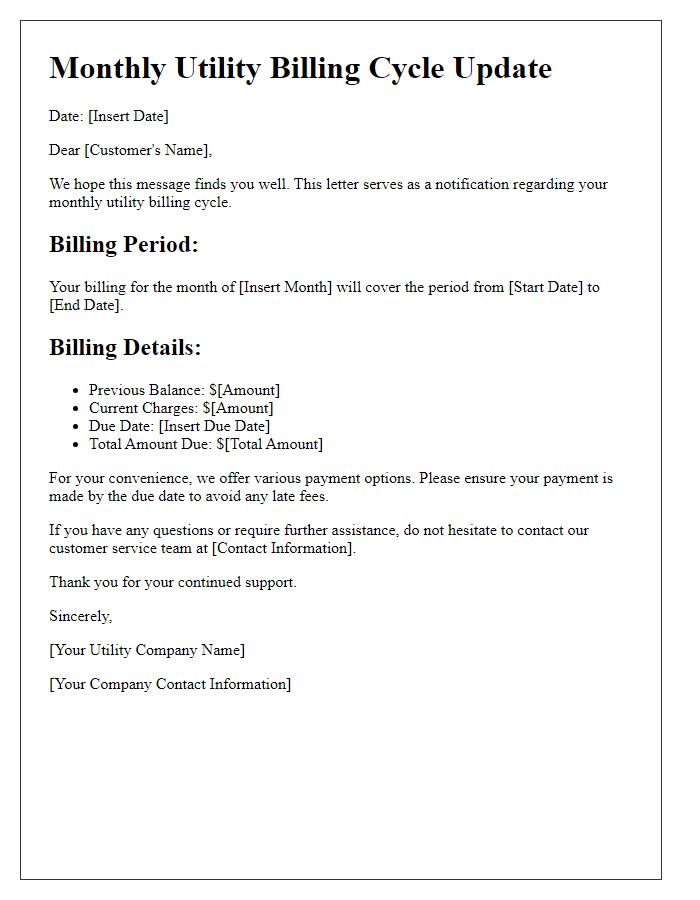

Account Details

Utility billing cycles play a crucial role in managing account details for consumers and businesses alike. Each cycle typically spans approximately thirty days, resulting in a monthly billing statement that outlines usage for electricity, water, or gas services based on meter readings. Account details include vital information such as the account holder's name, address of service location, account number (usually a unique identifier), and past due balances, reflecting payment history and service interruptions. Additionally, utility companies often provide a breakdown of charges and credits, enabling customers to monitor their consumption patterns and manage costs effectively. Clear communication regarding payment due dates and available payment methods is essential for maintaining a positive relationship between utility providers and their customers.

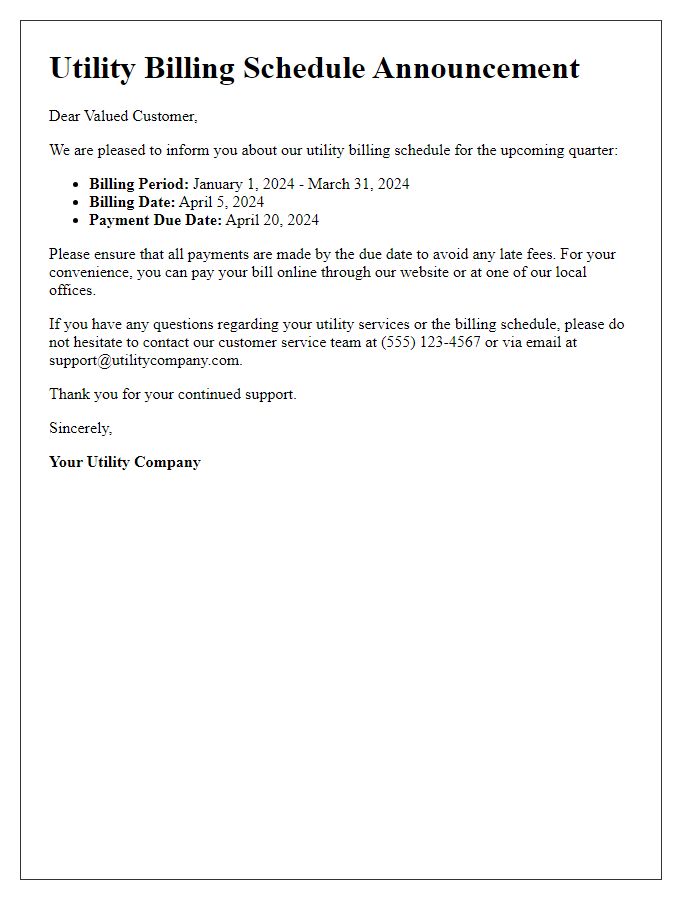

Billing Cycle Dates

Utility billing cycles are essential for understanding when payments are due and how consumption is measured. Most utility providers follow a monthly billing cycle, often spanning from the first to the last day of the month. For example, January's cycle typically runs from January 1 to January 31, while February might shift slightly, especially during non-leap years. Bill statements are usually generated within a few days after the cycle ends--January bills might be issued around February 5. Payment deadlines are commonly set 15 days post-issuance, requiring timely submission to avoid late fees. Service areas vary in operational practices; urban centers may have different cycles compared to rural districts. Customers are encouraged to review their utility provider's communications for specific dates and potential adjustments due to holidays or service changes.

Payment Due Dates

The utility billing cycle consists of specific payment due dates each month, determining when customers are expected to settle their accounts to avoid late fees. For instance, bills are typically issued on the first of the month, with payments due by the 15th to ensure uninterrupted services such as water, electricity, and gas. Customers who miss this deadline may incur a late fee of $10 or face disconnection of services after 30 days of non-payment, emphasizing the importance of timely payments. Local regulations may vary, and some utilities offer grace periods or flexible payment plans to accommodate financial hardships. Understanding the billing cycle helps customers manage their expenses effectively and maintain continuous access to essential utilities.

Contact Information for Inquiries

Utility billing cycles are critical for managing payment schedules for services such as electricity, water, or gas. Typically, a billing cycle lasts approximately 30 days, with specific days designated for meter reading, invoicing, and payment deadlines. Customers should note that utility companies often provide various methods for inquiries, including dedicated customer service hotlines, email support, and online chat services. In certain regions, utility providers may also utilize mobile applications for enhanced access to billing information and support. Important details such as account number, service address, and date of inquiry are often necessary for efficient resolution of issues. Keeping this information handy ensures a smoother communication process when addressing questions or concerns regarding utility bills.

Payment Methods Available

Various payment methods are available for utility billing, ensuring convenience for customers. Credit and debit card options allow for immediate payments online, while electronic checks offer a secure bank transfer alternative. Automatic billing provides hassle-free, scheduled deductions directly from accounts, aiding budget management. In-person payments can be made at designated locations, such as community service centers in cities like Los Angeles, facilitating direct interactions. Additionally, mobile payment apps enable quick transactions from smartphones, reflecting modern banking trends. Utilizing these varied methods supports timely payments and reduces potential late fees.

Comments