Are you considering a vehicle lease but unsure where to start? Navigating the world of leasing options can be overwhelming, but it doesn't have to be! In this article, we'll break down the essential steps and tips to make your leasing experience as smooth as possible. Ready to drive into the details? Let's get started!

Subject Line Optimization

Subject line optimization for vehicle leasing inquiries should focus on clarity and relevance. A well-structured subject line can significantly increase open rates. For example, "Inquiry: Leasing Options for 2024 SUV Models in New York" captures key elements: inquiry purpose (leasing options), target year (2024), vehicle type (SUV), and location (New York). Including specific details enhances the likelihood of a prompt response from the leasing company. Key terms such as "inquiry," "leasing," "options," and "2024 SUV Models" should be strategically placed to ensure immediate recognition of the request's purpose. This targeted approach facilitates efficient communication and demonstrates professionalism in the inquiry process.

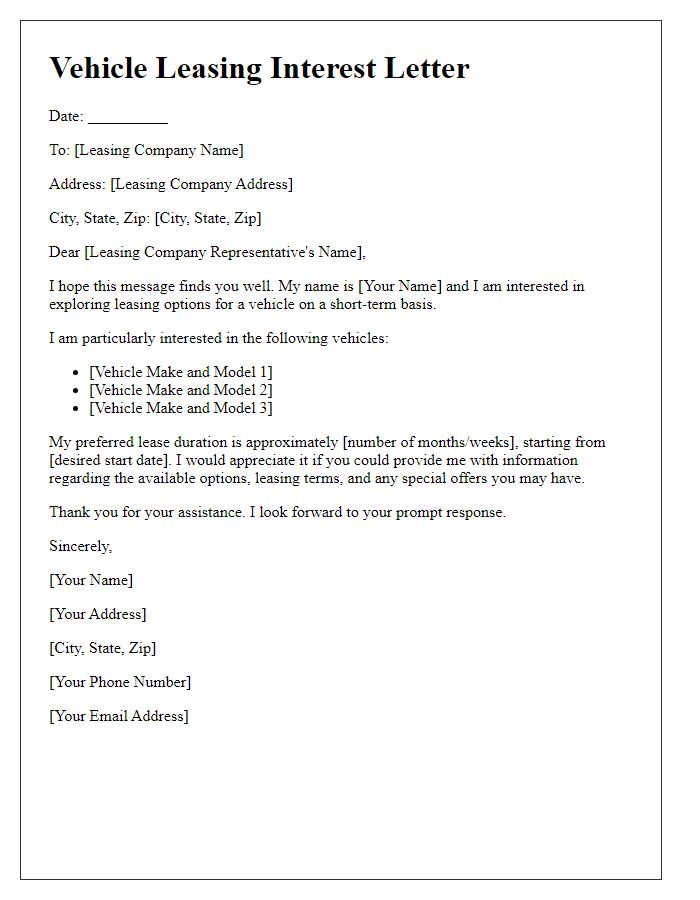

Personalization and Greeting

Vehicle leasing inquiries often begin with a polite and personalized greeting that sets the tone for the conversation. Prospective lessees should address the leasing company or representative by name, if known, and express genuine interest in their leasing options available for models such as the 2023 Honda Accord or the 2024 Tesla Model 3. A friendly approach helps establish rapport, encouraging a positive response. Including specifics about intended usage, like daily commuting or weekend adventures, adds context and allows for tailored recommendations. Clarifying the individual's budget range, such as between $200 to $400 monthly, can assist in identifying suitable vehicle choices aligned with financial considerations. This personalized touch not only enhances the inquiry experience but also reflects preparedness and seriousness in the leasing pursuit.

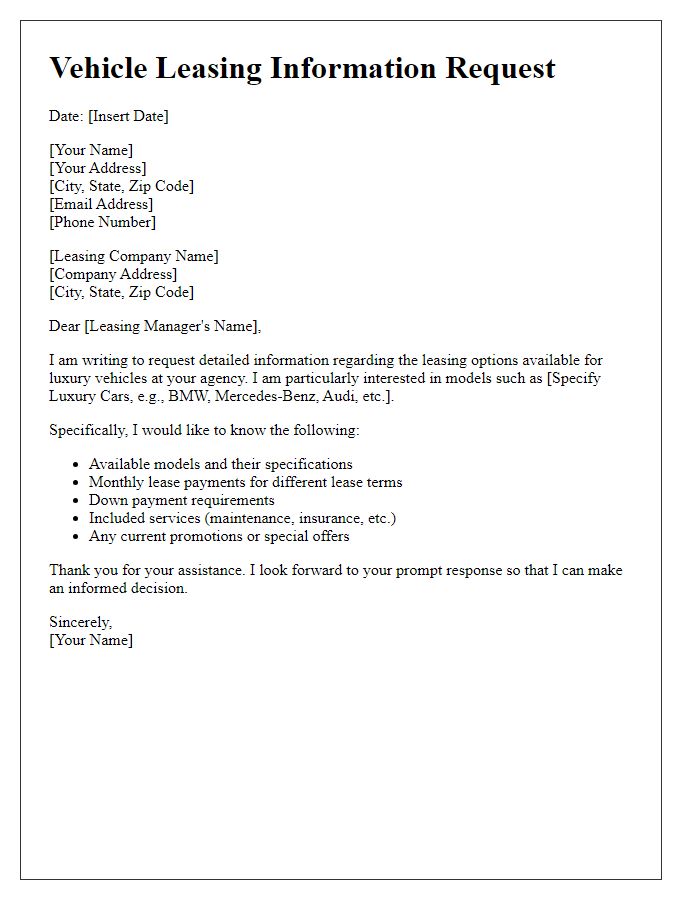

Clear Purpose and Inquiry Details

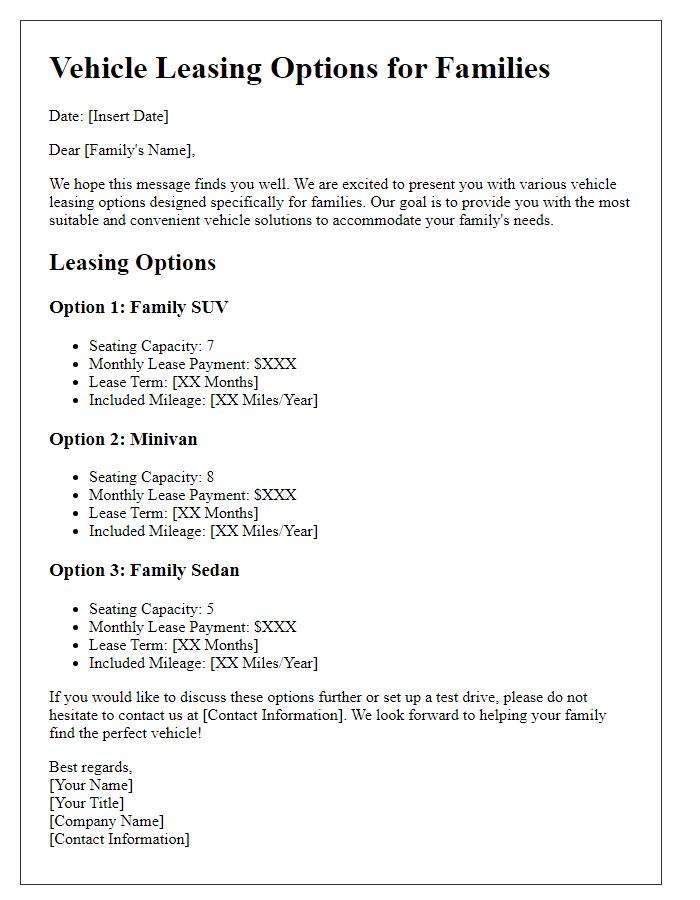

Vehicle leasing programs offer various options tailored for personal or business needs. A comprehensive inquiry should include specifics such as vehicle make and model, lease terms (typically ranging from 24 to 60 months), mileage allowances (commonly between 10,000 to 15,000 miles annually), and monthly payment estimates. Understanding any down payment requirements, fees associated with the lease (like acquisition fees), and potential end-of-lease options (such as purchase prices) is also vital. Gathering this information from reputable dealerships or leasing companies can ensure an informed decision.

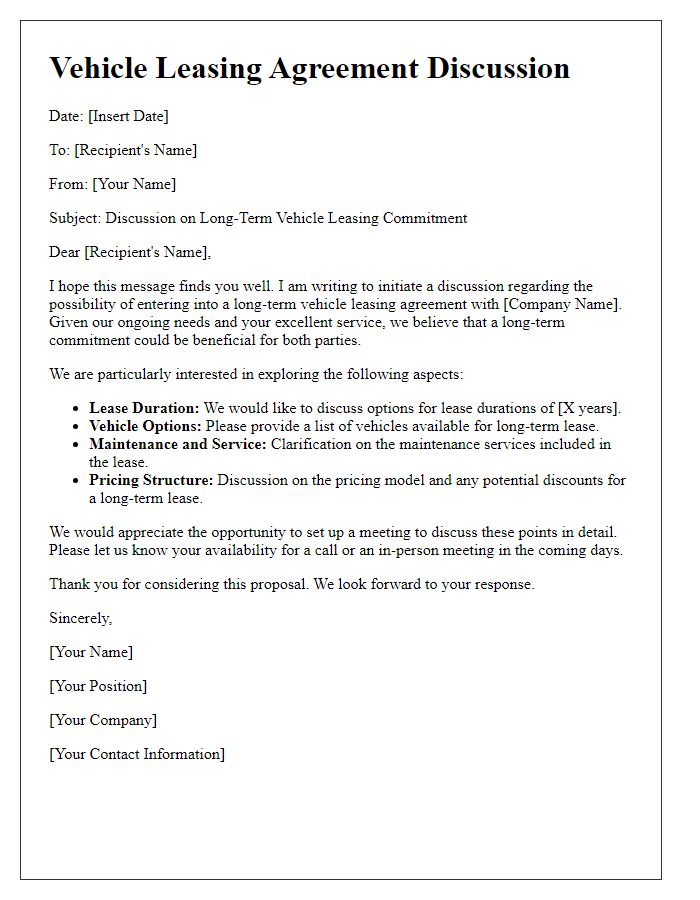

Vehicle Specifications and Preferences

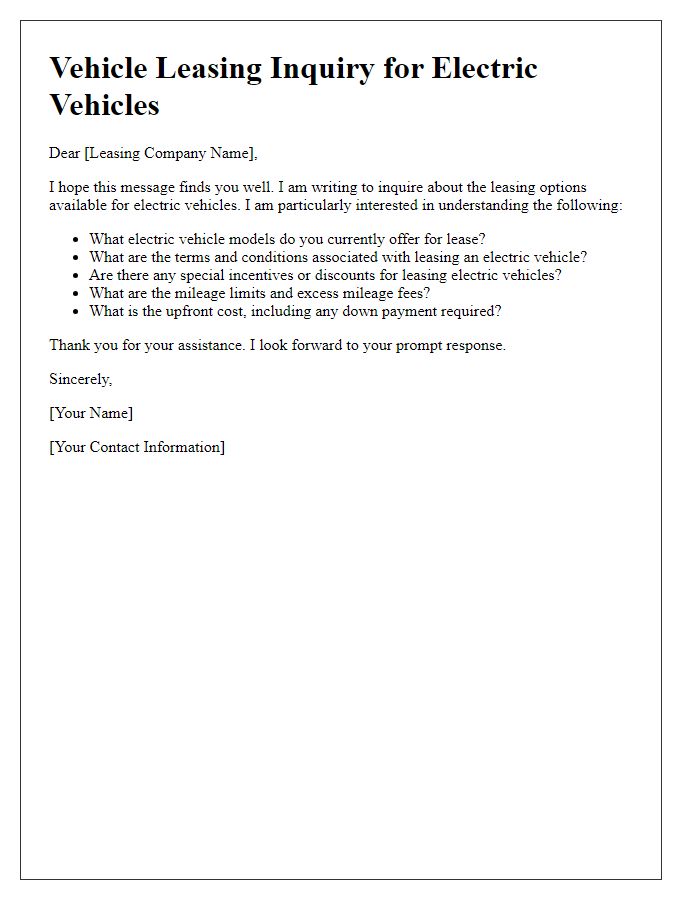

Inquiring about vehicle leasing involves understanding specific specifications and personal preferences. Preferred vehicle types include SUVs, sedans, or electric vehicles, with attention given to engine size (e.g., 2.0L turbocharged), fuel efficiency (e.g., miles per gallon), and safety ratings (such as those from the National Highway Traffic Safety Administration). Additional considerations include interior features like touchscreen infotainment systems, Bluetooth compatibility, and advanced driver-assistance systems (ADAS) like adaptive cruise control. Color options and trim levels also play a significant role, as many consumers prefer particular aesthetics, such as metallic finishes or leather interiors. Monthly leasing costs, down payment requirements, mileage limits (e.g., 10,000 miles per year), and lease term duration (e.g., 36 months) are vital financial elements to clarify during lease inquiries.

Contact Information and Call to Action

When considering vehicle leasing options, individuals should understand key details such as leasing terms, mileage limits, and monthly payment estimates. Key entities include local dealerships that specialize in vehicle leasing, typically offering a range of makes and models suitable for diverse needs (e.g., sedans, SUVs). For instance, annual mileage limits often vary between 10,000 to 15,000 miles, impacting the total leasing costs. Additionally, potential lessees should inquire about the down payment requirements, which can range from zero to several thousand dollars, as well as whether gap insurance (covering the difference between the lease amount and the vehicle's actual cash value in case of total loss) is included in the lease agreement. A valid driver's license and proof of income are essential documents needed during the inquiry process to facilitate approval.

Letter Template For Vehicle Leasing Inquiry Samples

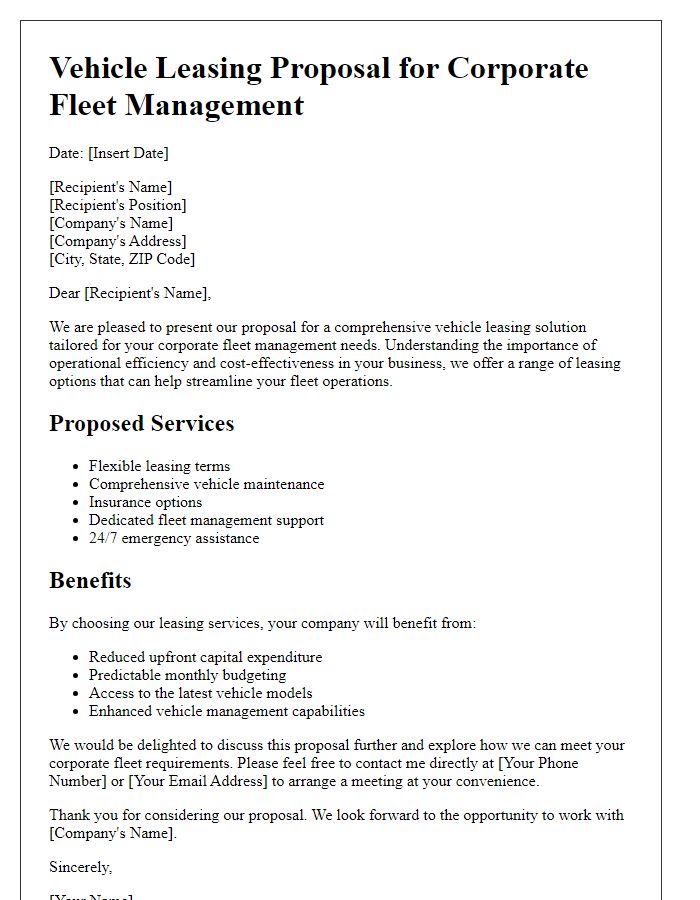

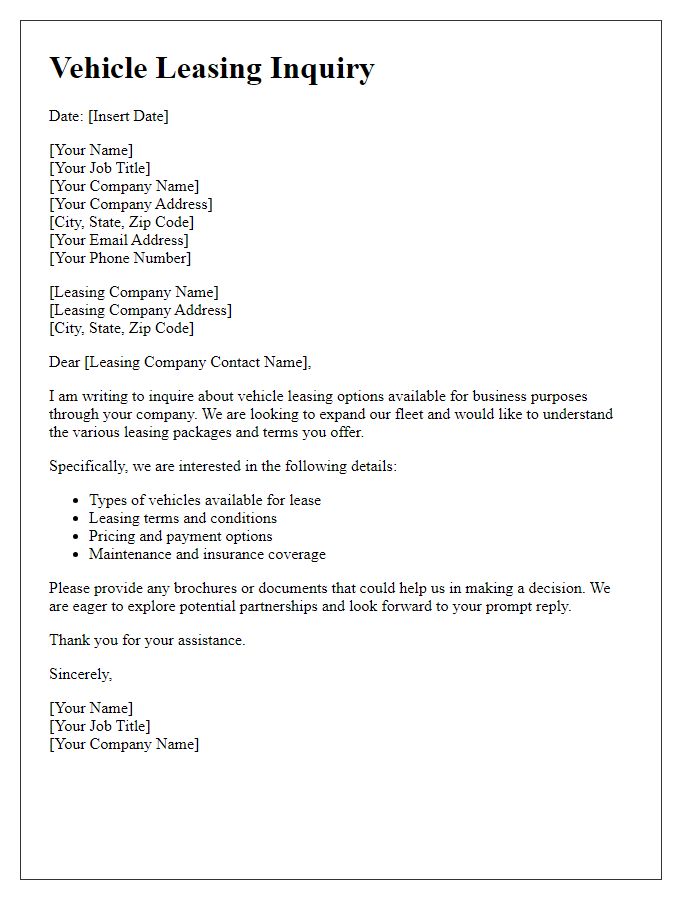

Letter template of vehicle leasing proposal for corporate fleet management.

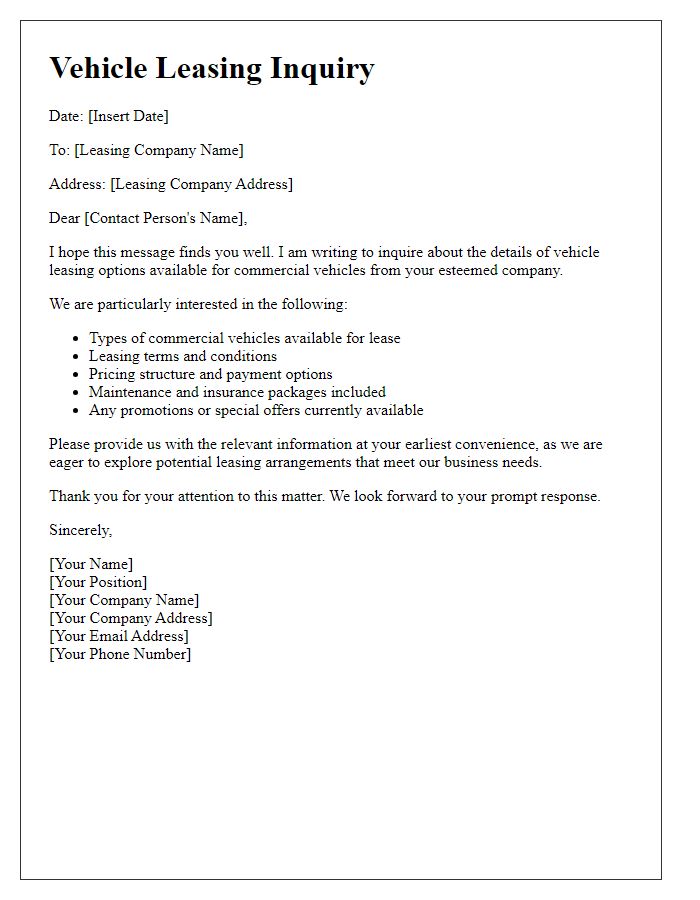

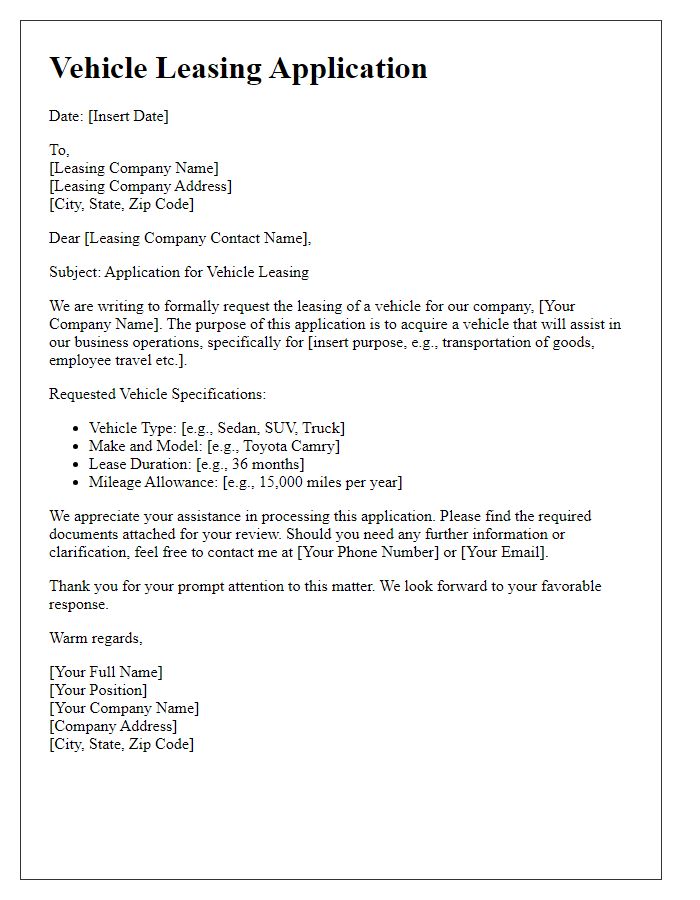

Letter template of vehicle leasing details inquiry for commercial vehicles.

Comments