Are you ready for your vehicle insurance renewal? It's that time again when we take a moment to review and update our coverage to ensure we're fully protected on the road. Whether you're considering new options or simply looking to renew your existing policy, understanding the process can make all the difference. Let's dive into the essentials of renewing your vehicle insurance so you can hit the road with peace of mind!

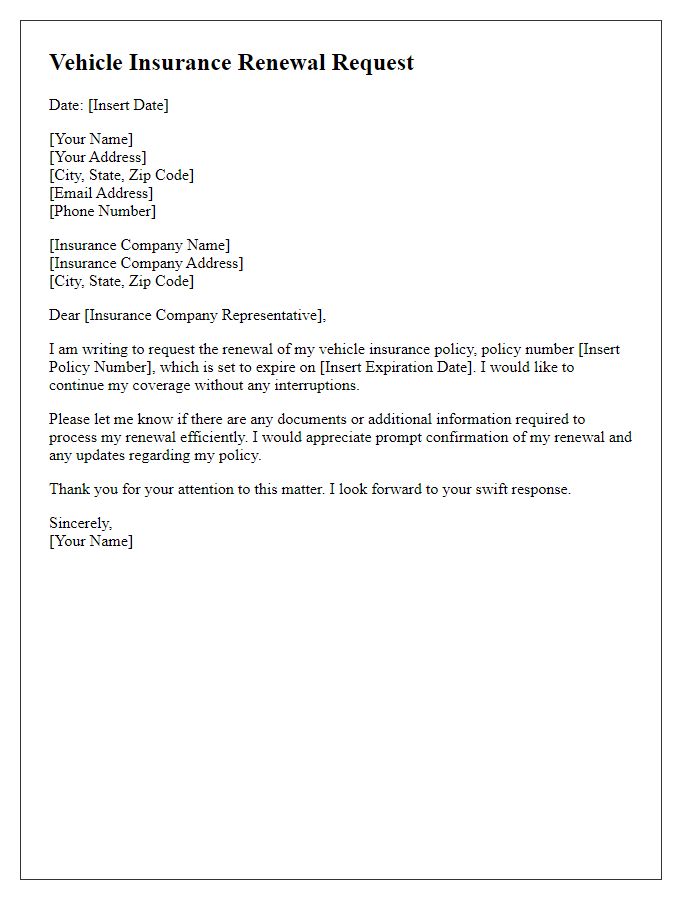

Policyholder Information

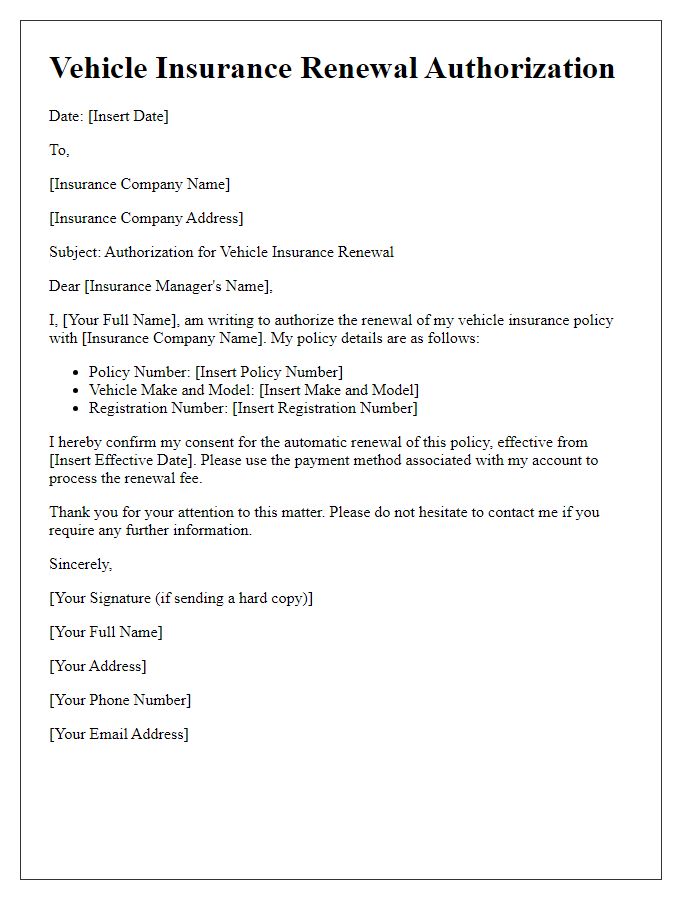

Vehicle insurance renewal is essential for maintaining coverage and ensuring compliance with state regulations. Policyholder information, including full name, address, contact number, and policy number, is critical for accurately identifying the insured vehicle and owner. Vehicle details such as make, model, year, and Vehicle Identification Number (VIN) must also be documented to assess coverage needs. Renewal dates inform policyholders about upcoming deadlines, while premium amounts ensure financial planning for upcoming payments. Additionally, reviewed claims history can help adjust coverage options based on previous incidents. Clear communication about policy changes or updates enhances understanding and satisfaction with services offered.

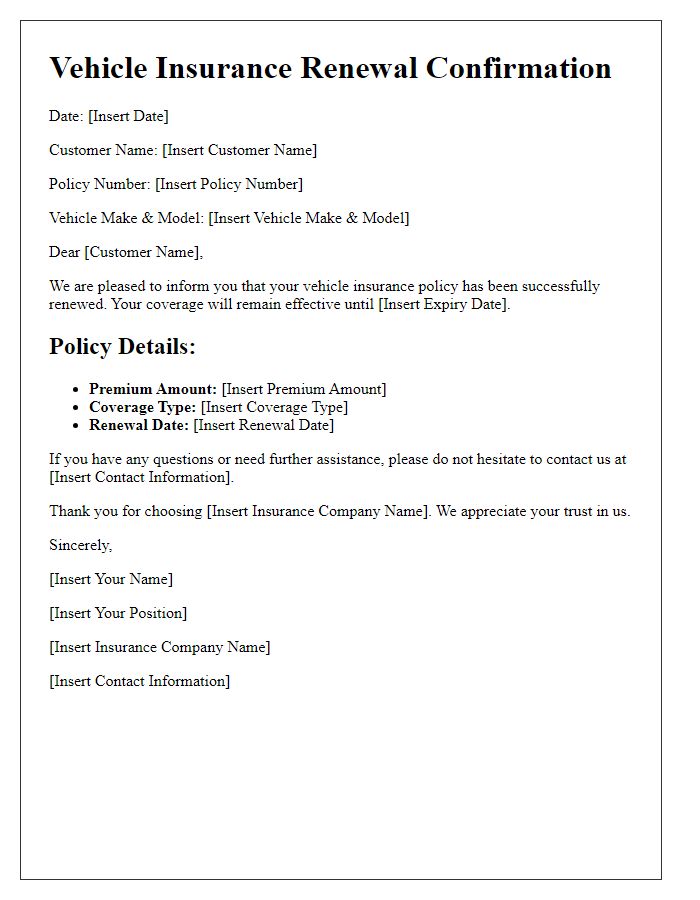

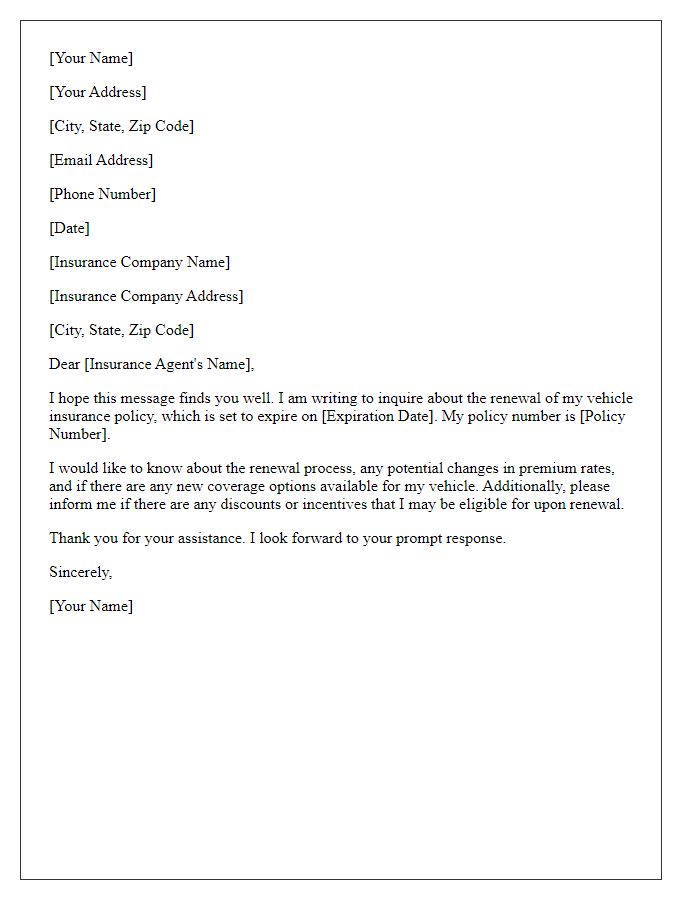

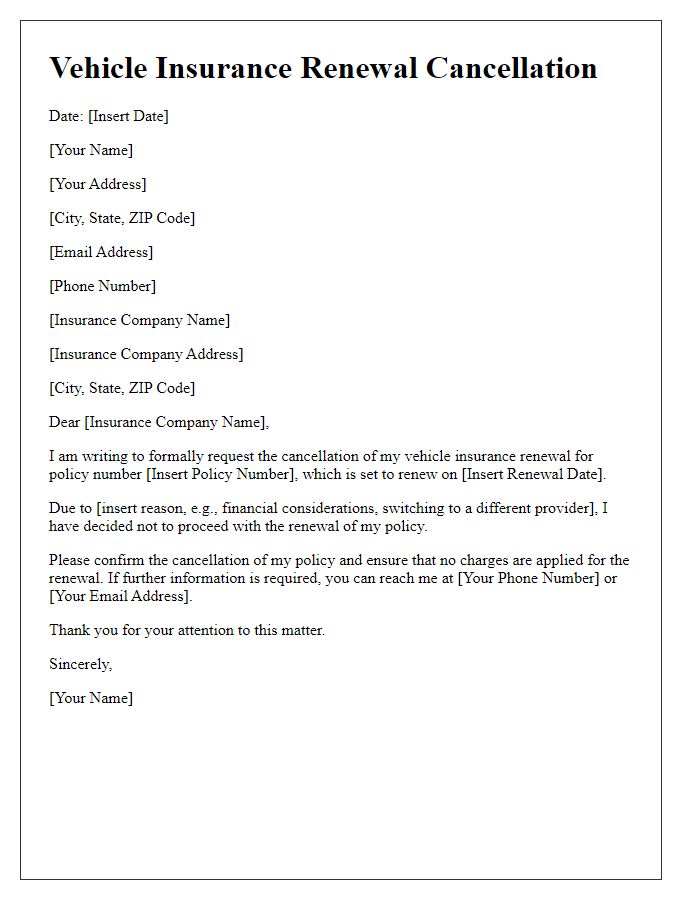

Renewal Terms and Conditions

Vehicle insurance renewal requires understanding specific terms and conditions that impact coverage. Policyholders must note the renewal date, which often occurs annually and can vary by provider. Premium rates may change based on factors such as claims history, vehicle make and model, and driving records. Insurers typically reassess risk profiles, potentially leading to increased or decreased premiums. It is crucial to review coverage limits, deductibles, and any additional benefits offered. Policyholders should also check for relevant discounts applicable for factors such as safe driving, bundling policies, or membership organizations. Remember, a lapse in coverage can lead to legal penalties and financial liabilities in case of an accident.

Payment Options and Instructions

Vehicle insurance renewal presents essential payment options and straightforward instructions. Customers should be aware of multiple payment methods, such as online transactions via credit cards or bank transfers, ensuring secure and immediate processing. For those preferring convenience, automatic payments can be set up monthly or annually, aligning with personal budgets. Detailed instructions accompany renewals, including accessing accounts through dedicated insurance provider websites or mobile apps. Contact information for customer service is available for assistance regarding payment discrepancies or policy inquiries. Additionally, some providers may offer discounts on renewals when paid before the due date, incentivizing timely action for policyholders.

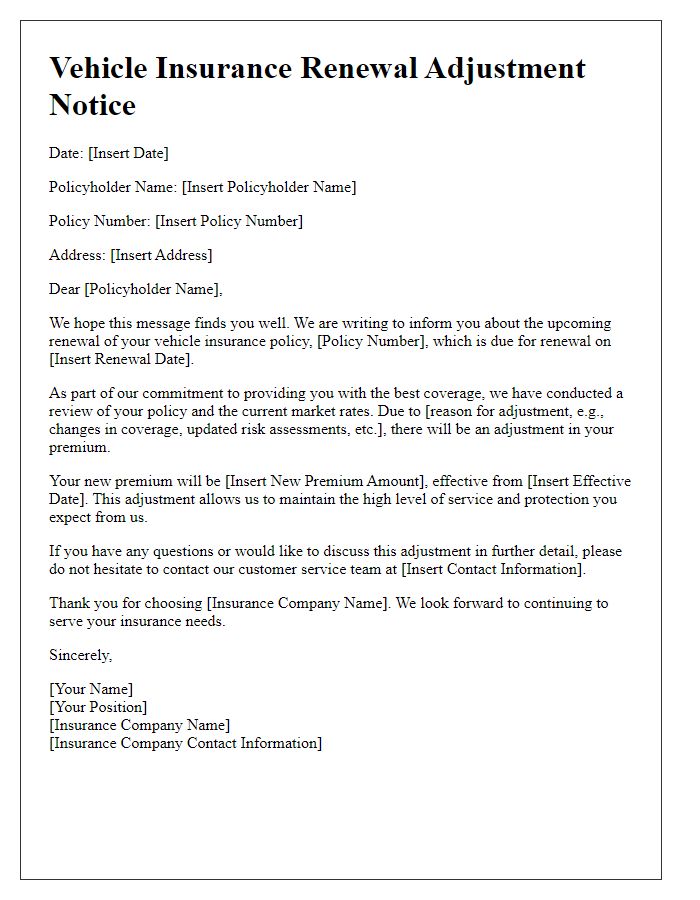

Coverage Details and Changes

Vehicle insurance renewal often involves reviewing coverage details and potential changes to policy terms. Comprehensive coverage protects against theft, weather-related damage, and other risks, while liability coverage ensures protection against financial responsibility in accidents. Additionally, uninsured motorist coverage safeguards policyholders from drivers without insurance. Premium adjustments may occur depending on factors such as driving history, claims made in the previous term, and changes in vehicle value. Premium discounts may apply for safe driving records or for installing anti-theft devices. Reviewing these aspects thoroughly ensures adequate coverage and optimal financial protection. When approaching the renewal date, understanding these elements becomes critical to avoid lapses in coverage.

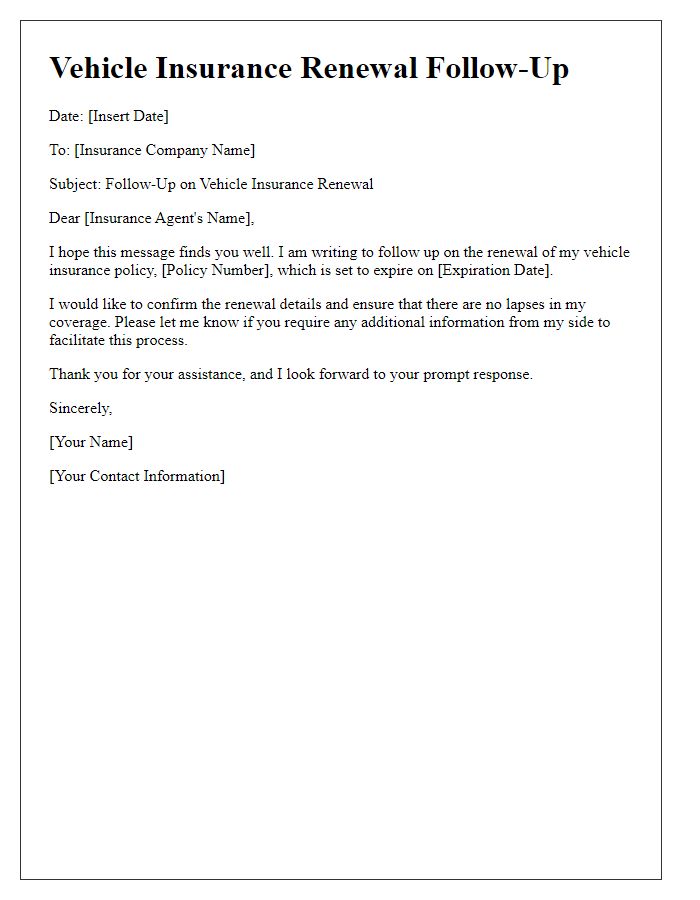

Contact Information for Inquiries

Insurance companies often provide a dedicated contact information section for inquiries regarding vehicle insurance renewal. This typically includes essential details such as a customer service phone number, usually available from 9 AM to 5 PM on weekdays, an email address specifically designated for customer inquiries, and possibly a physical address for sending documents or forms. Many insurers also offer online chat support through their official websites, allowing customers to get immediate assistance. Sometimes, specific agents or departments might be assigned to handle renewals, indicated by a direct line or extension number, ensuring a streamlined process for policyholders during renewal season.

Comments