Are you thinking about requesting a credit limit increase but don't know where to start? Whether you're looking to boost your purchasing power or improve your credit score, writing a clear and concise letter can make all the difference. In this article, we'll walk you through a simple letter template that effectively communicates your request while highlighting your responsible credit behavior. Ready to take your credit management to the next level? Let's dive in!

Personal Information

Personal credit information can significantly influence financial decisions such as a credit limit increase. Individuals often seek this increase for various reasons, including improvements in credit scores typically above 700, increased income statements highlighting earnings from full-time employment or additional side jobs, and consistent, timely payment history on existing credit accounts over several months or years. Credit limit increase requests may be directed to financial institutions like Chase or Bank of America, where important details like account number, current credit limit, and any recent changes in financial status must be included. Clear justification, such as planned large purchases or travel expenses, often strengthens the request. Therefore, providing accurate personal information alongside a compelling rationale is crucial for achieving a favorable outcome.

Current Credit Account Details

Current credit account details provide essential information regarding the status of a credit account with a financial institution. The account number, typically a series of 16 digits unique to each user, can help identify individual accounts. The current credit limit, often denoted in a specific currency, indicates the maximum amount that the user can borrow against the credit line. Account holders should also be aware of their current balance, representing the amount of credit already utilized compared to the limit. Payment history is crucial, especially if it reflects timely payments over the past months, influencing future credit decisions. Annual percentage rate (APR) details represent the cost of borrowing, usually expressed as a percentage, impacting interest owed on carried balances. Lastly, any recent transactions may exhibit the account's activity level, an indicator of credit usage and financial behavior to lenders.

Reason for Increase Request

A credit limit increase may be beneficial for consumers seeking to improve their financial flexibility and boost their credit score. Increased limits can enhance credit utilization ratios by allowing users to maintain lower balances relative to their available credit, which is essential since a lower utilization rate (ideally under 30%) positively impacts credit scores. Additionally, during significant life events such as buying a home in suburban areas or financing education in prestigious universities, higher credit limits provide essential liquidity for managing expenses. Regularly reviewing accounts and requesting increases with a history of on-time payments and consistent income strengthens the case for approval with issuing banks or credit unions, ultimately contributing to better financial health and purchasing power.

Supporting Financial Documents

A credit limit increase request requires supporting financial documents to demonstrate financial stability and the ability to manage increased credit responsibly. Key documents include recent pay stubs, ideally within the last 30 days, reflecting current income levels. Tax returns from the previous year provide a comprehensive view of annual earnings, while bank statements for the last three months show overall financial health and cash flow. Additionally, a credit report detailing current debt obligations across all accounts is crucial for understanding existing credit utilization. Lastly, a personal statement outlining reasons for the requested increase, future financial plans, or any significant life changes, such as a recent job promotion, can strengthen the case for approval.

Contact Information

Increasing credit limits can enhance financial flexibility for consumers, particularly for credit cards issued by major banks like Chase or Capital One. A typical consumer, often with a credit score above 700, may request this limit increase to improve their credit utilization ratio, which ideally should stay below 30% for optimal scoring. Contacting customer service at the bank can involve providing personal identification details and specific income amounts, such as annual salary or additional sources of income, to support the request. This process typically takes place through secure online portals or dedicated customer service lines, ensuring data privacy and security throughout the transaction.

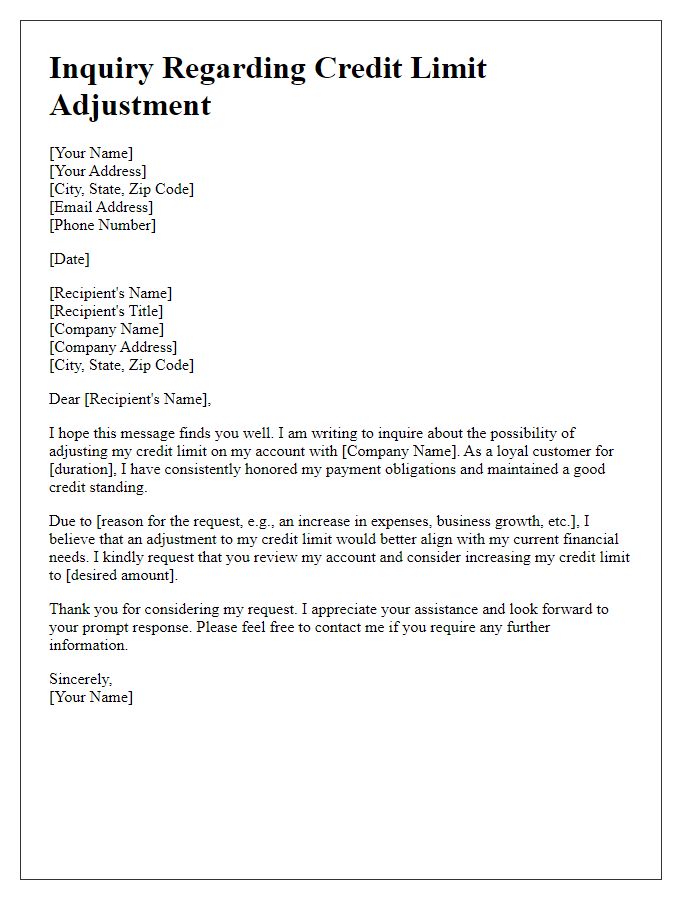

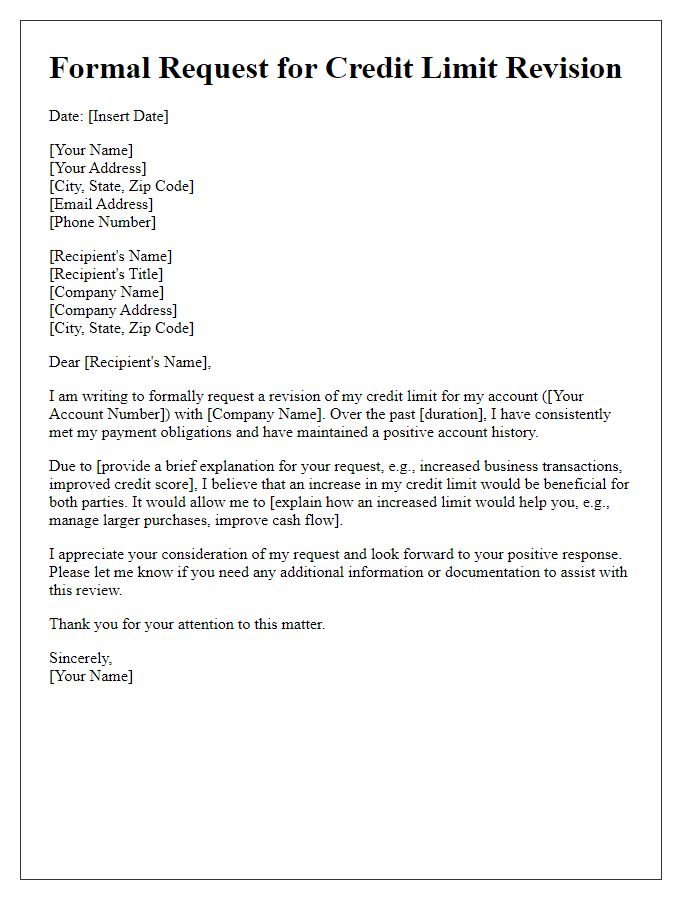

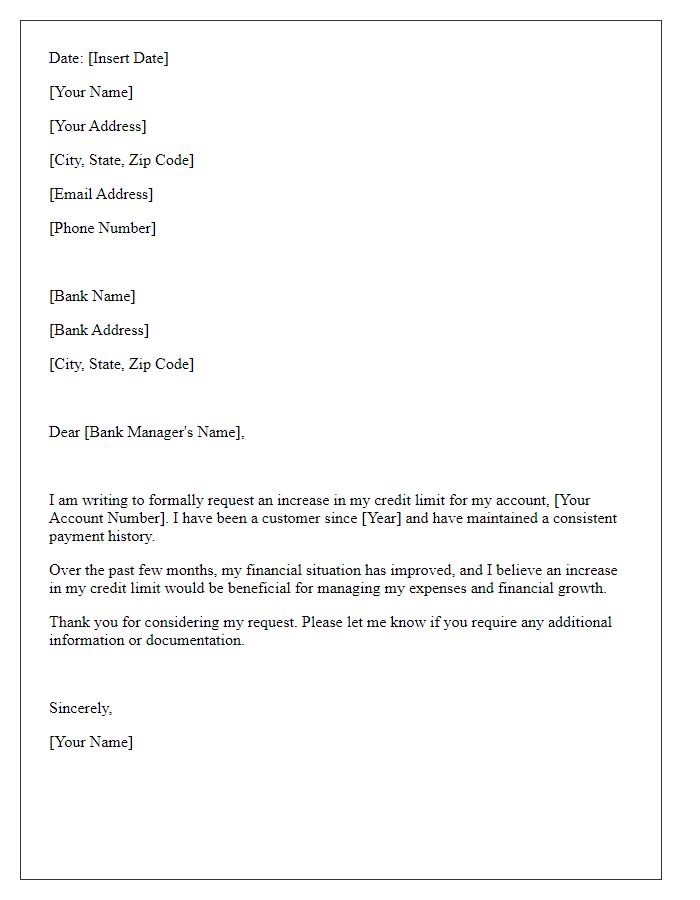

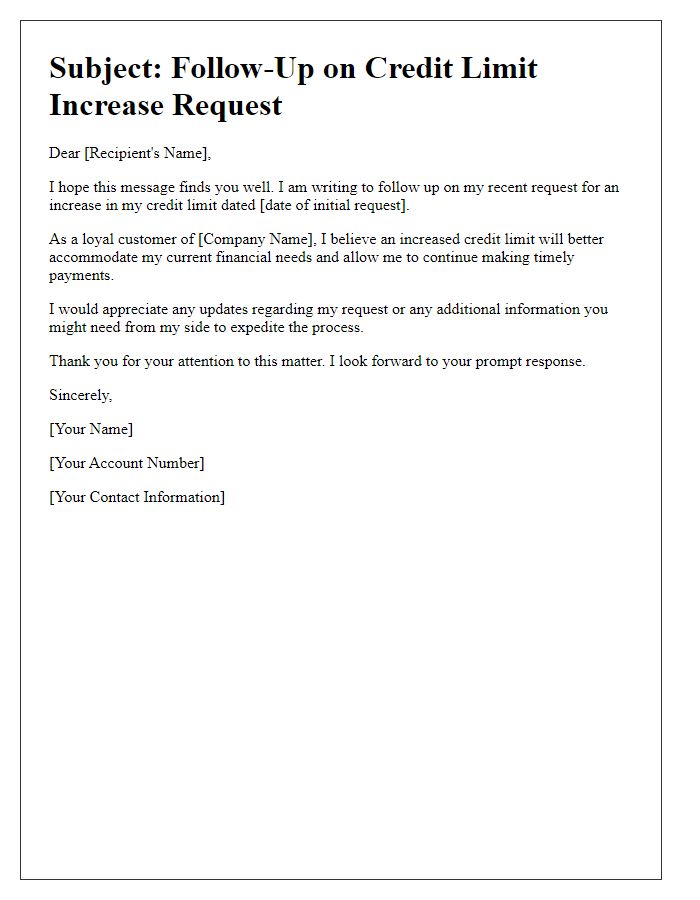

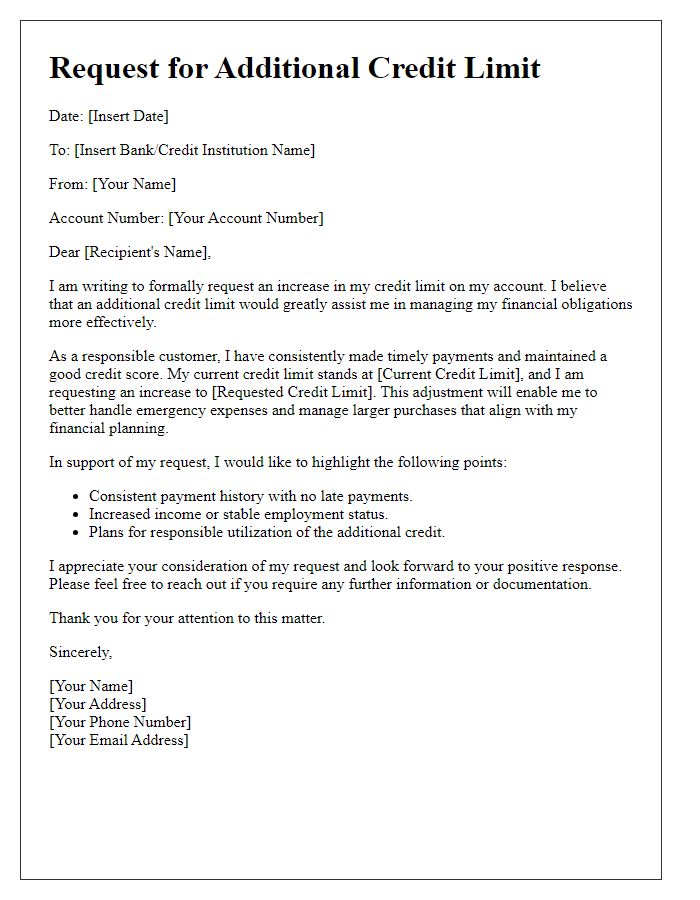

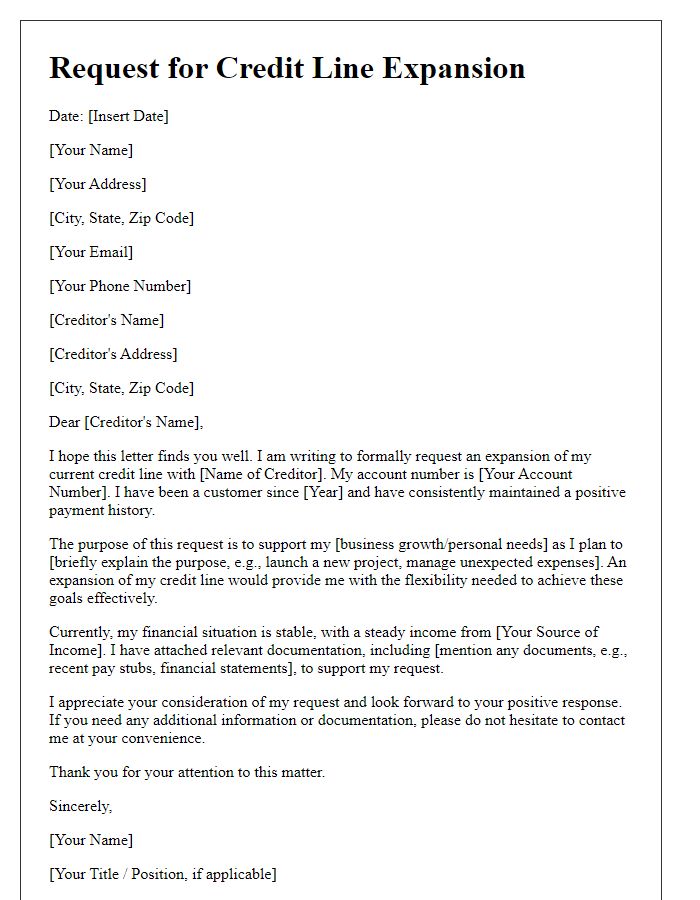

Letter Template For Credit Limit Increase Samples

Letter template of notification for credit limit increase consideration.

Comments