Are you tired of the hassle that comes with managing recurring payments? We understand how important it is to streamline your finances while ensuring your bills are paid on time. In this article, we'll guide you through the process of creating a straightforward letter template for recurring payment authorization. So, grab a cup of coffee, sit back, and let's dive in to make your payment management effortless!

Payer and Payee Information

Recurring payment authorization establishes a financial agreement between payer and payee for consistent transactions. Payer details include full name, contact information, such as email address and phone number, and bank account details, including account number and routing number for direct debit withdrawals. Payee information encompasses the business name, address, and contact details of the organization receiving payments. This authorization agreement typically specifies payment frequency, such as weekly, bi-weekly, or monthly, along with the transaction amount and the duration of the agreement. Additionally, terms surrounding cancellation and modification of payment arrangements provide essential clarity for both parties.

Payment Details and Amount

Recurring payment authorization facilitates automated transactions for services or subscriptions. Details must include payment amounts (e.g., $29.99 monthly for streaming services), frequency (e.g., monthly, quarterly), and payment methods (e.g., credit card, bank account). Additionally, service providers must specify duration (e.g., 12 months commitment) and conditions for changes or cancellations. Clarity on billing dates (e.g., payment processed on the 1st of each month) ensures transparency for consumers, preventing unexpected charges. Providing customer support contact details (e.g., email: support@example.com) also assures users of assistance with any issues regarding their subscription.

Authorization Statement

Recurring payment authorization ensures automatic transactions for services or products. Individuals typically provide consent for monthly charges, such as subscriptions or memberships, allowing businesses to debit their accounts without further approval. Important details include the payment amount, frequency (e.g., monthly, quarterly), and duration of the authorization. Payment methods can involve credit cards, bank drafts, or digital wallets, depending on the organization's policies and customer preferences. Clear communication about cancellation terms and customer rights is essential to maintain transparency. Organizations often utilize secure systems to safeguard sensitive information during these transactions.

Effective Date and Frequency

Recurring payment authorization is critical for managing subscriptions and services in industries such as telecommunications, utilities, and fitness. Effective date determines when the automated payments commence, often set to align with billing cycles, like monthly or quarterly, ensuring seamless service continuity. Frequency of payments, such as weekly, biweekly, or monthly, establishes how often the payment processor withdraws funds from the customer's bank account. This setup is crucial for maintaining cash flow for businesses while providing convenience for customers, allowing them to avoid late fees associated with missed payments in places like gyms and subscription-based streaming services. Clear communication of these details enhances customer trust and satisfaction.

Cancellation Terms and Conditions

Recurring payment authorization agreements for services often include specific cancellation terms and conditions that outline the process and requirements for terminating the payment arrangement. These terms typically specify notice periods, such as requiring a minimum of 30 days' notice before cancellation. They may delineate acceptable methods for submitting cancellation requests, whether via email, online account management, or written correspondence sent to a designated address. The conditions might also detail refund policies concerning payments already processed, ensuring transparency for consumers. Finally, important contact information for customer service is often provided to facilitate communication regarding cancellations and any potential disputes that may arise.

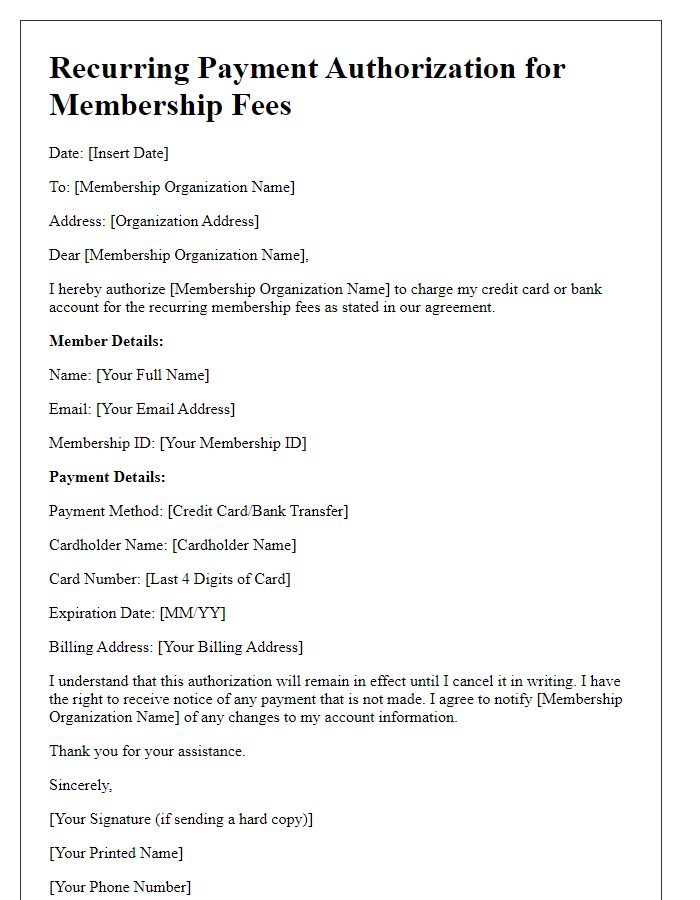

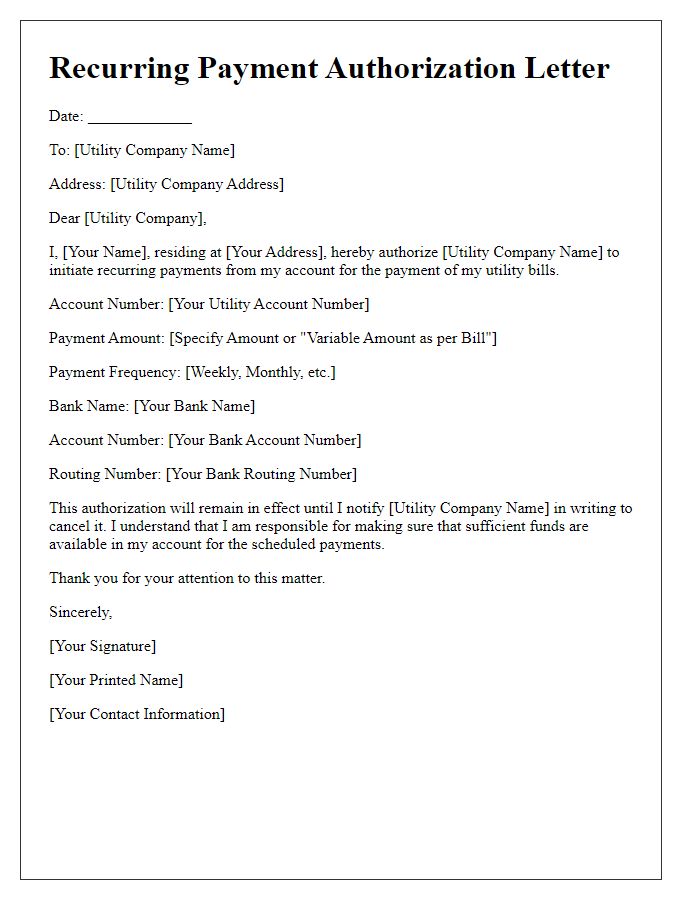

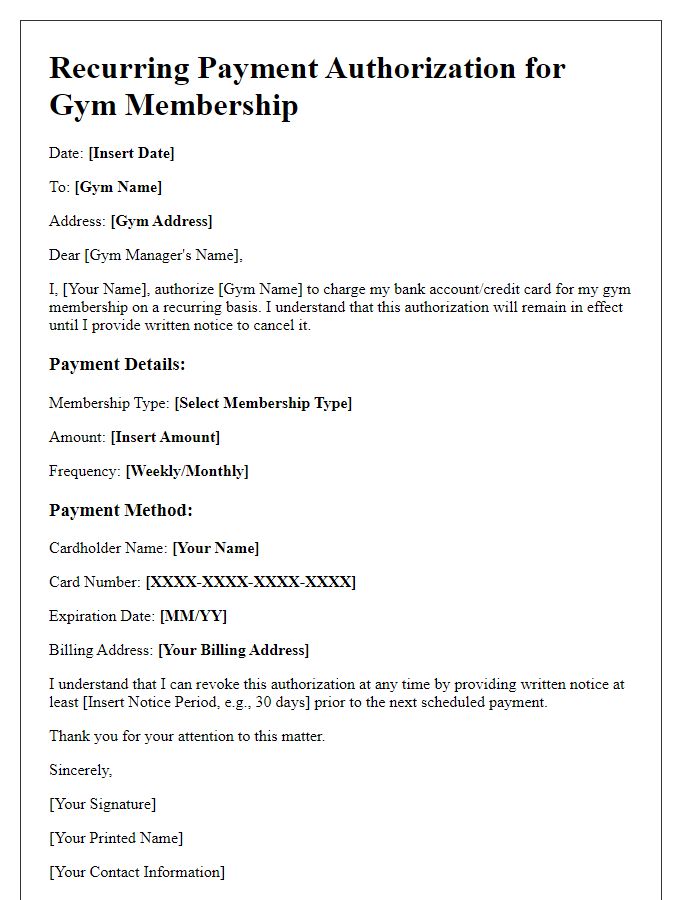

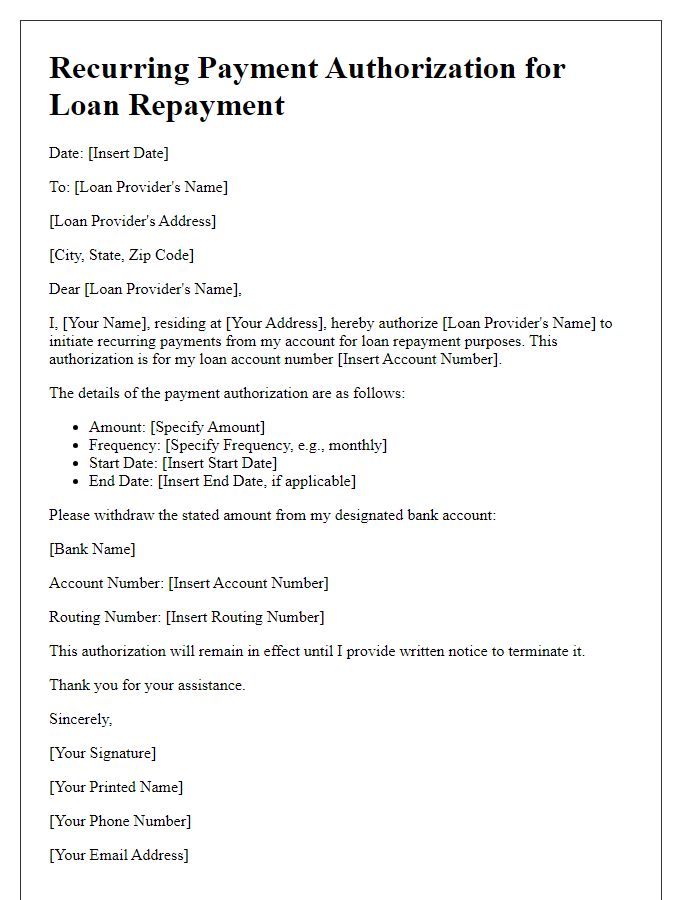

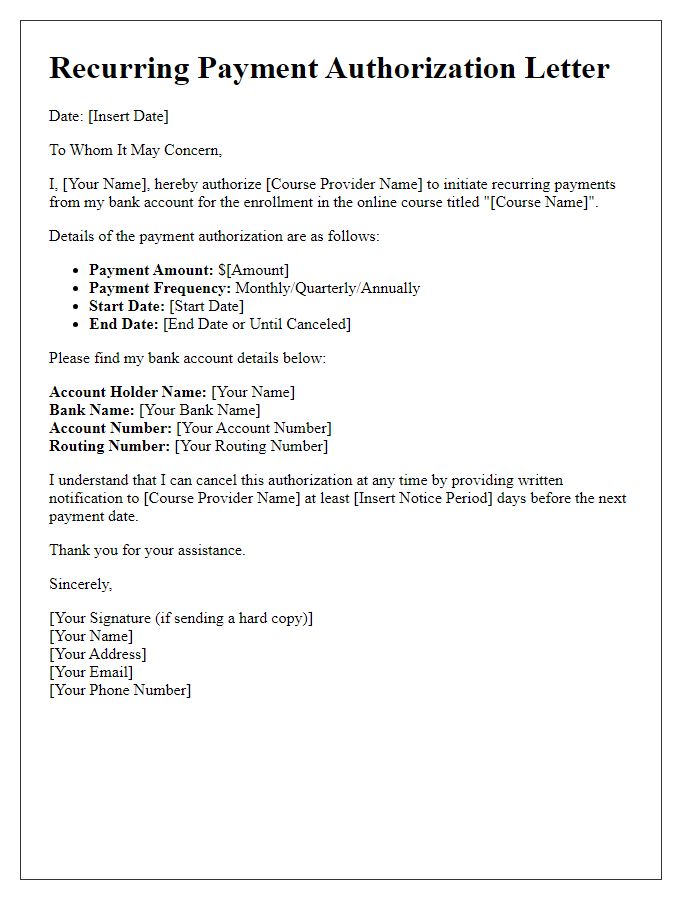

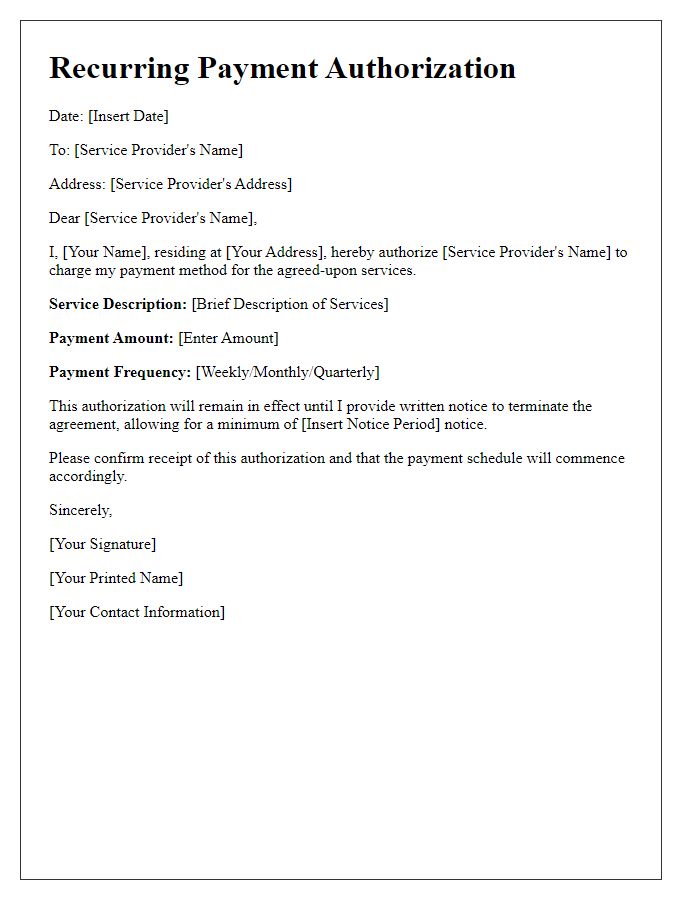

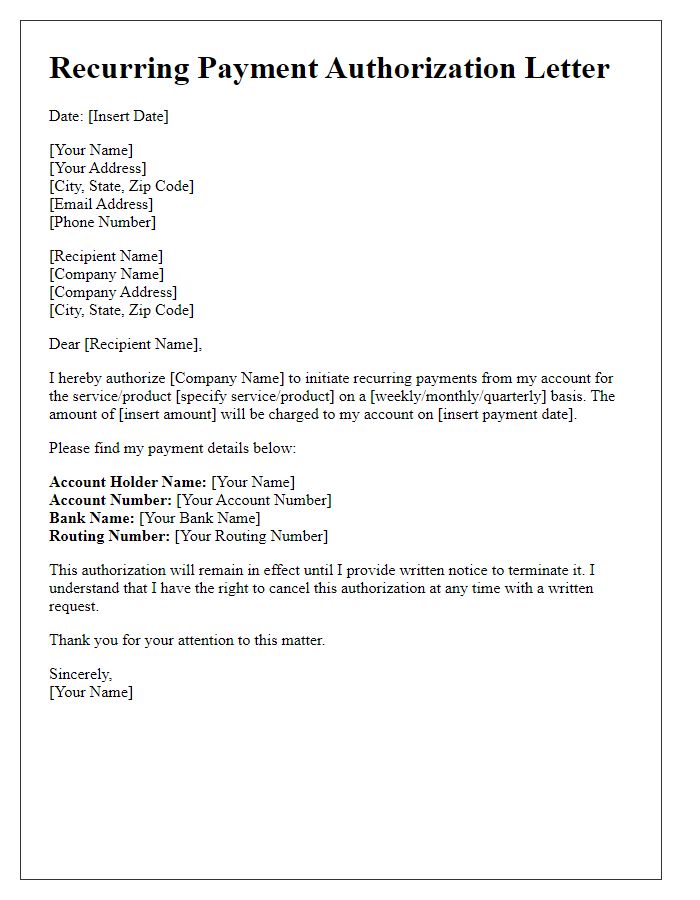

Letter Template For Recurring Payment Authorization Samples

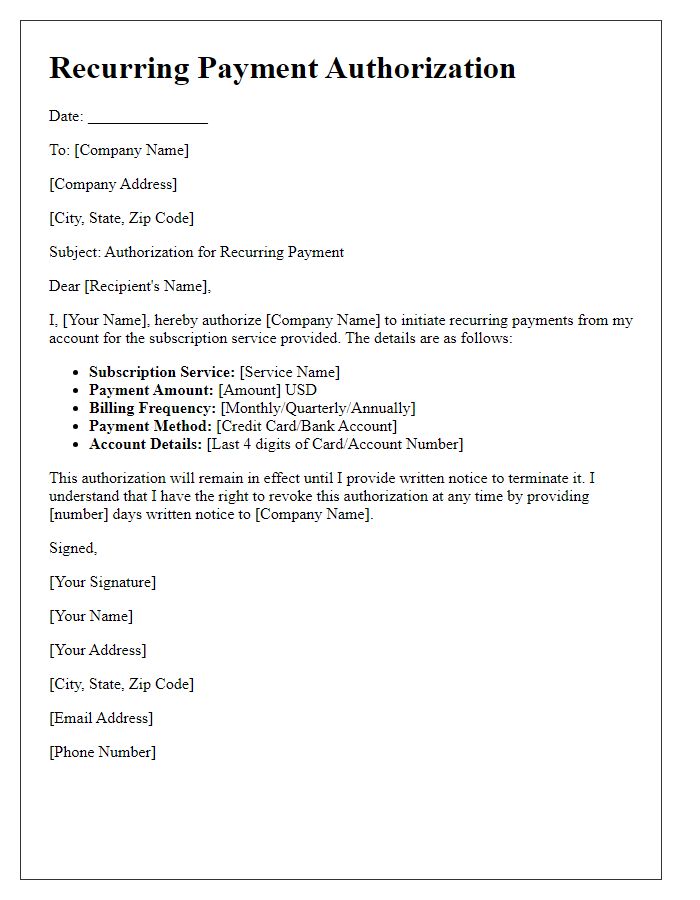

Letter template of recurring payment authorization for subscription services.

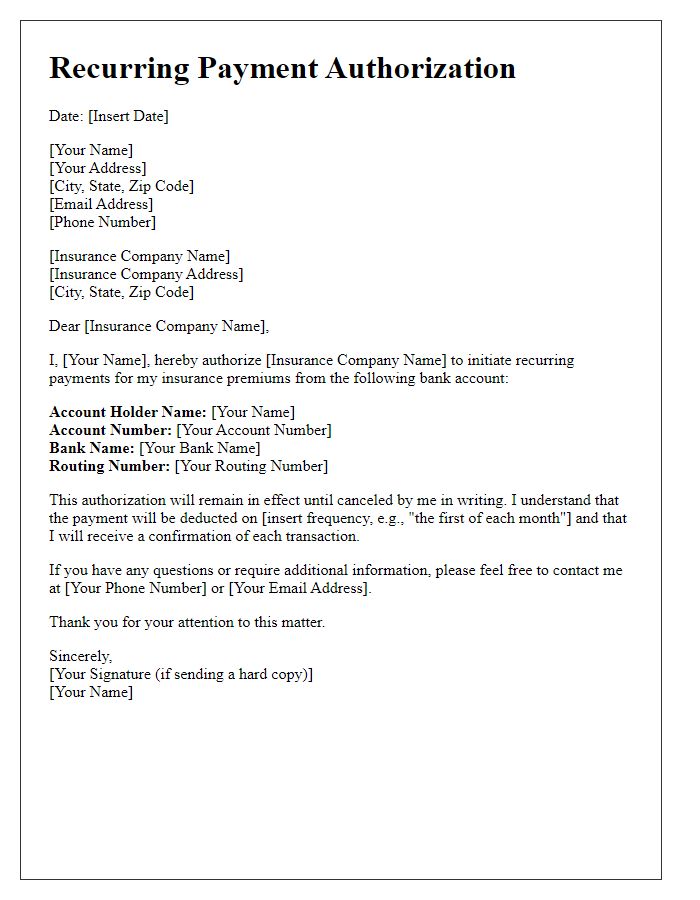

Letter template of recurring payment authorization for insurance premiums.

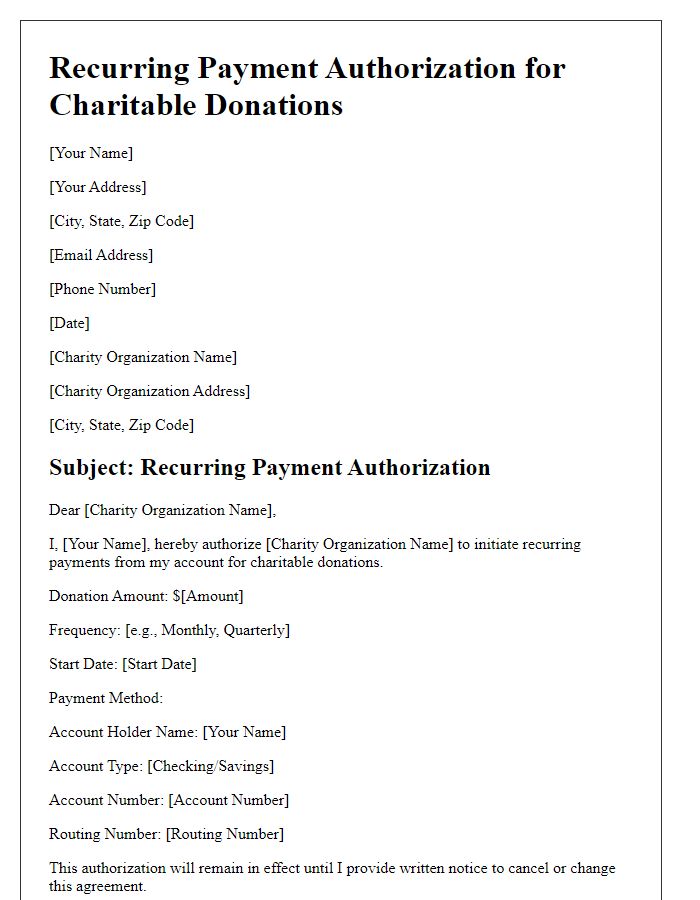

Letter template of recurring payment authorization for charitable donations.

Comments