Are you tired of missing bill payments and dealing with pesky late fees? Setting up automatic payments can streamline your financial life and give you peace of mind knowing that your bills are paid on time, every time. This simple yet effective solution allows you to focus on the things that matter most while keeping your finances in check. Curious about how to get started? Read on!

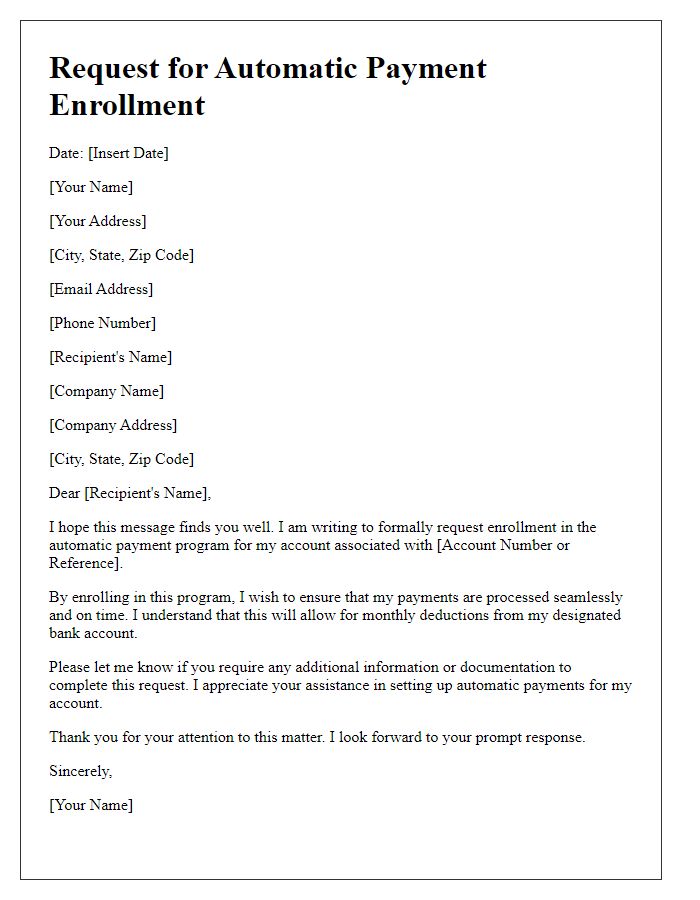

Personal and account information

Establishing an automatic payment setup entails providing detailed personal information such as full name, mailing address, and contact number, alongside account information including bank account number and routing number for seamless transactions. Additionally, the service provider may require specific details about the payment schedule, such as the specified amount and due date, ensuring timely processing within institutions like banks or credit unions. Security measures must be considered, emphasizing the importance of protecting sensitive data against unauthorized access and potential identity theft. Financial institutions and service providers typically outline terms and conditions regarding the automatic payment process, highlighting consumer rights and dispute resolution procedures.

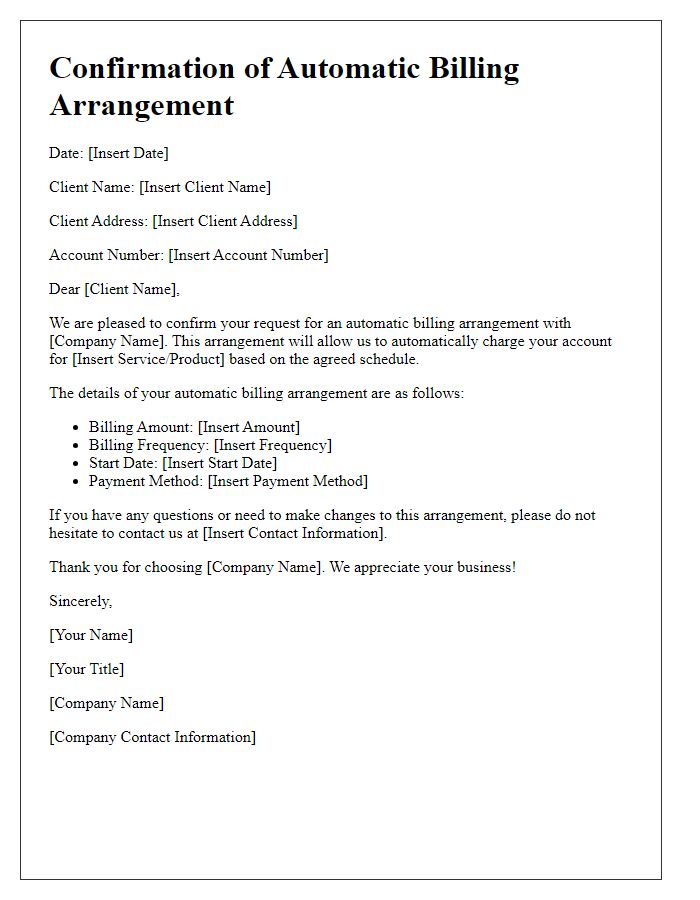

Payment details and frequency

Automated payment setups streamline financial transactions, providing convenience for both consumers and service providers. Payment details often include critical information such as the account number, routing number, and credit card information, which are necessary for initiating automated transactions. Frequency of payments, determined by the terms of service, can vary from monthly, quarterly to annually, aligning with billing cycles of utilities, subscriptions, or loans. Establishing a reliable system for automatic payments can prevent missed dues, ensuring uninterrupted services in places like housing leases, mobile services, or online streaming platforms. Security measures, such as encryption and two-factor authentication, are essential to protect sensitive information during these transactions.

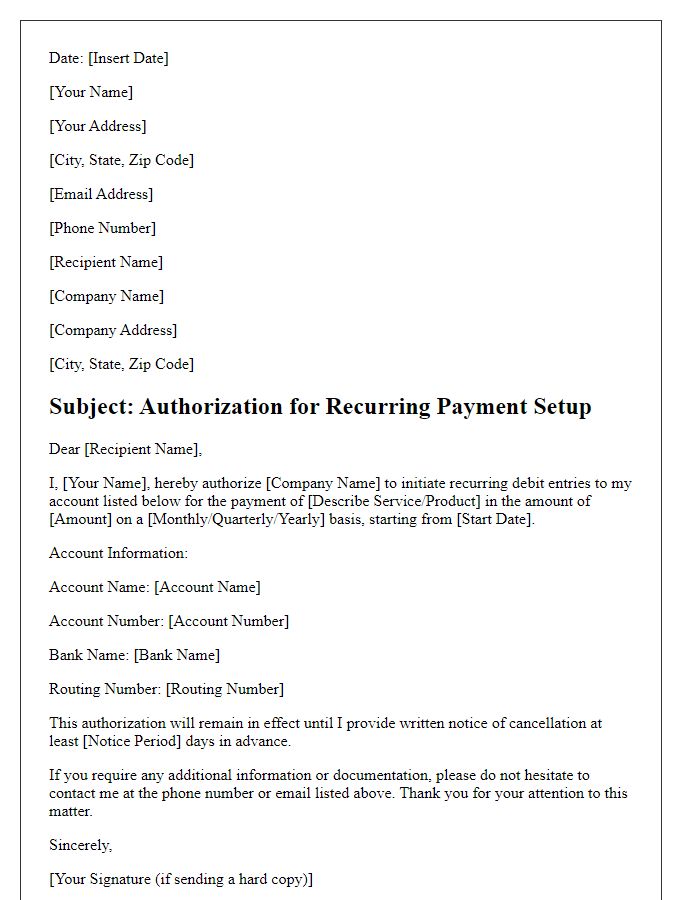

Authorization statement

Setting up automatic payment authorization can streamline bill payments and enhance financial management. A typical authorization statement outlines permission granted to a service provider or company to withdraw specified amounts from a bank account at designated intervals. This often includes details such as the account holder's name, account number, and the frequency of payments (weekly, monthly, quarterly). Additionally, it may specify billing amounts and the start date for deductions. Clear communication about cancellation policies and the ability to modify payment amounts ensures transparency in the arrangement. Institutions often require signatures to finalize the authorization process.

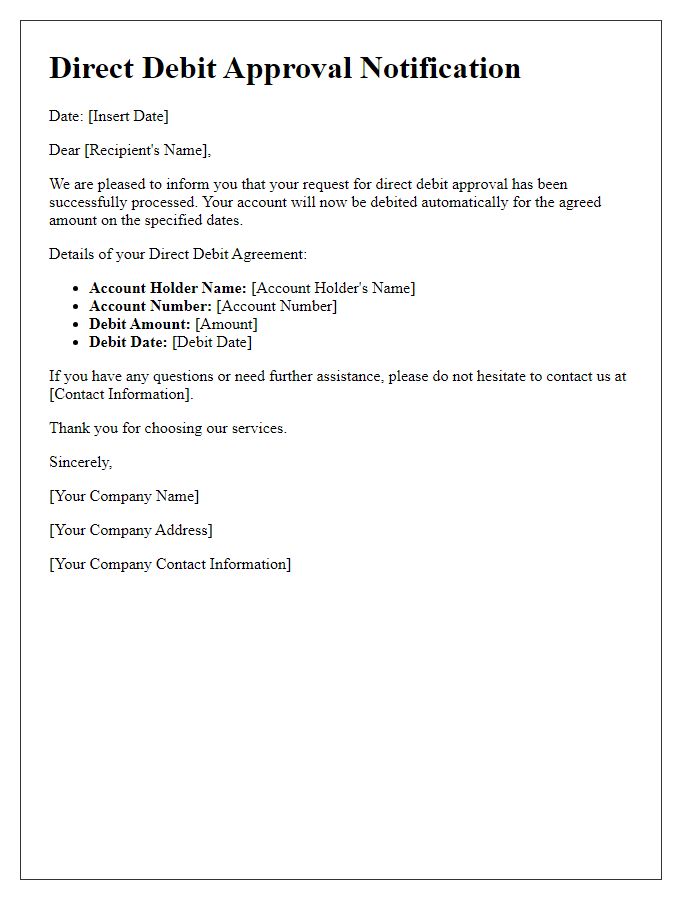

Contact information for inquiries

Setting up automatic payments ensures timely transactions for services or bills. For assistance, customers can reach out to the designated contact department at the service provider's office located in Springfield, USA, phone number 1-800-555-0199. Email inquiries can be directed to support@serviceprovider.com, with responses typically within 24 hours. FAQs regarding payment setup and management can be found on the official website, providing essential guidance for seamless service continuity.

Terms and conditions agreement

Establishing automatic payment setups involves detailed agreements outlining the terms and conditions relevant to the transaction process. These agreements define essential elements such as payment frequency, due dates, associated fees (typically ranging from $0 to $35 depending on the institution), and methods of payment, including credit card or bank transfer options. Compliance with privacy legislation, such as the General Data Protection Regulation (GDPR) for European entities, must be ensured to protect personal information. Furthermore, cancellation policies require clear stipulations, allowing customers to terminate the agreement without penalties under specific conditions, usually within a defined notice period such as 30 days. Acknowledgment of these terms is crucial for accountability and transparency between service providers and consumers.

Comments