In today's fast-paced business environment, effective communication of risk management policies is crucial for ensuring that everyone is on the same page. It's not just about having a policy; it's about fostering a culture of awareness and responsibility among all team members. By clearly articulating the guidelines and expectations, we empower our employees to make informed decisions and mitigate potential threats. Ready to dive deeper into how a well-communicated risk management policy can transform your organization?

Clarity and Purpose

Risk management policies are essential frameworks guiding organizations in identifying, assessing, and mitigating potential risks. These documents outline procedures and responsibilities, establishing clear protocols for risk evaluation and response. Effective communication regarding these policies ensures employees understand their roles in safeguarding organizational assets. Regular training sessions, as recommended by industry standards such as ISO 31000, enhance awareness. In a dynamic environment like finance or healthcare, where regulatory requirements continuously evolve, clarity in these communications protects both the organization and its stakeholders, fostering a proactive culture toward risk management.

Roles and Responsibilities

The communication of roles and responsibilities in risk management is critical for organizations such as multinational corporations or small businesses to ensure effective handling of potential threats. Clear delineation of responsibilities among team members, such as risk managers, department heads, and compliance officers, enhances accountability. For instance, the risk manager is tasked with identifying and assessing risks, while department heads implement specific mitigation strategies within their areas. Regular training sessions, such as quarterly workshops, help reinforce these roles, ensuring that all personnel understand and execute their responsibilities effectively. Additionally, utilizing technology like risk management software can streamline reporting and collaboration, fostering a proactive risk management culture within the organization.

Risk Assessment Process

Risk assessment processes in organizations involve systematically identifying, analyzing, and evaluating potential risks that could impact operations, finances, or reputation. The initial step includes hazard identification, which may encompass workplace safety issues, cybersecurity threats, and financial liabilities. Following identification, an analysis phase occurs, assessing the likelihood of these risks and their potential impact, often using qualitative and quantitative methods. Evaluation of the risks involves comparing against established criteria or benchmarks, determining risk tolerance levels intrinsic to the organization. Continuous monitoring is critical, utilizing tools such as risk matrices to prioritize actions and implement mitigation strategies. Regular reviews ensure the process remains current, adapting to evolving threats and organizational changes, thus fostering a proactive risk management culture.

Reporting and Monitoring

Effective risk management communication is critical in organizations for ensuring safety and compliance. Reporting mechanisms must be established to collect and analyze data related to potential risks. This includes regular audits conducted quarterly to assess vulnerabilities within operational areas, such as finance or health and safety. Monitoring frameworks should involve key performance indicators (KPIs) that track risk management effectiveness, reported through dashboards accessible to senior management. Timely dissemination of findings is crucial for fostering an adaptive risk culture. Emphasis should be on continuous improvement through feedback loops, ensuring that all team members can contribute to the identification and mitigation of emerging risks. Regular training sessions empower employees with knowledge to recognize hazards and report them appropriately, supporting collaborative risk reduction efforts.

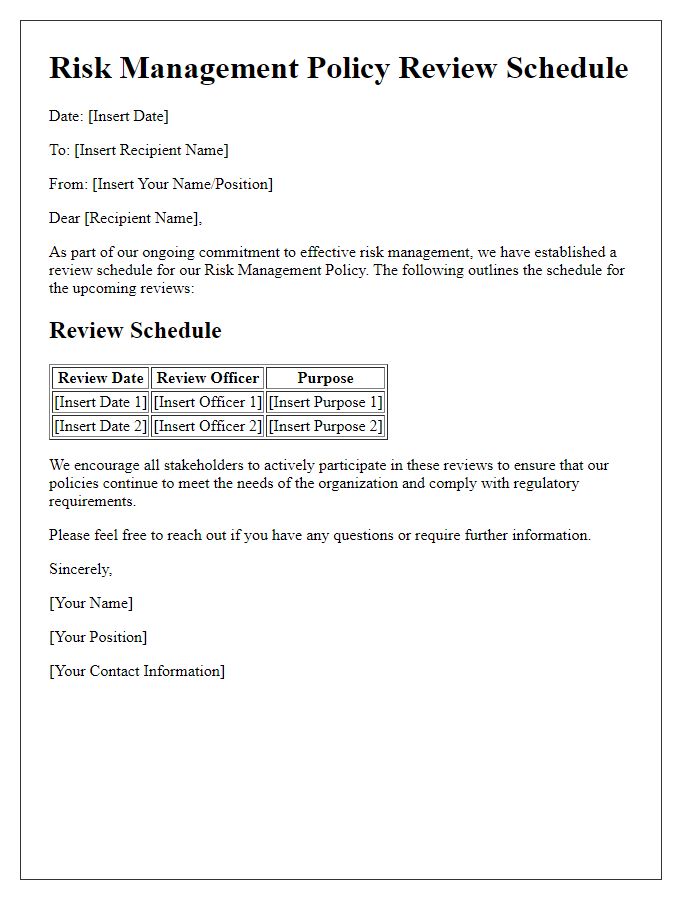

Continuous Improvement and Review

Risk management policies are critical for organizations, ensuring effective identification, assessment, and mitigation of potential risks. Continuous improvement processes, such as regular audits, training sessions, and feedback mechanisms, are essential for enhancing these policies. The annual review, held in November, aims to analyze incident reports and adjust strategies according to emerging trends and challenges. Stakeholders, including department heads, risk managers, and compliance officers, meet quarterly to discuss updates and facilitate a dynamic approach to risk management. Documented policies are stored centrally, ensuring accessibility and transparency, which reinforces the organization's commitment to maintaining a strong risk management framework while adapting to ever-changing environments.

Comments