Managing multiple subscriptions can feel like a daunting task, especially when you're juggling bills, renewals, and varying payment dates. In today's digital age, it's common to subscribe to everything from streaming services to monthly snack boxes, and keeping track of them all is essential to avoiding unnecessary charges. By streamlining your subscriptions, you can save both time and money, ensuring you're only paying for services you truly enjoy. Curious to learn how to manage your subscriptions effectively? Keep reading!

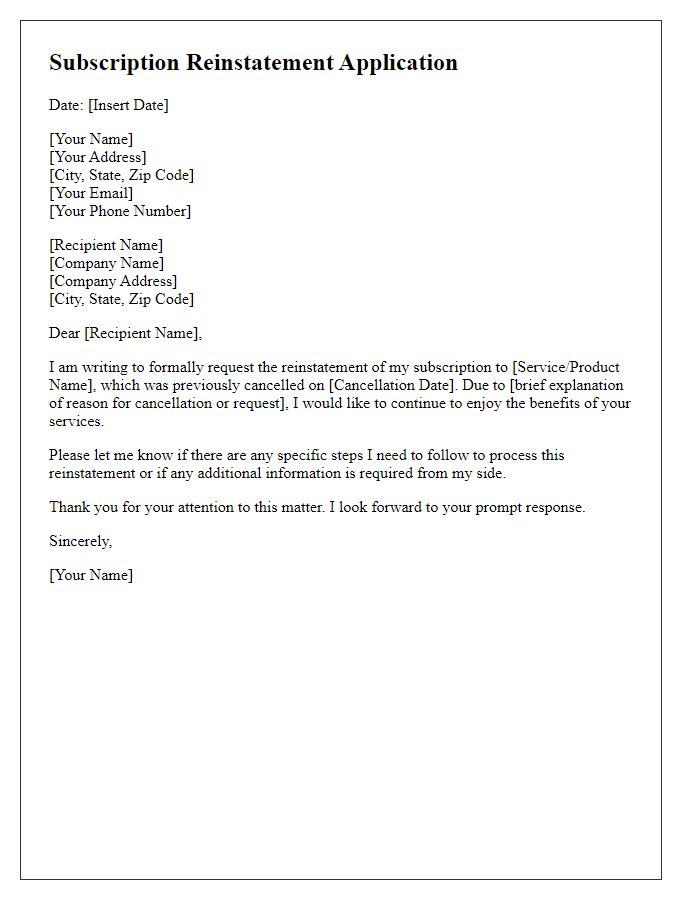

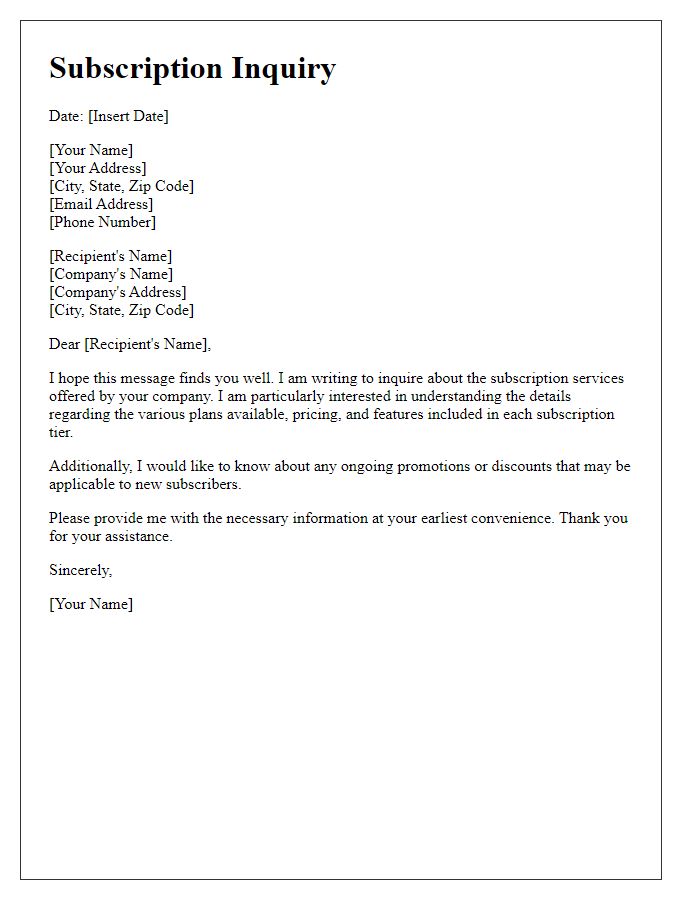

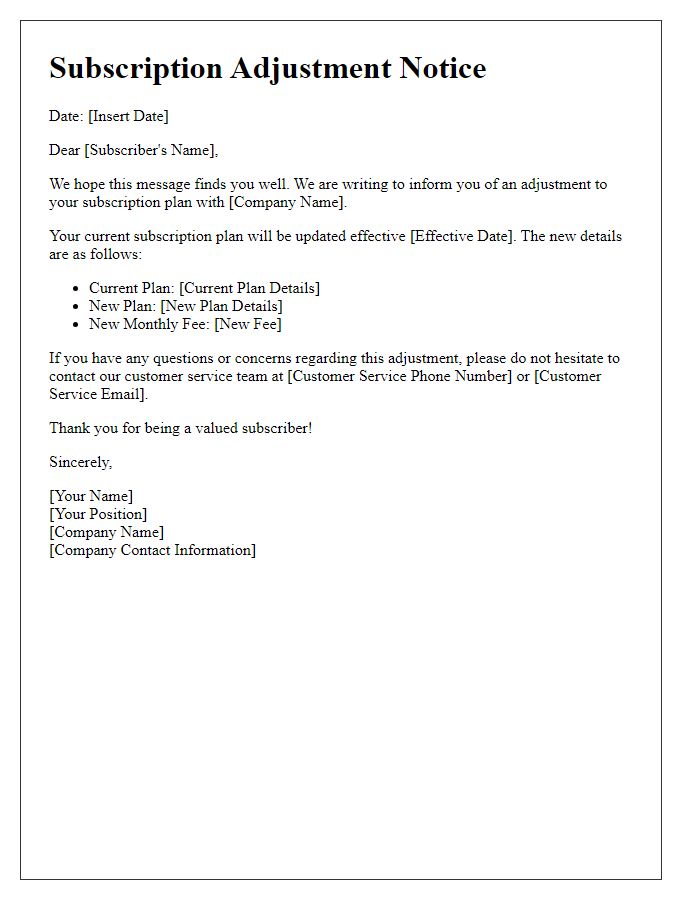

Clear Subject Line

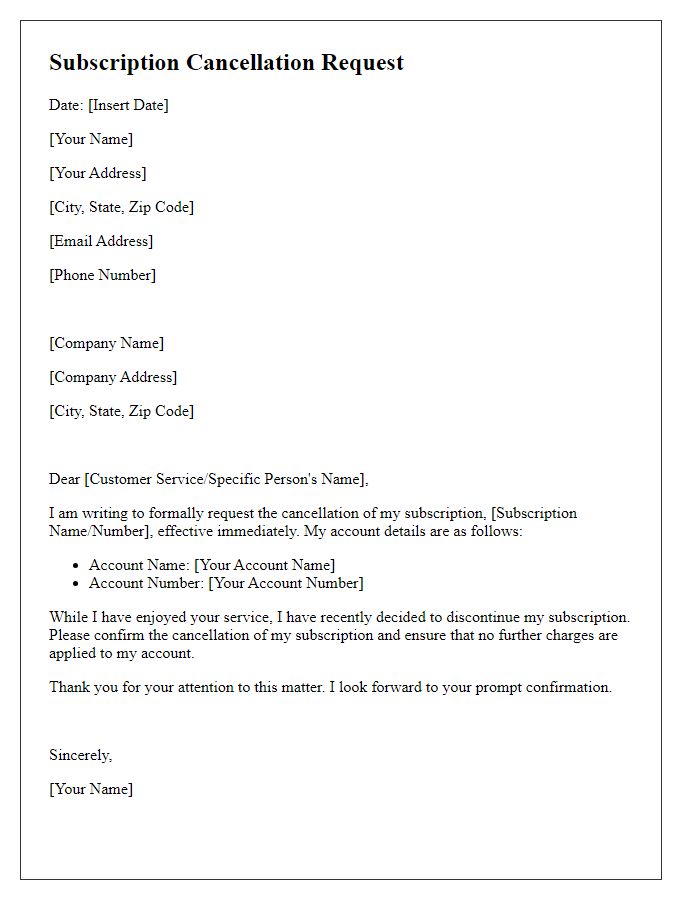

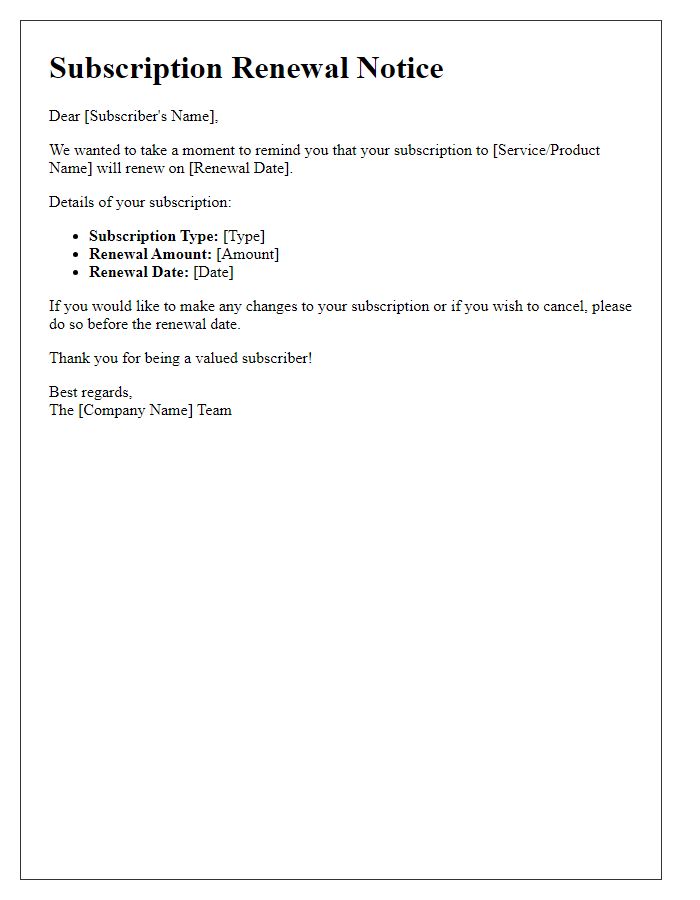

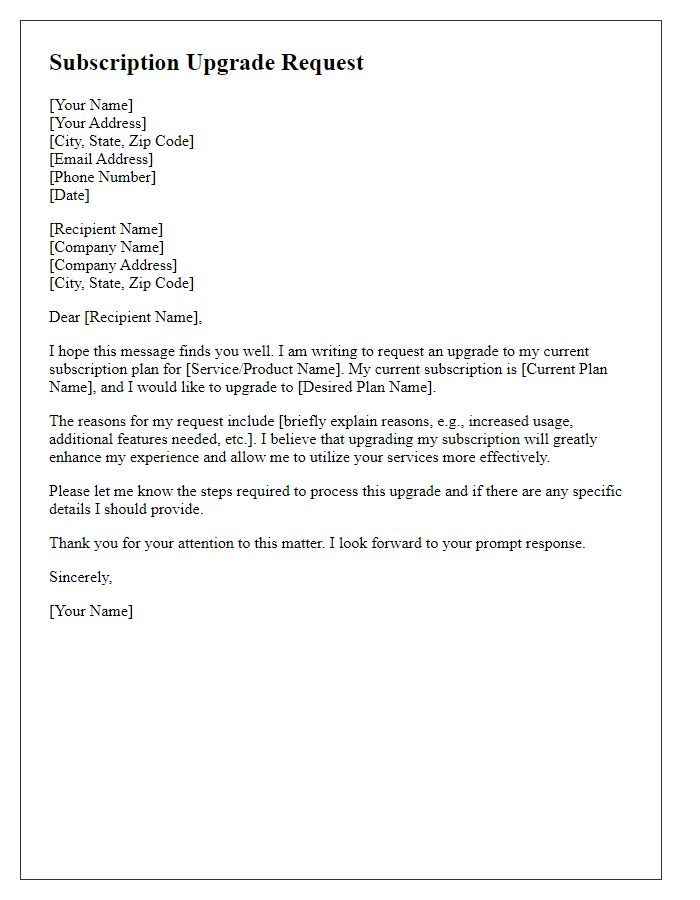

Managing multiple subscriptions effectively requires an organized approach. An excel spreadsheet can be valuable for tracking renewals, payment dates, and subscription fees across various platforms, such as Netflix, Spotify, and Adobe Creative Cloud. Noteworthy details include the monthly costs, renewal dates (often ranging from $9.99 to $52.99), and any promotional offers or discounts applicable. Additionally, creating alerts a week before a subscription renewal ensures timely cancellations or adjustments, helping to avoid unexpected charges. Utilizing apps like Truebill or Bobby can automate this process, providing insights into overall spending and helping to streamline financial management.

Personalized Greeting

Managing multiple subscriptions can become overwhelming, especially with various billing dates and renewal periods. Subscription management services, like those provided by platforms such as Truebill or Trim, enable users to track expenses from different providers (e.g., Netflix, Spotify, Amazon Prime) in one centralized dashboard. Users can set reminders for renewal dates, allowing time for cancellation or negotiation to prevent unwanted charges. Additionally, these services often analyze spending patterns, offering insights into potential savings, such as downgrading or bundling subscriptions. With the average American spending around $200 monthly on subscriptions, this management can lead to significant savings and better financial control.

Concise Content Structure

Managing multiple subscriptions across streaming services, magazines, and software platforms can become overwhelming. Notable subscription services such as Netflix (with over 200 million global subscribers), Adobe Creative Cloud (important for creative professionals), and Amazon Prime (known for its wide range of benefits) require regular monitoring. Awareness of renewal dates is essential to avoid unwanted charges; for instance, annual plans can range from $59 to over $200 depending on the service. Tracking these subscriptions using a dedicated app or spreadsheet allows users to categorize expenses and plan budgets effectively. Furthermore, setting reminders for cancellations can help manage cash flow and optimize spending on services that may not be used frequently.

Subscription Details Overview

Managing multiple subscriptions can be challenging without a structured overview. A comprehensive subscription management overview should include key details such as the subscription service name (e.g., Netflix, Spotify), billing cycle (monthly or annually), payment amount ($9.99 for Netflix per month, $14.99 for Spotify per month), renewal dates (e.g., January 15, 2024, for Netflix), and cancellation policies (30 days notice required for some services). Additionally, users should track login information (username, email associated) and usage trends (frequency of logins or hours spent on each service). Having this organized layout can help individuals assess total monthly expenditure, identify unwanted subscriptions, and streamline personal entertainment or resource consumption.

Call-to-Action (CTA)

Managing multiple subscriptions efficiently can simplify personal finance and enhance budgeting accuracy. Subscription services such as Netflix, Spotify, and Amazon Prime (with millions of active users) can accumulate unexpected charges if not monitored closely. Keeping track of renewal dates (often monthly or annually) is essential to avoid unnecessary cancellations or unwanted charges. Utilizing subscription management apps like Truebill or Trim (which help track and manage recurring payments) can automate this process. Users should analyze spending patterns to determine which subscriptions provide value and which may no longer be necessary. Regular reviews of subscription services offer opportunities to negotiate or cancel unused services, leading to potential savings that can be redirected towards other financial goals.

Comments