Have you ever found yourself puzzled by an unexpected subscription charge on your account? It can be quite frustrating to discover that you've been billed for something you didn't intend to subscribe to, leaving you wondering how it happened. The good news is that addressing this issue is usually straightforward, and we're here to guide you through the process! Keep reading to learn how to craft a polite and effective letter to resolve that mistaken charge.

Clear Subject Line

A mistaken subscription charge can cause financial discrepancies for users. For instance, a subscription fee of $9.99 may have been charged unexpectedly to credit cards from banks like Chase or Wells Fargo without proper notification. Users may notice this erroneous charge on their billing statements, potentially leading to confusion or frustration. Contacting customer service via official websites or dedicated helplines can help resolve such issues promptly. Verification of subscription details, including start dates and charges, can aid in clarifying any misunderstandings regarding payments and services. Users should also monitor their accounts regularly to prevent similar occurrences.

Detailed Account Information

A mistaken subscription charge typically refers to an erroneous billing event related to a digital service or online platform. For instance, on platforms like Spotify, users might mistakenly be billed for a subscription tier (such as Premium) that they did not authorize or intend to purchase. This often occurs when promotional offers or trial periods are miscommunicated, leading to unexpected fees--often around $9.99 per month. Users usually need to provide detailed account information, including their account email, subscription details, and the date of the unauthorized charge, which may help customer support quickly resolve the issue. In some cases, users could also refer to the payment processor, such as PayPal or credit card companies for assistance.

Specific Charge Details

A mistaken subscription charge can lead to significant financial concerns for consumers. For example, a $15.99 recurring fee from a streaming service such as Netflix may appear unexpectedly on a monthly bank statement. This recurring charge could result from an unintentional renewal of a premium plan, often activated by a trial period ending without prior notification. Additionally, platforms like Apple or Google Play may automatically renew subscriptions unless users opt-out within a specified timeframe. Consumers must keep track of their subscriptions to avoid such discrepancies, which can sometimes stem from inadequate communication.

Request for Resolution

A mistaken subscription charge can lead to customer frustration, especially in services such as streaming platforms or software subscriptions. An unexpected fee, which typically ranges from $10 to $30 monthly, can occur due to system errors or miscommunication. The charge often appears on bank statements, usually tied to companies like Netflix or Adobe. To resolve this issue, it is essential to contact customer support via official channels, such as email or live chat, providing details like account information and transaction dates. It's advisable to document all communications for reference. Most reputable companies tend to issue refunds or credits upon verification of the error within a few business days.

Contact Information

Customers often face mistaken subscription charges that can be confusing and frustrating. Mistaken charges may occur due to software glitches, unauthorized credit card use, or changes in billing cycles. For instance, a popular streaming service like Netflix may mistakenly charge a user after a cancellation request was submitted. Users should check their account settings and transaction history regularly, as the issue may involve multiple platforms. Documenting the charge amount, date of occurrence, and any relevant correspondence with the service provider is essential when seeking a resolution, typically through email or customer service phone lines. Actively disputing the charge through financial institutions, such as credit card companies like Visa or Mastercard, can also yield results. Providing detailed account information (like subscription ID numbers or user IDs) can expedite resolution processes.

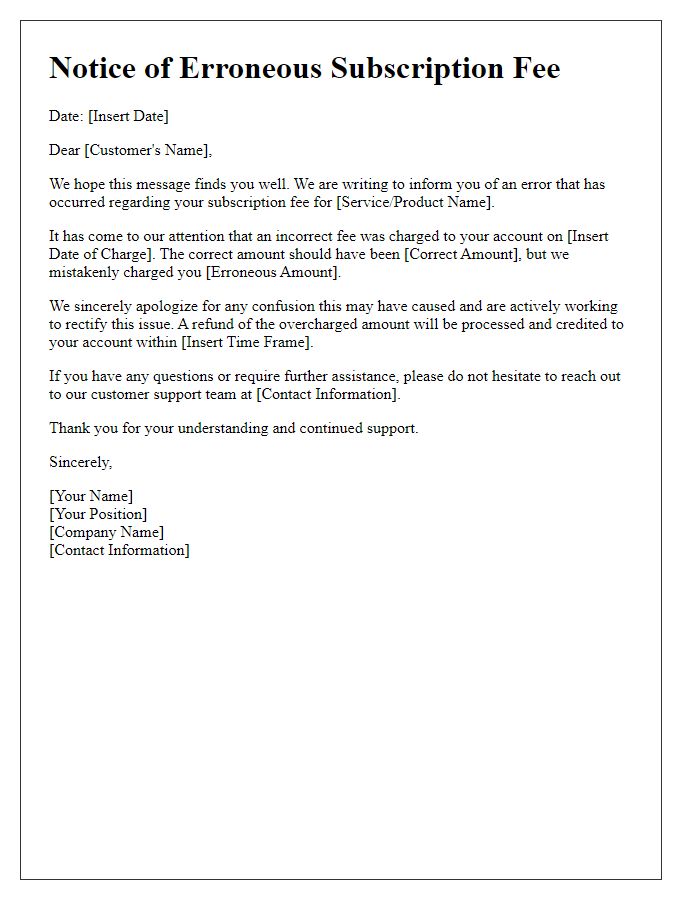

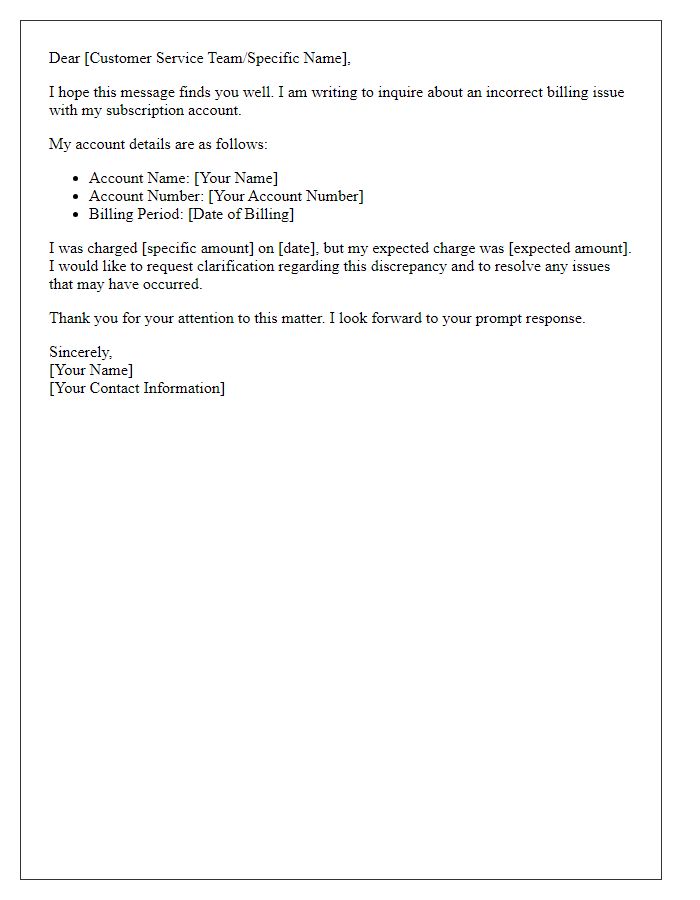

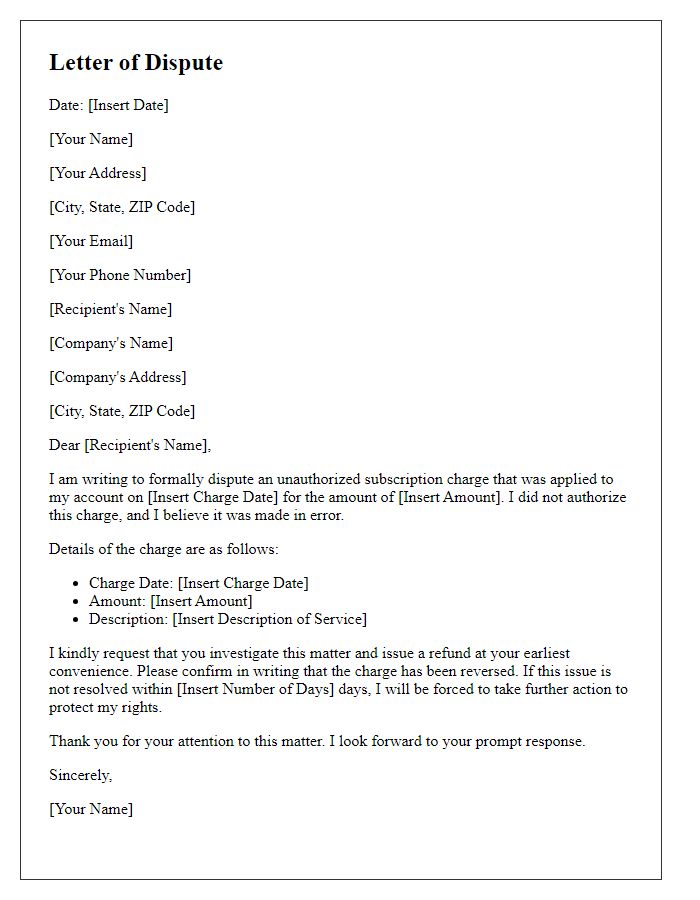

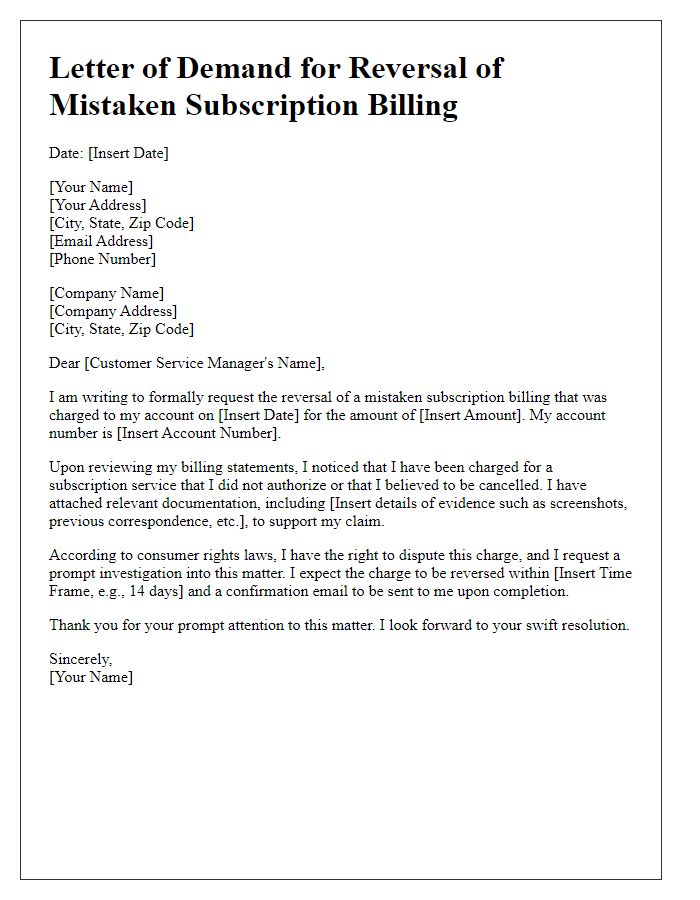

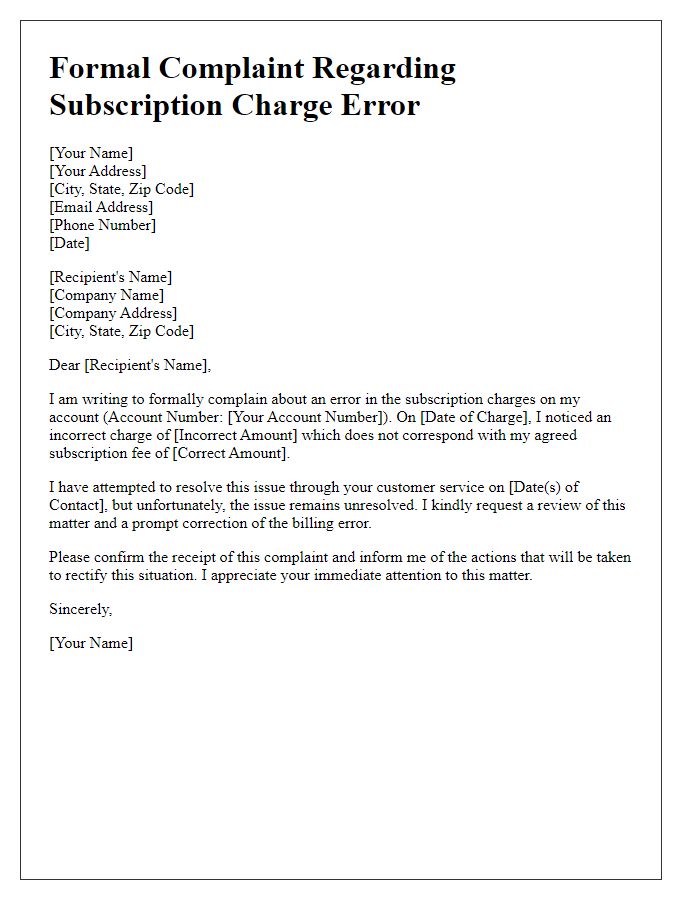

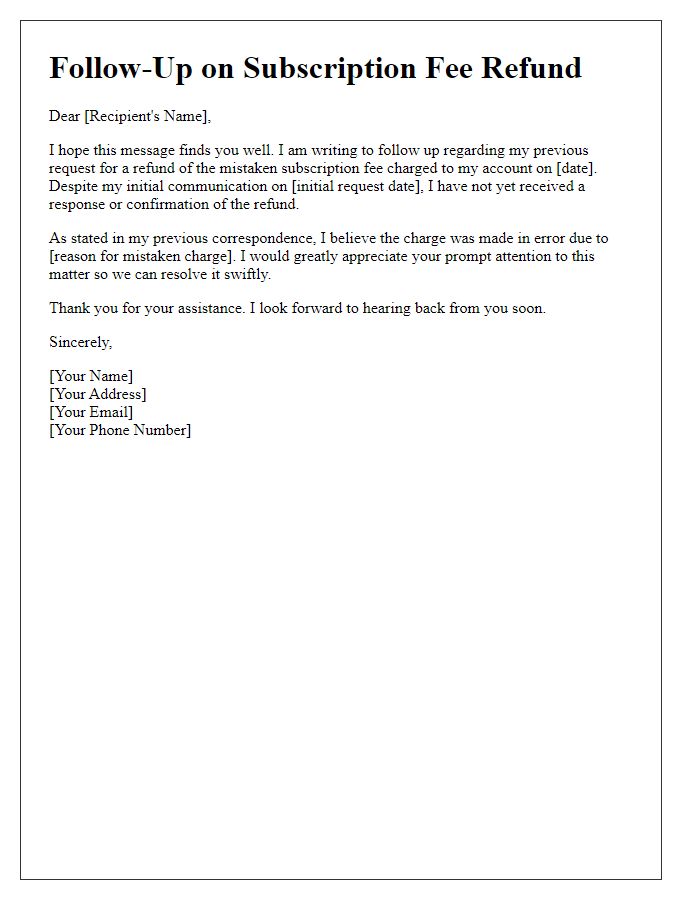

Letter Template For Mistaken Subscription Charge Samples

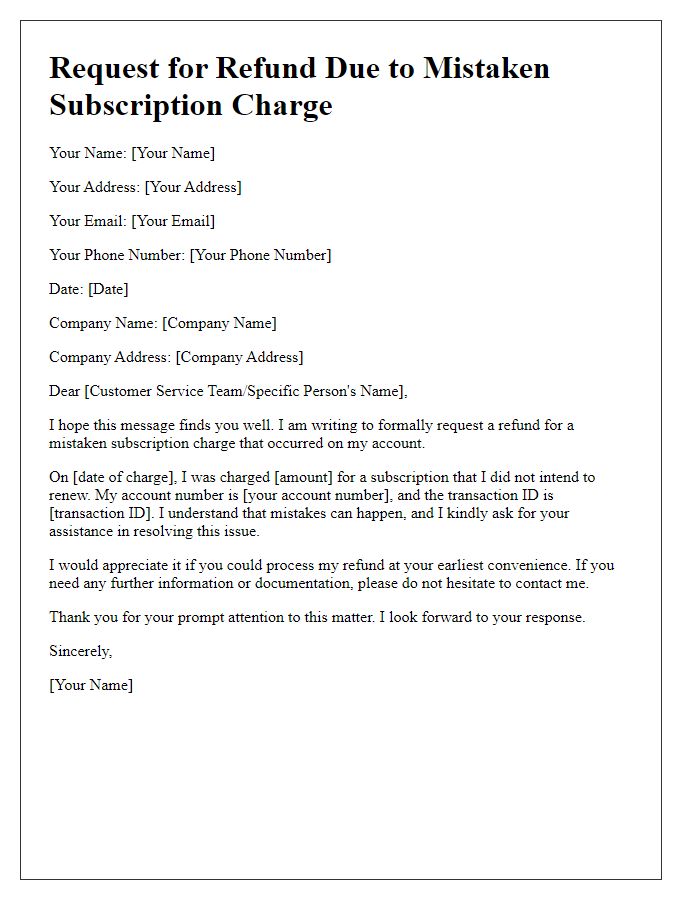

Letter template of request for refund due to mistaken subscription charge

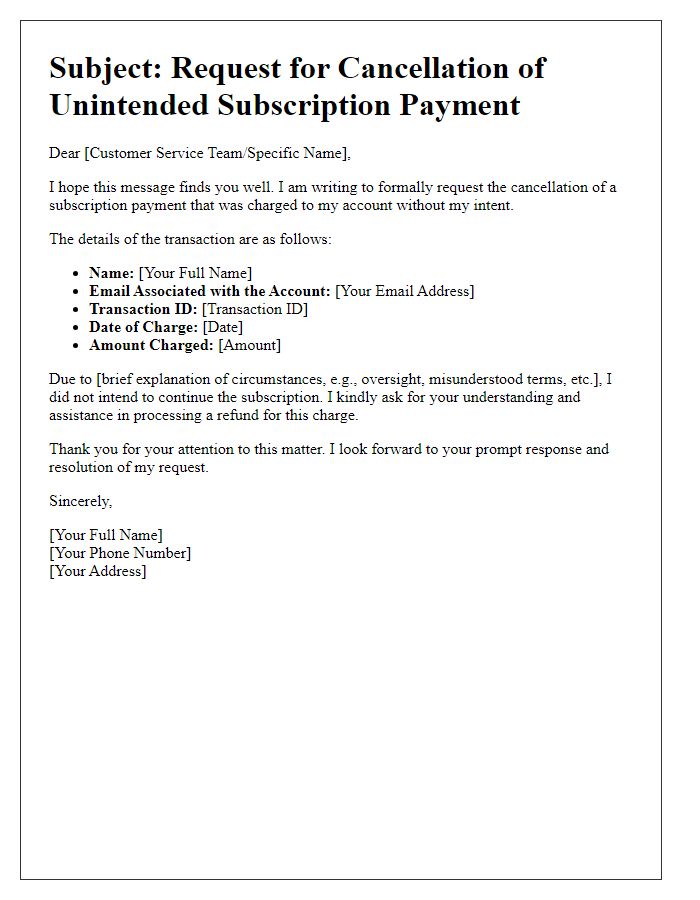

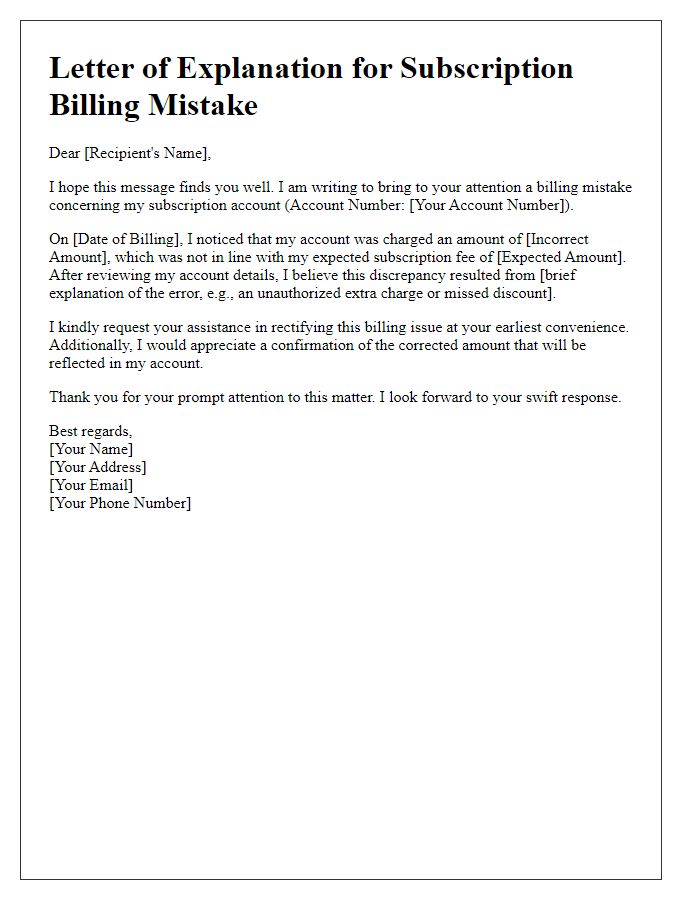

Letter template of appeal for cancellation of unintended subscription payment

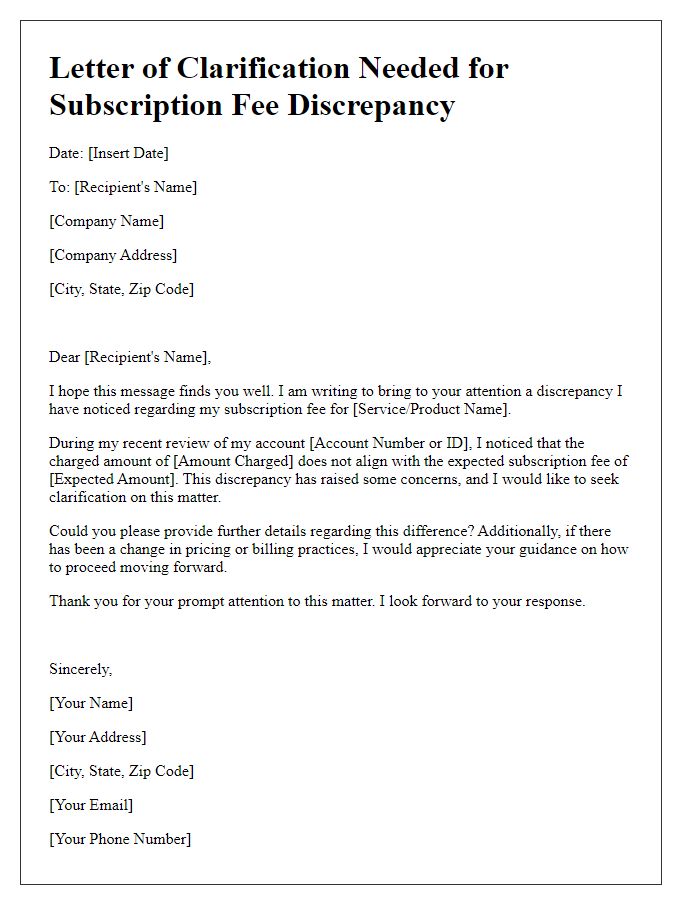

Letter template of clarification needed for subscription fee discrepancy

Comments