Are you looking to secure funding for your next big idea? Crafting a compelling investment proposal letter can make all the difference in attracting potential investors. In this article, we'll delve into the key elements that make a proposal stand out, ensuring you communicate your vision and the potential for returns effectively. Join us as we explore helpful tips and a template you can use to boost your chances of securing that crucial investment!

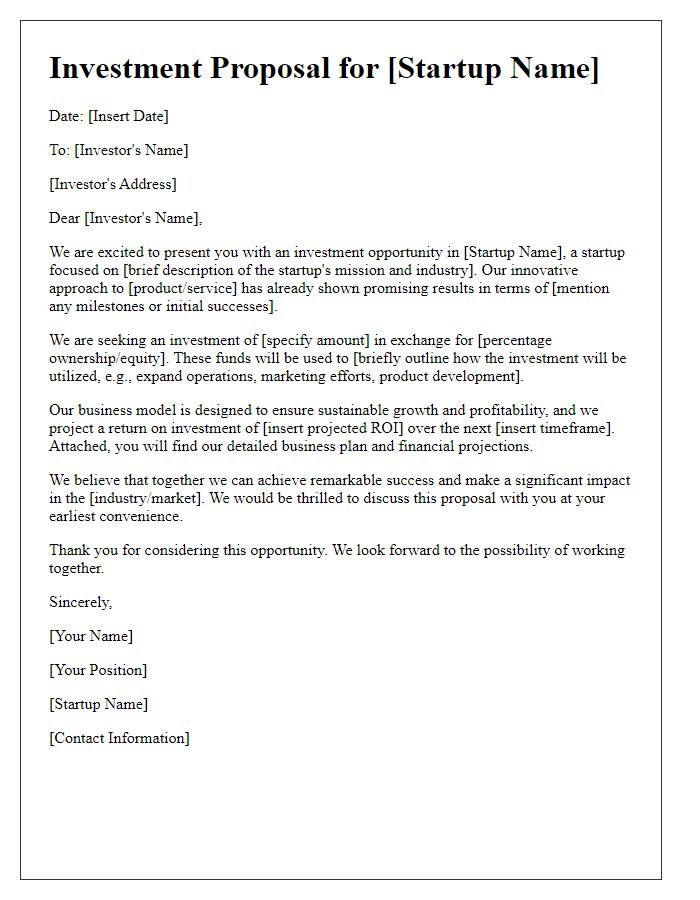

Clear and Concise Subject Line

A clear and concise subject line for an investment proposal submission might read: "Investment Proposal Submission: [Your Project/Company Name] for [Specific Opportunity/Amount]". This direct format immediately informs the recipient of the content while highlighting the main focus, which is the investment request related to a particular project or opportunity, enabling quick identification and prioritization.

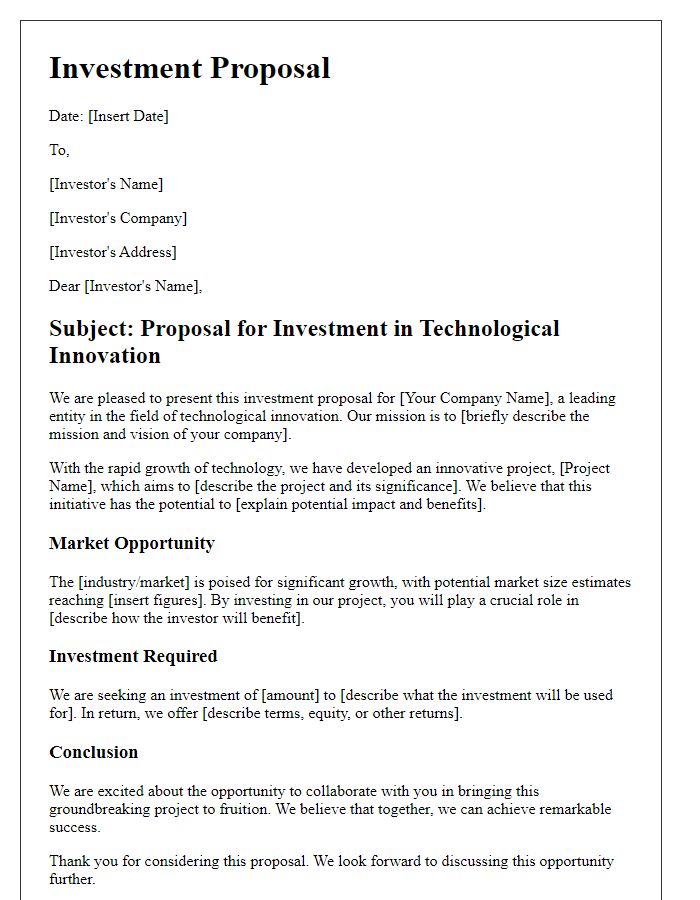

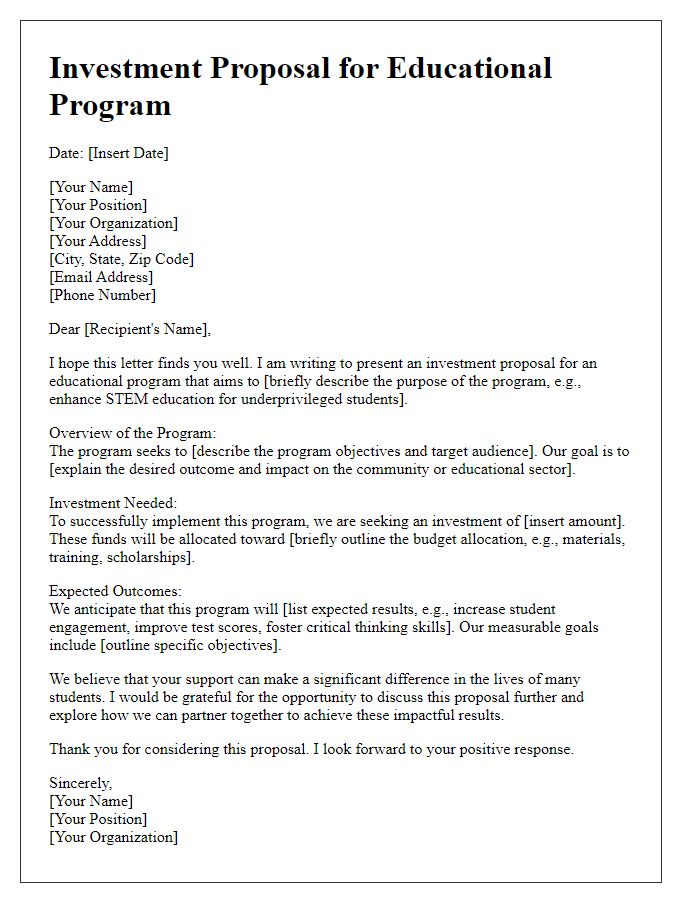

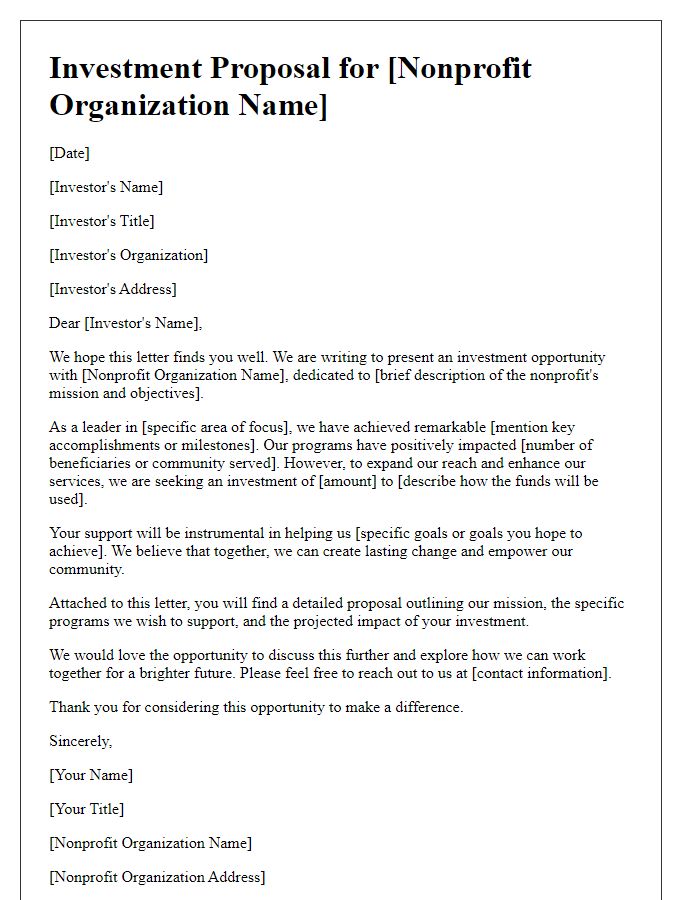

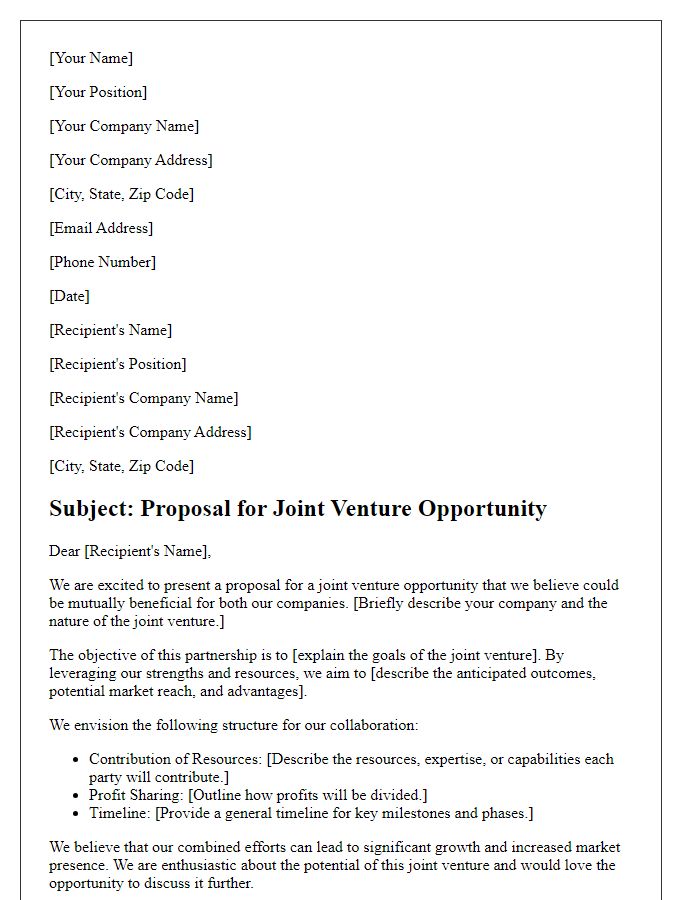

Brief Introduction and Purpose

An investment proposal serves as a pivotal document for securing financial backing and fostering business growth. This proposal outlines specific goals, such as seeking a capital infusion of $500,000 to expand operations within the biotechnology sector, particularly focusing on innovative drug development. The target audience includes prospective investors or venture capital firms interested in high-potential opportunities in the pharmaceutical landscape. Clarity and precision in detailing the funding requirements, anticipated returns on investment, and long-term growth strategies are essential for compelling presentation. Moreover, highlighting the competitive advantages and unique value propositions of the business will enhance the overall appeal of the proposal.

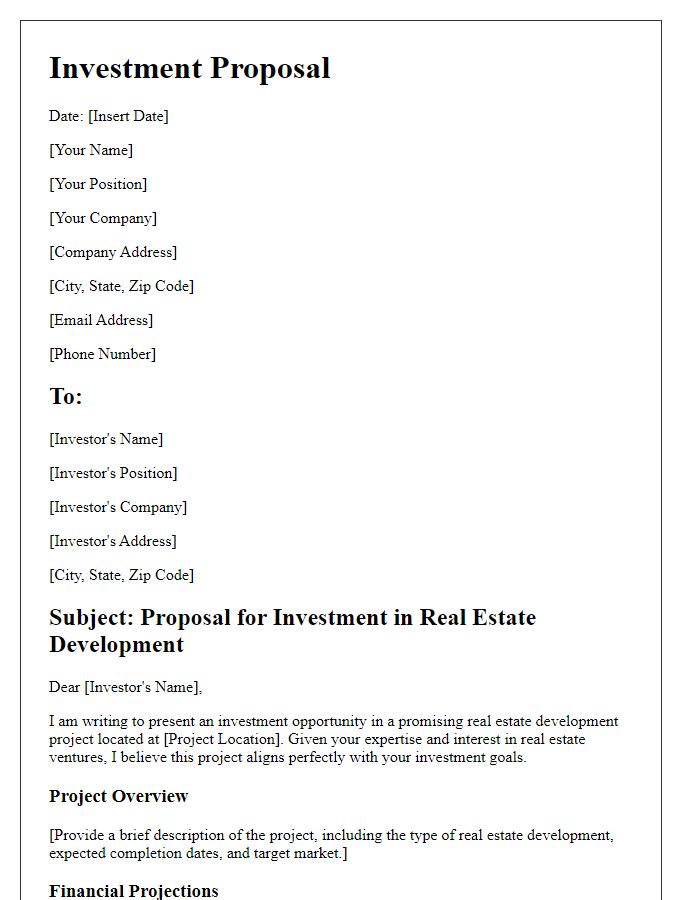

Detailed Project Description

The detailed project description outlines the innovative GreenTech initiative focused on sustainable urban development within the city of San Francisco, California. This project aims to integrate smart technology into renewable energy solutions, emphasizing solar panel installations and green roofing systems. The initiative seeks to reduce the carbon footprint by 30% within the next five years, aligning with the city's objective to achieve 100% renewable energy by 2030. Expected outcomes include the creation of approximately 250 green jobs and a projected annual energy savings of $500,000 for local businesses. The partnership with local government and community organizations will enhance public engagement and promote eco-friendly practices, fostering a long-term commitment to environmental sustainability in urban settings.

Financial Projections and Funding Needs

A comprehensive investment proposal includes detailed financial projections and funding needs, which are critical for attracting potential investors. Financial projections often include key numbers such as projected revenue, net income, and expenses over a three to five-year timeline. Analysts frequently utilize financial formulas to forecast cash flow, break-even points, and return on investment (ROI), providing a quantitative basis for growth expectations. Additionally, funding needs specify precisely how much capital is required, typically outlined in dollar amounts. This segment may identify allocation towards operational costs, equipment purchases, or marketing strategies essential for scaling operations. Investors appreciate clarity on how funds will propel the business forward, as well as potential milestones such as reaching profitability or expanding market presence.

Call to Action and Contact Information

In a compelling investment proposal, a strong call to action encourages potential investors to engage with the project. Clear contact information is essential, ensuring interested parties can easily reach out for further discussion or clarification. Include specific details such as the project name, investment opportunity overview, and the potential for return on investment. Provide direct phone numbers, email addresses, and social media links where applicable, facilitating immediate communication. Highlight the urgency of investment participation, emphasizing time-sensitive opportunities or limited availability to enhance interest and prompt responses from potential investors.

Comments