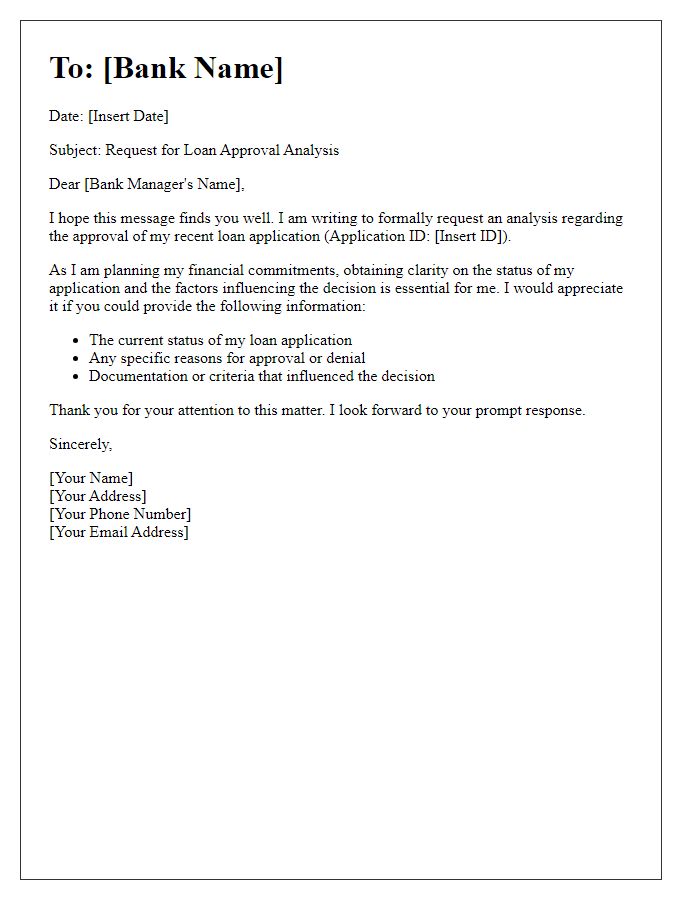

Are you currently navigating the process of securing a bank loan, only to find yourself uncertain about the next steps? Understanding the feedback from your bank can greatly enhance your approach, whether you're celebrating approval or seeking clarity on a denial. In this article, we'll explore the essential components of a thoughtful letter template that can guide your communication with the bank regarding loan decisions. So, if you're ready to take control of your financial journey, read on to discover valuable insights!

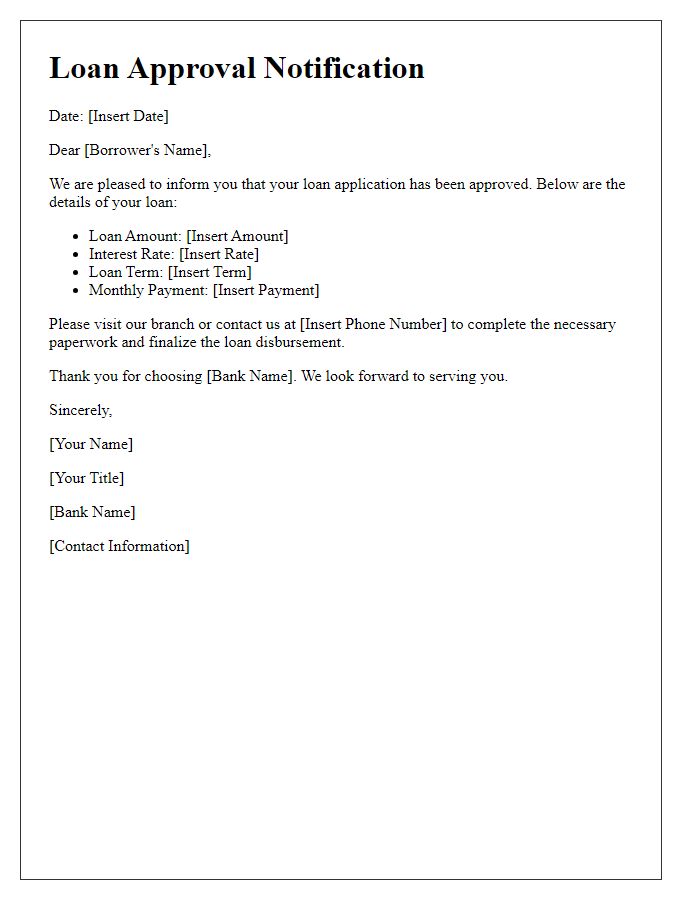

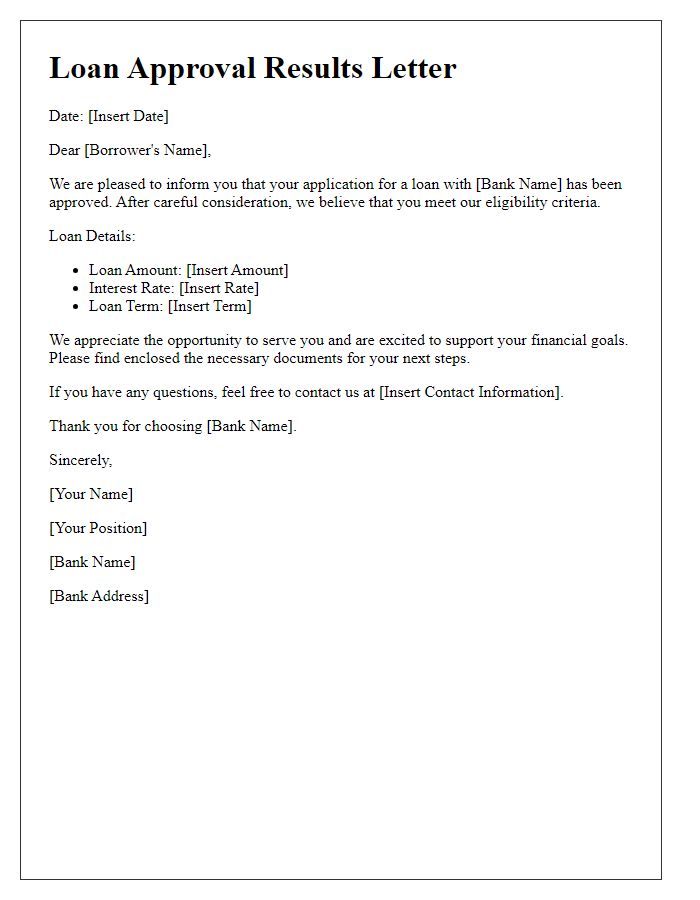

Personalized Greeting

Bank loan approval processes often involve careful evaluation of financial backgrounds and credit histories. Approval notifications usually convey essential details such as loan amounts, interest rates, and repayment terms. Borrowers should expect personalized communication, often addressing their specific circumstances. Timelines for disbursement, annual percentage rates (APRs), and potential fees may also be included to ensure clarity and transparency for the recipient. Furthermore, providing guidance on the next steps can significantly enhance the customer's experience, making it easier to navigate what follows after approval.

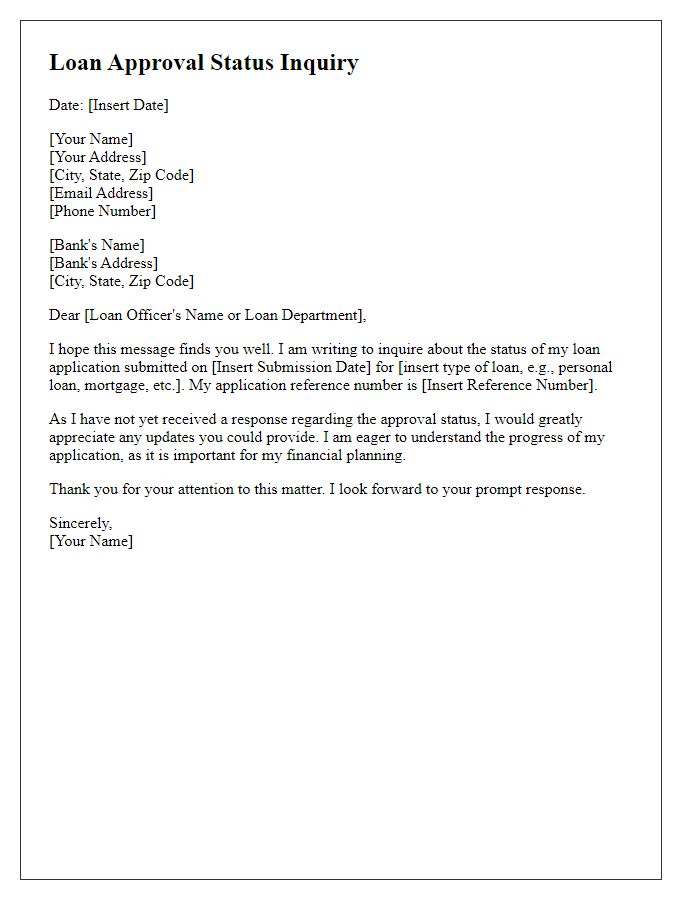

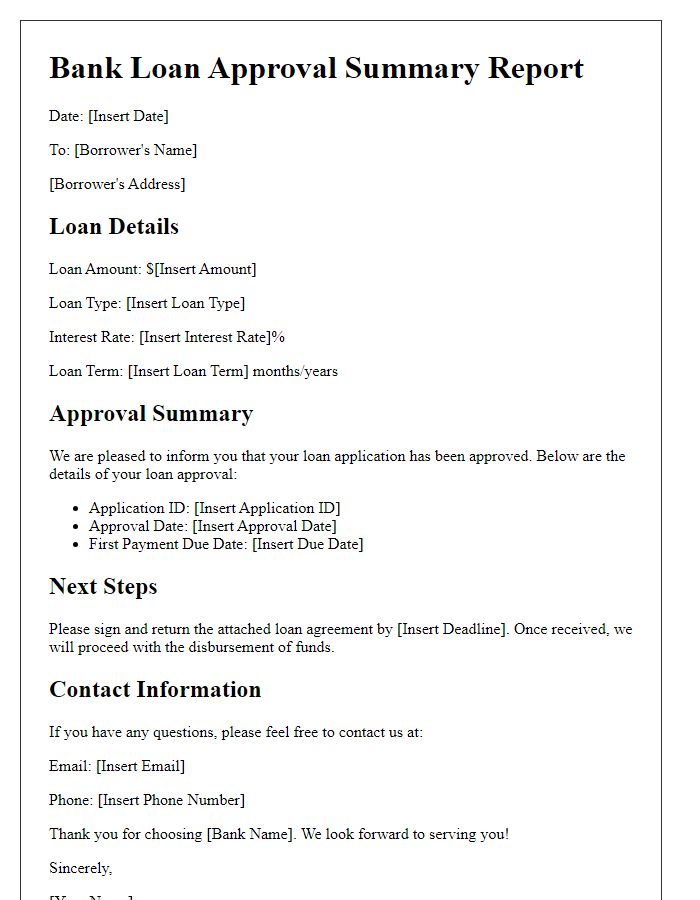

Approval Confirmation and Details

Bank loan approval notifications typically provide essential details for borrowers regarding their loan application status. After rigorous evaluation, the loan application may receive confirmation of approval, including critical information such as the approved loan amount, interest rate terms (often ranging from 3% to 10% for various loan types), repayment period (typically between 5 to 30 years), and any applicable fees. Additionally, the notification might include instructions for the next steps in the disbursement process, ensuring that borrowers understand how to access their funds. Overall communication regarding approval timelines and customer service contact details can significantly enhance the borrower's experience, instilling confidence in the financial institution's support.

Terms and Conditions

Bank loan approval often includes specific terms and conditions that borrowers must adhere to. Common provisions involve guidelines for repayment duration, interest rates ranging from 3% to 7% depending on the applicant's credit score, and stipulations regarding late payment penalties, which may incur fees of up to $50 for each missed installment. Security requirements typically necessitate collateral ownership, such as property or vehicles, with a fair market value assessed by a certified appraiser. Additionally, prepayment options may allow borrowers to pay off the loan early without penalty, although some lenders impose restrictions. Regular updates on loan account activity are also mandatory, helping borrowers remain informed about outstanding balances and upcoming due dates. Transparency in the approval process helps both lenders and borrowers maintain a clear understanding of financial obligations.

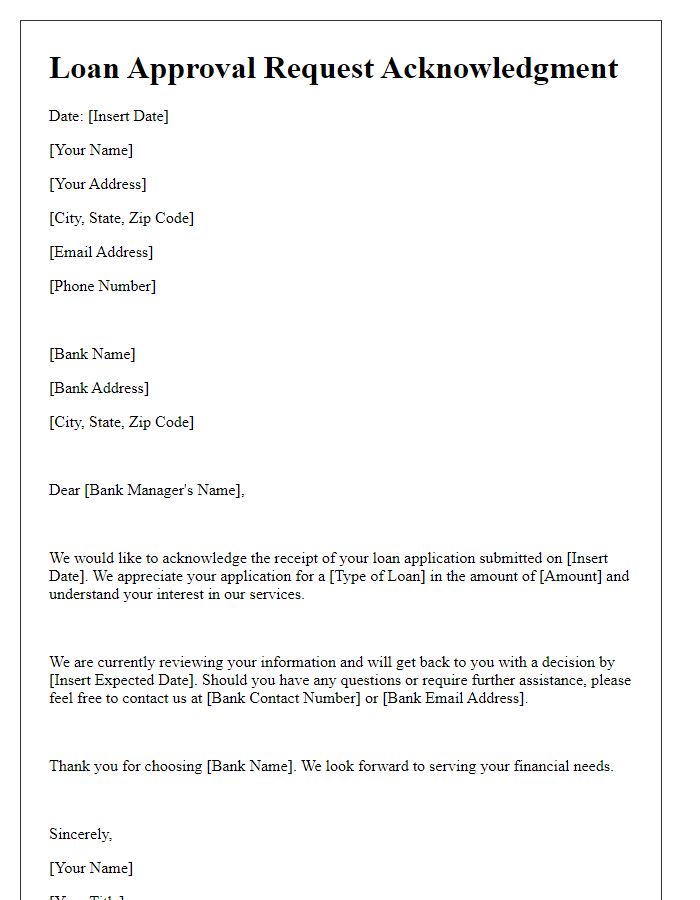

Repayment Schedule and Options

The repayment schedule for bank loans, such as personal loans or mortgages, can significantly impact a borrower's financial planning. Most lenders offer various repayment options, allowing borrowers to choose a plan that best suits their budget. Typical schedules include fixed monthly payments over a set period, like 15 or 30 years for mortgages, or flexible repayment plans with adjustable rates. Interest rates, often ranging from 3% to 10%, play a crucial role in determining the total repayment amount. Early repayment options may also be available, allowing borrowers to pay off their loans faster without incurring penalties. Additionally, organizations like the Federal Housing Administration provide guidelines that can help borrowers understand pre-payment rights and obligations. Understanding these details is vital for responsible financial management and ensuring loan compliance.

Contact Information for Assistance

Bank loan approval notifications are crucial financial events in an individual's life, often determining the ability to secure funding for significant purchases such as homes or vehicles. After receiving loan approval, borrowers may require assistance with understanding terms or payment schedules. Contact information for assistance typically includes customer service numbers, usually available from 8 AM to 8 PM on weekdays, dedicated support teams that can guide through paperwork processes, and online chat options for immediate inquiries. Branch locations often provide face-to-face consultations for personalized assistance, ensuring that borrowers fully understand their loan agreements and repayment obligations.

Comments