Are you looking to secure a performance bond for your subcontractors? A performance bond is a crucial safeguard that ensures project completion according to the stipulated terms and conditions. This letter template can help streamline your request process, making it easier to communicate your needs clearly and professionally. Dive into our detailed guide to explore how to effectively draft a performance bond request letter that sets your project up for success!

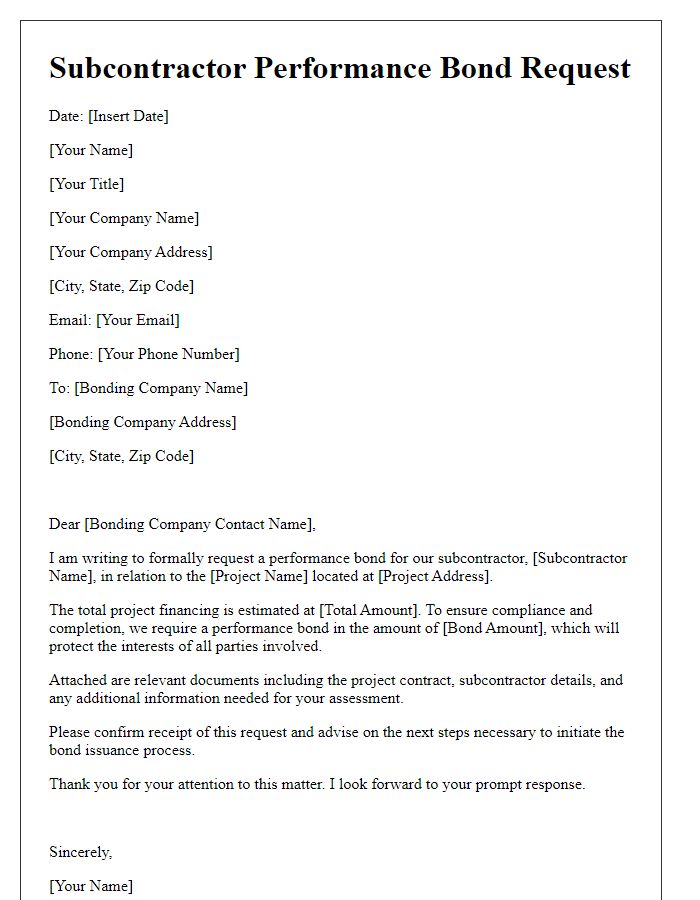

Company Details

A subcontractor performance bond request serves as a crucial component in construction and contracting sectors, ensuring project completion and adherence to specified terms. For example, ABC Construction Inc., based in New York City, employs skilled subcontractors to complete tasks such as electrical work, plumbing installations, or carpentry. Typically, performance bonds are required to protect against non-completion, covering financial damages up to 10% of the contract value. In this case, a $1 million contract would necessitate a $100,000 surety bond. This guarantee holds the subcontractor accountable for taking necessary actions to fulfill contractual obligations and enables the main contractor to engage reliable partners, ensuring successful projects and maintaining client trust.

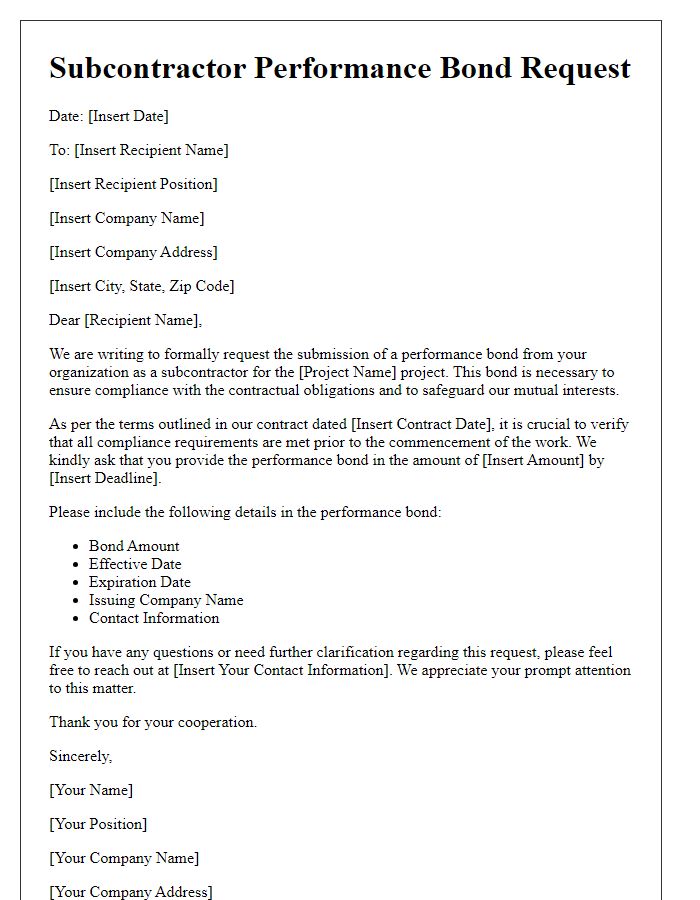

Bond Amount and Conditions

A subcontractor performance bond is a crucial aspect of construction projects, ensuring that subcontractors fulfill their contractual obligations. The bond amount, typically based on a percentage of the total contract value, often ranges between 10% to 20%, depending on the project size and risk factors involved. Conditions for the bond may include timely completion of tasks, adherence to quality standards, and compliance with safety regulations. In specific industries, such as commercial and industrial construction, stringent requirements may apply, relating to materials used and labor practices. The bond acts as a financial safeguard for project owners, providing recourse in case of default or non-performance by the subcontractor. Thorough documentation and a clear understanding of contractual obligations are essential to enforce bond claims effectively.

Project Description

A subcontractor performance bond request is crucial for construction projects, ensuring that subcontractors fulfill their contractual obligations. The bond acts as a financial assurance for the project owner, providing protection against potential defaults. For instance, in a commercial construction project valued at $2 million in New York City, the bonding requirement may be set at 10% of the contract amount, which would equate to a $200,000 bond. This bond guarantees that the subcontractor will perform their duties as outlined in the agreement, including adherence to timelines, quality standards, and compliance with local building codes and regulations. In case of a default, the bonding company can provide financial compensation to cover the costs of hiring a replacement subcontractor to complete the work, safeguarding the project's overall timeline and budget.

Legal Terminologies and Compliance

A subcontractor performance bond serves as a financial guarantee for project completion, ensuring that subcontractors fulfill their obligations under the main contract. Typically issued by surety companies, this bond aligns with legal requirements established by state regulations, including the Miller Act, which governs federal contracts exceeding $150,000. Key aspects include the penal sum, which is often set at a percentage (usually 100%) of the subcontract amount, providing coverage in case of default. Project stakeholders, including general contractors and project owners, must carefully review the bond's terms to ensure compliance with local laws and contract requirements. Failure to secure an adequate performance bond can result in legal repercussions, potentially jeopardizing project timelines and financial stability.

Contact Information and Submission Instructions

A subcontractor performance bond request involves essential details for establishing financial guarantees during a construction project. Typically, parties involved include the general contractor, subcontractor, and the bonding company. The submission process requires accurate contact information, which includes the subcontractor's name (such as ABC Construction LLC), mailing address (1234 Builder Lane, Cityville, State), email address (info@abcconstruction.com), and phone number (555-123-4567). The submission instructions should clarify that bonds should be submitted to the general contractor's office, often requiring a physical copy along with supporting documents. Specific deadlines for submission could be outlined, such as "please submit by January 15, 2024," to ensure the bond is secured prior to commencing work on the project, located at 5678 Development Drive, Cityville.

Letter Template For Subcontractor Performance Bond Request Samples

Letter template of subcontractor performance bond request for construction projects

Letter template of subcontractor performance bond request for renovation works

Letter template of subcontractor performance bond request for specialty trades

Letter template of subcontractor performance bond request for large-scale developments

Letter template of subcontractor performance bond request for government contracts

Letter template of subcontractor performance bond request for residential projects

Letter template of subcontractor performance bond request for commercial projects

Letter template of subcontractor performance bond request for specific trades

Letter template of subcontractor performance bond request for project financing

Comments