Are you navigating the complex waters of subcontractor insurance compliance? It can often feel overwhelming to ensure that all parties are meeting the necessary legal and contractual obligations. Understanding the key requirements and maintaining proper documentation is crucial for protecting your business and avoiding potential pitfalls. Dive into this article to explore actionable tips and templates that will simplify the process for you!

Legal Requirements and Regulations

Subcontractor insurance compliance encompasses essential legal requirements and regulations designed to protect all parties involved in construction projects. In many jurisdictions, subcontractors must hold general liability insurance with minimum coverage levels, often around $1 million per occurrence. Workers' compensation insurance is another critical requirement, mandated by state laws to cover employee injuries on the job. Additionally, compliance with local contractual obligations often necessitates commercial auto insurance, particularly if vehicles are used for project-related activities. Regulatory bodies, such as the Occupational Safety and Health Administration (OSHA), enforce standards that necessitate proper insurance coverage to mitigate risks associated with workplace accidents. Failure to meet these legal requirements can result in penalties, project delays, or termination of contracts, underscoring the importance of thorough documentation and verification of insurance policies before commencing work on any project.

Insurance Coverage Types and Limits

Subcontractor insurance compliance is critical in ensuring that all parties are adequately protected during construction projects. Major elements include general liability insurance, typically with coverage limits of at least $1 million per occurrence and $2 million in aggregate, ensuring protection against claims of bodily injury or property damage. Workers' compensation insurance is mandatory, with state-specific minimum limits to cover employee injuries occurring on the job site. Professional liability insurance, often required for subcontractors providing design services, usually has limits of $1 million per claim. Additionally, commercial auto insurance may be necessary if vehicles are used for project-related activities, commonly requiring at least $1 million per accident in liability coverage. Each subcontractor must provide certificates of insurance evidencing these coverages and limits to confirm compliance before commencing work on the project site.

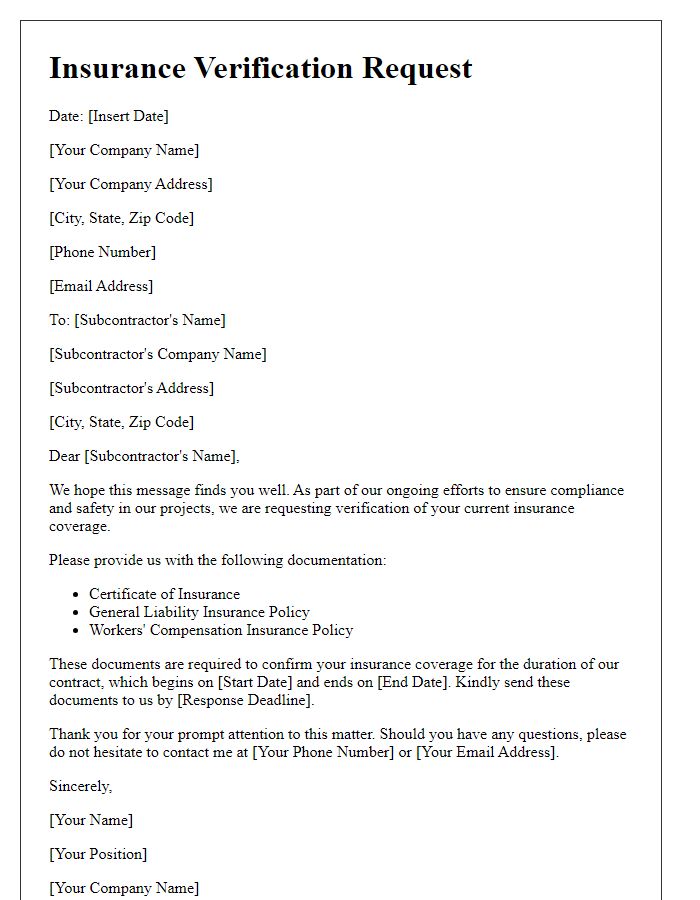

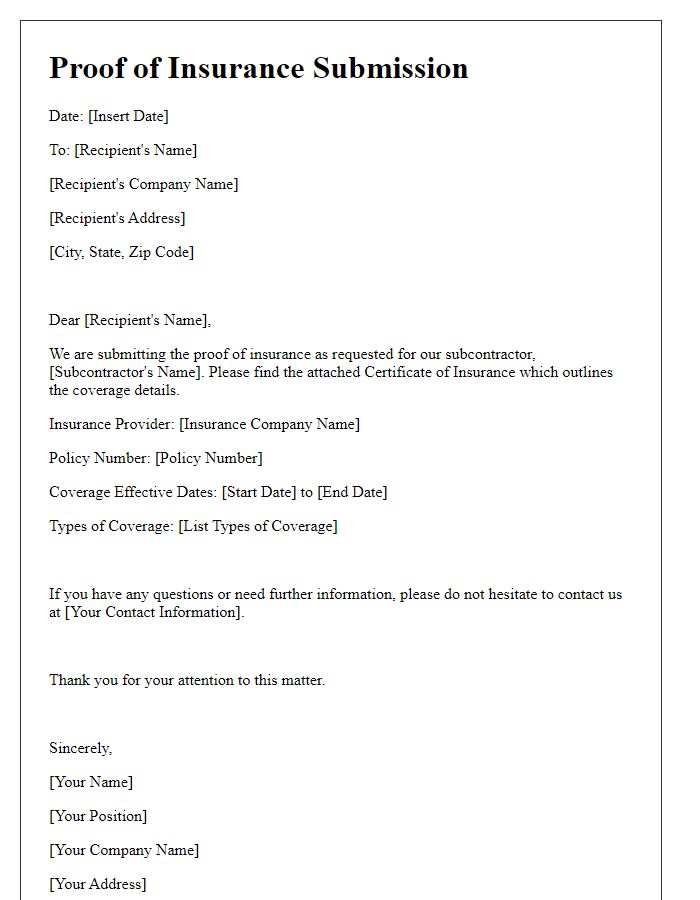

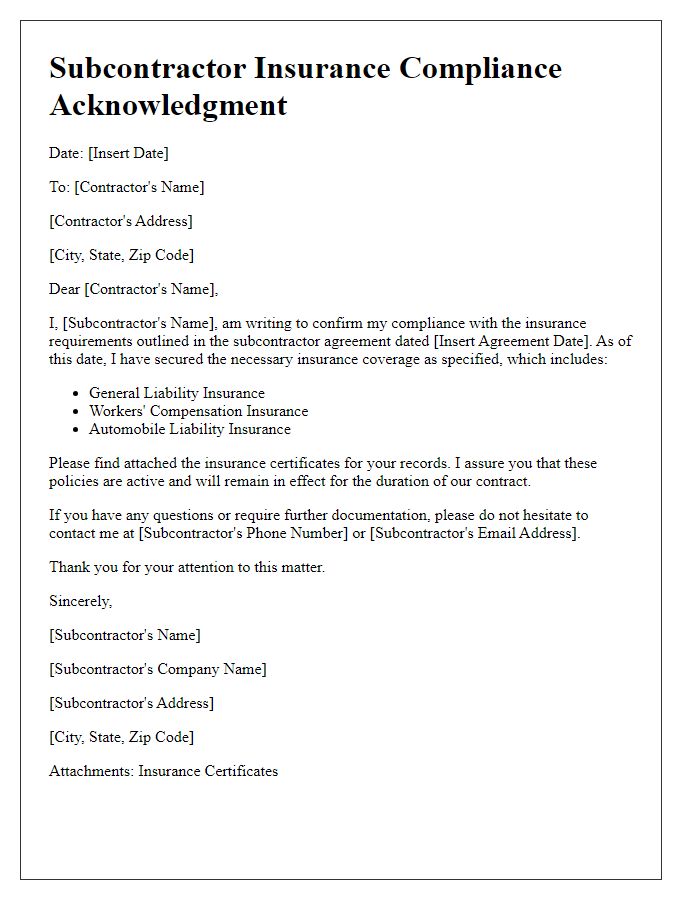

Proof of Insurance Documentation

Subcontractor insurance compliance verification process necessitates the submission of proof of insurance documentation, particularly General Liability Insurance (often with a minimum coverage of $1 million), Workers' Compensation Insurance (mandatory in most states), and any additional coverage such as Auto Liability Insurance. The documentation should include the policy number, expiration date, and the certified proof of insurance certificate, which indicates the subcontractor's compliance with industry standards as per the requirements outlined by regulatory bodies and the primary contractor. Proper verification of these documents ensures risk management for projects, safeguarding against potential liabilities during construction activities.

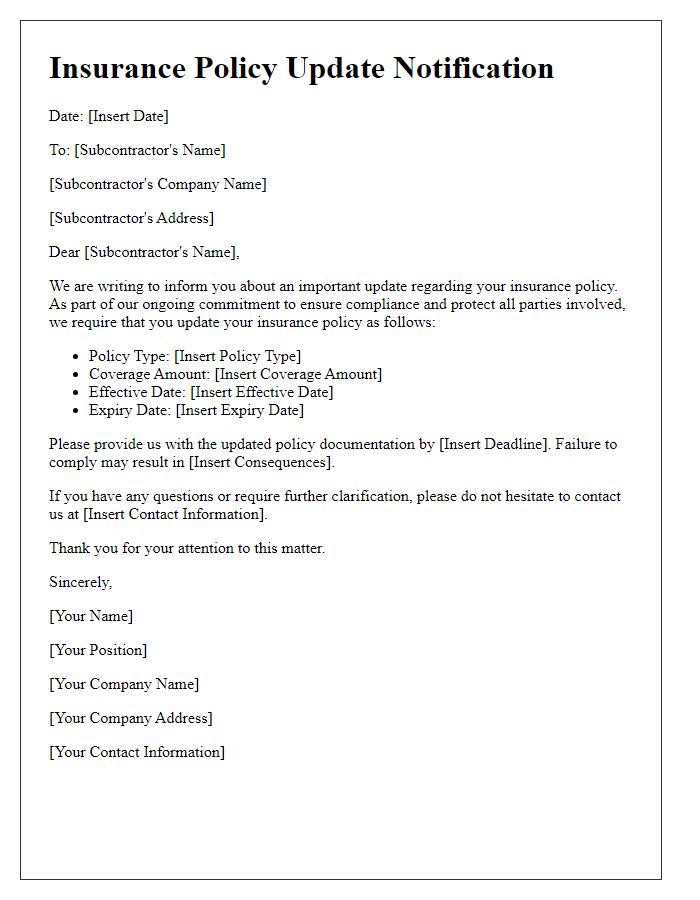

Renewal and Expiry Dates Monitoring

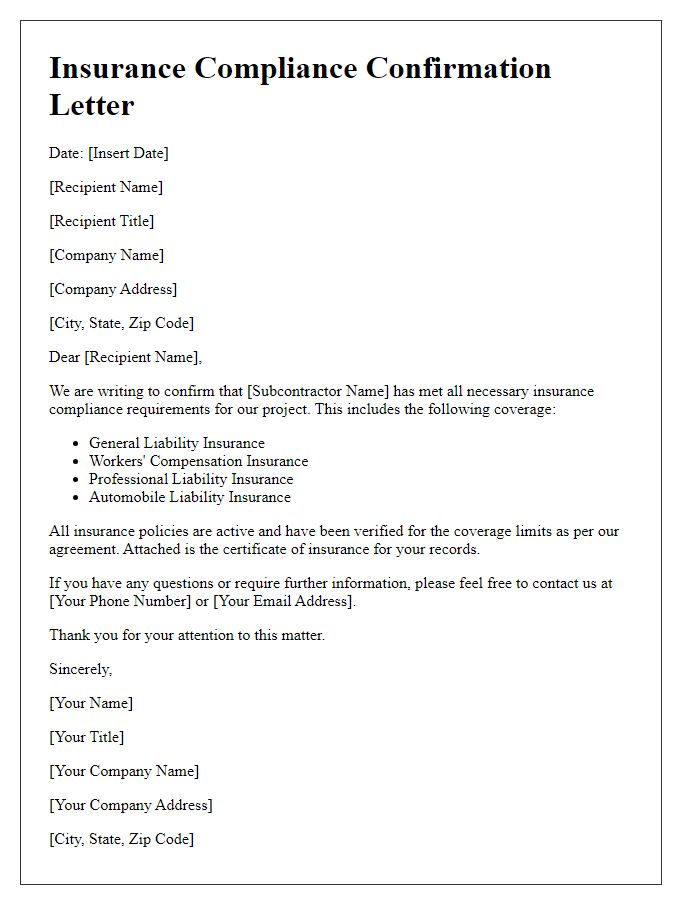

Subcontractor insurance compliance is crucial for maintaining risk management standards in construction projects. Monitoring renewal and expiry dates ensures that all subcontractor insurance policies, such as general liability and workers' compensation, remain valid. Dates for renewals must be tracked meticulously, with a typical policy length of one year, to prevent coverage lapses. Additionally, a comprehensive database can be created to log documents, including insurance certificates, policy limits, and bonding information. Regular audits should be scheduled quarterly to verify compliance and address any discrepancies promptly, minimizing potential liabilities and safeguarding the project's financial health.

Terms and Conditions Compliance

Subcontractor insurance compliance is essential for ensuring that all participating parties adhere to industry standards and protect against potential liabilities. Insurance coverage typically includes general liability insurance with minimum limits of $1 million per occurrence, workers' compensation insurance to cover employee injuries, and professional liability insurance for any errors or omissions in services provided. Contractual obligations may also stipulate that subcontractors provide proof of insurance before commencing work at specified project locations, such as construction sites in metropolitan areas. Compliance with these terms not only safeguards the subcontractor's interests but also protects the primary contractor and clients from unforeseen risks. Regular audits and documentation checks should be conducted to maintain ongoing compliance with the agreed terms and conditions, ensuring all parties remain informed and protected throughout the project lifecycle.

Comments