Are you facing financial difficulties and considering a hardship withdrawal from your retirement plan? It can feel overwhelming to navigate the process, but you're not alone in this situation. In this article, we'll guide you through a simple letter template that can help you request the funds you need. Read on to discover the essential steps and tips for crafting your request successfully!

Personal Information

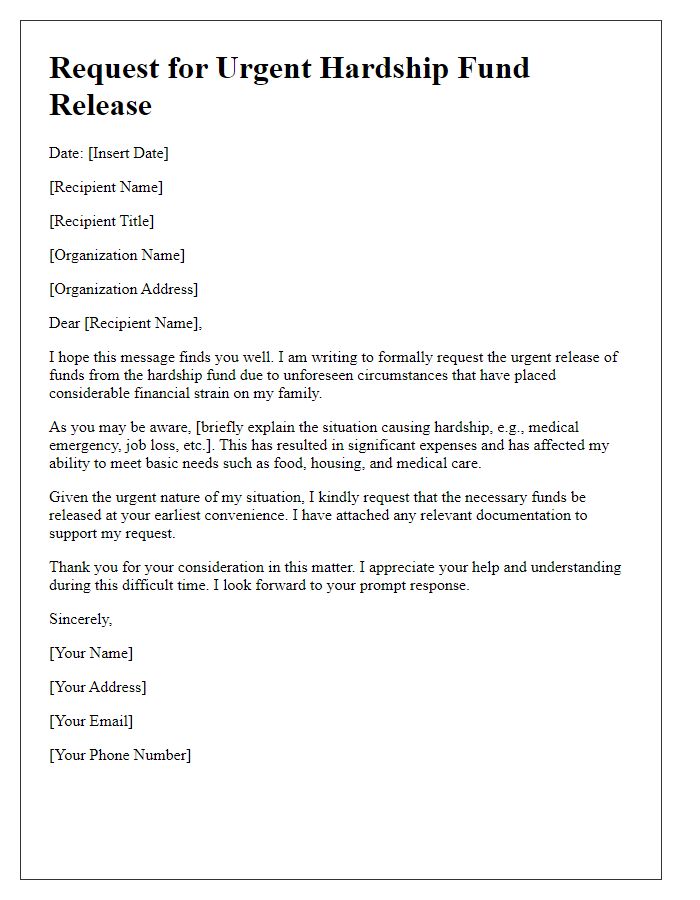

Requesting a hardship withdrawal necessitates clear presentation of personal circumstances. Relevant personal information includes full name (e.g., John Doe), social security number (e.g., XXX-XX-XXXX for identification purposes), contact details (address, phone number), and the date of the request (essential for record-keeping). Specifying the retirement plan name (e.g., 401(k), IRA) and account number is crucial for processing the request. A detailed explanation of the hardship situation (e.g., medical emergencies, financial crises) can substantiate the need for withdrawal, while attaching supporting documentation (e.g., medical bills, eviction notices) provides further validation.

Reason for Hardship Withdrawal

When faced with unexpected financial difficulties, individuals often seek a hardship withdrawal from retirement accounts. Common reasons for these withdrawals include high medical expenses, housing costs, or educational expenses, each posing significant impacts on financial stability. Medical emergencies, such as surgeries requiring immediate funds, can lead to exorbitant bills, often exceeding thousands of dollars. Housing-related issues, like foreclosure proceedings, may arise in places heavily impacted by economic downturns, necessitating urgent cash flow to prevent loss of a home. Additionally, the rising costs of education, especially in major cities where tuition can exceed $30,000 per year, can compel individuals to withdraw funds from retirement savings. These financial strains are often compounded by unexpected life events, creating a compelling need for accessing retirement savings under hardship withdrawal provisions.

Financial Impact Explanation

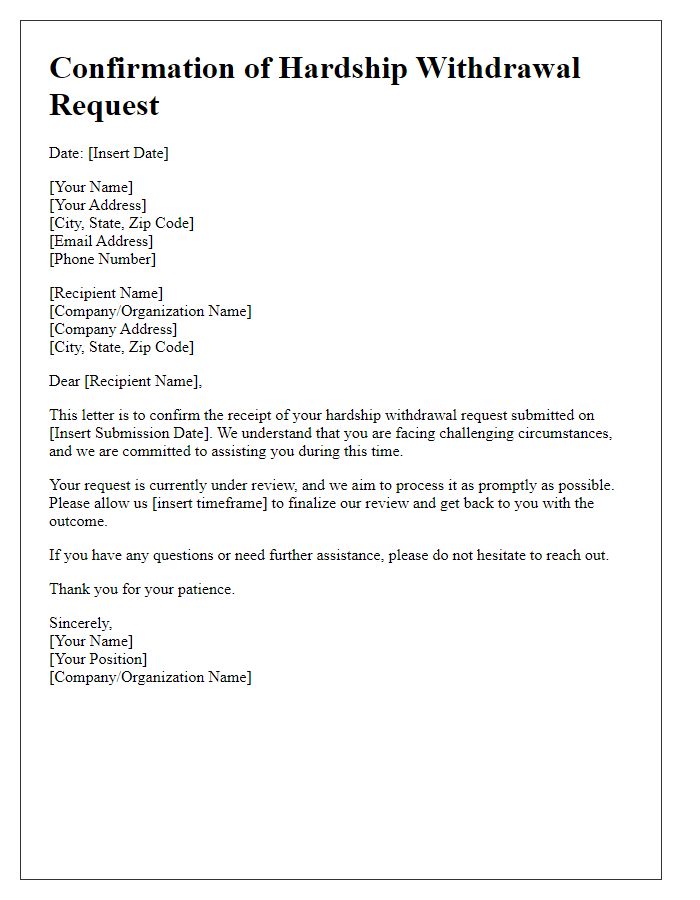

A hardship withdrawal letter template serves as a structured document for individuals seeking early access to their retirement savings due to significant financial strain. The template typically includes key sections such as a detailed explanation of the financial impact, which outlines the reasons for the withdrawal request, such as medical expenses, unemployment, or housing instability. By providing specific details about the personal circumstances, the individual articulates their need for immediate funds, emphasizing urgency and necessity. This clarity aids in presenting a compelling case to the financial institution or plan administrator evaluating the request, fostering understanding and compassion during the decision-making process.

Requested Amount

A hardship withdrawal allows individuals to access their retirement savings under specific circumstances, such as medical emergencies, education costs, or housing issues. The requested amount usually reflects the immediate financial need. For example, an individual may request $5,000 to cover unexpected medical bills from a recent hospitalization at a local healthcare facility, or $3,000 to avert eviction due to missed rent payments resulting from a temporary loss of income. It is crucial to provide documentation supporting the hardship, including invoices, medical records, or eviction notices, to ensure the withdrawal is approved following IRS regulations.

Supporting Documentation

A hardship withdrawal request involves providing detailed supporting documentation that substantiates the financial difficulties faced by the individual. Common documents required include recent pay stubs highlighting income depletion, bank statements illustrating insufficient funds, medical records demonstrating health-related expenses, and eviction notices or mortgage statements showing potential loss of housing. For education-related hardships, tuition and fee invoices from accredited institutions, along with scholarship notifications or denial letters, may also be pertinent. Collecting and submitting these documents to retirement plan administrators is crucial for a successful withdrawal application. Specific guidelines vary based on the plan provider, making it essential to consult the plan's provisions for accurate documentation requirements.

Letter Template For Requesting Hardship Withdrawal Samples

Letter template of justification for financial hardship withdrawal request

Letter template of formal request for early withdrawal due to unforeseen hardship

Comments