Are you feeling overwhelmed by your student loans and wondering how to manage your payments during challenging times? If so, you're not alone, and there are options available that may help ease your burden. In this article, we'll guide you through the process of writing a letter for student loan deferment, ensuring that you have all the necessary information at your fingertips. So, let's dive into how you can craft that letter and take control of your financial future!

Loan Account Details

Student loan deferment allows borrowers to temporarily suspend repayment on federal or private loans, providing relief during challenging financial circumstances such as job loss or returning to school. The eligibility criteria can vary by lender, often requiring submission of specific forms that detail financial hardship or enrollment status in an accredited institution. Commonly, borrowers must provide essential information including Loan Account Number, which uniquely identifies the borrowed funds, and the amount owed, impacting the deferment terms. The status of loans, such as Direct Subsidized loans or Perkins loans, can influence deferment options, as different loan types have distinct regulations regarding interest accrual during the deferment period.

Reason for Deferment

Student loan deferment can be requested for various reasons, including economic hardship, unemployment, enrollment in school, or medical issues. Economic hardship may pertain to financial difficulties affecting the borrower's ability to make regular payments, such as a decrease in income or unexpected expenses. Unemployment could reference job loss during a challenging economic period, such as the COVID-19 pandemic, resulting in a need for temporary relief from loan payments. Enrollment in school further implies that the borrower is pursuing higher education, typically at accredited institutions, which may provide a deferment option. Medical issues may involve serious health conditions requiring recovery time, impacting the borrower's financial situation and ability to manage loan repayments. Each circumstance must be documented appropriately to ensure successful deferment approval.

Supporting Documentation

When applying for student loan deferment, the inclusion of appropriate supporting documentation is crucial. Start by gathering a current proof of income, such as recent pay stubs or tax returns, typically within the last year. Include documentation of any financial hardship, like termination letters from employers or medical bills exceeding $500. For military service deferments, provide deployment verification, which may come from the Defense Department or your commanding officer. Additionally, educational enrollment verification from your institution can substantiate your status as a full-time or part-time student. Ensure all documents are clearly labeled and organized for easy review, as clarity can expedite the assessment process.

Contact Information

Students facing financial difficulties may seek loan deferment options to temporarily suspend loan payments. This process often begins with the completion of a deferment request form, which should include detailed contact information such as the student's full name, current address (including city, state, and zip code), phone number, and email address. Additionally, students must provide their loan account number and details regarding the type of loan (federal or private). Schools such as community colleges and universities often offer specific guidance and resources to help students navigate the deferment application process. Organizing this information accurately is crucial to avoid delays in processing the request.

Request and Acknowledgment

Student loan deferment allows borrowers to temporarily pause their loan payments, typically due to financial hardships, enrollment in school, or military service. Borrowers must officially request deferment through their loan servicer, providing necessary documentation such as proof of enrollment in a recognized institution or a detailed statement of financial difficulties. Acknowledgment of the request from the loan servicer is crucial, signaling that the borrower's application is under review. Specific deferment periods vary depending on the loan type; federal student loans can generally be deferred for up to three years, while private loans often have different criteria. Understanding these guidelines is vital for effective management of student loan obligations.

Letter Template For Student Loan Deferment Samples

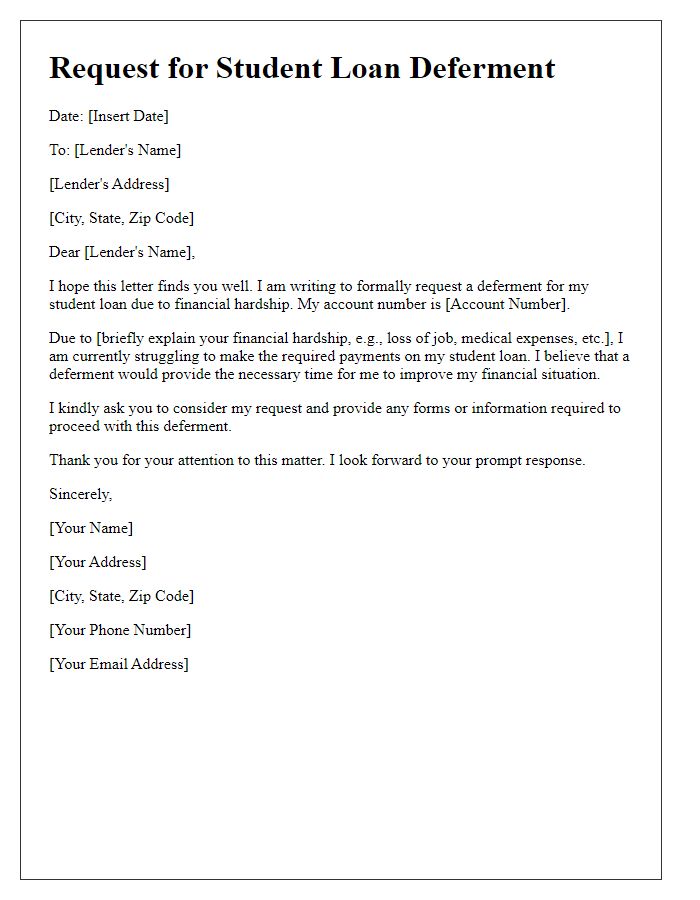

Letter template of request for student loan deferment due to financial hardship.

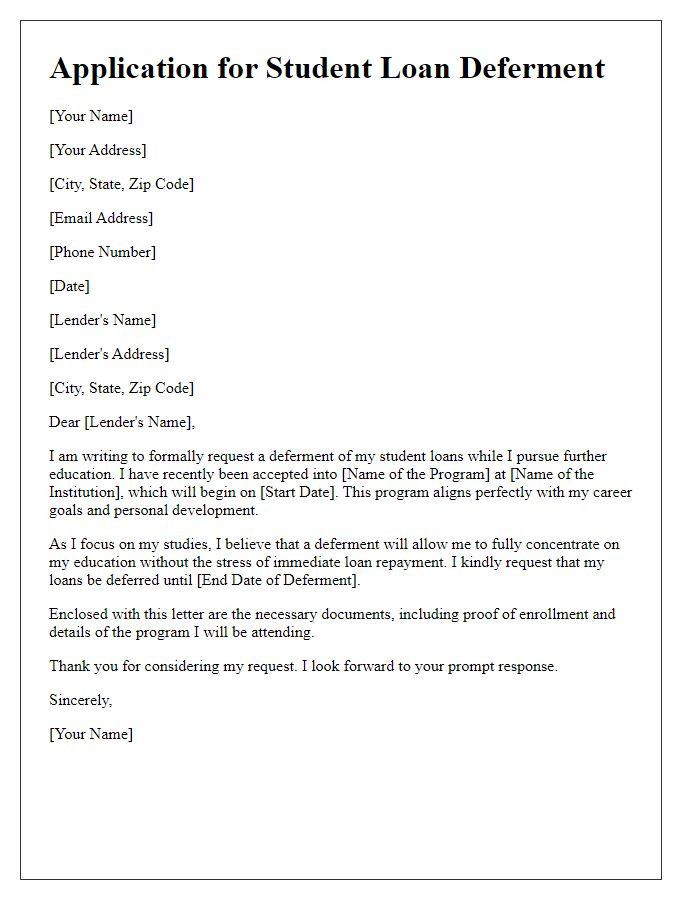

Letter template of application for student loan deferment while pursuing further education.

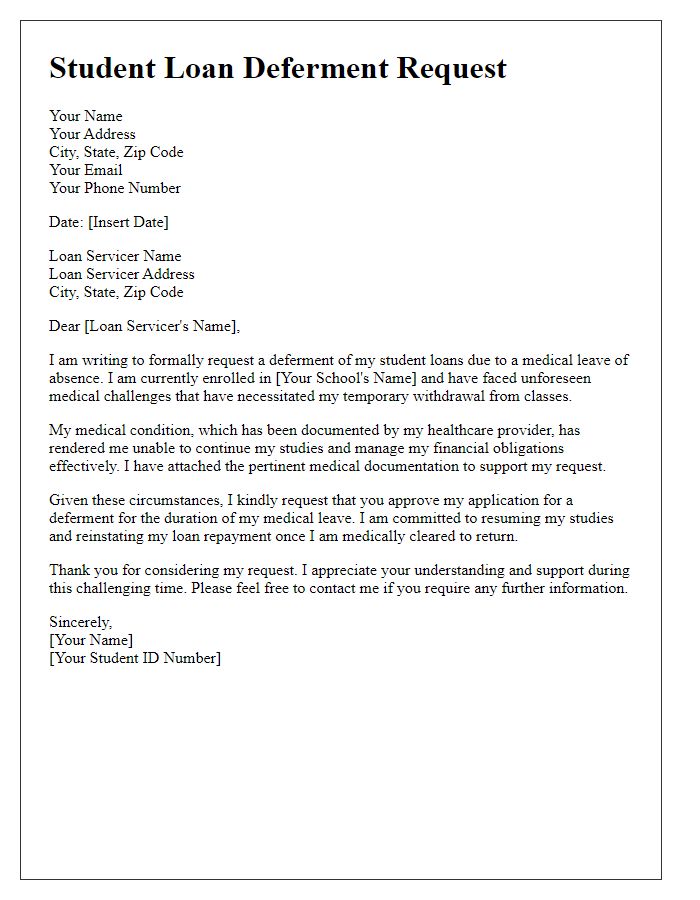

Letter template of justification for student loan deferment during medical leave.

Letter template of inquiry for student loan deferment options for recent graduates.

Letter template of appeal for student loan deferment based on unemployment status.

Letter template of notification for student loan deferment due to military service.

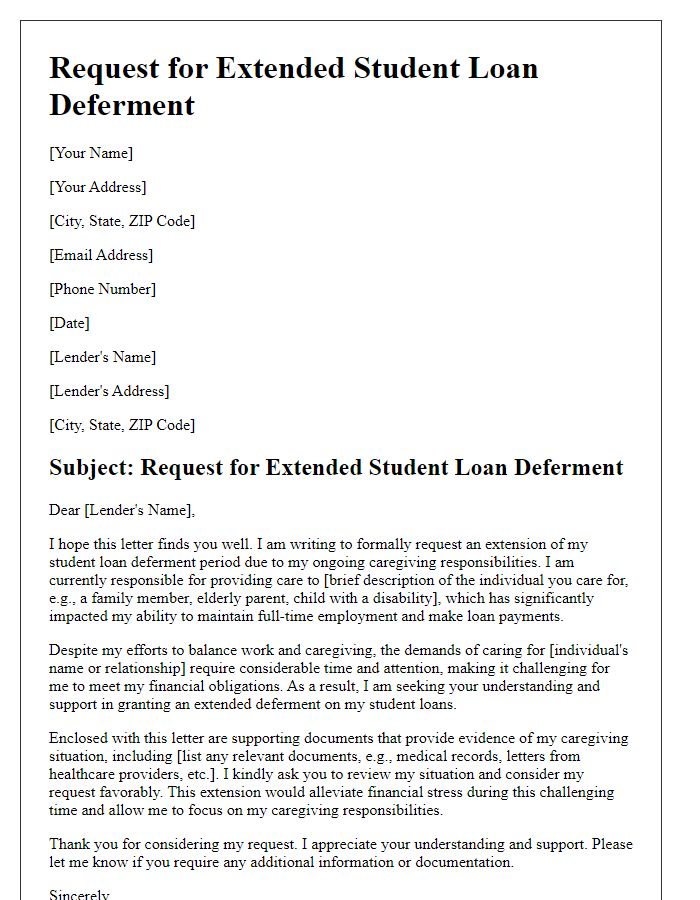

Letter template of submission for temporary student loan deferment due to personal circumstances.

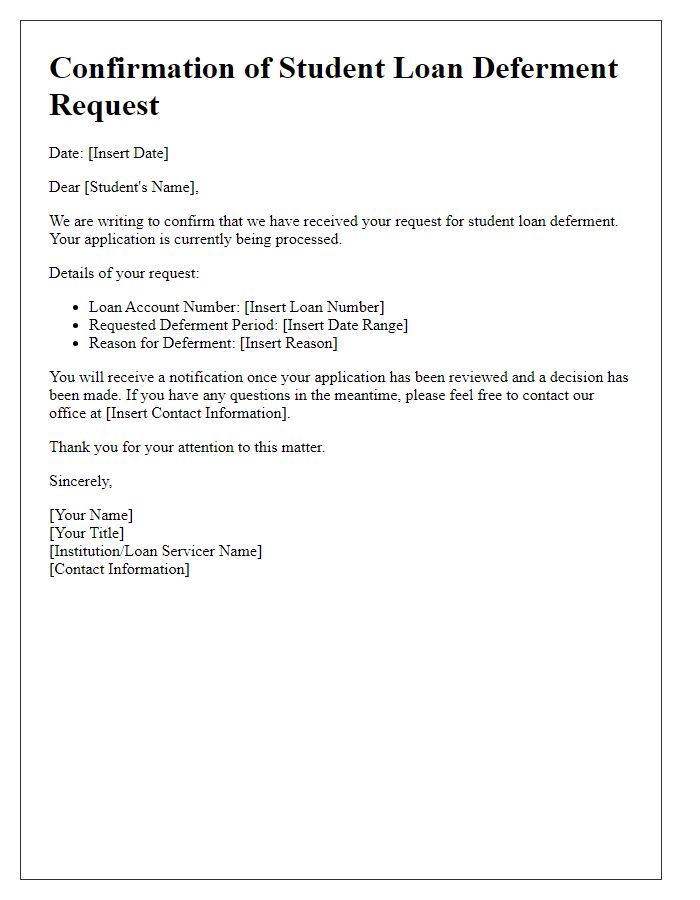

Letter template of confirmation for student loan deferment request processing.

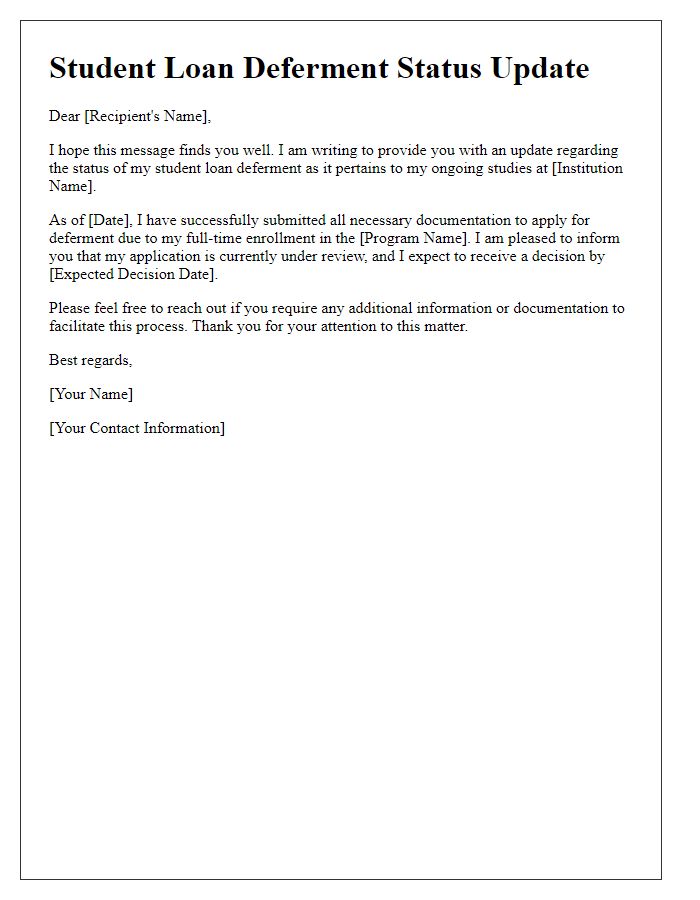

Letter template of update on student loan deferment status for ongoing studies.

Comments