Hello there! Mergers and acquisitions can be quite the journey, filled with opportunities and exciting changes ahead. We understand that keeping our stakeholders informed is essential during this transformative process, and we're committed to sharing updates every step of the way. So, if you're curious about what's happening and how it might impact you, we invite you to read more and stay connected!

Clear Purpose and Context

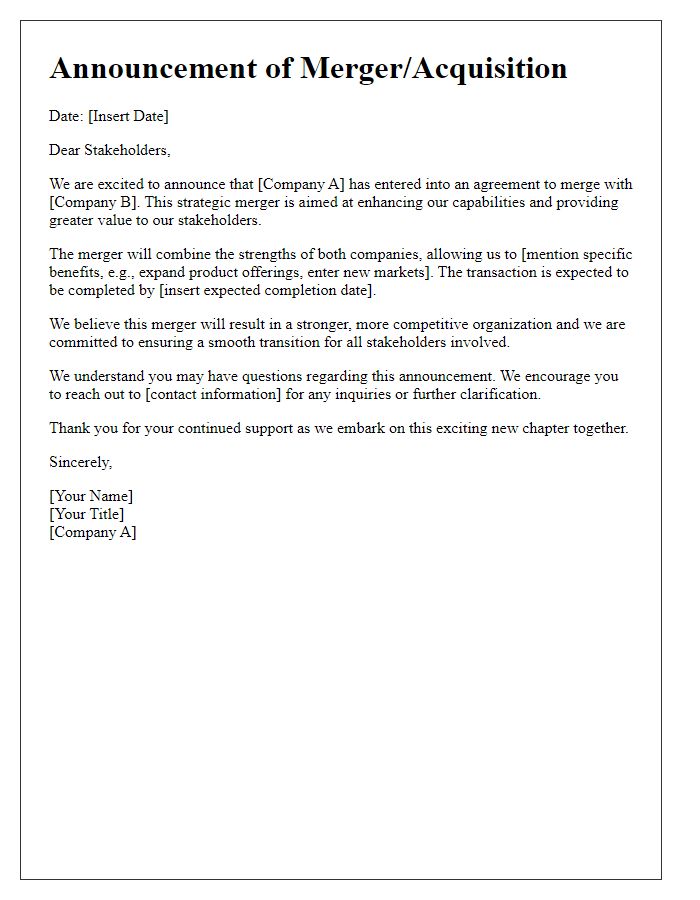

In the context of corporate finance, mergers and acquisitions (M&A) serve as critical strategies for growth and consolidation among companies. As stakeholders in this evolving landscape, understanding the current developments in ongoing negotiations is essential. Recent discussions among key players in the technology sector, particularly involving companies like Microsoft and Activision Blizzard, emphasize a shifting focus towards strategic synergies and market expansion. These interactions are governed by regulatory frameworks such as the Federal Trade Commission's antitrust guidelines, which review potential impacts on competition. Clear communication of progress or obstacles in these negotiations ensures stakeholders remain informed, ultimately fostering trust and alignment in organizational goals. Timely updates on valuation assessments, due diligence findings, and potential timelines for integration can significantly influence stakeholder confidence and investment decisions.

Key Merger/Acquisition Details

The recent merger between Company A and Company B has resulted in a powerful collaboration in the technology sector. The acquisition, valued at approximately $1 billion, aims to enhance product innovation (emphasizing AI-driven solutions) and expand market reach across North America and Europe. The new entity will combine Company A's established cloud services with Company B's cutting-edge cybersecurity technologies, creating a comprehensive suite of offerings. Executives project a growth rate of 15% over the next three years, driven by seamless integration and cost synergies estimated at $100 million annually. Stakeholders will receive regular updates on the integration process, ensuring transparency and engagement throughout this transformative journey.

Impact on Stakeholders

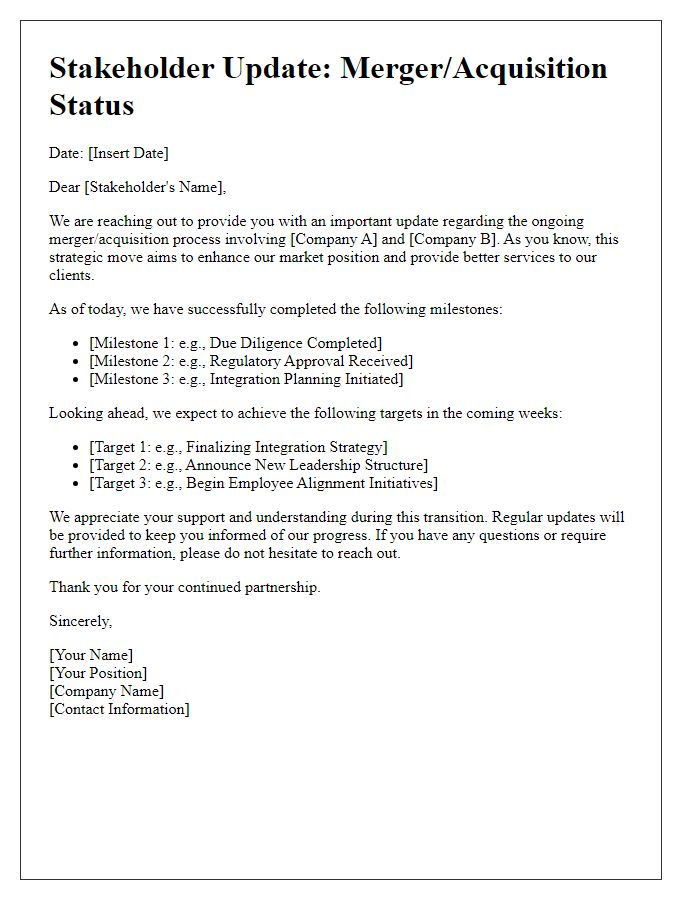

The recent merger of Acme Corp and Beta Innovations is set to create significant shifts within the industry landscape, affecting various stakeholder groups across the board. Employees, numbering over 2,000 from both organizations, will face a period of transition as roles are evaluated for alignment with the new corporate strategy, potentially leading to reorganization or new opportunities in a unified workforce. Investors will watch the merger closely, anticipating changes in stock performance and long-term profitability, particularly as revenue projections indicate a potential growth increase of 15% in the coming fiscal year. Customers of Acme Corp, with a market presence in over 20 countries, can expect enhanced product offerings and improved service delivery as combined resources are leveraged to increase innovation. Additionally, suppliers may see alterations in contracts as the merged entity seeks to optimize its supply chain, impacting existing agreements and negotiations. Local communities, especially in the headquarters located in Chicago, may experience economic fluctuations due to potential changes in employment levels and corporate social responsibility initiatives aligning with the new vision. The successful integration of both companies will ultimately determine the overall impact on these stakeholders, influencing both immediate and long-term outcomes.

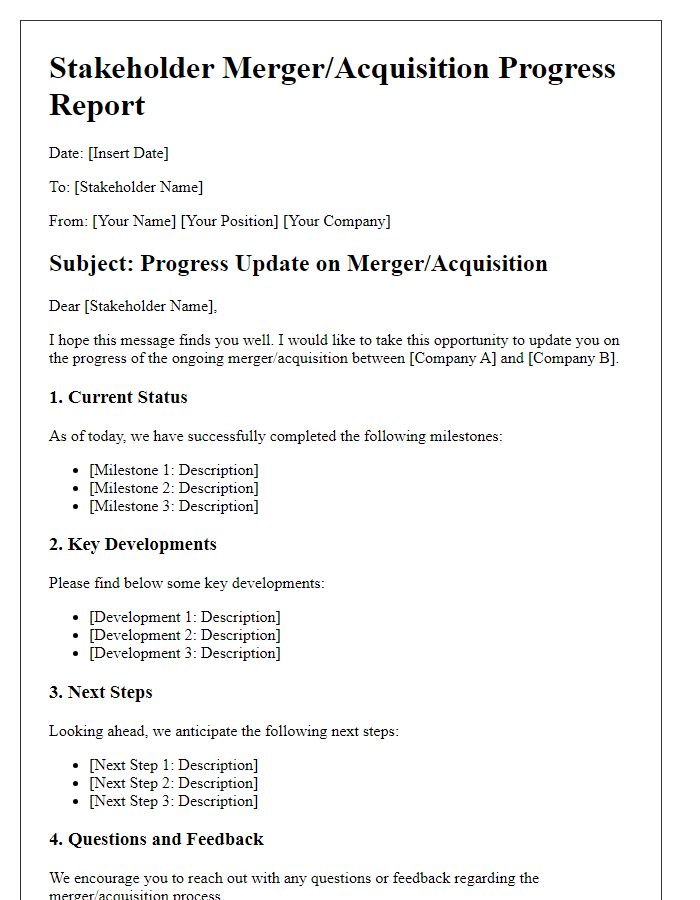

Next Steps and Timeline

A merger or acquisition update serves as a critical communication tool to inform stakeholders about the status and expected timeline of significant corporate transitions. Key considerations embody drafting a comprehensive overview that outlines potential synergies, strategic objectives, and anticipated challenges. The timeline should highlight critical milestones such as due diligence completion, regulatory approvals, and integration phases, fostering transparency. Engaging stakeholders, including investors, employees, and customers, is essential during these transitions, ensuring they understand the vision and rationale behind the merger or acquisition. Using precise language enhances clarity, empowering stakeholders to remain informed and confident throughout the process.

Contact Information for Queries

Mergers and acquisitions (M&A) significantly impact organizational structures. Communication is essential during this transitional phase, particularly for stakeholders who require timely updates. Adequate contact information should be provided for inquiries, ensuring stakeholders can reach specific departments or personnel. Establishing dedicated email addresses and phone lines streamlines communication, preventing information bottlenecks. For example, a designated email address such as inquiries@companymerge.com can facilitate inquiries regarding acquisition status. Additionally, including a phone number, such as +1-800-555-0199, helps address urgent queries quickly. Clear communication protocols foster transparency and reassure stakeholders about ongoing developments in the M&A process.

Comments