In today's fast-paced corporate world, engaging shareholders in board decisions has never been more crucial. The perspectives and insights of shareholders can significantly enhance the governance and direction of a company. By creating an open dialogue, shareholders can voice their opinions, ensuring that their interests align with the strategic goals of the organization. If you want to learn how to effectively craft a letter template for seeking shareholder input, read on!

Purpose and Agenda

Shareholders play a crucial role in corporate governance, influencing board decisions that impact company direction and performance. The purpose of this meeting is to gather shareholder input on key decisions, including potential mergers, executive compensation, and sustainable business practices. The agenda will include presentations on financial performance from the past quarter, an analysis of proposed strategic initiatives, and opportunities for direct shareholder feedback. Attention will be given to environmental, social, and governance (ESG) criteria, reflecting increasing investor demand for responsible corporate behavior. The meeting will take place at the corporate headquarters in New York City, providing shareholders with a platform for transparent discussions regarding their interests and concerns in the company's future.

Background and Context

Shareholder involvement in corporate governance significantly shapes board decisions and strategic direction. Engaging shareholders, particularly in publicly traded companies, fosters transparency and accountability. Events such as annual general meetings (AGMs) often serve as crucial platforms for shareholders to voice opinions. Shareholders represent diverse interests, influencing key outcomes like mergers (the strategic joining of two companies) or executive compensation packages. In regions like North America and Europe, regulations such as the Sarbanes-Oxley Act (2002) impose strict guidelines on financial practices, ensuring shareholder protection. Assessing shareholder perspectives can enhance decision-making processes and align the company's objectives with investors' expectations, ultimately promoting sustainable growth and long-term value.

Shareholder Concerns

Shareholder input is vital for informed board decisions, ensuring representation of diverse perspectives within the corporate structure. Active shareholders, holding a percentage of ownership (often requiring at least 5% to voice significant concerns), can influence strategic initiatives during annual meetings. Key topics such as financial performance, executive compensation, and environmental sustainability often arise during these discussions, providing an opportunity for stakeholders to express their views. Addressing shareholder concerns helps foster transparency, enhances corporate governance, and strengthens the relationship between management and shareholders, ultimately benefiting long-term growth and stability. Notable events, such as shareholder meetings held in major cities like New York or San Francisco, serve as crucial platforms for these dialogues.

Desired Outcomes

Shareholder input on board decisions is crucial for fostering transparency and accountability in corporate governance. Engaging shareholders in the decision-making process can enhance trust and align company strategies with stakeholders' long-term interests. Desired outcomes include improved communication channels, ensuring shareholder voices influence major corporate strategies such as mergers and acquisitions, capital allocation, and sustainability initiatives. Establishing regular forums for shareholder feedback can lead to more informed decisions, increased shareholder satisfaction, and potentially higher stock performance. Additionally, documenting and addressing shareholder concerns can enhance the company's reputation and promote more active involvement from the investor community.

Call to Action and Contact Information

Shareholders play a crucial role in influencing board decisions and corporate governance. Engaging with the board of directors is essential for a transparent and effective decision-making process. Shareholders are encouraged to express their thoughts, opinions, and concerns regarding strategic initiatives, financial policies, and corporate ethics. Effective channels for communication include formal meetings, dedicated email addresses, and public forums, fostering a collaborative environment. Customarily, shareholder feedback can be collected through surveys, open comment periods during annual meetings, or designated contact points within the company's governance framework. Ensuring that shareholder voices are heard contributes significantly to building trust and alignment with the company's mission and vision.

Letter Template For Shareholder Input On Board Decisions Samples

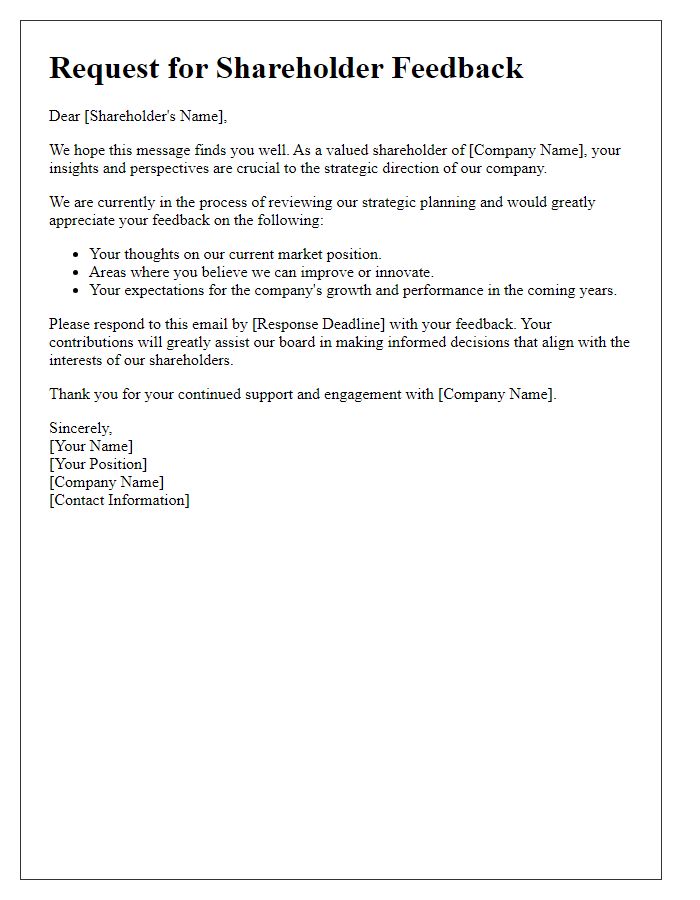

Letter template of shareholder feedback request for board strategy insights

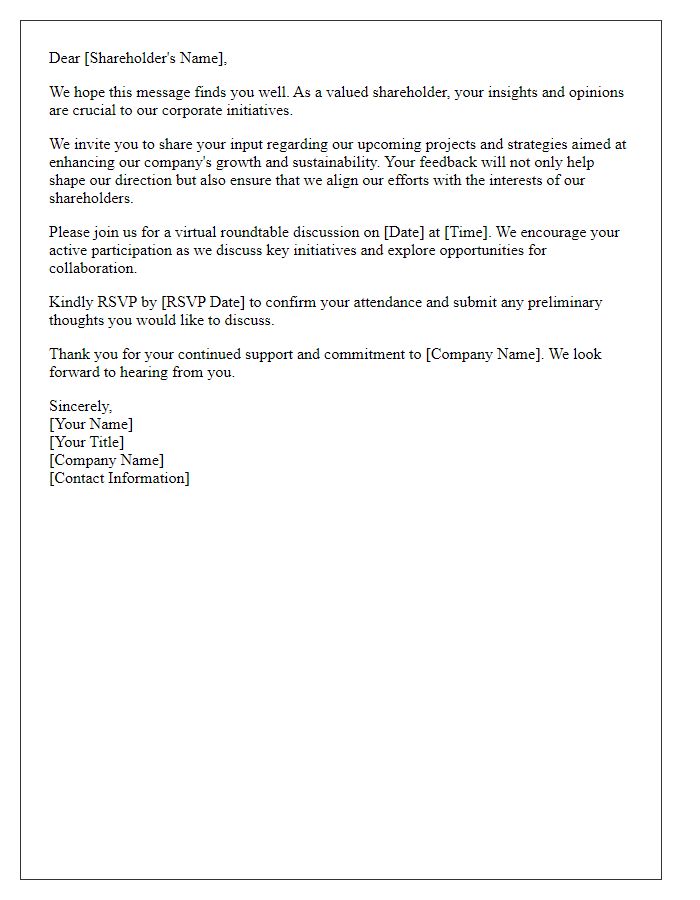

Letter template of shareholder input invitation on corporate initiatives

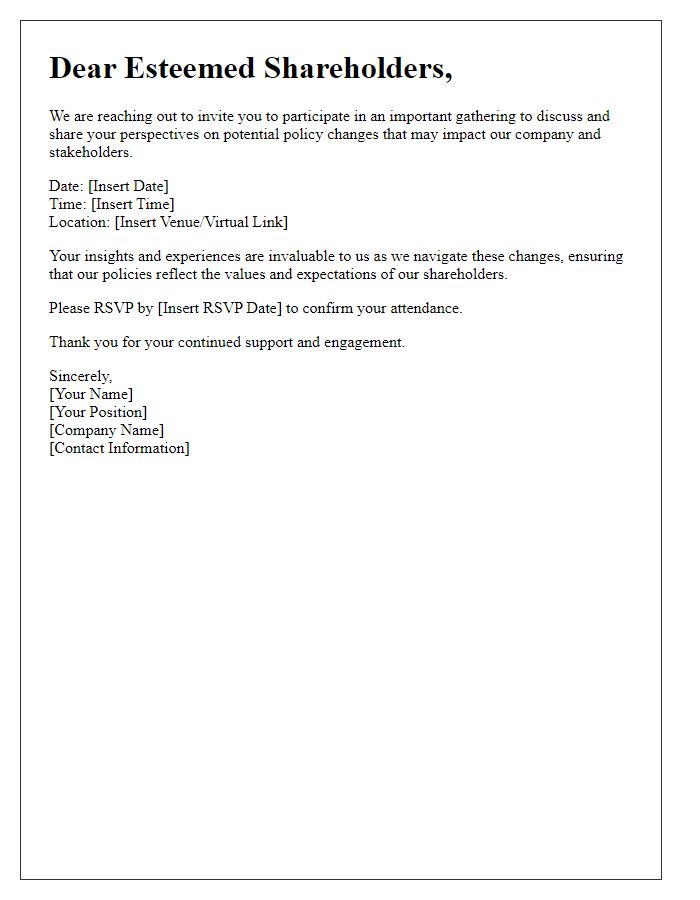

Letter template of shareholder perspectives gathering for policy changes

Comments