Hey there! If you're considering exercising your shareholder options, it's essential to understand the process and the impact it may have on your investments. In this article, we'll break down the steps involved, as well as some key considerations to keep in mind to ensure a smooth transaction. Whether you're a seasoned investor or just starting out, you'll find valuable insights that can help you make informed decisions. So, let's dive in and explore the world of shareholder option exercises together!

Introduction and Purpose

Shareholder options exercise instruction provides vital information for stakeholders wishing to exercise their options. This process outlines the steps necessary for shareholders to convert their options into shares of a company, enabling them to participate in the company's growth. Clear communication is essential, as options typically have an expiration date and specific terms that must be adhered to. Understanding the implications of exercising options, including potential tax liabilities and ownership stakes, ensures informed decisions are made by shareholders. Note: Shareholder options refer to financial contracts that give shareholders the right, but not the obligation, to buy or sell shares at a predetermined price during a certain period.

Shareholder Details

Shareholder options exercise involves a critical process for stakeholders intending to convert options into shares. The exercise of options typically occurs within specified timeframes established in the shareholder agreement, often within three to ten years from the grant date. Shareholders must provide essential details such as their full name, the number of options being exercised, and primary contact information, including email address and phone number. Additionally, the exercise price, which is the cost to acquire each share, should be clearly stated. Compliance with legal regulations and company-specific procedures is crucial to ensure successful processing. Timely submission of the exercise instruction, often required in writing, is necessary to solidify the transaction, which may take place on or around significant corporate events, such as annual meetings or funding rounds.

Option Details and Terms

Shareholders exercising options must adhere to specific procedures outlined in the company's stock option plan, established in January 2020. Each option grant, identified by unique numbers, will include the exercise price, vesting schedule, and expiration date. For instance, options granted under the plan may have a strike price of $15 per share, with a four-year vesting period and an expiration term of ten years post-grant. Shareholders must submit an exercise notice to the company's stock administration department, ensuring compliance with key deadlines. Required documents include a completed exercise form, payment for the total exercise price, and proof of identification. Timely execution is crucial, as options not exercised before the expiration date will become void.

Exercise Instructions and Payment Information

Shareholder options allow stakeholders to purchase company shares, typically at a predetermined price. In exercising stock options, pertinent details include the exercise price (the fixed price at which options can be converted into shares), the expiration date (the deadline for exercising these options), and the number of options being exercised. Payment options often include cash payments (direct funds transfer), stock swaps (using existing shares to pay for new shares), or cashless exercise methods (selling a portion of the options' shares to cover the exercise price). Additionally, the tax implications related to exercising options can vary significantly, making it crucial for shareholders to understand potential liabilities and consult financial advisors for optimal decision-making.

Signature and Date

Options exercise instructions require careful documentation to ensure the correct execution of shareholder rights. Shareholders must provide a signed request that includes details like the number of shares being exercised and the strike price. This request needs to be dated accurately, indicating when the exercise is authorized by the shareholder. All documents should be directed to the appropriate corporate secretary of the issuing company, ensuring compliance with the specified timelines as outlined in the company's stock option plan. Proper execution facilitates seamless transaction processing and upholds shareholder interests.

Letter Template For Shareholder Options Exercise Instruction Samples

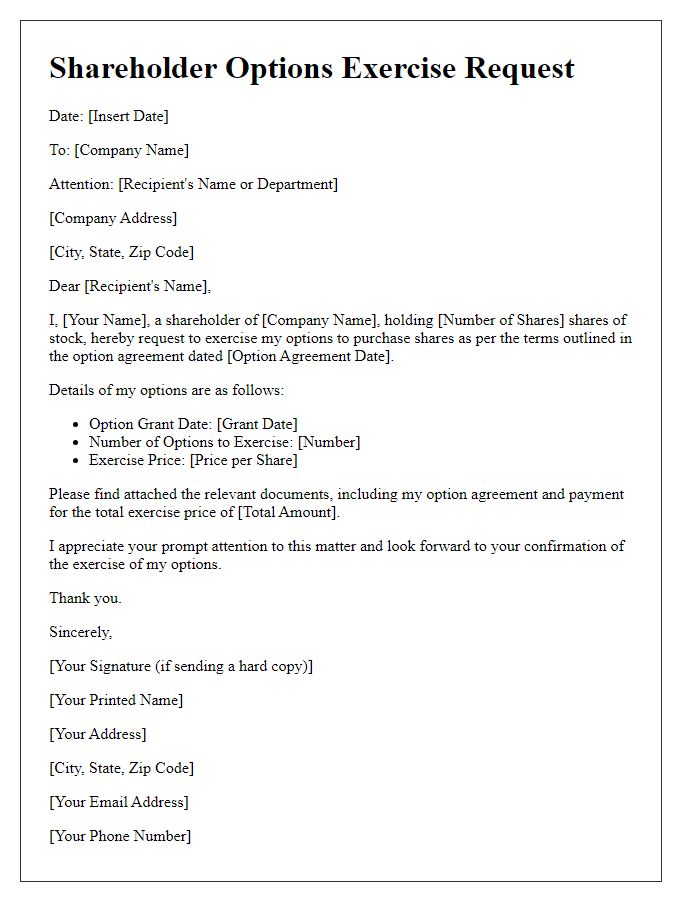

Letter template of shareholder options exercise request for individual shareholders.

Letter template of shareholder options exercise notification for group of shareholders.

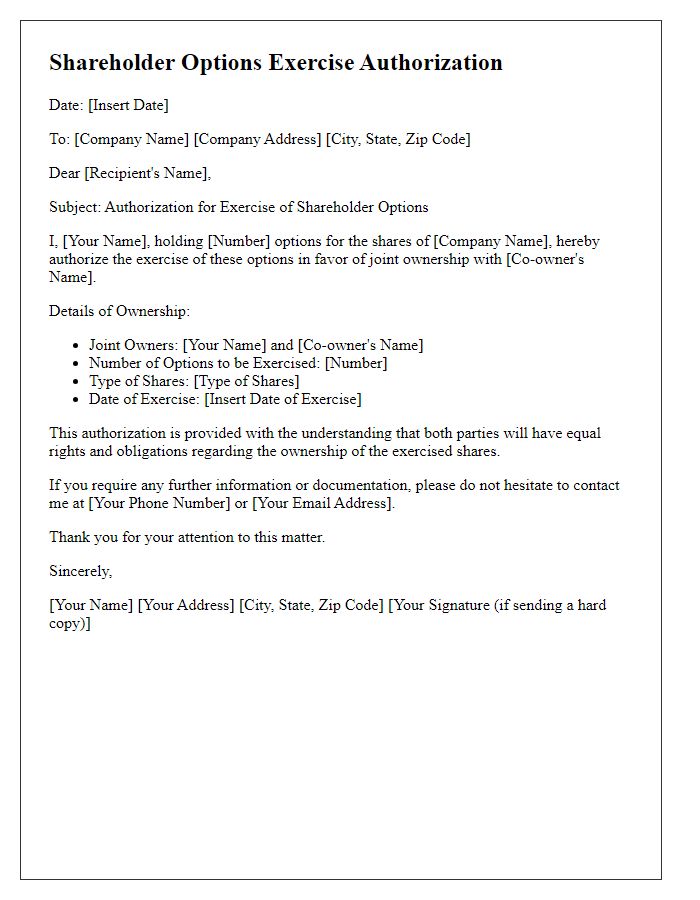

Letter template of shareholder options exercise authorization for joint ownership.

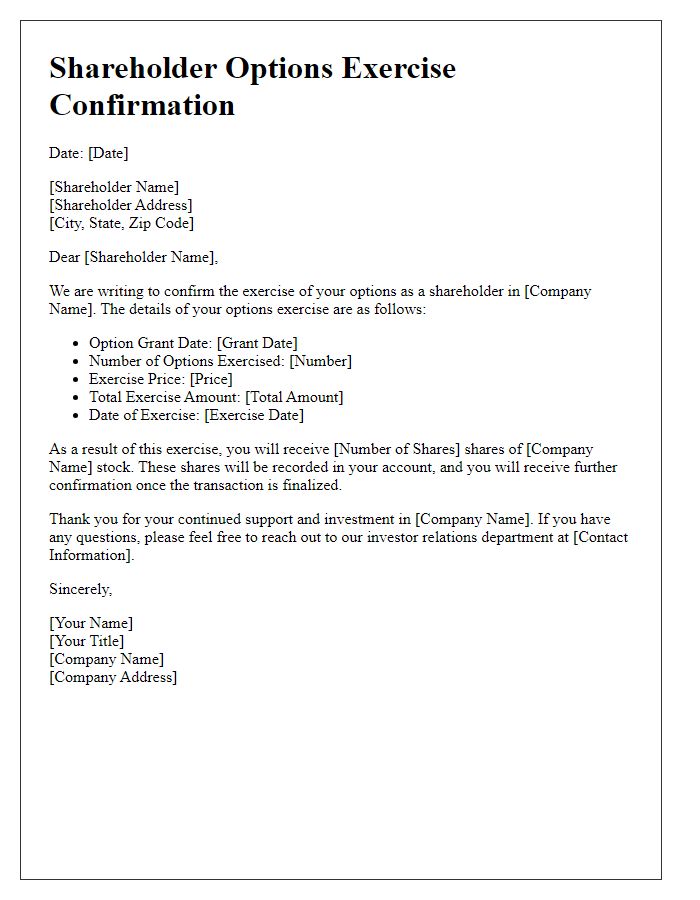

Letter template of shareholder options exercise confirmation for corporate entities.

Letter template of shareholder options exercise application for stock option plan participants.

Letter template of shareholder options exercise directive for recent shareholders.

Letter template of shareholder options exercise procedure for eligible employees.

Letter template of shareholder options exercise intent for preferred shareholders.

Letter template of shareholder options exercise notice for pending transactions.

Comments