Hey there! We're excited to share some updates on our equity financing progress with you, our valued shareholder. As we continue to navigate this journey, we've made significant strides towards our goals, ensuring that your investment is well on its way to delivering strong returns. Stay tuned, because we have more exciting details to share that will shed light on our plans and strategies moving forwardâlet's dive in!

Shareholder Identification

Shareholder identification is crucial in equity financing processes, ensuring accurate communication and compliance with financial regulations. Key factors include maintaining an updated register of shareholders, reflecting ownership stakes in companies. Identification techniques often involve using unique identifiers like shareholder registration numbers or tax identification numbers for clarity. Addressing various shareholders, including institutional investors and individual stakeholders, requires a targeted approach that respects the diverse backgrounds and interests. Ensuring transparency about equity financing progress instills confidence in shareholders, enabling informed decision-making regarding investment strategies and future participation in corporate growth initiatives. Additionally, adherence to legal standards during identification processes fosters trust and strengthens shareholder relationships.

Equity Financing Overview

Equity financing plays a crucial role in providing necessary capital for business operations and growth. Successful completion of equity financing can lead to increased funding, enhancing company stability. Recent transactions, notably the December 2023 round, raised approximately $5 million from institutional investors, emphasizing investor confidence. Key milestones include securing commitments from prominent firms such as Venture Capital Group and Growth Equity Partners, which specialize in funding emerging businesses. Utilization of funds focuses on strategic initiatives, including product development and market expansion efforts aimed at garnering a significant share in the competitive technology sector. Shareholders can monitor periodic updates on the progress and impact of these initiatives to better understand the company's trajectory.

Current Progress Update

Equity financing progress, particularly in 2023, has shown significant advancements for the company as stakeholders analyze ongoing developments. Recent fundraising rounds reported over $5 million in new investments, boosting the overall valuation to approximately $50 million. Strategic partnerships formed with investors such as Venture Capital Firm A are expected to enhance market reach and operational capacity. In addition, interest from institutional investors has surged, with preliminary discussions indicating potential commitments upward of $10 million. This momentum is crucial as it aligns with the upcoming product launch scheduled for Q4 2023, which aims to penetrate the tech sector further. Enhanced marketing strategies are being implemented to maximize investor exposure, ensuring stakeholders remain informed throughout this pivotal phase.

Future Expectations and Plans

Equity financing developments play a critical role in the financial strategy of companies seeking growth. Recent actions taken by our management team, including a successful fundraising round in September 2023, have raised $5 million aimed at expanding operations in the renewable energy sector, specifically solar technology. Our strategic plans involve investing in innovative solutions to increase efficiency and reduce costs in production facilities located in California, home to a burgeoning market for sustainable energy. Anticipated milestones for the next fiscal year include launching a new product line, with projections of a 30% growth in revenue, underlining our commitment to shareholder value. Furthermore, strategic partnerships with key players in this industry will enable us to broaden our market reach and secure a stronger position in the competitive landscape, ultimately enhancing investor confidence and driving sustainable long-term returns.

Contact Information for Queries

In the rapidly evolving landscape of corporate financing, equity financing serves as a crucial avenue for companies to bolster their capital foundation. This method, typically involving the issuance of shares, not only raises funds but also invites stakeholder participation in the company's future. As of October 2023, numerous corporations are exploring diverse equity financing strategies, with notable examples being the Initial Public Offerings (IPOs) in major financial hubs like New York and London. Additionally, shareholders are often provided with detailed progress updates to maintain transparency regarding the number of shares issued, the application of raised funds, and expected milestones. For inquiries or further details, direct communication channels, such as dedicated email addresses or contact numbers, are essential in facilitating engagement between shareholders and company representatives.

Letter Template For Notifying Shareholder On Equity Financing Progress Samples

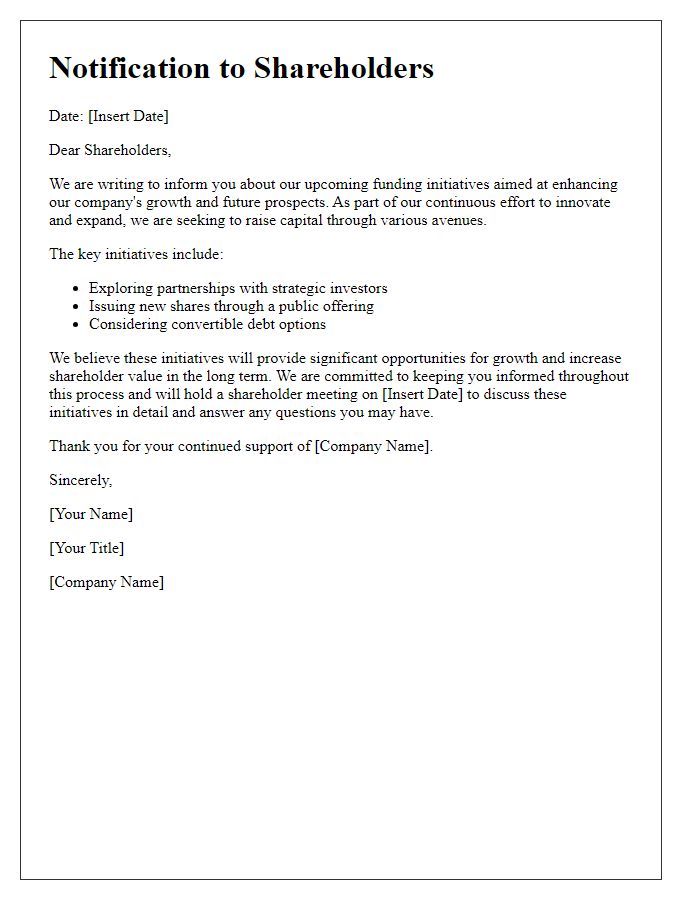

Letter template of shareholder notification regarding funding initiatives

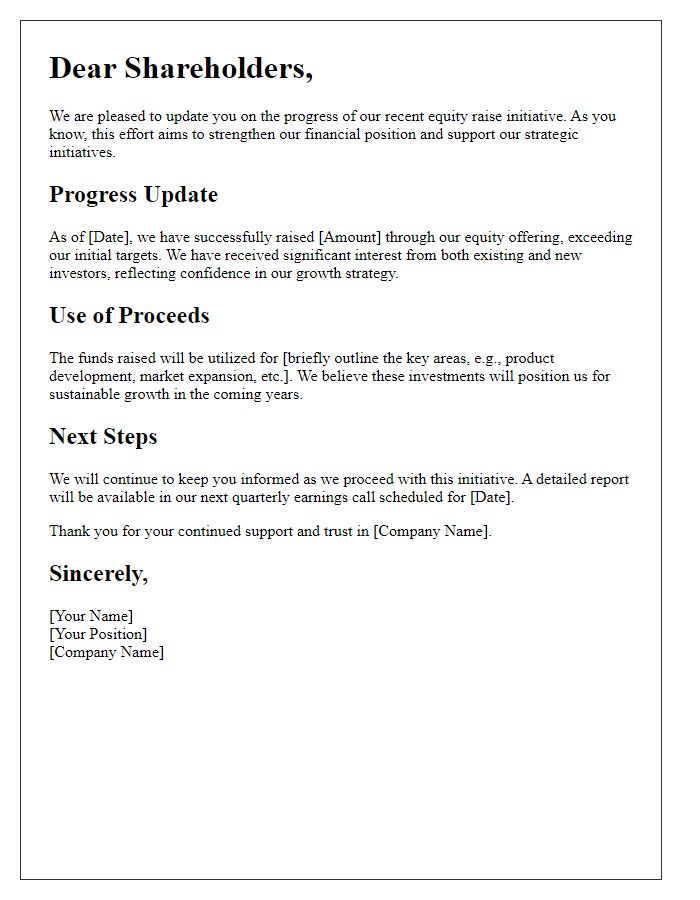

Letter template of communication to shareholders about equity raise progress

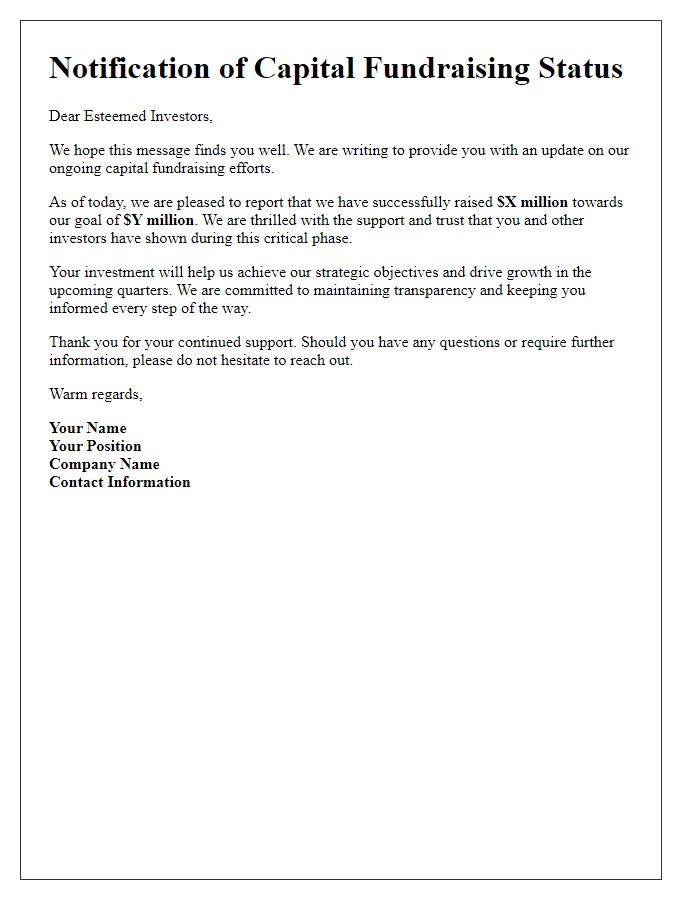

Letter template of notification to investors about capital fundraising status

Comments