Welcome to our sneak peek of the upcoming shareholder meeting, where we'll dive into the heart of our company's progress and future plans. In this gathering, we'll discuss key topics such as financial performance, upcoming projects, and shareholder initiatives that matter most to you. Our agenda is designed to foster an engaging dialogue and transparency while addressing your valuable feedback. So, grab a cup of coffee and join us as we explore these important topics further!

Opening Remarks and Welcome

Shareholder meetings play a crucial role in corporate governance, providing a platform for company leaders to communicate directly with stakeholders. During the Opening Remarks segment, typically initiated by the Chief Executive Officer (CEO) or the Chairperson of the Board, key accomplishments from the previous fiscal year (such as achieving a revenue milestone of $1 billion) will be highlighted. The meeting also serves to address ongoing strategies within a dynamic market environment, especially focusing on innovation and sustainable practices. This opening sets the tone for engagement, fostering collaboration among shareholders on critical issues such as dividend distribution and corporate social responsibility initiatives. The venue for these meetings often takes place in significant business cities, like New York City or London, attracting both local and international investors.

Approval of Previous Meeting Minutes

Approval of Previous Meeting Minutes signifies a crucial agenda item in shareholder meetings, reflecting compliance with corporate governance standards. During this segment, stakeholders will review and validate the accuracy of documented discussions and decisions from the prior meeting held on [insert date], ensuring alignment and transparency. This practice fosters trust among shareholders, enhancing organizational integrity and credibility. Typically, minutes encompass key decisions, votes recorded, and action items delegated to specific individuals or committees for follow-up. Accurate recording is essential, as discrepancies can lead to misunderstandings or conflicts regarding corporate direction and decisions.

Financial Performance Review

The financial performance review provides a comprehensive analysis of the company's fiscal health over the previous quarter. Key metrics include revenue growth (measured in percentage increase from Q2 2023), net profit margins (averaging 15% across several market segments), and operational expenditures (noting a rise to $5 million due to expansion initiatives). Insights gathered from regional sales performance (highlighting strong contributions from the Asia-Pacific market) play a crucial role in strategic decision-making. Additionally, the discussion will address forecasts for the upcoming fiscal year, examining how global economic trends (such as inflation rates hovering around 5%) may impact profitability. Stakeholder engagement (spanning various investment circles, including institutional investors and retail shareholders) remains a vital component in shaping the company's financial strategies and investment opportunities.

Strategic Initiatives Updates

The Strategic Initiatives Updates section in the shareholder meeting agenda will cover recent progress and future roadmap in key areas such as sustainability, digital transformation, and market expansion. The Sustainability initiative, focused on reducing carbon emissions by 30% by 2025, aims to enhance the company's environmental impact. Digital Transformation updates will highlight the implementation of cutting-edge technologies like artificial intelligence in customer service processes, which have increased efficiency by 15% over the past year. Market Expansion efforts will discuss entering the Asian markets, specifically targeting countries such as India and Vietnam, which are projected to see significant growth in consumer demand over the next five years. The discussion will also include a review of financial metrics linked to these initiatives, providing stakeholders with insights into profitability and competitive positioning.

Open Floor for Shareholder Questions

The Open Floor for Shareholder Questions segment allows investors to voice concerns, seek clarifications, and engage directly with the management team during the Annual General Meeting (AGM). This interactive session provides an opportunity for shareholders to address topical matters, including the company's financial performance, growth strategies, and future projections. By allocating dedicated time (usually 30-45 minutes) within the agenda for this segment, shareholders can influence decision-making and foster transparency. Addressing common queries can illustrate management's accountability, enhance stakeholder trust, and promote a collaborative atmosphere, essential for long-term business sustainability.

Letter Template For Shareholder Meeting Agenda List Samples

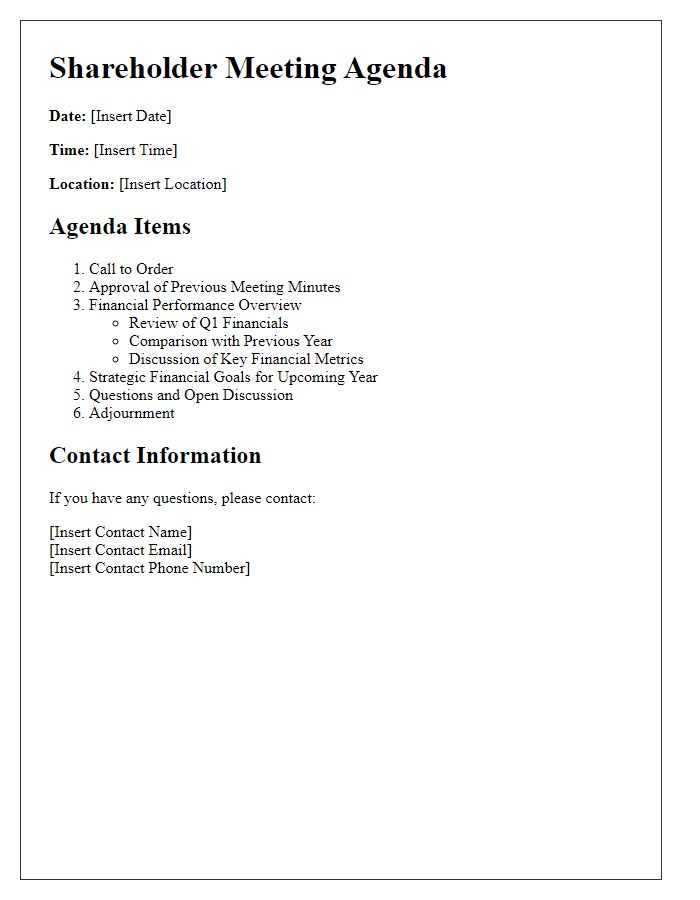

Letter template of shareholder meeting agenda for financial performance discussion

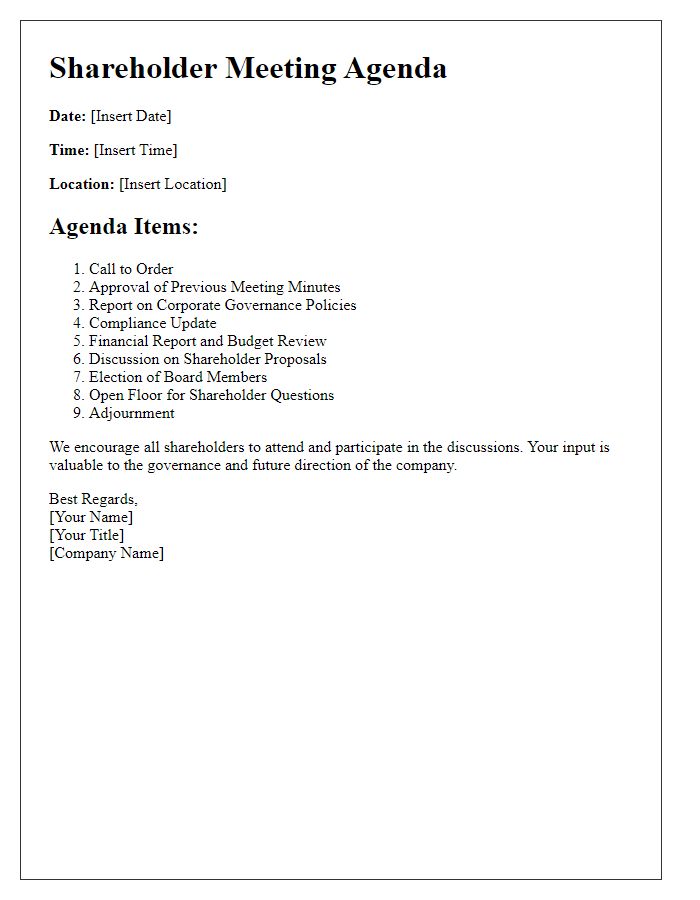

Letter template of shareholder meeting agenda for compliance and governance

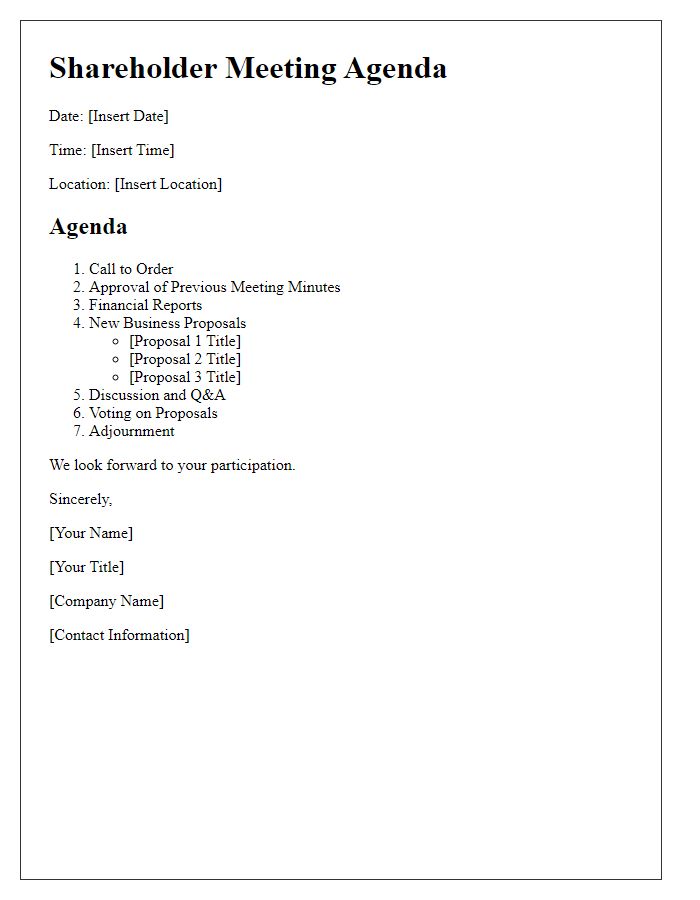

Letter template of shareholder meeting agenda for new business proposals

Letter template of shareholder meeting agenda for risk management assessment

Letter template of shareholder meeting agenda for shareholder feedback session

Letter template of shareholder meeting agenda for executive compensation review

Comments