Dear Valued Shareholder, we are excited to inform you about our upcoming bond offering, designed to strengthen our company's growth and enhance shareholder value. This strategic move not only reflects our commitment to transparency but also aims to provide you with an opportunity to further invest in our bright future. By participating in this offering, you can take advantage of attractive returns while supporting our ongoing projects. We invite you to read more about the details in the full article and discover how this initiative can benefit you.

Clear Introduction

The upcoming bond offering scheduled for February 15, 2024, represents an important financial initiative for our company, XYZ Corporation, headquartered in San Francisco, California. This bond issuance, aimed at raising $50 million, will support expansion projects and enhance operational capabilities. Shareholders can expect detailed information regarding terms, interest rates, and the expected impact on our capital structure. Investors are encouraged to carefully review the offering documents upon availability to make informed decisions.

Purpose of Offering

The upcoming bond offering aims to raise capital for expanding operations and enhancing infrastructure at key facilities, specifically targeting a 15% increase in production capacity over the next 12 months. This initiative supports our commitment to sustainability, as we plan to invest approximately $10 million in environmentally-friendly technology enhancements. Investors are encouraged to participate in this bond offering, which will feature a competitive interest rate of 5% per annum, providing an attractive return on investment. These funds will also aid in strengthening our position in the market, particularly in the renewable energy sector, which is projected to reach a valuation of $1 trillion by 2030.

Terms and Conditions

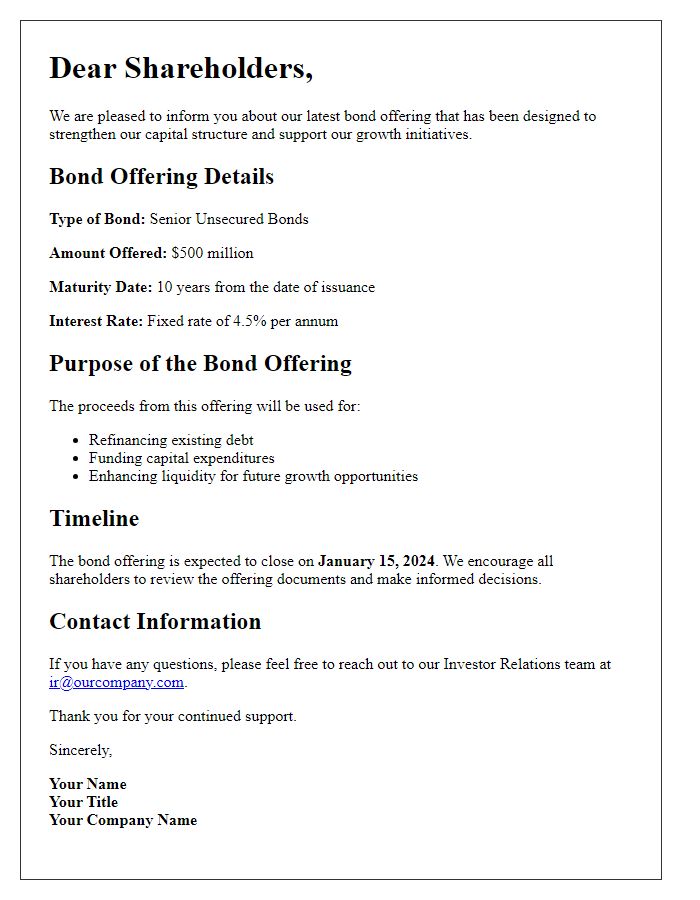

The recent bond offering aims to raise capital for the ongoing expansion project of the renewable energy sector, targeting a specific investment amount of $500 million. The bonds, maturing in 2033, offer an attractive fixed interest rate of 4.5% per annum, payable semi-annually, ensuring a steady income stream for investors. The offering will be managed by a leading investment bank, Goldman Sachs, known for its expertise in capital markets. Detailed terms and conditions include the minimum investment threshold set at $10,000, along with stipulations regarding early redemption options, which allow bondholders to redeem before maturity under certain circumstances. Investors will receive comprehensive documentation outlining the financial health of the issuing entity, projected cash flows, and risk factors associated with the renewable energy market. The bond issuance, governed by U.S. Securities and Exchange Commission regulations, is scheduled for the first quarter of 2024, with investor presentations starting next month in major cities like New York and San Francisco.

Call to Action

A bond offering provides an opportunity for shareholders to invest in corporate debt, typically with fixed interest rates and set maturity dates. This particular offering, announced on October 15, 2023, aims to raise $200 million to fund expansion projects in renewable energy, aligning with global trends for sustainable practices. Interested investors can participate by purchasing bonds in denominations of $1,000, with a yield of 4.5% per annum, payable semi-annually. Bond sales will begin on November 1, 2023, and end on November 30, 2023, making it essential for shareholders to act promptly to secure their investments. Detailed prospectuses will be available on the company website, and a dedicated investor contact line is established for inquiries to facilitate informed decision-making.

Contact Information

A bond offering provides a method for companies to raise capital through debt instruments, often appealing to investors seeking steady income. The issuer usually specifies key attributes, such as interest rate, maturity date, and credit rating. Recent offerings, like the $1 billion bonds issued by Company XYZ in 2022, highlight the increasing demand for corporate bonds in the current low-interest-rate environment. Investors located in urban financial hubs such as New York City or London often monitor these opportunities closely to diversify their portfolios and manage risk. Understanding the detailed terms and conditions outlined in the bond prospectus is crucial for making informed investment decisions.

Letter Template For Notifying Shareholder About Bond Offering Samples

Letter template of bond offering prospectus distribution to shareholders

Letter template of formal notice to shareholders about bond availability

Comments