Have you ever found yourself staring at a payment statement, scratching your head over discrepancies that just don't add up? It can be frustrating when numbers don't match up, especially when timely payments are crucial for your business operations. In this article, we'll explore a straightforward letter template to help you address and resolve payment discrepancies effectively. So, let's dive in and arm you with the tools you need to tackle this issue head-on!

Subject Line

Payment discrepancies can arise in various business transactions, often involving invoices and receipts. Timely and accurate resolution is crucial for maintaining positive vendor relationships. When discrepancies occur, it's important to reference specific invoice numbers, transaction dates, and involved parties. A detailed account of the amounts in question, as well as supporting documents (receipt copies, bank statements), need to be attached for clarity. Clear communication regarding the discrepancy can expedite the resolution process and foster trust between involved entities. Ensuring adherence to established payment terms and timelines (often 30 days from invoice date) is also essential in resolving any issues effectively.

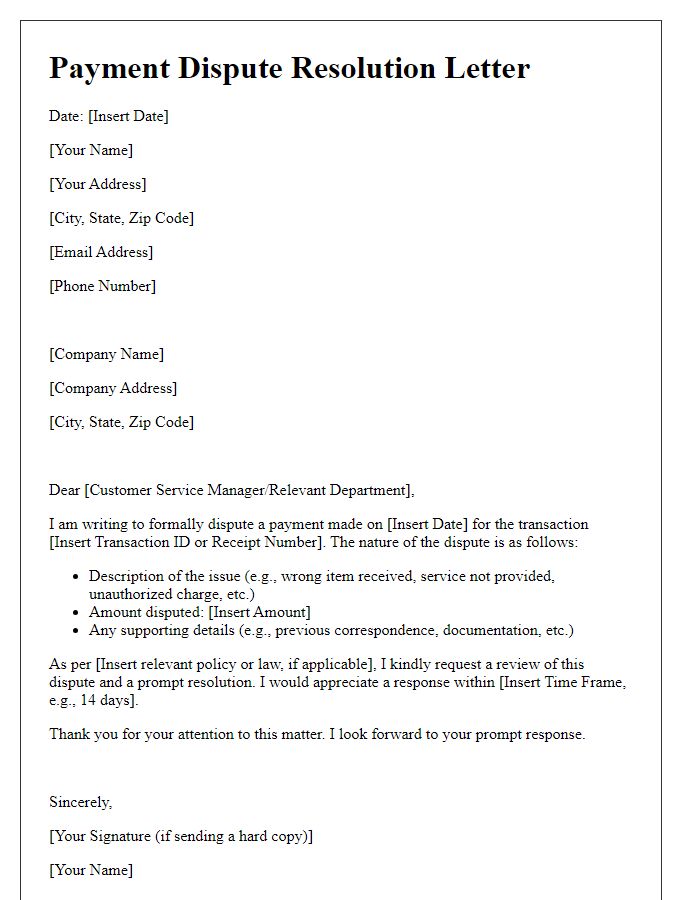

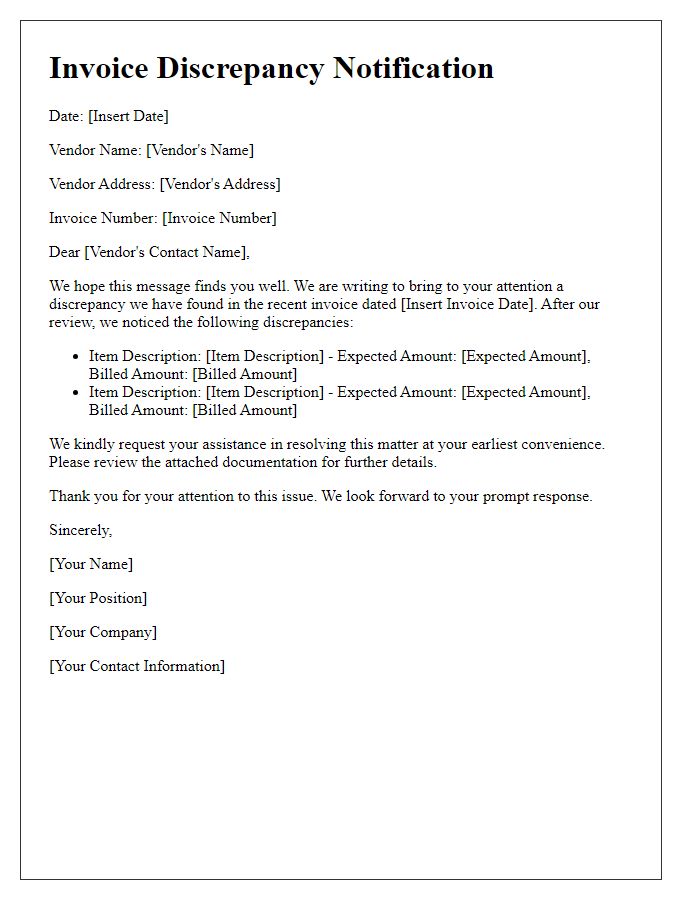

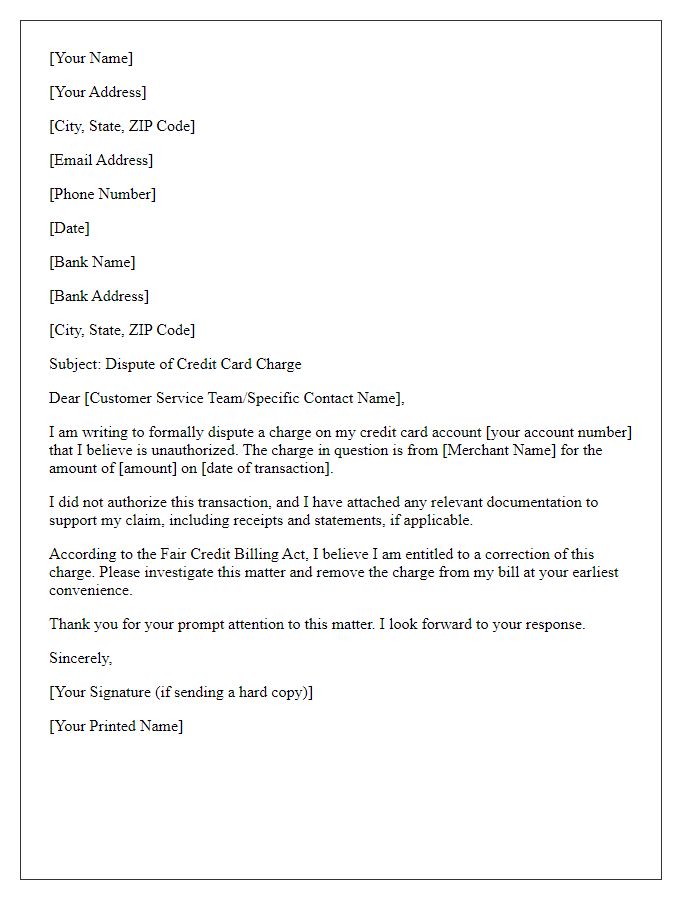

Sender and Receiver Information

Discrepancies in payments can occur during transactions between various entities, such as individuals or businesses, leading to confusion and potential financial issues. For example, the sender, a small business owner in New York, might notice an inconsistency in payments received from a supplier in California. This discrepancy could involve a missing invoice amounting to $500, causing significant issues in cash flow management. Accurate and prompt communication regarding such discrepancies is vital to ensure timely resolution. Documenting all relevant information, including invoice numbers, transaction dates, and amounts, plays a crucial role in clarifying misunderstandings and maintaining good relationships between sender and receiver. Detailed records enhance the credibility of claims and facilitate efficient discussions aimed at resolving the financial issues at hand.

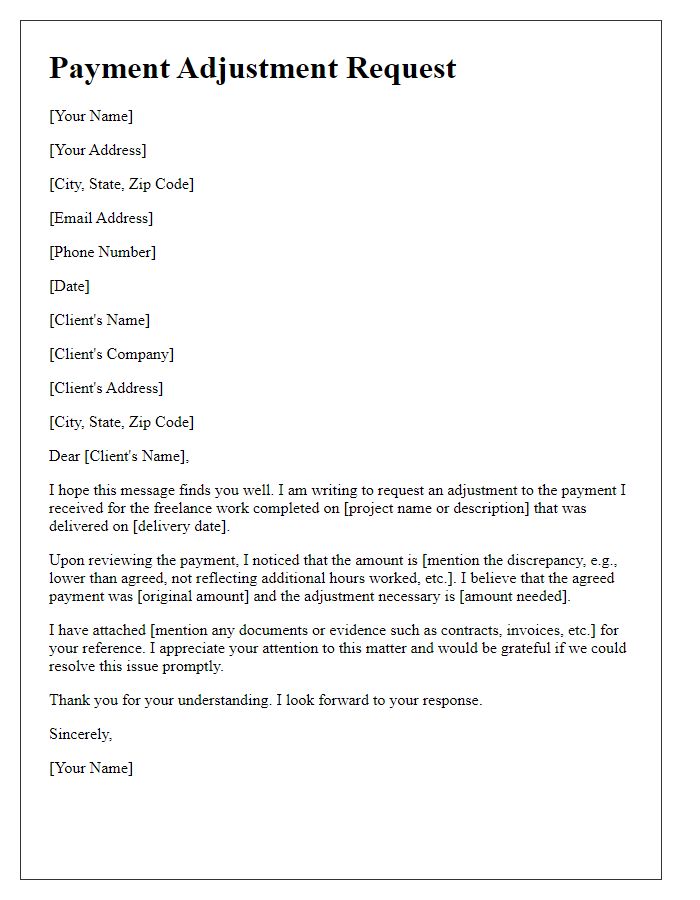

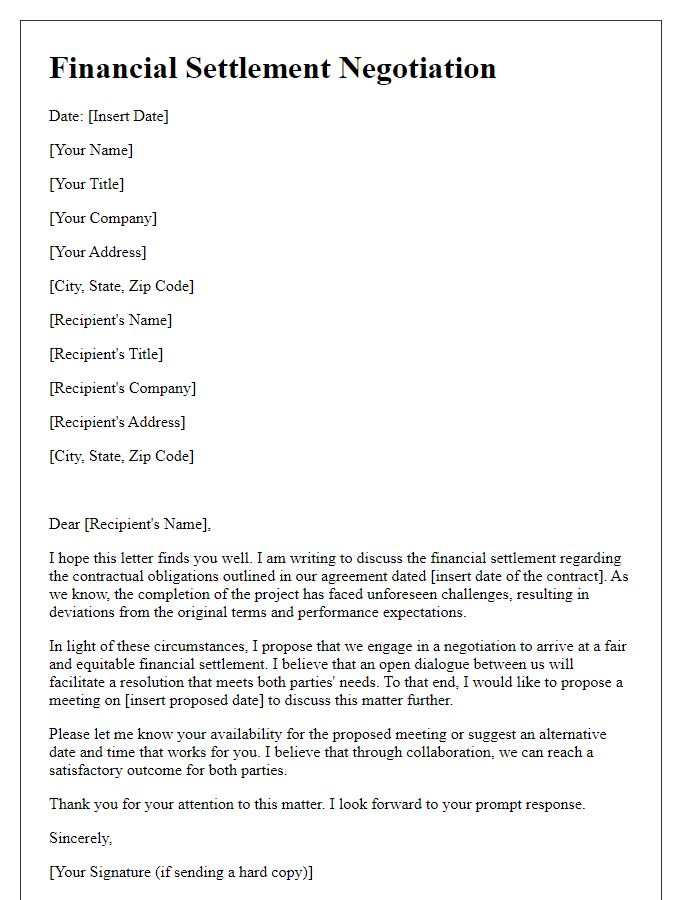

Clear Description of Discrepancy

Payment discrepancies can arise in various business transactions, such as billing errors or payment mismatches. An example could involve an invoice (issued on September 15, 2023, by XYZ Corporation) which stated a total amount of $2,500. Upon reviewing the payment record, a total of $2,000 was received, leaving a $500 discrepancy. This situation may also involve comparing transaction details from financial statements or payment processors, like PayPal, which document when payments were made or received. Thorough analysis of all related documents, including receipts and emails, is essential to identify the source of the discrepancy, whether it involves miscommunication or input errors. Providing detailed evidence helps facilitate swift resolutions and enhances the understanding of the issue for all parties involved.

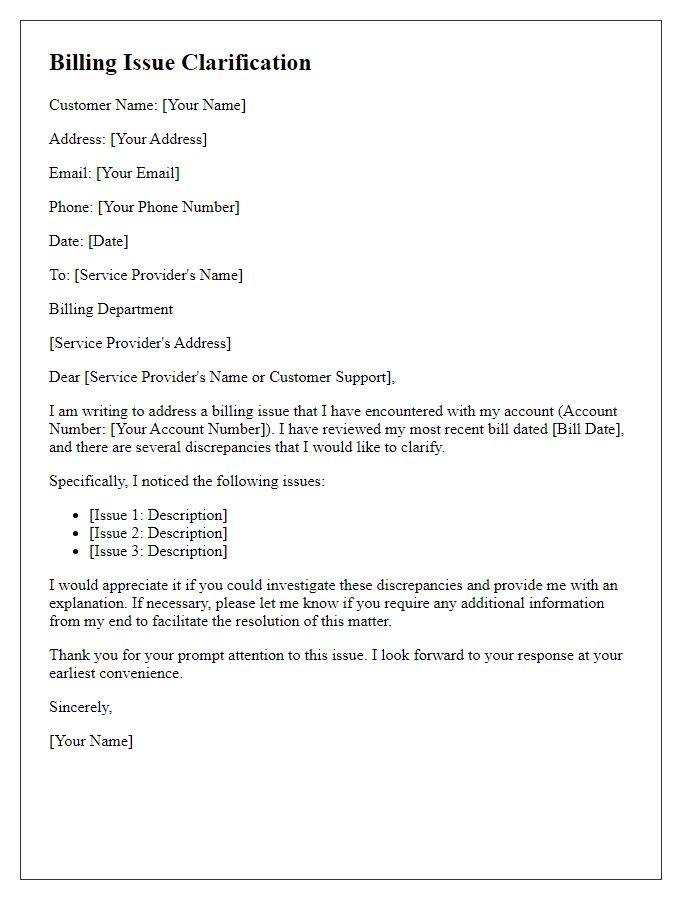

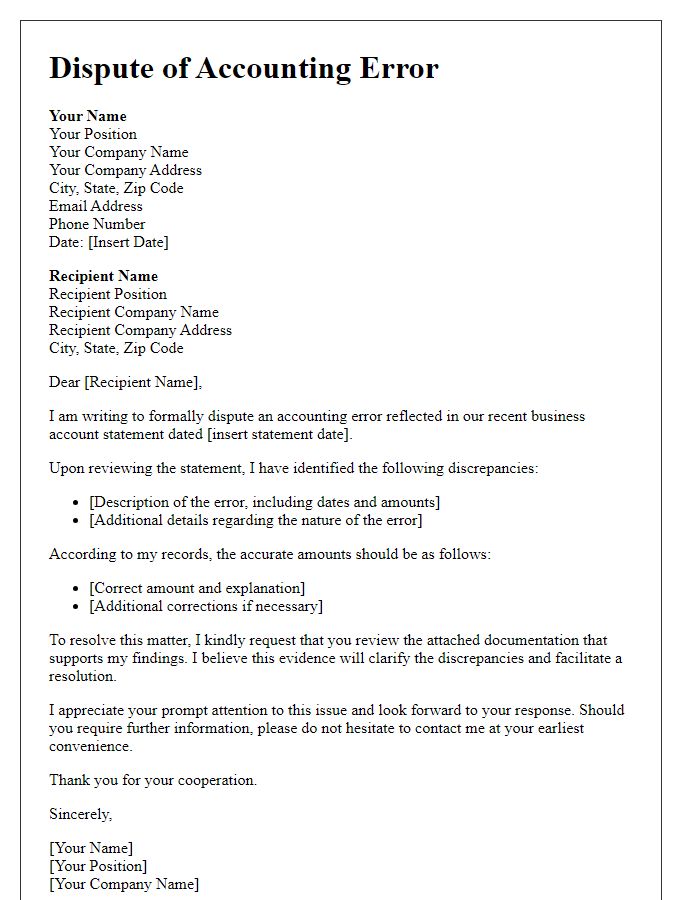

Supporting Documentation

Payment discrepancies often arise in business transactions, resulting in the need for supporting documentation to clarify and resolve issues effectively. Common discrepancies can include invoice mismatches, incorrect amounts, or unaccounted transactions. Vital documents to provide include itemized invoices listing goods or services rendered, purchase orders detailing agreed terms, and payment receipts confirming transactions completed. Additionally, bank statements may serve as evidence of payment processing dates and amounts, ensuring transparency in financial dealings. Clear documentation helps both parties review the transaction history and facilitates a prompt resolution, fostering a reliable and professional business relationship.

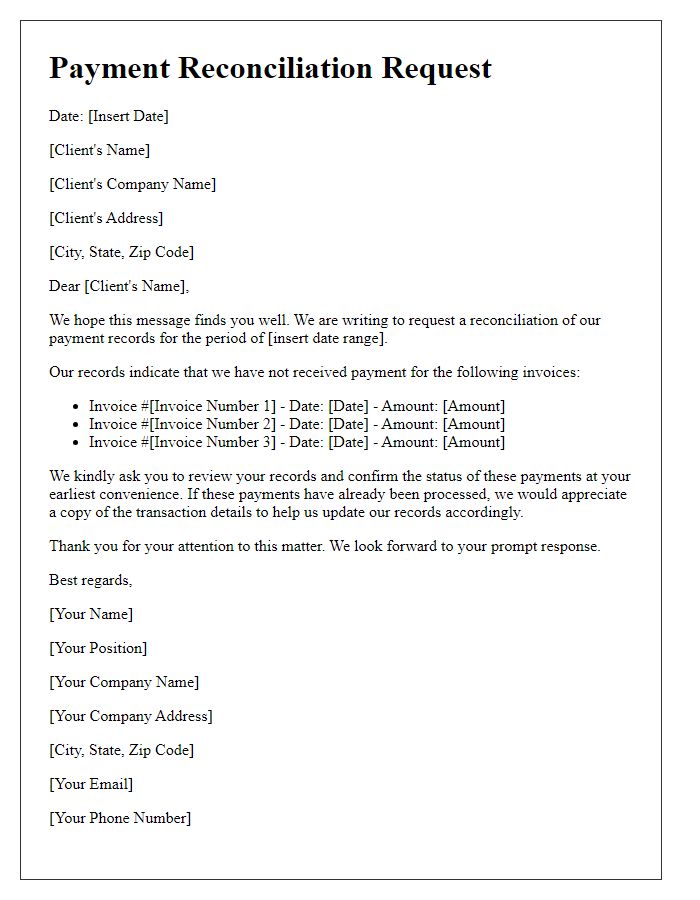

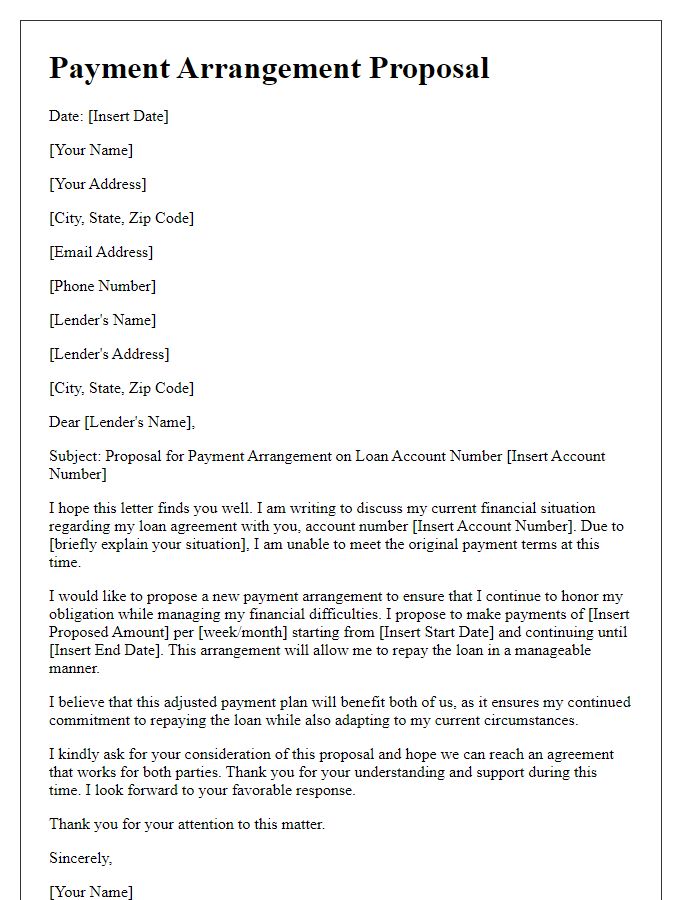

Proposed Resolution Plan

Payment discrepancies can significantly impact financial operations and customer relationships. A proposed resolution plan involves conducting a thorough audit of transaction records, identifying errors, and collaborating with financial institutions like banks or payment processors. Accurate documentation, including invoices, receipts, and account statements, is essential for transparent communication. Timelines must be established; for instance, a resolution may need to be reached within 14 business days to avoid additional penalties or disruptions. Stakeholder engagement, including finance teams and affected customers, ensures clarity on issues and fosters trust. Implementation of preventative measures, such as automated reconciliation systems, can minimize future discrepancies and enhance overall operational efficiency.

Letter Template For Resolving Payment Discrepancies Samples

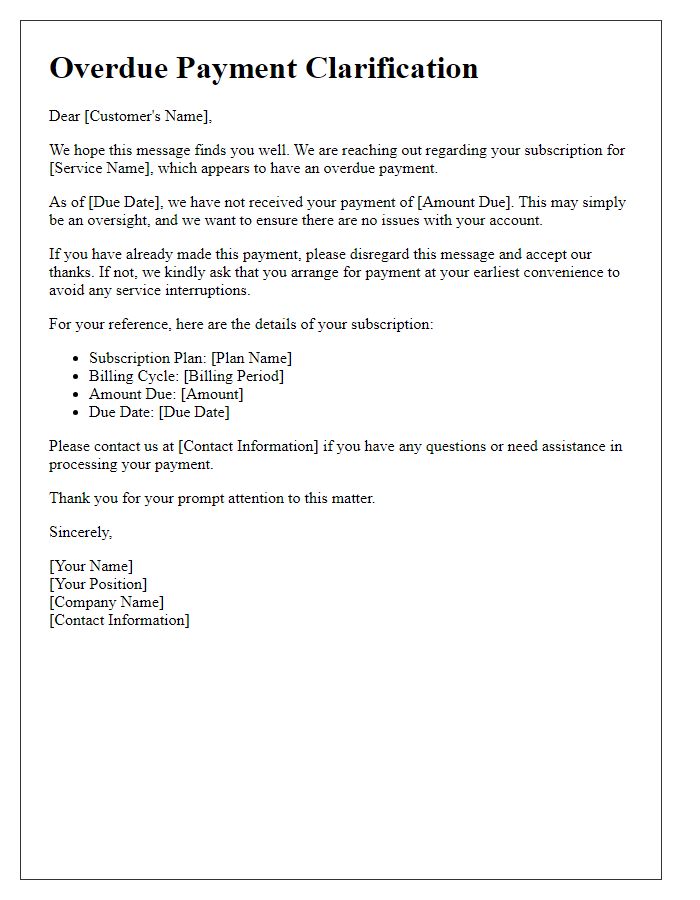

Letter template of overdue payment clarification for subscription services

Comments