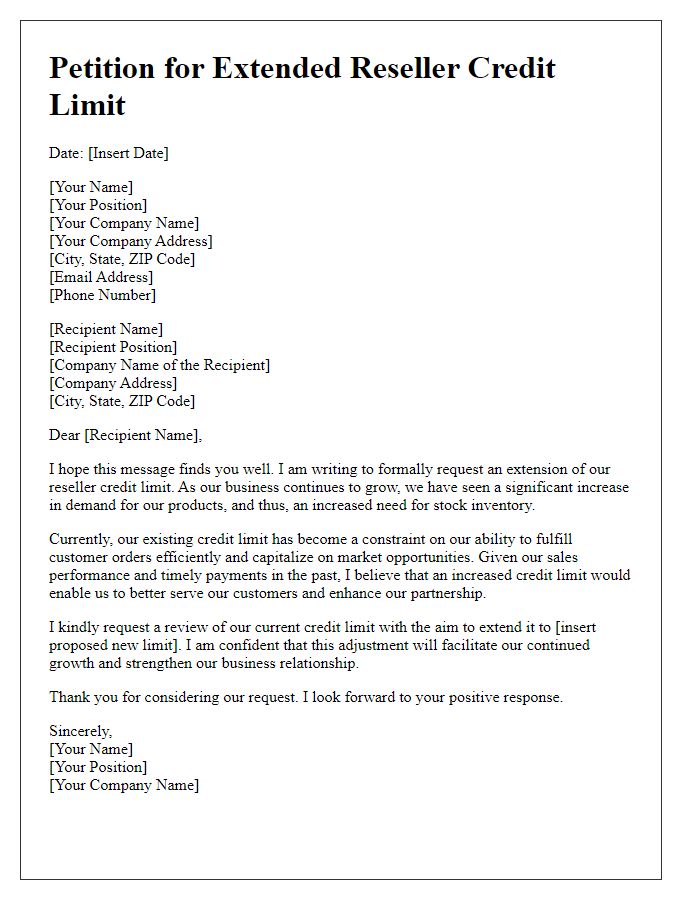

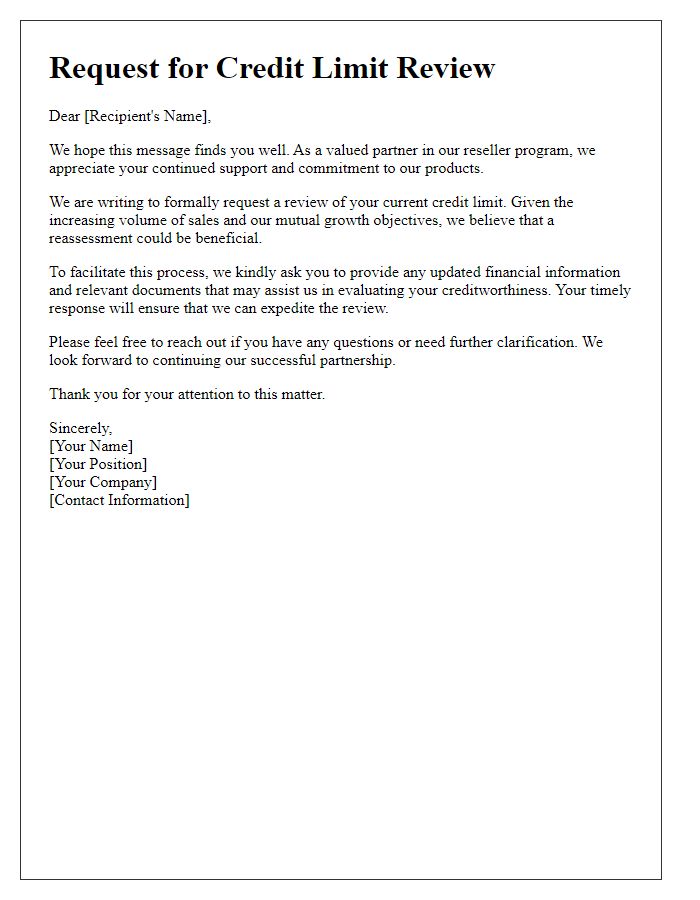

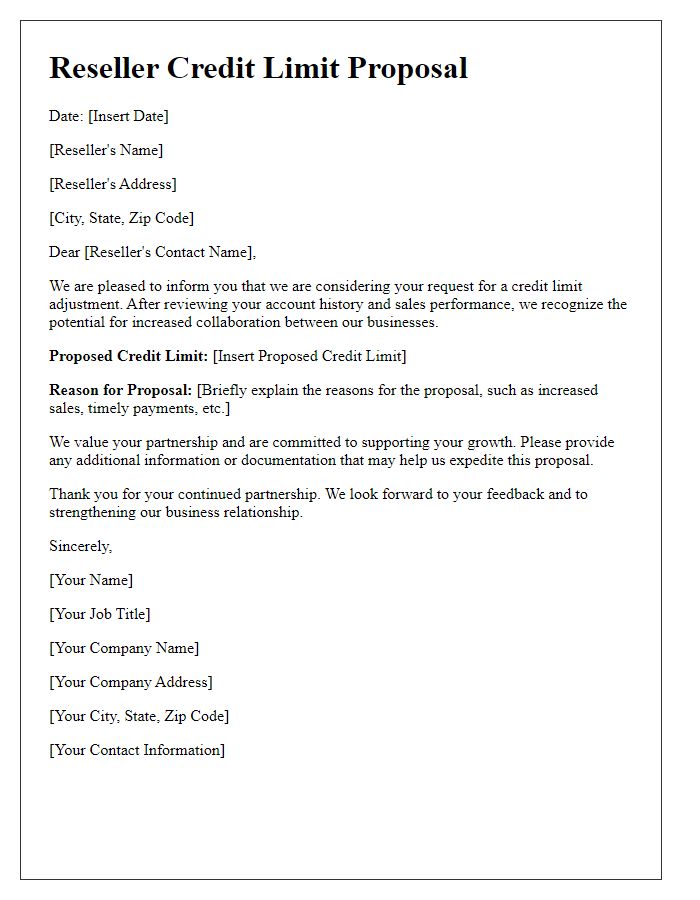

Are you looking to extend your reseller credit limit but unsure how to go about it? Whether you're planning to expand your product offerings or just needing a bit more financial flexibility, a well-crafted letter can pave the way for a smoother process. In this article, we'll explore effective strategies and templates for requesting a credit limit extension that will resonate with your supplier. So, grab a cup of coffee and let's dive in to discover how you can enhance your business opportunities!

Clear Subject Line

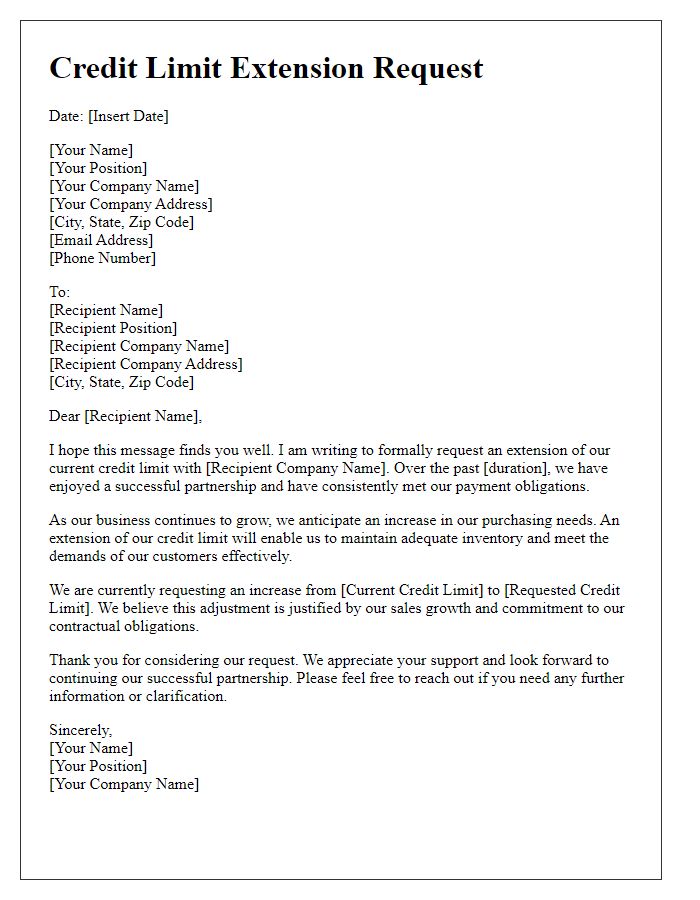

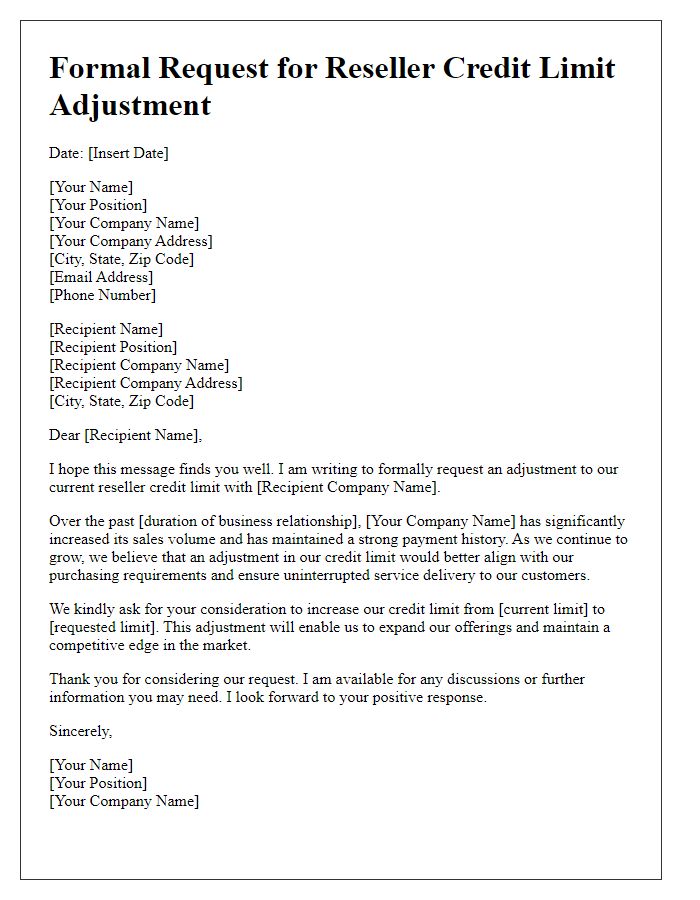

Reseller credit limits play a vital role in the financial management of businesses, especially for those engaged in wholesale distribution. Companies often evaluate credit limits based on various factors such as payment history, current sales volume, and overall market conditions. In the context of a request for a credit limit extension, businesses may outline their intention to increase order sizes or expand product lines, potentially referencing previous successful collaborations or significant events that demonstrate growth. Key financial indicators, such as monthly sales figures, can be included to strengthen the case for an increased credit limit. Accurate forecasting of future performance and strategic plans for scalability can provide essential context for the request, emphasizing the mutual benefits of this adjustment.

Detailed Business Information

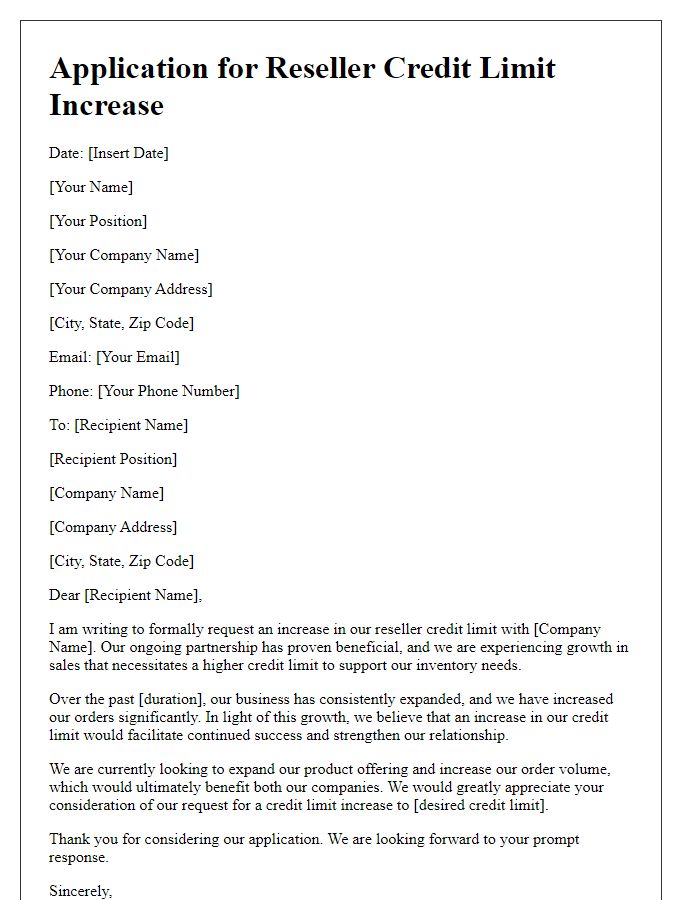

Reseller credit limit extension requests require thorough documentation and precise information. Key business details include the company's legal name, which corresponds to registration documents, and the business address, significant for verifying operational location. The tax identification number (TIN) enables financial institutions to track tax obligations accurately. An overview of annual revenue, showcasing financial health, is essential; typically, this figure falls between $100,000 and $5 million for small to medium enterprises. Additionally, credit references from suppliers, indicating payment histories, consolidate trustworthiness in extending limits. Finally, industry classification codes provide context on business operations, aligning them with market-specific conditions.

Current Credit Terms

In the business landscape, particularly within the wholesale and retail sectors, reseller credit limits serve as crucial financial parameters. Current credit terms play an essential role in defining the maximum amount that a reseller, such as a small electronics distributor, can borrow from a supplier, ensuring smooth operational cash flow. Typically, companies may offer terms like Net 30 or Net 60 days, indicating the period within which payment must be made post-invoice. These terms can vary significantly; for example, a high-volume reseller may negotiate extended credit limits of $50,000 or more, depending on their sales performance and creditworthiness. This financial arrangement can bolster product sourcing strategies, allowing resellers to maintain adequate inventory levels to meet consumer demands without immediate cash outflows. The formal request for a credit limit extension often requires supporting financial statements, past transaction history, and a clear growth projection in sales volumes, underlining the importance of financial health in business relationships.

Justification for Extension

Reseller credit limit extension requests often arise during significant business growth phases, reflecting a company's need to accommodate increased inventory purchases powered by rising customer demand. A well-supported justification highlights previous sales performance, showcasing a notable increase (e.g., 30% over the last quarter) in order volume. Furthermore, timely payments (maintained at 100% over six months), affirm financial reliability. Market expansion efforts, such as entering new regions (e.g., Northeast USA) or launching new product lines (e.g., eco-friendly materials), emphasize the potential for increased revenue. Demonstrating a proactive approach to customer acquisition strategies (like targeted marketing campaigns) reinforces the rationale for enhancing credit limits. Ultimately, a comprehensive request should underline how a credit extension facilitates operational agility, positioning the reseller for continued growth and stronger market presence.

Future Business Plans

Reseller credit limit extensions play a critical role in managing cash flow for businesses, particularly in scenarios involving significant inventory purchases and market expansion. Companies often seek to enhance their financial flexibility through increased credit limits, enabling them to invest in larger stock quantities that meet consumer demand, especially during peak seasons or when launching new products. Formal requests for credit limit extensions typically outline future business plans, including projected sales growth, marketing strategies, and targeted demographic markets. These details provide lenders with insights into the reseller's capacity to repay increased credit lines. Additionally, demonstrating strong financial history, such as timely payments and consistent revenue streams, further bolsters the case for extension approval and serves to establish a trusting relationship between the reseller and the financial institution.

Comments