Are you looking to make changes to your insurance policy? Whether it's updating your coverage, adding a new beneficiary, or altering the terms, it's important to communicate your needs clearly. In this article, we'll walk you through a simple yet effective letter template that can help you request these amendments without a hitch. So, let's dive in and explore how to ensure your insurance policy reflects your current situationâread on for more insights!

Clear identification of policyholder and policy number

The policyholder, Johnathan Smith, residing at 123 Maple Street, Springfield, IL, holds insurance policy number ABC123456789 with Universal Insurance Company. This policy, established on January 15, 2020, covers comprehensive health and life insurance. The request pertains to an amendment in the policy terms, specifically regarding the inclusion of critical illness coverage. These changes are essential for enhancing the protection provided under the current policy terms.

Specific details of requested amendment

Requesting an insurance policy amendment involves detailing the specific changes desired. Individuals may seek to modify coverage limits, adjust premiums, or update personal information. For instance, a homeowner's insurance policy might require an increase in dwelling protection from $250,000 to $300,000 due to recent renovations. Alternatively, a traveler could request additional coverage for hazardous activities, like scuba diving, during an upcoming trip to the Caribbean. Effective communication ensures the insurance provider understands the precise amendments needed, thereby streamlining the update process and ensuring suitable protection for policyholders.

Justification or reason for amendment

Insurance policy amendments require clear justification to ensure that changes accurately reflect current circumstances or needs. Frequent reasons for amendments include changes in beneficiary designations, adjustments to the coverage amount based on life events such as marriage or the birth of a child, or the addition of new assets that require protection. Other considerations might involve updating personal information like address changes or changes in employment status that could affect the risk assessment associated with the policy. Detailed documentation supporting these requests strengthens the case, facilitating a more efficient amendment process.

Contact information for follow-up

To request an amendment to an insurance policy, it is essential to provide specific contact information for follow-up purposes. The contact information should include the policyholder's name, the policy number, a current phone number for immediate communication, and an email address for written correspondence. Providing a detailed home address may also be beneficial for formal notices or documents that may need to be mailed. Additionally, specifying preferred contact times or methods can facilitate smoother communication between the policyholder and the insurance provider.

Courtesy statements and closing remarks

An insurance policy amendment can ensure coverage aligns with current needs. Policyholders should include a formal request to the insurance provider. Clear statements, such as stating the policy number, facilitate identification. Specific details regarding the amendments requested, including changes in coverage limits or additional riders, enhance clarity. Courteous language maintains professionalism, fostering a positive relationship with the insurer. Closing remarks should express appreciation for attention to the request, encouraging prompt processing. Contact details, including phone number or email, enable efficient communication regarding the amendment.

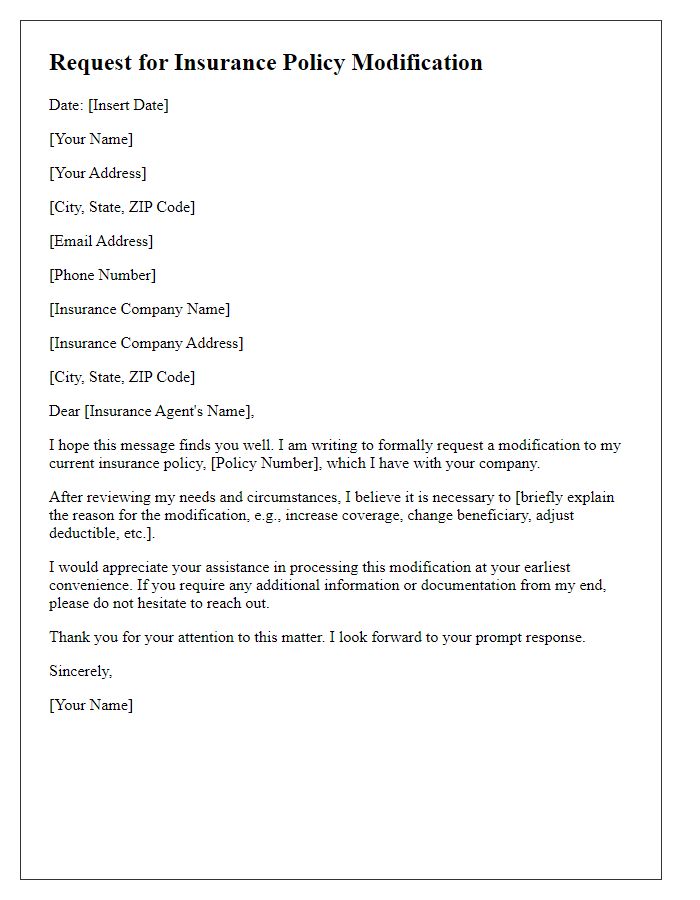

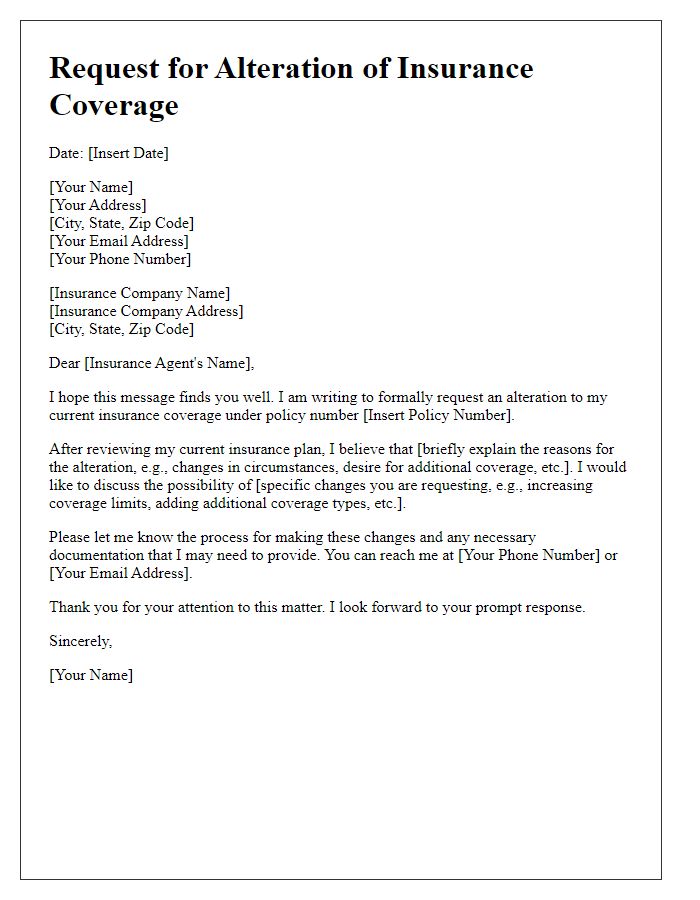

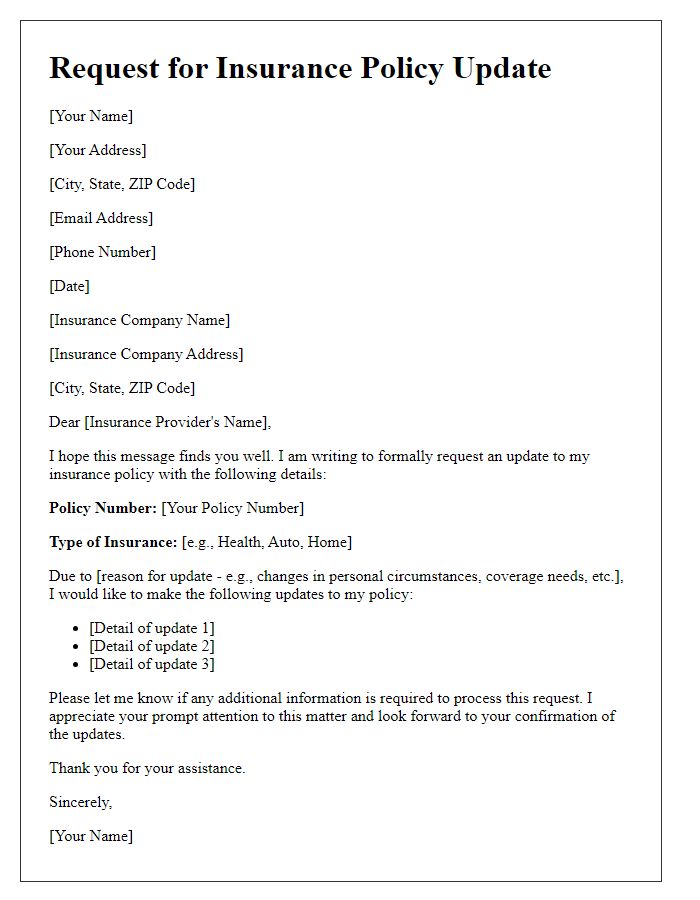

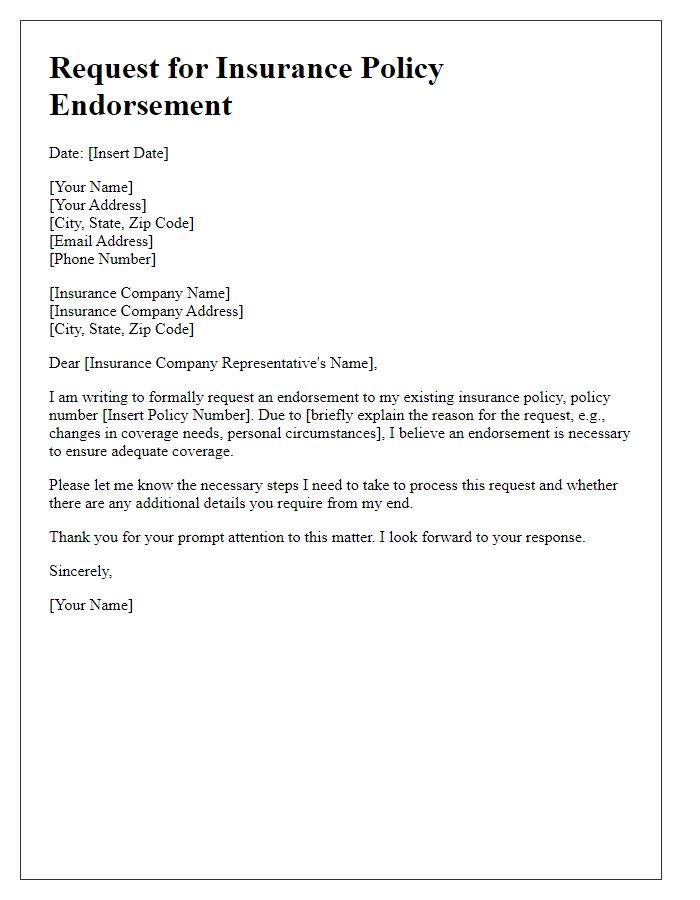

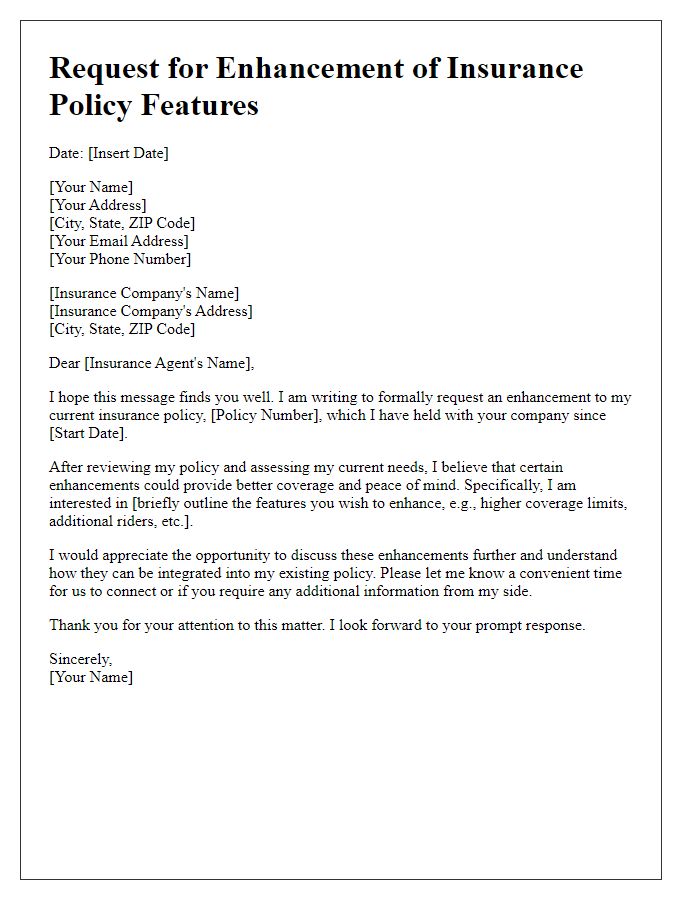

Letter Template For Request Insurance Policy Amendment Samples

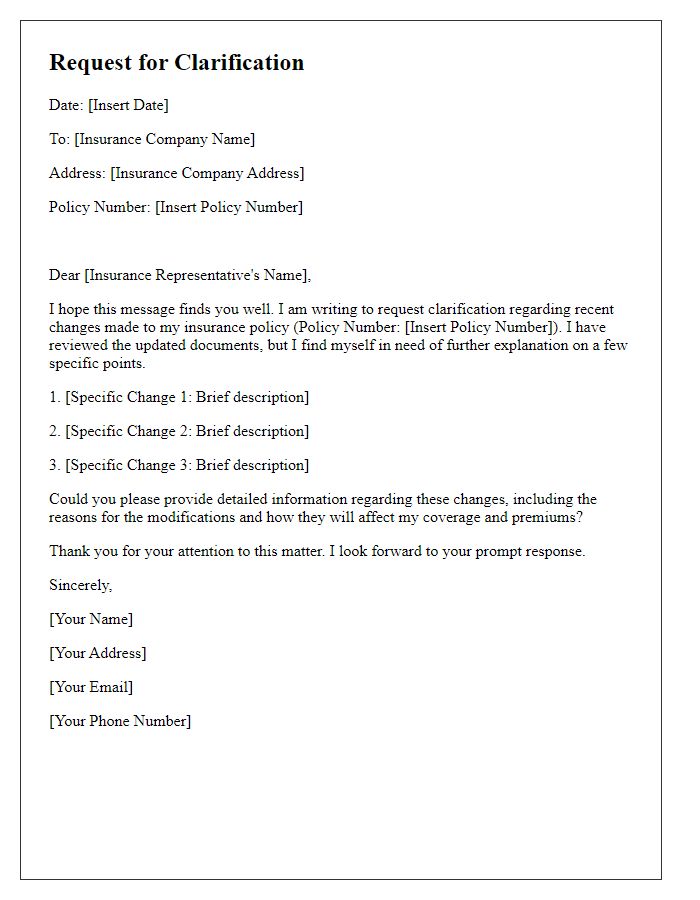

Letter template of request for clarification on insurance policy changes.

Comments