Are you considering requesting a credit card limit increase but unsure how to start? Writing a letter for this purpose can feel daunting, but it doesn't have to be! By clearly stating your reasons and demonstrating responsible usage, you can pave the way for a successful request. Let's dive into the essential elements you should include in your letter to enhance your chances of approval!

Account Information

A request for a credit card limit increase involves providing specific account information that reflects your financial status and account history. The credit card account number, which uniquely identifies your account, is essential. Current credit limit details should also be included to understand your existing boundaries. Showing payment history, highlighted by on-time payments over the past 12 months, demonstrates responsible usage. Additionally, any income changes, such as a recent salary increase or additional sources of income, support your case for a higher limit. Financial institutions often review credit scores, highlighting the importance of keeping this metric in good standing, usually above 700 for favorable assessment. Lastly, mentioning the purpose for increasing the limit, like planned travel expenses or home renovations, adds context to your request.

Current Credit Card Usage

Requesting an increase in a credit card limit can be influenced significantly by current credit card usage patterns and financial behavior. Maintaining a good credit utilization ratio, ideally below 30%, showcases responsible credit management. Consistent on-time payments, particularly over the past six months, positively reflect reliability to creditors. Additionally, a sustainable income level, such as a stable job with an annual salary of $50,000 or more, can support the request. Credit card issuers typically consider the account history as well, including the duration of the relationship, such as a two-year track record with the same card. Furthermore, having low debt levels, including a minimal balance on other debts, can also bolster the request for a limit increase.

Reason for Requesting Increase

Consumers often request credit card limit increases for various financial reasons. Typical motivations include improved cash flow management (for everyday expenses), enhanced credit utilization ratio (typically below 30% recommended for optimal credit score), or to accommodate larger purchases (such as appliances or travel expenses). Additional reasons may involve recent increases in income or credit score improvements, making consumers eligible for higher limits. Maintaining a responsible debt-to-income ratio (ideally below 36%) can also support these requests. Noteworthy, credit card issuers like Visa or Mastercard evaluate payment history, frequency of utilization, and overall credit history when assessing limit increase requests.

Financial Status and Income

A request for a credit card limit increase often hinges on a borrower's financial status and income stability. Applicants should present their current income, ideally an annual figure exceeding $50,000, documenting consistent earnings through pay stubs or tax returns. Highlighting a positive credit score, typically above 700, enhances credibility. Including any recent employment advancements, such as a promotion or new job, can illustrate economic growth. Additionally, mentioning reduced debts or increased savings demonstrates responsible financial management. This context reassures card issuers that the applicant can manage a higher credit limit without increased risk. Overall, a well-documented request showcases financial reliability and ongoing commitment to responsible borrowing.

Customer Loyalty and Payment History

Many credit card companies, such as Visa and Mastercard, assess customer loyalty and payment history to determine eligibility for credit limit increases. A strong payment history, characterized by on-time payments over a period of at least six months (or longer for some institutions), significantly enhances the likelihood of approval. Additionally, a long-standing relationship with the credit issuer, ideally exceeding two years, can positively influence the decision-making process. Financial institutions often review factors such as credit utilization ratio, typically recommended to remain below 30%, along with the customer's credit score, which should ideally be above 700. A formal request for a credit limit increase can benefit from documented evidence of stable income and low debt-to-income ratios, further demonstrating responsible credit management.

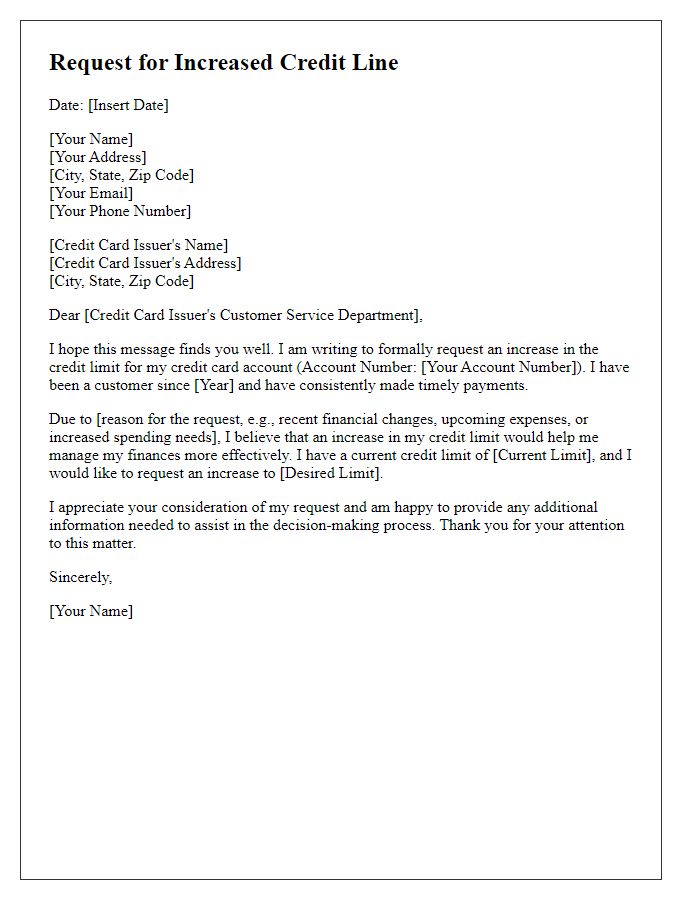

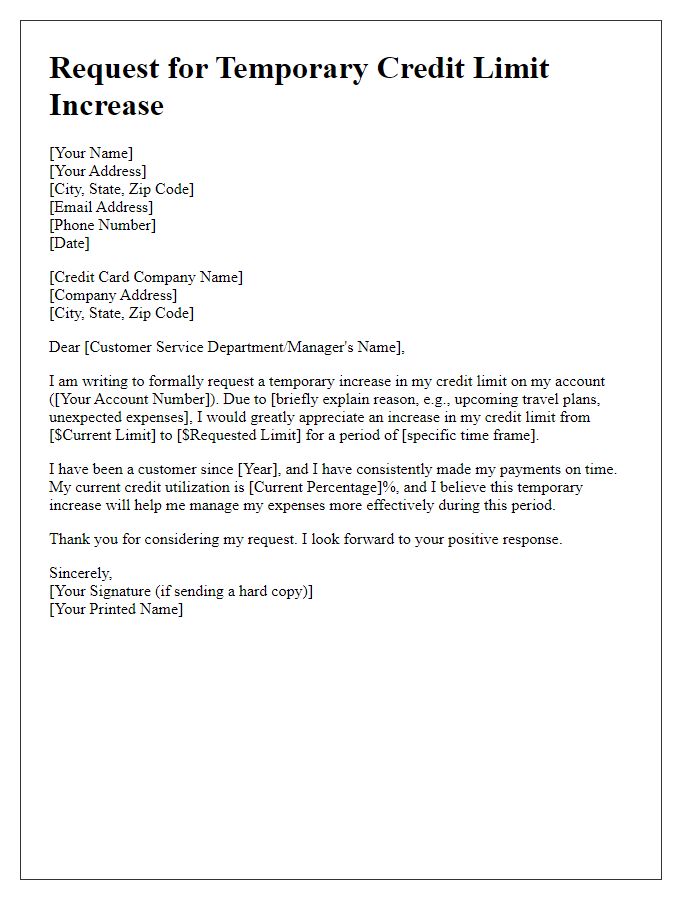

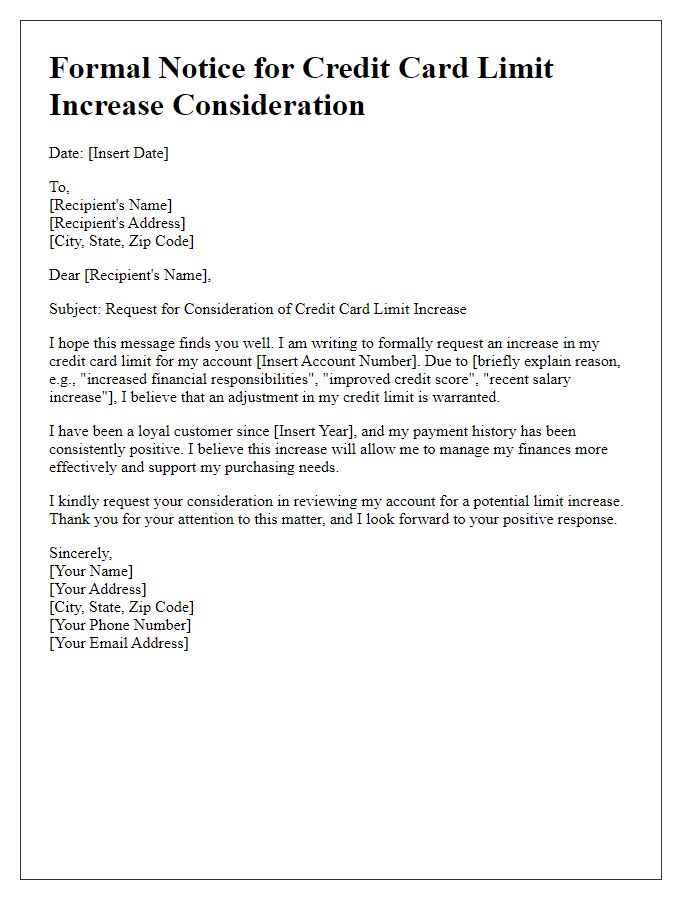

Letter Template For Request Credit Card Limit Increase Samples

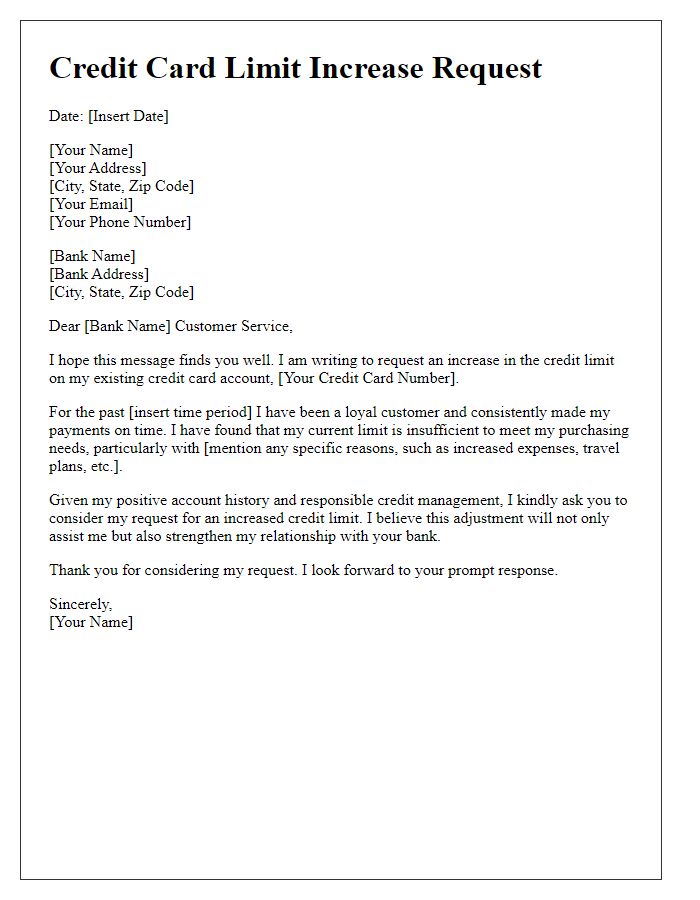

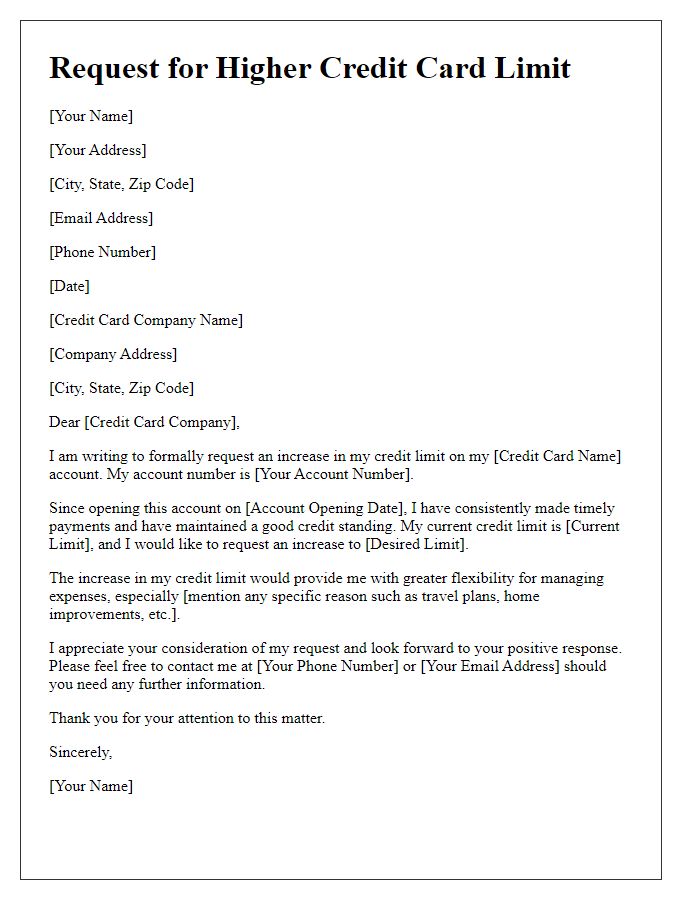

Letter template of credit card limit increase request for existing customers

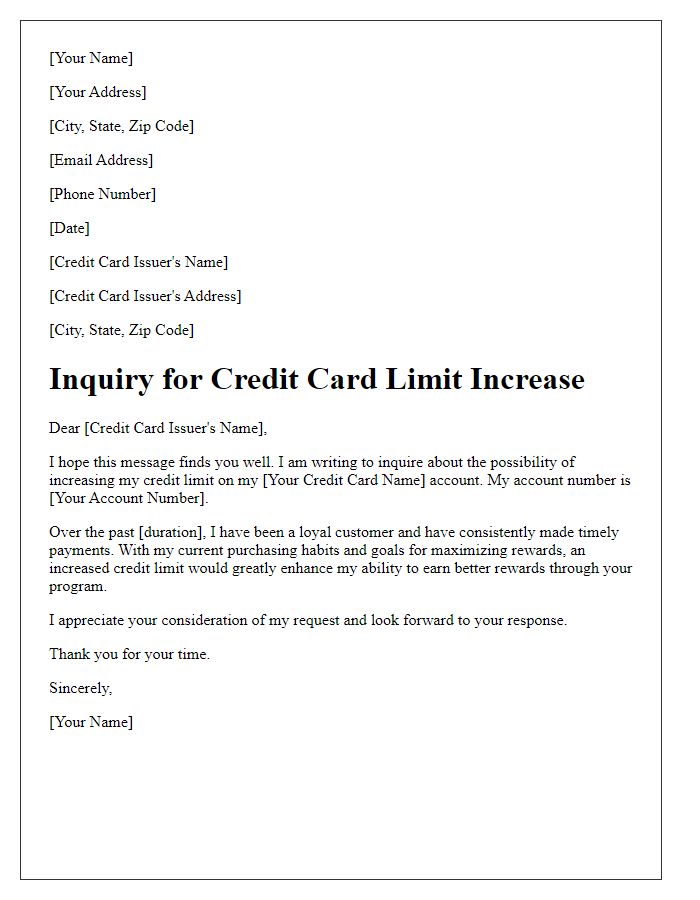

Letter template of credit card limit increase inquiry for better rewards

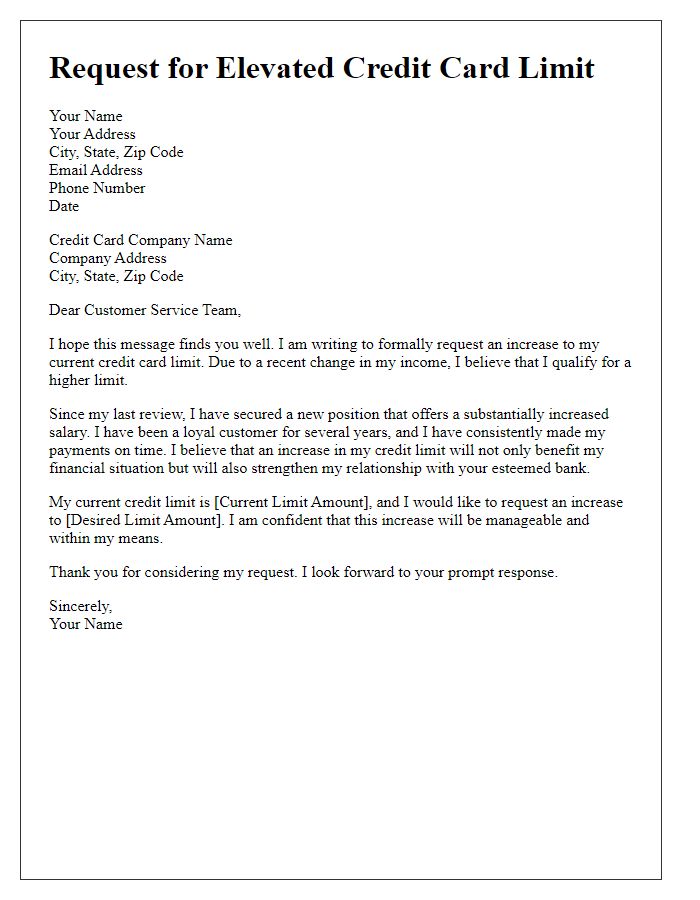

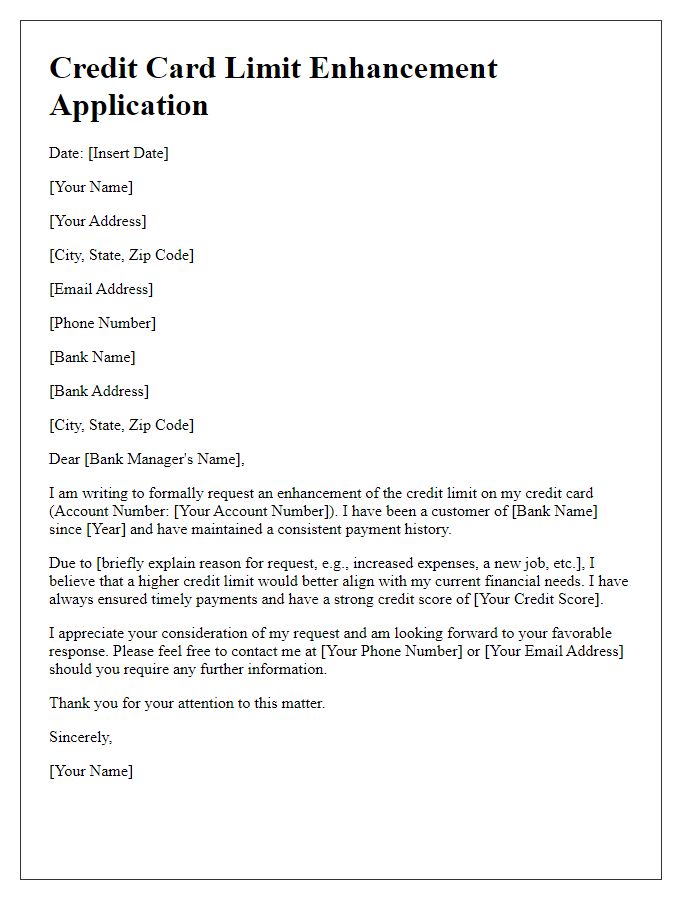

Letter template of request for elevated credit card limit due to income change

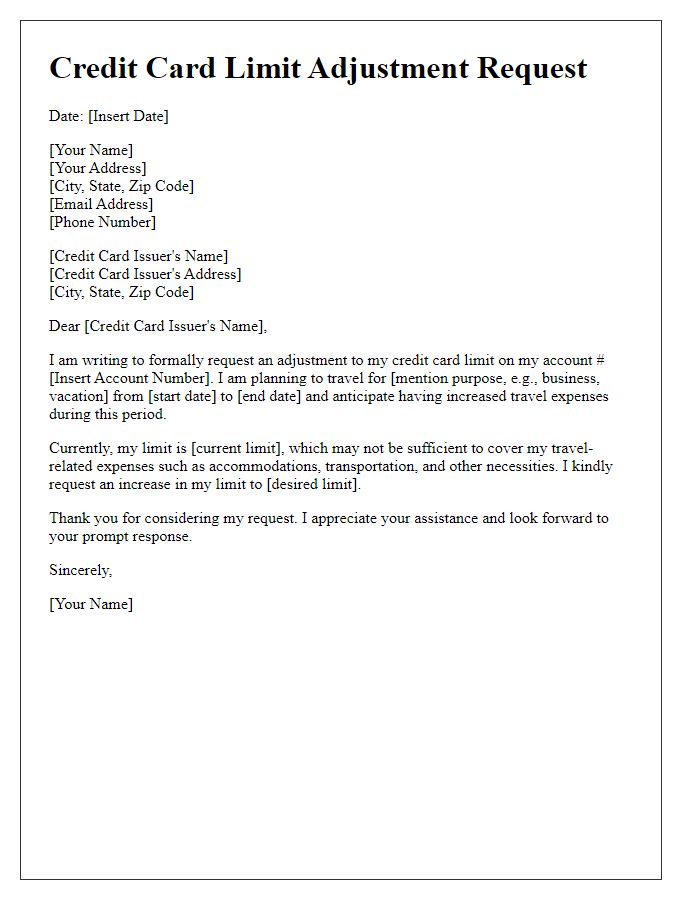

Letter template of credit card limit adjustment request for travel expenses

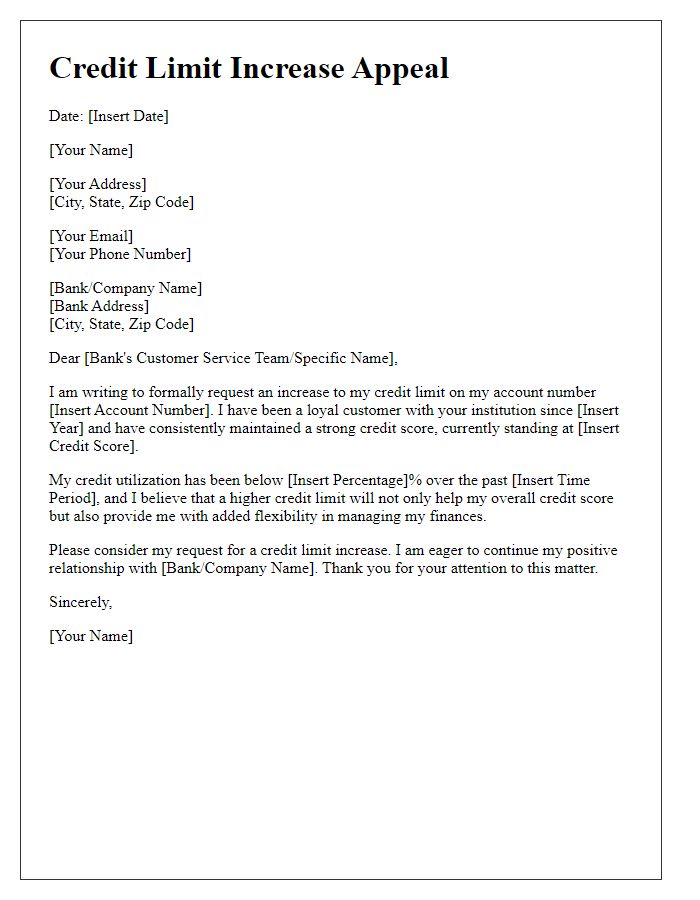

Letter template of appeal for increased credit limit based on credit score

Comments