Hey there! If you've ever found yourself puzzled over discrepancies in your payroll records, you're not alone. Many employees encounter this issue at some point, and addressing it promptly is crucial to ensure your financial accuracy. In this article, we'll walk you through a simple template for crafting a request to correct those payroll records, making the process stress-free. So, let's dive in and get those records rightâread on to discover how!

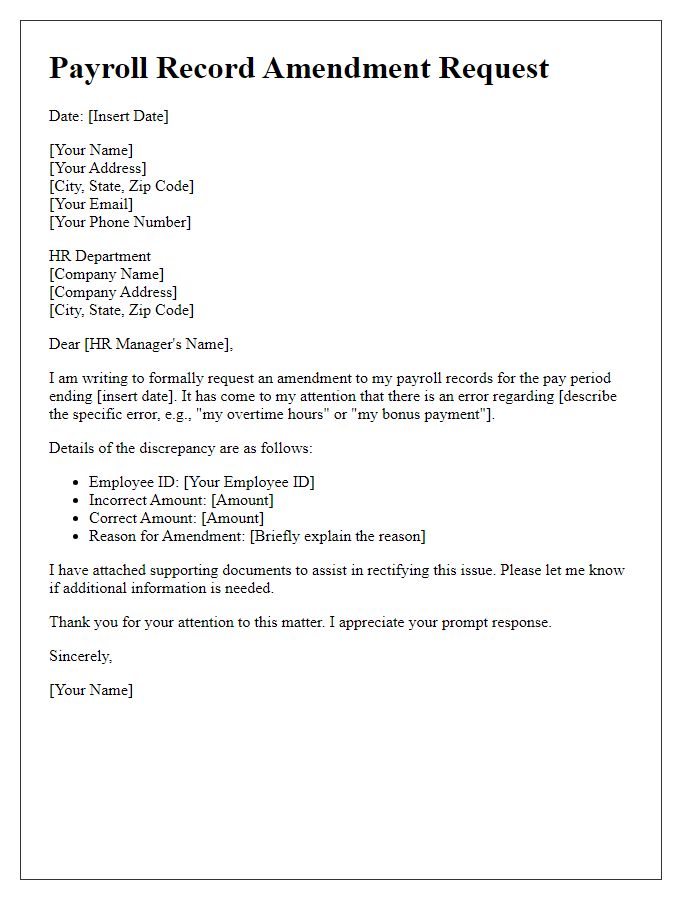

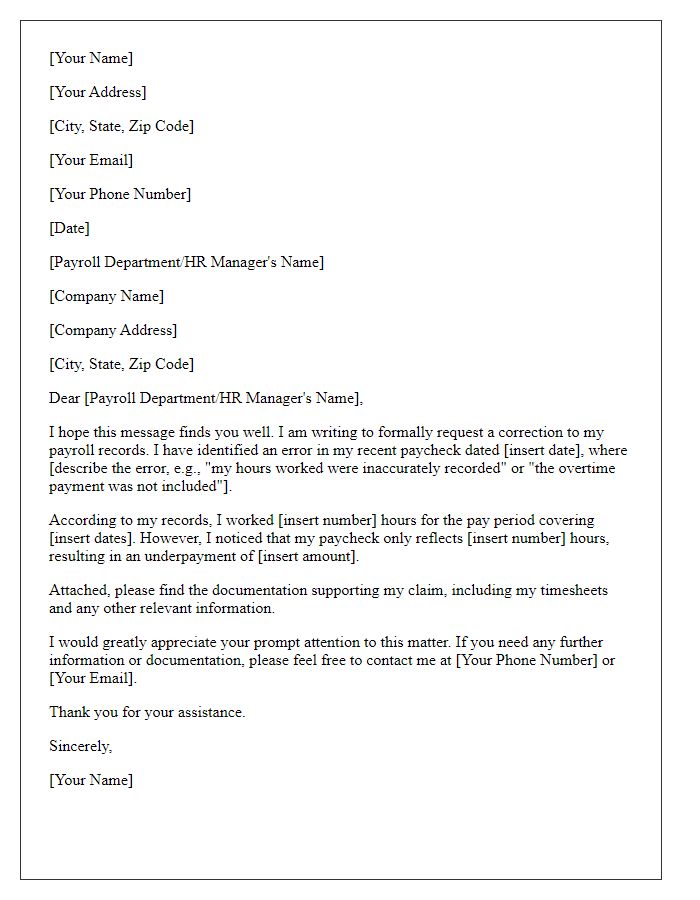

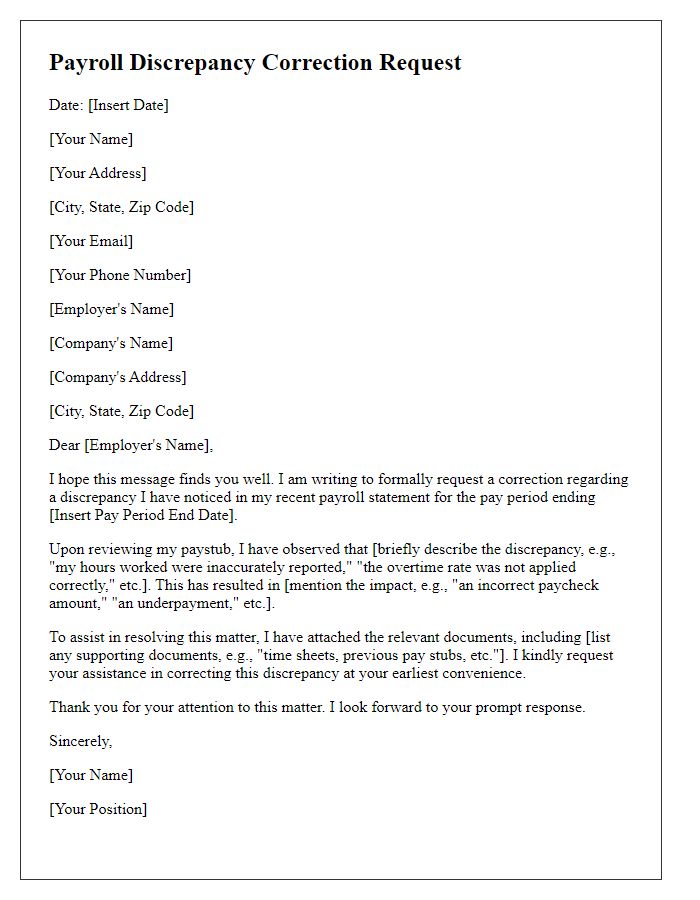

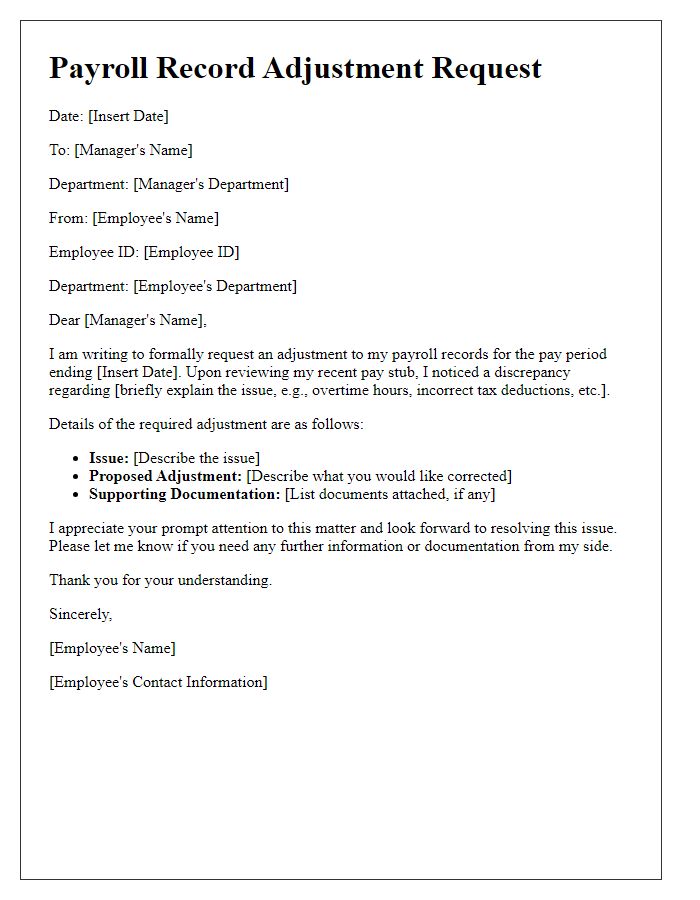

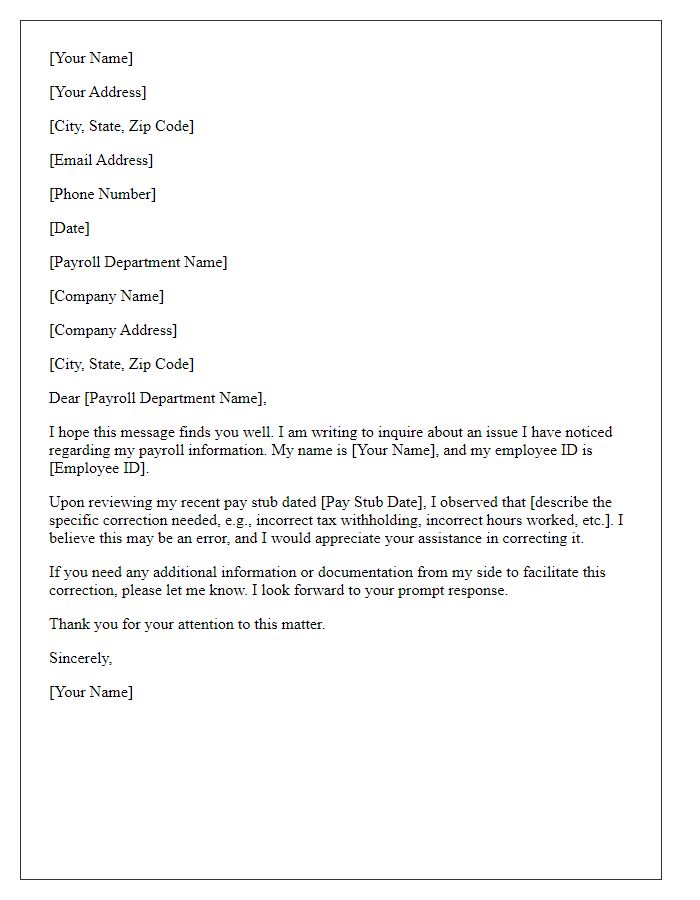

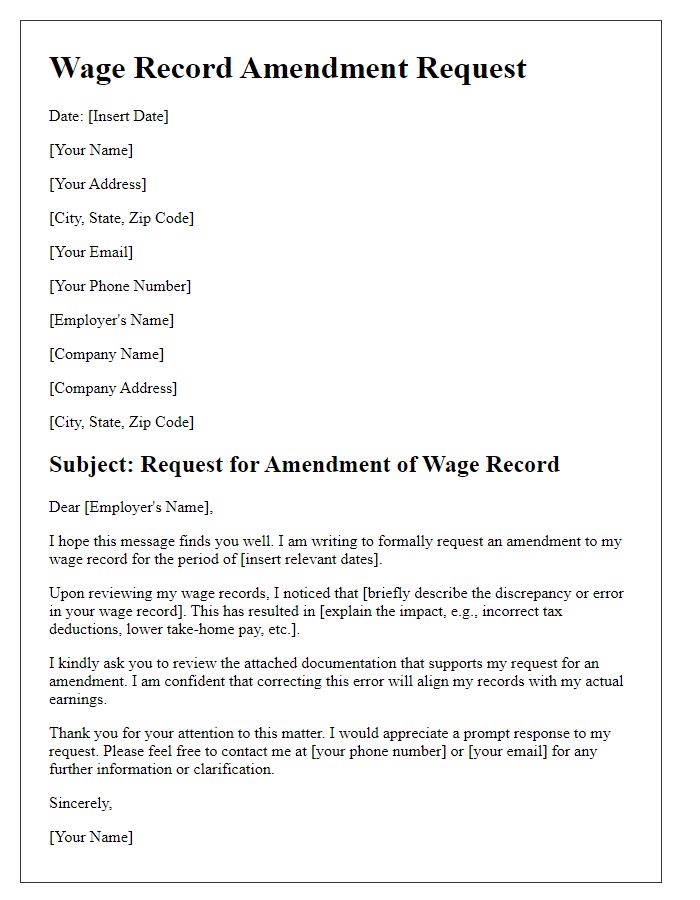

Clear Subject Line

Request for Payroll Record Correction: Urgent Attention Needed My recent paycheck dated April 15, 2023, indicates an incorrect deduction amount of $300 for health insurance. According to my employment contract and previous pay stubs, my deduction should be $200. The discrepancy affects my overall earnings and may cause issues in my financial planning. Please review the payroll records from the Human Resources department to rectify this error. Timely correction is essential as the next pay cycle begins on May 1, 2023. Thank you for your immediate attention to this matter.

Accurate Employee Information

Inaccurate employee information can lead to significant discrepancies in payroll records, affecting payment precision and tax reporting. Employees may face issues, such as underpayment or overpayment, if their personal details, like Social Security numbers or bank account information, are incorrect. These inaccuracies can occur due to clerical errors during onboarding or updates to personal status. Timely correction of these records is essential to maintain compliance with regulations stipulated by the Internal Revenue Service (IRS) and ensure that employees receive their correct wages. Quick action on correcting these records minimizes potential delays in direct deposits and prevents complications during the annual tax season.

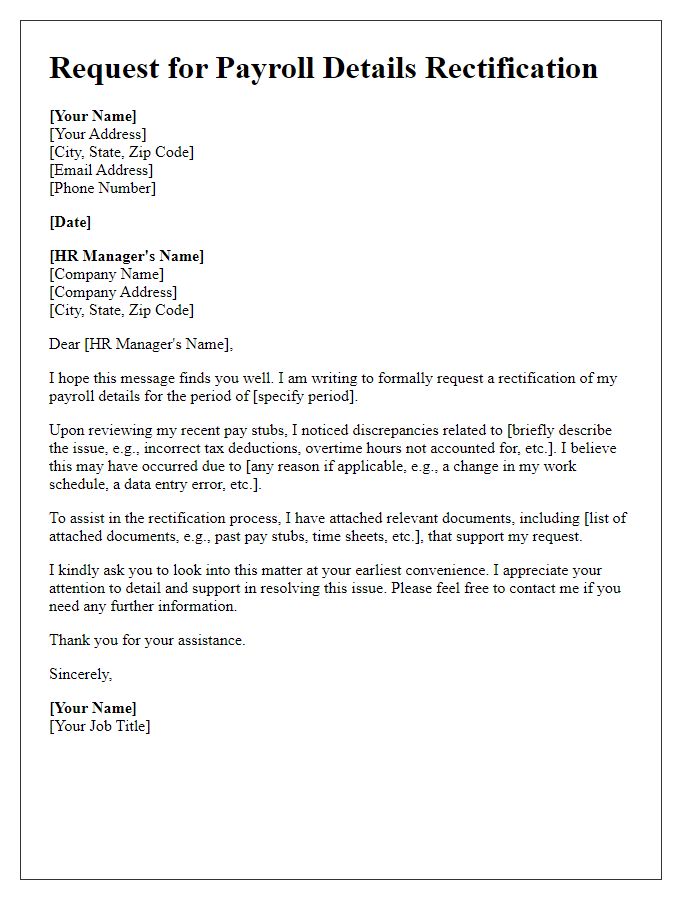

Detailed Error Description

The request for a payroll record correction should clearly outline the error encountered, including specific details about the incorrect information, such as incorrect figures in gross wages ($4,500 instead of the actual $5,200) or misreported deductions (for example, stating $150 instead of the correct $100 for health insurance). Highlight the affected pay period, such as September 1-15, 2023. Include any relevant employee identification details, like the employee ID number (123456) and job title (Marketing Specialist). Also, mention the impact of the error, such as potential implications for tax responsibilities and net pay discrepancies. Provide supporting documentation, like pay stubs or previous records, to strengthen the request for correction. Clear documentation ensures accurate rectification by the payroll department based at the company's headquarters in New York City.

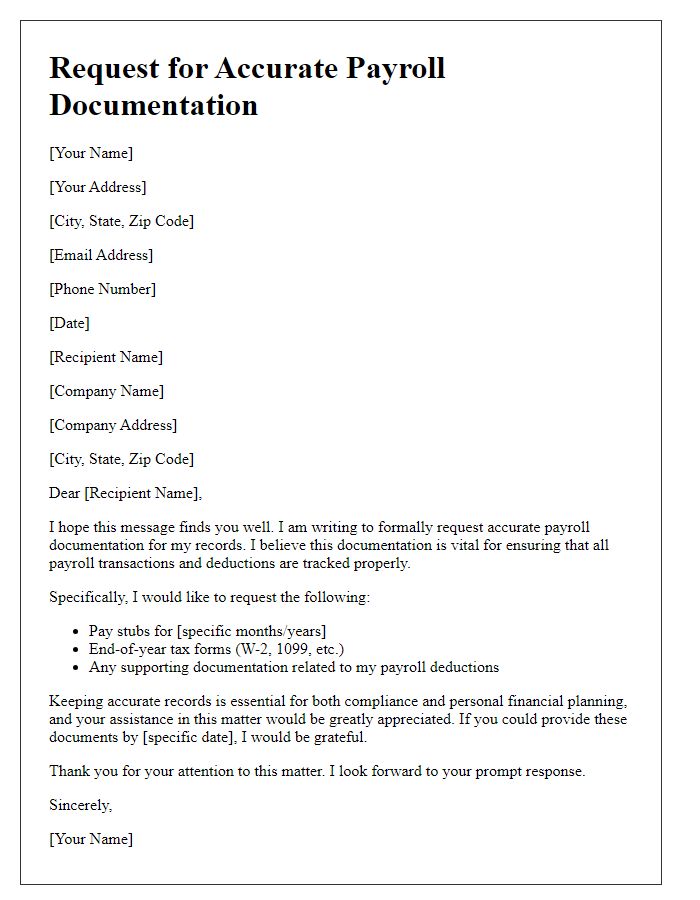

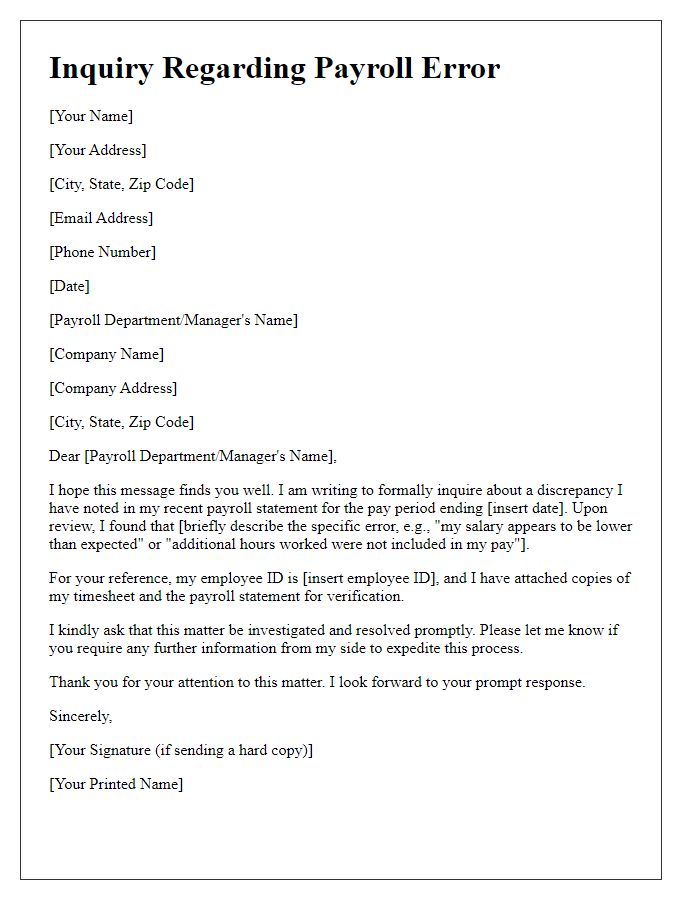

Supporting Documents or Evidence

Payroll record errors can lead to inaccuracies in employee compensation and tax reporting, causing financial discrepancies. To initiate a correction, gather supporting documents such as pay stubs, tax forms (like W-2 or 1099), and previous payroll statements that highlight the discrepancy. A detailed note specifying the correction request, including dates, amounts, and specific errors, is crucial for clarity. Submitting these documents to the Human Resources department or payroll bureau will streamline the process, ensuring accurate adjustments reflective of the employee's rightful earnings and compliance with IRS regulations. Timely action is essential to prevent further complications in financial records.

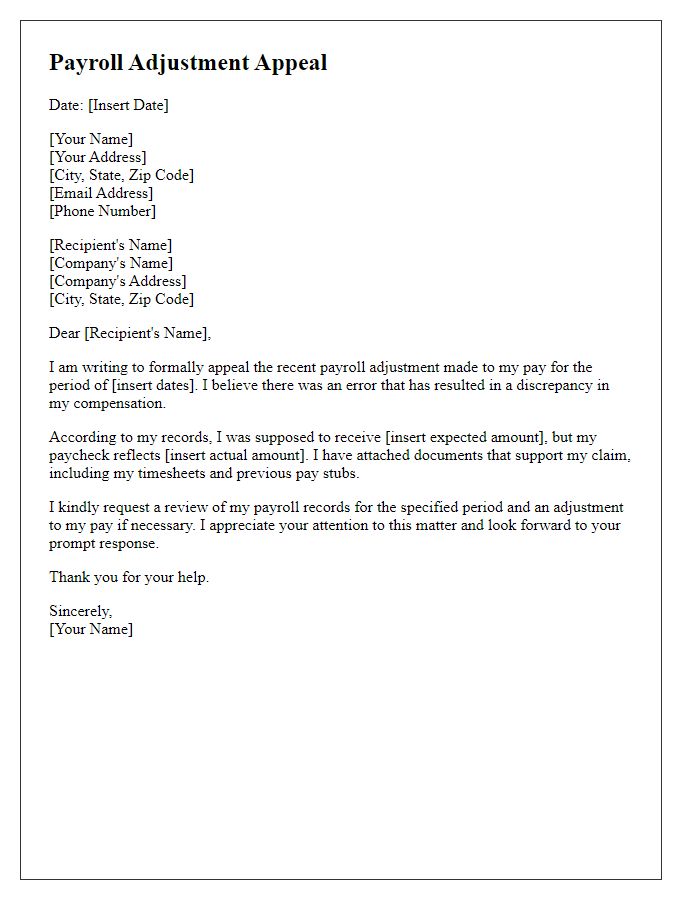

Requested Correction Action

Employees often need payroll record corrections to ensure accurate compensation reflects in issued checks. Common errors include incorrect wage rates, omitted bonuses, or miscalculated hours worked. For instance, an employee might discover an hourly rate discrepancy, where they should receive $20 per hour instead of the recorded $18. Such an issue can significantly affect total earnings over a pay period. To rectify this, the employee typically submits a formal request to the payroll department, detailing specific discrepancies, attaching supporting documents like previous pay stubs, and indicating the desired adjustments. Ensuring prompt resolution is crucial for maintaining employee trust in payroll systems and overall satisfaction.

Comments