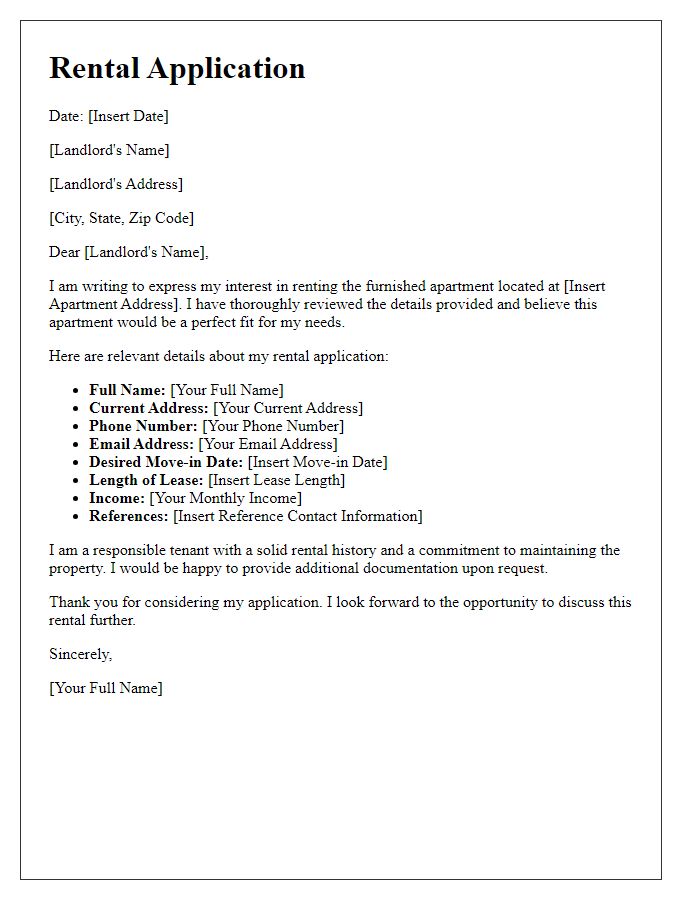

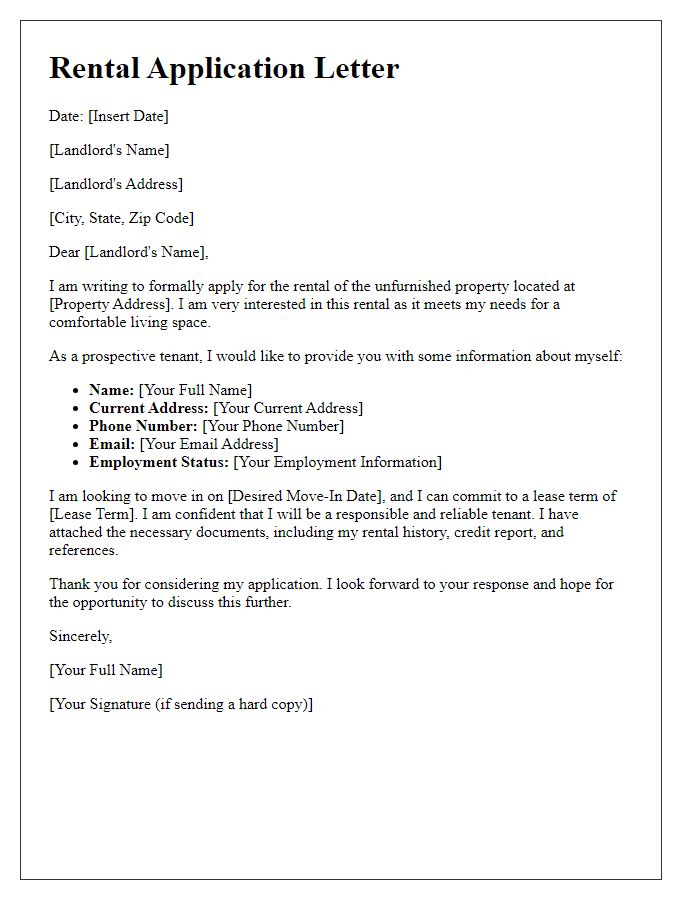

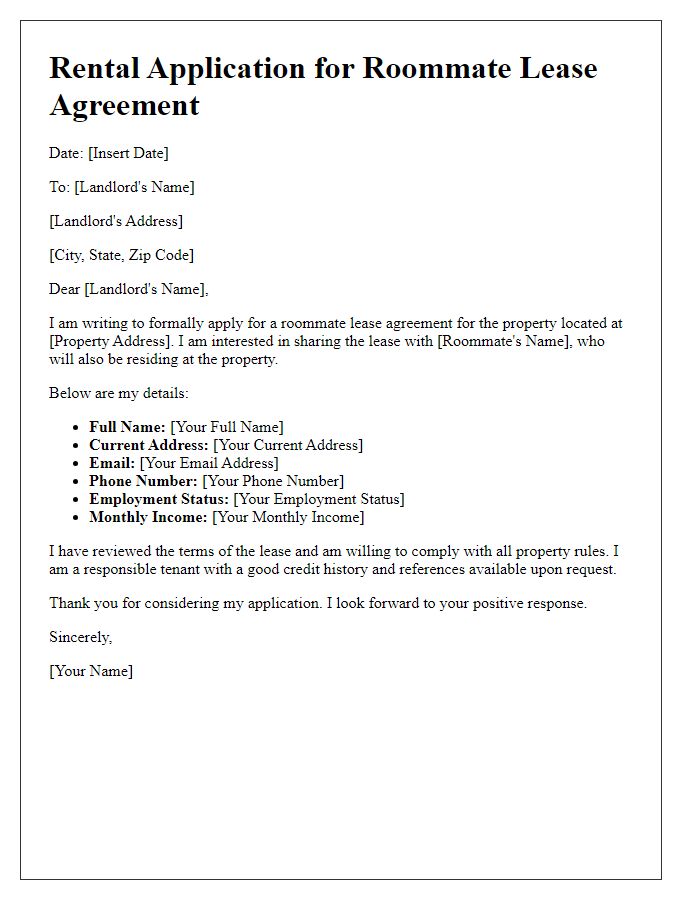

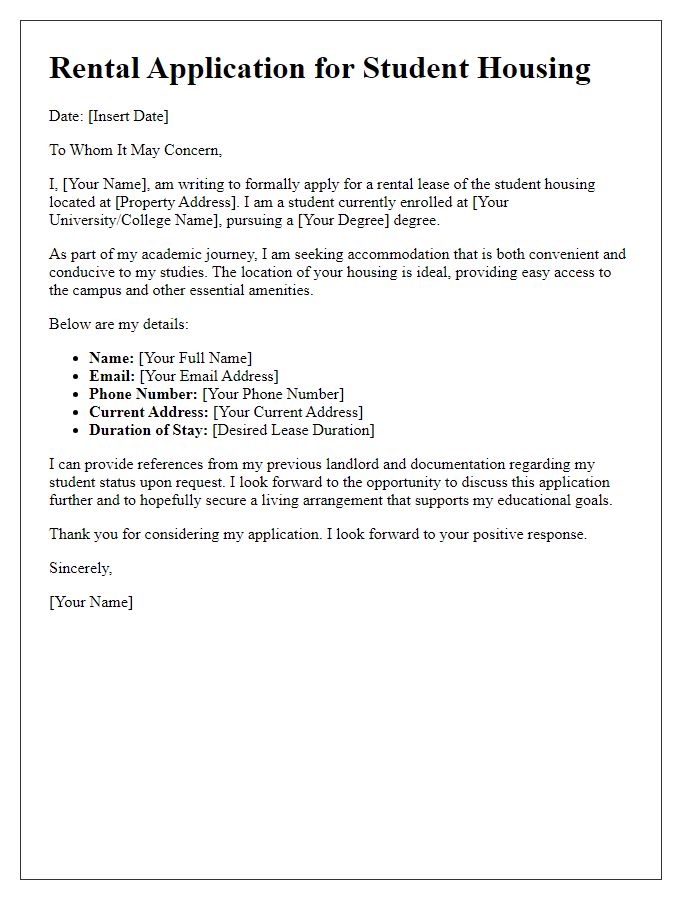

Are you looking to secure your dream rental property? Crafting the perfect rental application letter is a crucial step in making a lasting impression on landlords. By showcasing your strengths and reliability as a tenant, you can stand out in a competitive market. Ready to learn how to create an impactful application letter that increases your chances of approval? Read on for our comprehensive guide!

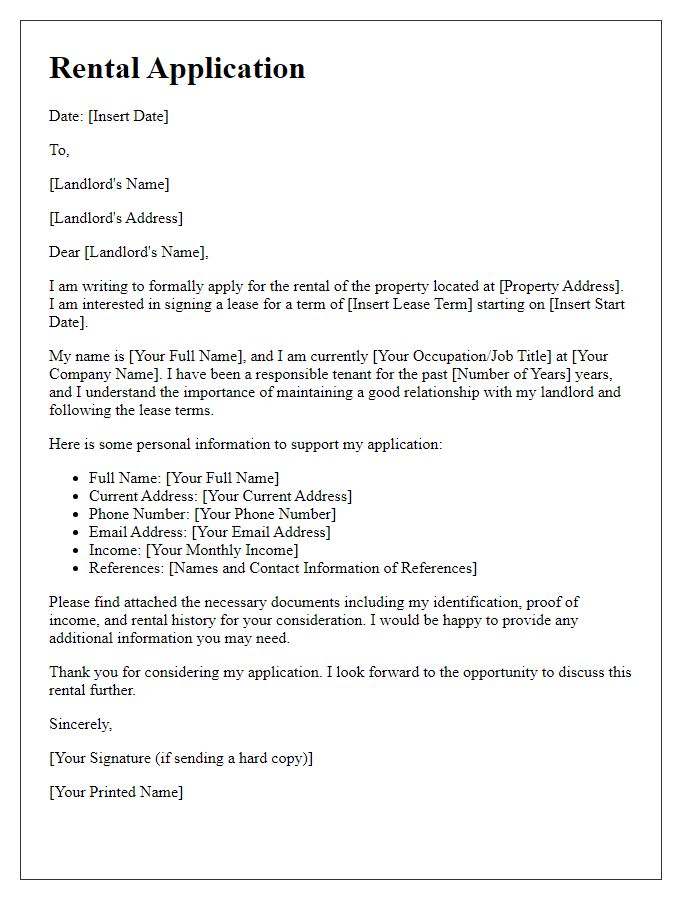

Applicant's personal and contact information

When submitting a rental application lease agreement, it is essential to include accurate personal and contact information. This typically consists of the full name of the applicant, which may include a middle name or initial. A current residential address must be provided, ensuring it corresponds to the rental history being submitted. The applicant should also list a reliable phone number, preferably a mobile number for immediate communication, and an email address for electronic correspondence. Additional details may include date of birth, Social Security number for identification purposes, and employment information such as the employer's name, position, and length of employment. Providing this comprehensive information helps landlords assess the suitability of the applicant for tenancy.

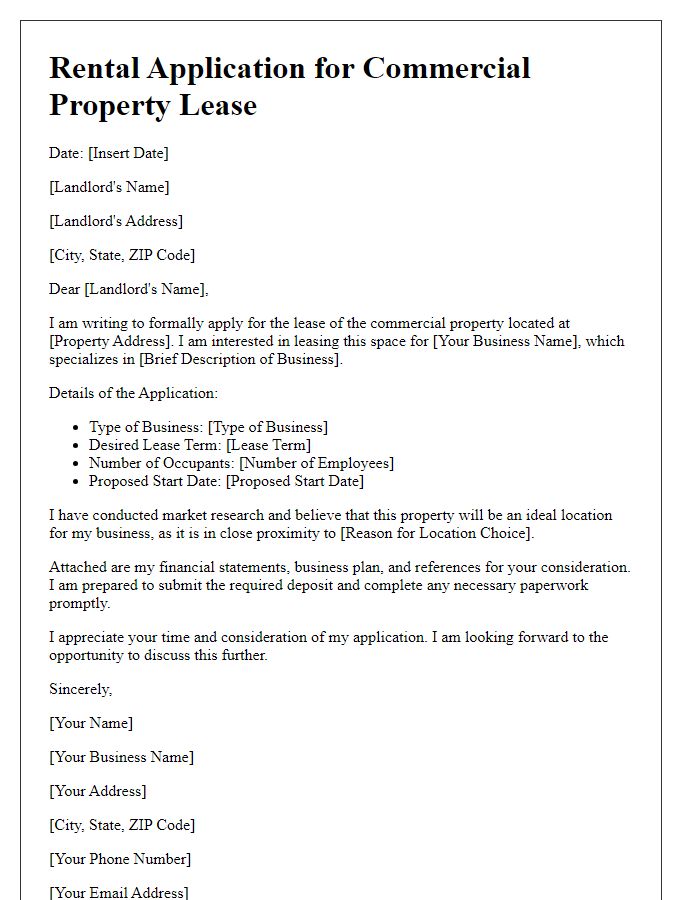

Employment and income details

This section provides a comprehensive overview of employment and income details necessary for a rental application lease agreement. Applicants should include the name of the employer, such as XYZ Corporation, along with the job title, which could be Marketing Manager. Current employment duration, noted as five years, demonstrates job stability. Monthly gross income, typically $5,000, illustrates financial capability to meet lease obligations. Supporting documentation may include recent pay stubs or bank statements to validate income claims. Additional financial details, such as credit score, which may be above 700, can strengthen the application, showcasing reliability in meeting financial commitments.

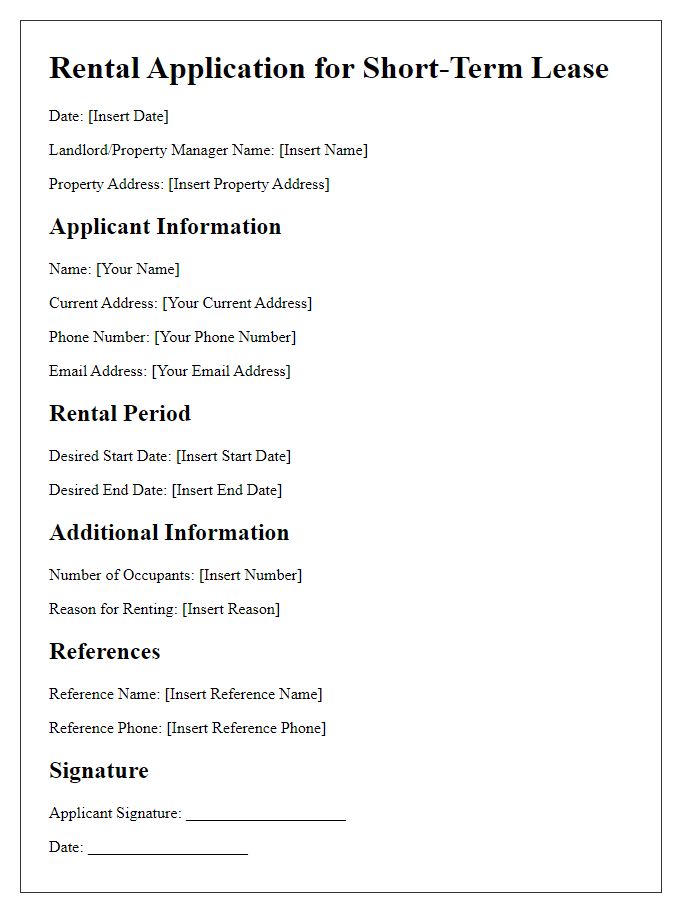

Rental history and references

When applying for a lease agreement, providing a comprehensive rental history can significantly enhance the credibility of your application. A typical rental history includes pertinent details such as the address of previous residences, the names of landlords, duration of tenancy (often measured in months or years), and reasons for leaving. Additionally, including references from previous landlords or property managers strengthens trust with potential landlords. Contact information for these references--typically phone numbers or email addresses--should be clearly stated to facilitate verification. Ensuring an impeccable rental history demonstrates reliability, responsibility, and a commitment to maintaining good tenant relationships, making a favorable impression on property owners.

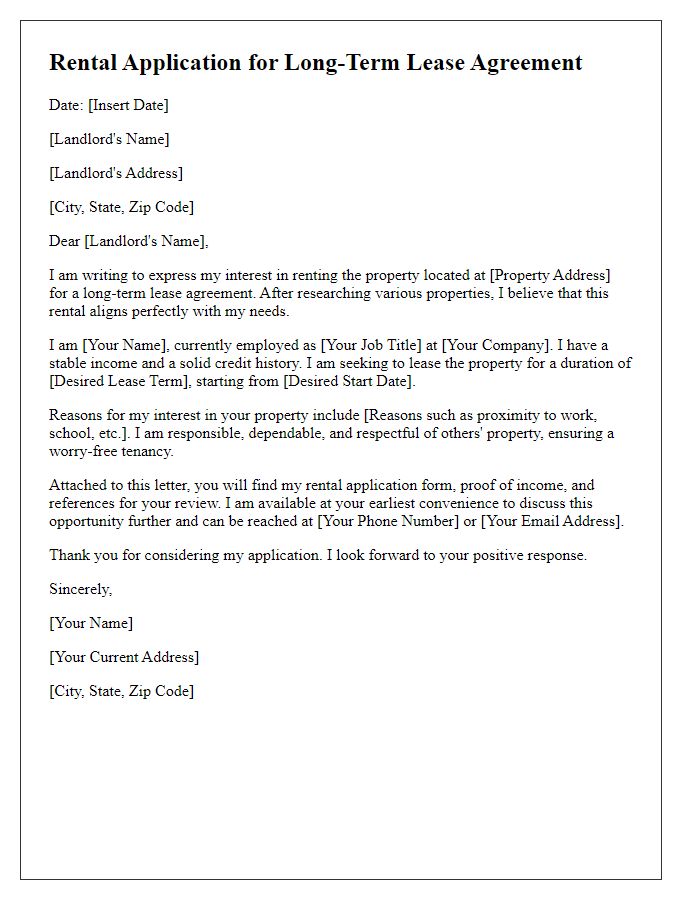

Terms and conditions of lease

The lease agreement outlines essential terms and conditions governing the rental relationship between the landlord and tenant in a specific property, such as a two-bedroom apartment located in downtown Chicago. The rental amount, set at $1,500 per month, is due on the first day of each month, with a grace period of five days before late fees apply. The duration of the lease is typically one year, beginning on July 1, 2023, and concluding on June 30, 2024. Security deposits, usually equivalent to one month's rent, are held to cover damages or unpaid rent, returnable upon lease termination if conditions are met. Maintenance responsibilities fall primarily on the landlord, ensuring that plumbing, heating, and electrical systems, compliant with the city's housing code, remain functional, while tenants are expected to uphold cleanliness and report issues promptly. Unauthorized subleasing of the unit can void the lease agreement, risking eviction procedures initiated by the landlord in accordance with Illinois state laws.

Security deposit and payment terms

The security deposit is a critical component in rental agreements, typically ranging from one to two months' rent, dependent on local regulations and landlord policies. This upfront payment, held in a separate account, secures the landlord against potential damages or unpaid rent during the tenancy. Payment terms outline the schedule for monthly rent obligations, often due on the first of each month. Accepted payment methods may include electronic bank transfers, checks, or online payment platforms, with late fees applying after a grace period (commonly five days). Additionally, local ordinances may dictate specific practices regarding the return of security deposits, including timelines (often 30 days post-lease termination) and itemized deductions for damages or unpaid balances.

Comments