Are you facing financial challenges that make securing a rental property a bit more difficult? You're not alone, and a well-crafted letter can help convey your situation to potential landlords. In this article, we'll guide you through a rental application letter template specifically designed for those experiencing financial hardship. Stick around to discover effective strategies and tips to strengthen your application and improve your chances of finding a home despite your current circumstances!

Applicant's Personal Information

The rental application process often requires detailed personal information from applicants facing financial hardship. Important identifiers include full name, current address, and contact number to ensure proper communication (e.g., phone or email). Additionally, details about income sources, such as employment or government assistance, should be included to provide context regarding financial stability or challenges. Previous rental history can highlight reliability, including past addresses and landlord references, which may be instrumental in demonstrating responsibility despite current difficulties. Lastly, demographic information such as age and family size could further tailor the application to the specific needs of potential landlords.

Explanation of Financial Hardship

Explaining financial hardship requires a clear understanding of the situation impacting your ability to maintain rental payments. Many individuals face economic challenges due to unexpected events such as job loss, medical bills, or family emergencies. In the case of a recent job loss, providing specifics about the employer, the date of termination, and the industry can highlight the severity. If medical bills are a concern, mentioning the type of medical issues and the financial burden can illustrate the impact on monthly income. Furthermore, detailing efforts to seek new employment, like attending job fairs or enrolling in retraining programs, can convey proactive steps taken amidst difficulty. Highlighting support systems, such as family assistance or community resources, will provide additional context to the hardship. An honest portrayal of these elements can facilitate understanding and potentially foster compassion in a rental application situation.

Details of Income and Expenses

Financial hardship can significantly impact an individual's rental application process, especially in regions with high living costs, such as New York City. Monthly income (net income of $3,000) often needs to be detailed alongside fixed expenses, including rent or mortgage ($1,500), utilities ($300), groceries ($400), and transportation costs ($200). Unexpected medical expenses ($150) or other debts can further strain financial resources and must be articulated clearly. Providing documentation such as recent pay stubs, bank statements, or a budget outline can substantiate claims of hardship, making a compelling case for potential landlords amid rising rental prices and limited supply in the market.

Proposed Payment Plan or Assistance Request

Low-income tenants often face financial hardship, significantly impacting their ability to meet rent obligations. An estimated 43 million people in the United States rent their homes, making them vulnerable during economic downturns. Many families experience a sudden loss of income or unexpected expenses, leading to difficulties in paying their monthly rent. A proposed payment plan, often drafted to accommodate financial constraints, might extend the usual payment period or suggest reduced monthly payments for an agreed duration. Furthermore, assistance requests can be directed to local housing authorities or nonprofits, which provide resources such as emergency rental assistance programs funded by the U.S. Department of Housing and Urban Development (HUD). Engaging with landlords for open communication about these challenges could yield mutually beneficial outcomes, ensuring tenants maintain stable housing while fulfilling their payment responsibilities as circumstances allow.

Supporting Documentation

When applying for rental housing, financial hardship can impact an individual's ability to secure a lease agreement. Essential supporting documentation might include recent pay stubs (showing monthly income, which may be reduced due to job loss or reduced hours), bank statements (demonstrating current financial status and any existing debts), and a detailed letter explaining the circumstances (providing context regarding employment status and reasons for financial distress). In some cases, applicants may also include documentation of government assistance programs (such as unemployment benefits or food stamps), evictions prior to the application, and medical bills (signifying unexpected expenses impacting overall financial stability). Together, this information helps landlords understand the applicant's situation, allowing for more informed decisions regarding rental applications.

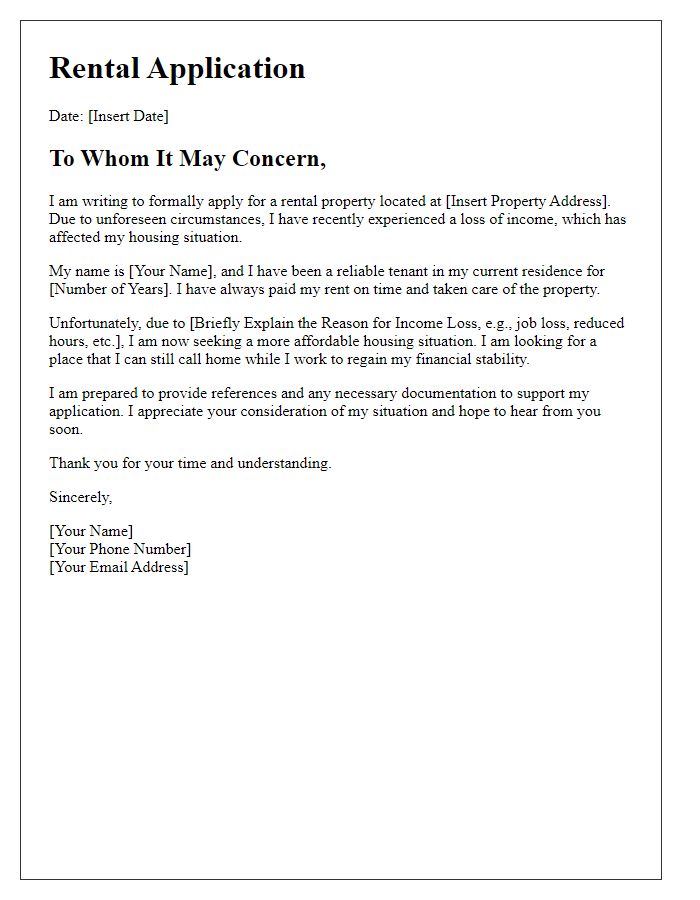

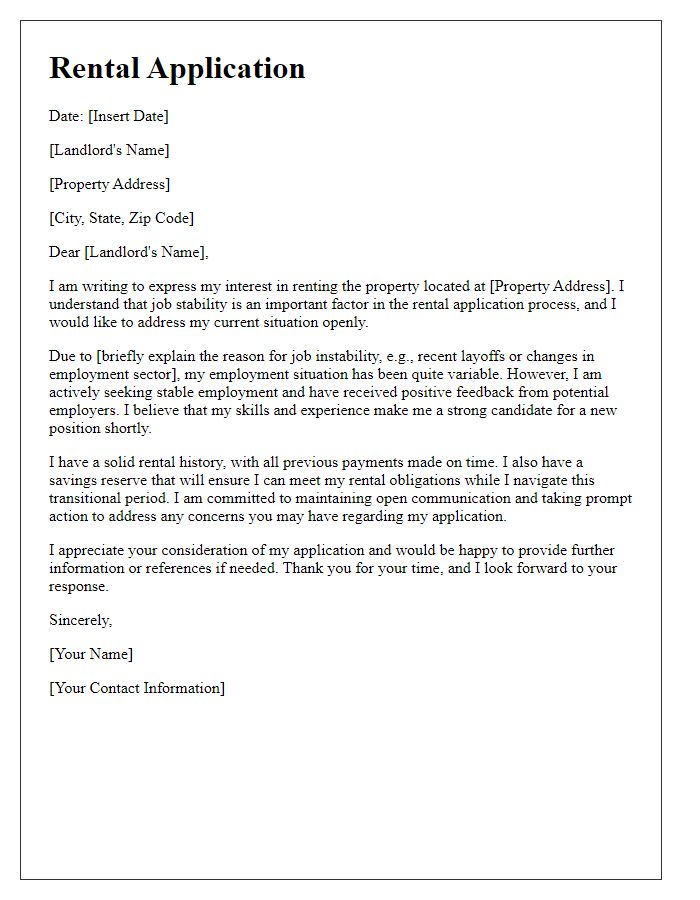

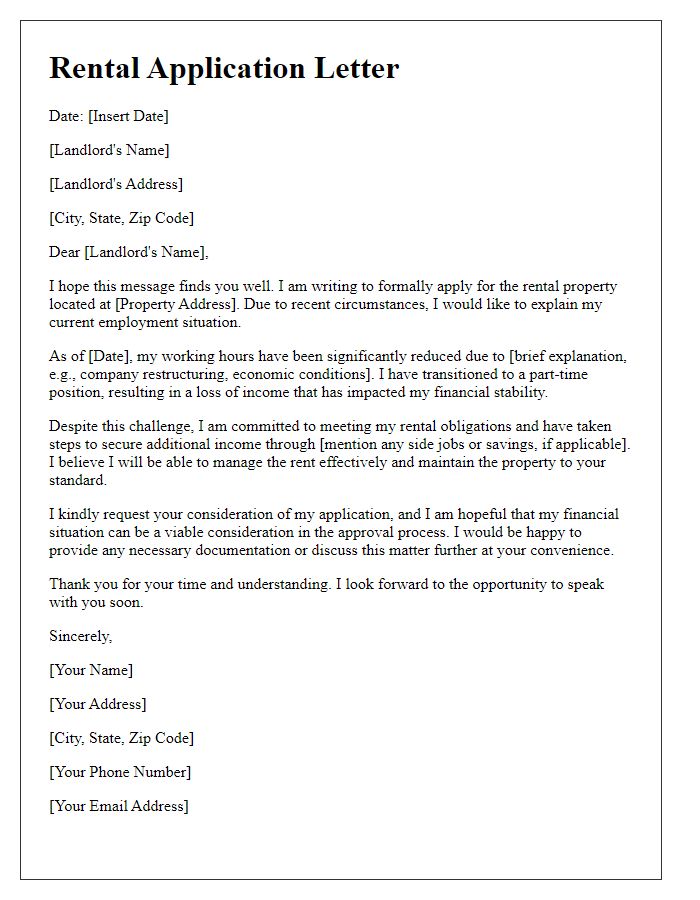

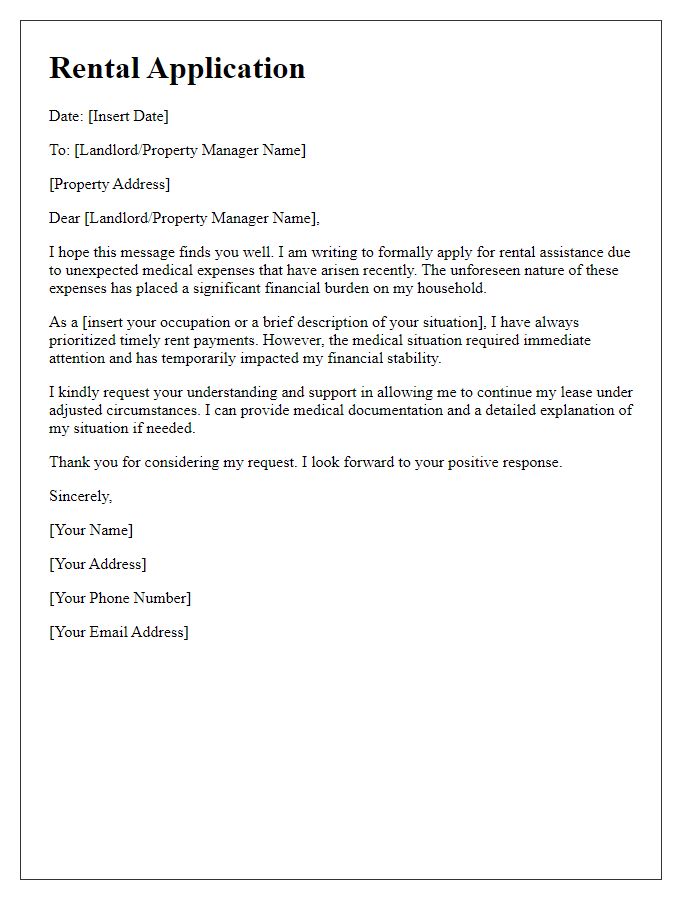

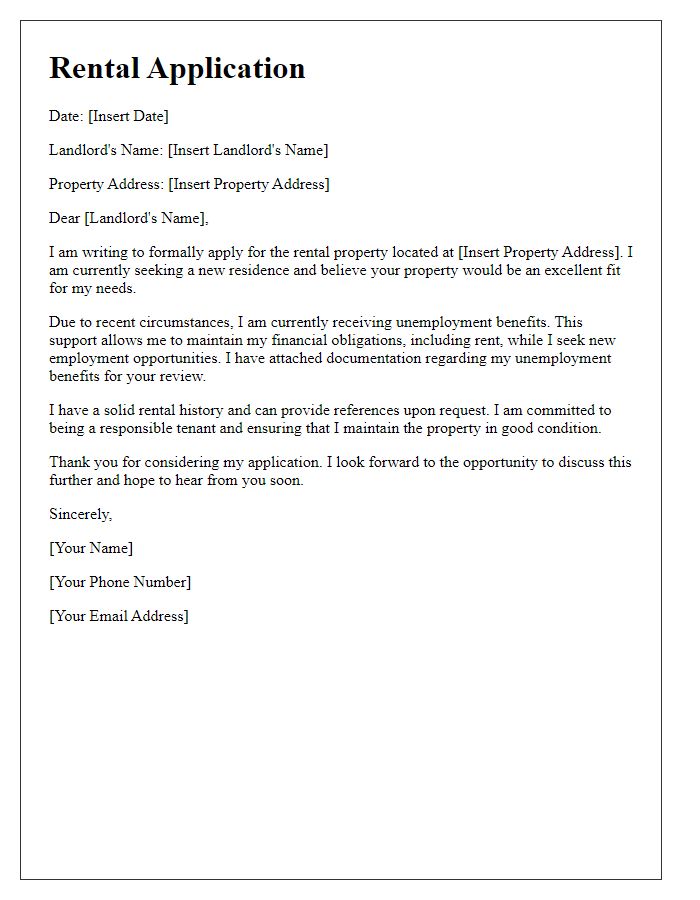

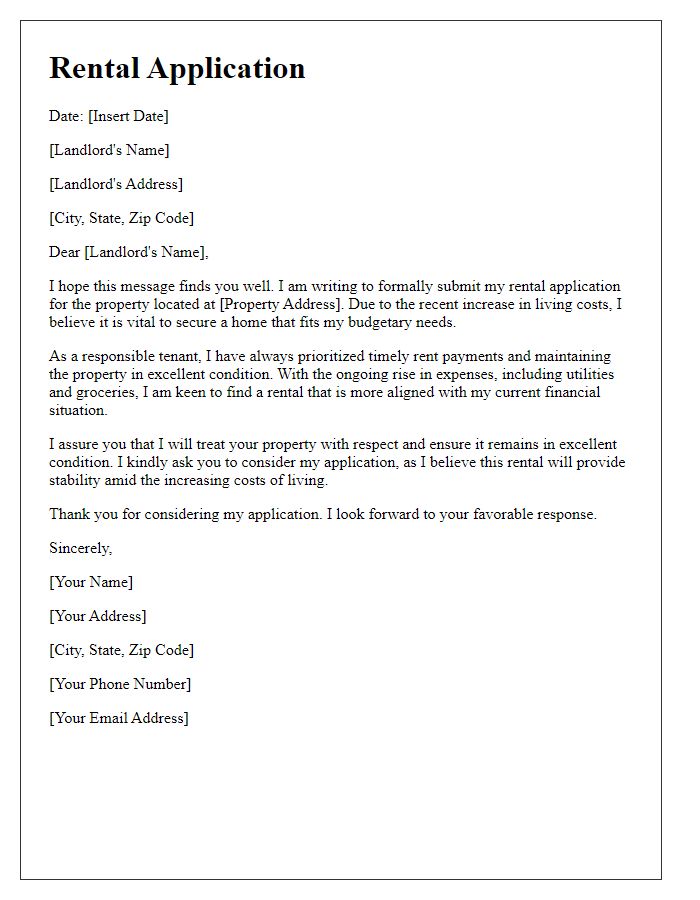

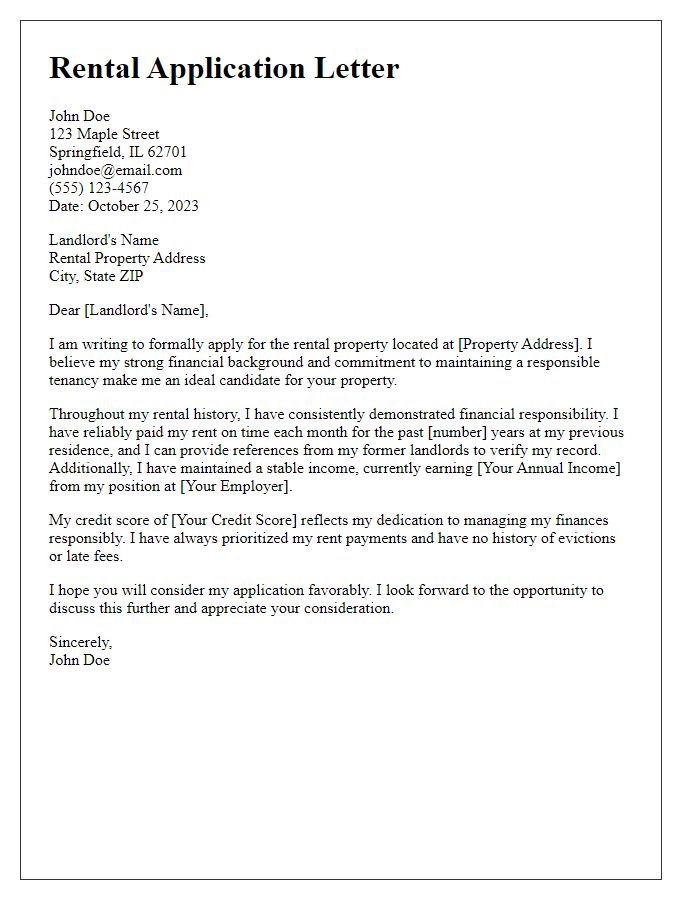

Letter Template For Rental Application Financial Hardship Samples

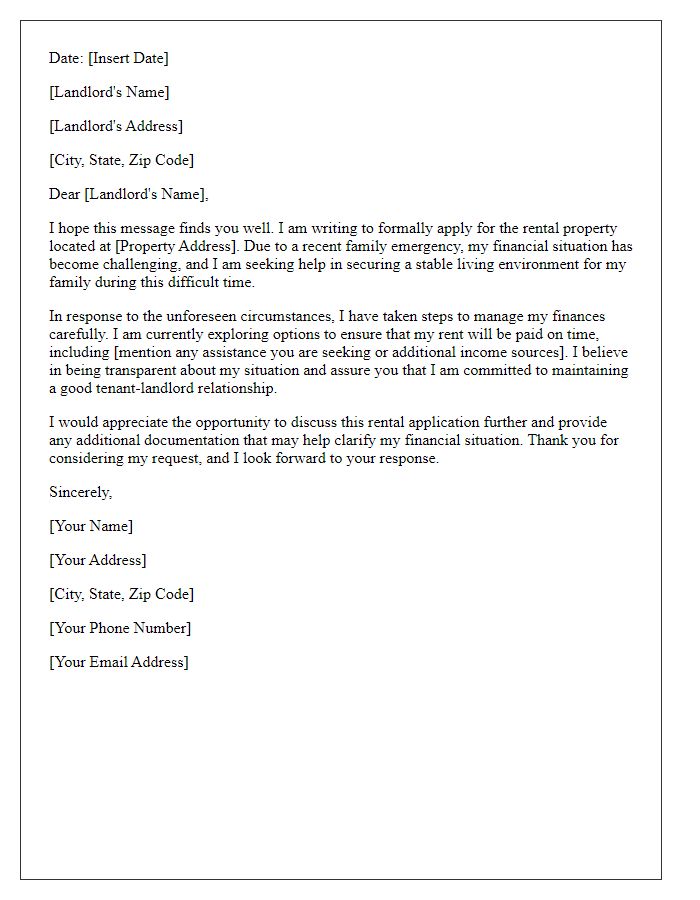

Letter template of rental application addressing family emergency finances

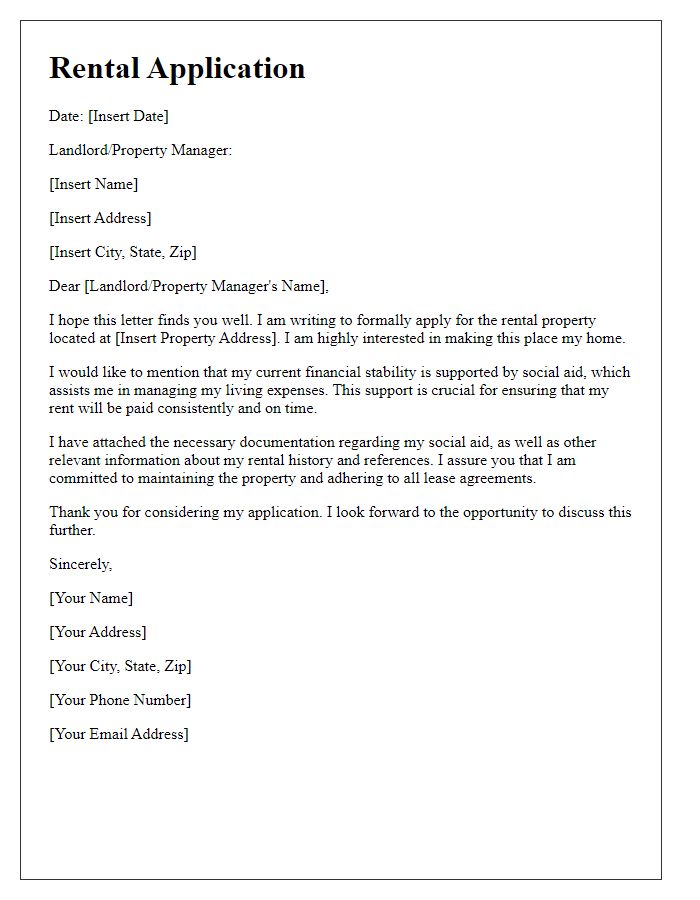

Letter template of rental application mentioning dependency on social aid

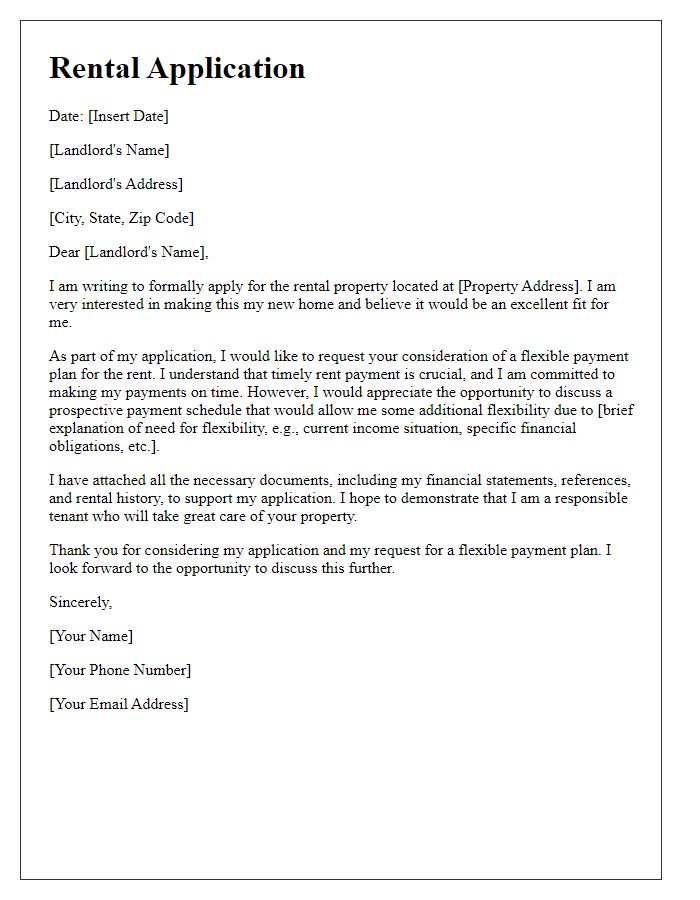

Letter template of rental application with a request for flexible payment plan

Comments