Hello there! We're excited to share the latest updates on your investment portfolio, as we understand how important it is for you to stay informed about your financial journey. This letter will provide a comprehensive overview of your investments' performance, recent market trends, and any strategic adjustments we've made to maximize your returns. We value your partnership and are committed to ensuring that your portfolio aligns with your financial goals. So, let's dive in and explore the details together!

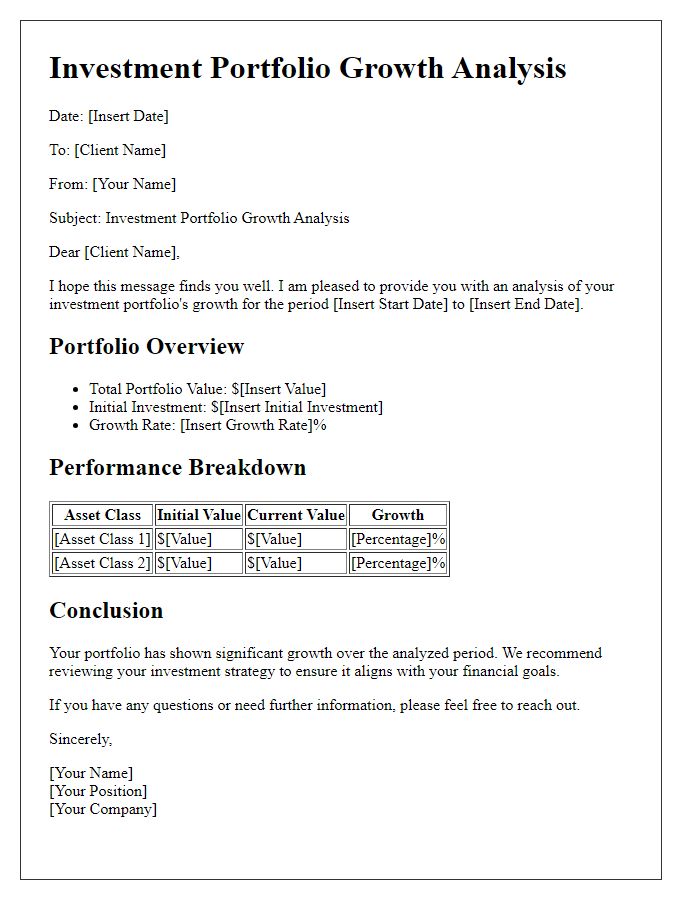

Portfolio Performance Summary

Investment portfolios require regular updates to assess performance metrics over time. Recent data from Q3 2023 highlights a diversified blend of assets, including equities, bonds, and alternative investments. The equity segment, particularly in technology stocks like NVIDIA and Apple, showcased a 15% growth due to increased consumer demand and innovation. Conversely, the bond sector experienced a minor downturn, approximately 2%, influenced by rising interest rates from the Federal Reserve's policy adjustments aimed at curbing inflation. Additionally, alternative investments, such as real estate investment trusts (REITs), provided stability with a 6% return, driven by strong rental demand in urban areas. Overall, the portfolio achieved a net gain of 8% over the quarter, reflecting a resilient strategy amidst market fluctuations.

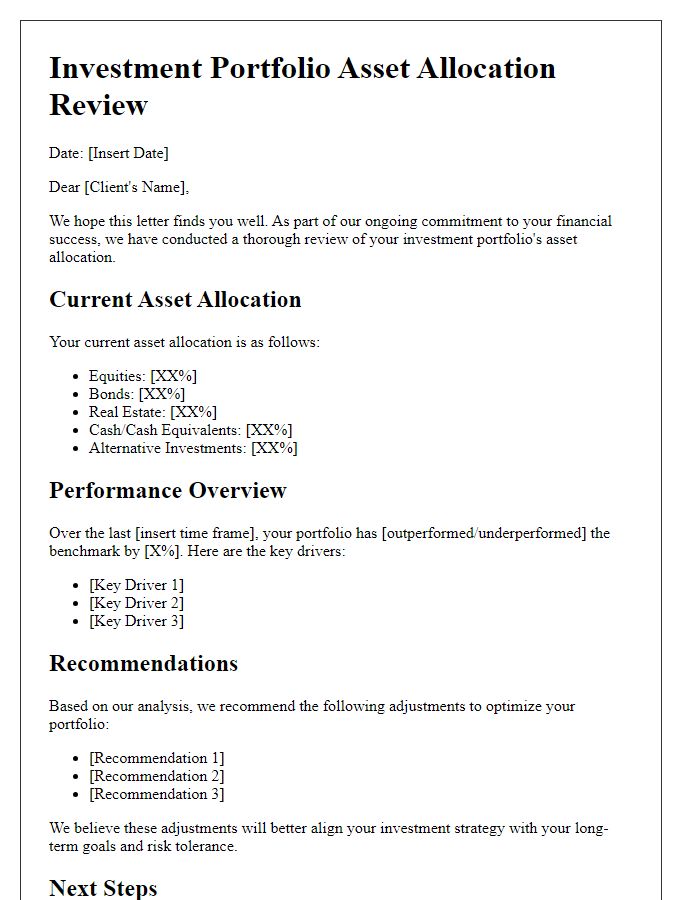

Market Trends Analysis

Market trends analysis indicates significant fluctuations within global equity markets, particularly during Q3 of 2023. Noteworthy sectors include technology and renewable energy, reflecting a shift in investor confidence. The Nasdaq Composite Index climbed 12%, driven by advancements in artificial intelligence and increased demand for sustainable energy solutions. Geopolitical events in Europe, including the ongoing conflict in Ukraine and changing energy policies, play pivotal roles in market stability. Additionally, inflation rates, currently averaging 3.7% in the United States, exert pressure on Federal Reserve monetary policy, influencing interest rate adjustments. These factors collectively shape investment strategies and portfolio performance, necessitating close monitoring for optimal asset allocation.

Portfolio Allocation Changes

Recent shifts in portfolio allocation reveal strategic adjustments aimed at enhancing overall returns and mitigating risks. Notably, a 5% increase in technology sector holdings, particularly in high-growth companies like Apple and Nvidia, aims to capitalize on the rising demand for artificial intelligence solutions. Simultaneously, a reduction of 3% in traditional energy stocks, including ExxonMobil and Chevron, reflects a pivot towards sustainable investments amid the global transition to renewable energy. Real estate assets, particularly diversified REITs (Real Estate Investment Trusts), now account for 20% of the portfolio, capitalizing on the recent surge in housing market activity driven by low mortgage rates. Cash holdings remain at 15%, providing liquidity for potential market opportunities in the upcoming quarter, especially with anticipated volatility due to geopolitical events such as the ongoing tensions in Eastern Europe.

Future Investment Strategies

Investment portfolios require strategic updates to maximize returns and mitigate risks. Asset allocation, which involves distributing investments among various asset classes like stocks, bonds, and real estate, plays a crucial role in long-term financial growth. Market trends, such as emerging technologies (e.g., artificial intelligence, renewable energy) and geopolitical events (e.g., trade agreements), significantly influence investment decisions. Regular portfolio reviews should assess individual asset performance, considering metrics like return on investment (ROI) and volatility. Diversification strategies can reduce exposure to market fluctuations and enhance stability, while ongoing research into sectors and companies allows for informed adjustments. Staying attuned to economic indicators, such as inflation rates and interest rates, is essential for proactive management of future investment strategies.

Risk Management and Outlook

Investment portfolios require constant assessment to ensure strategic alignment with market conditions and risk management protocols. Risk management encompasses techniques and strategies to identify, evaluate, and mitigate potential financial losses associated with investment decisions. Factors such as market volatility (often influenced by economic indicators like inflation and interest rates), geopolitical events (e.g., trade tensions between major economies such as the United States and China), and sector performance (e.g., technology, healthcare) can impact the overall risk profile. Analysts project that the dynamic market landscape may require adaptive strategies, incorporating diversified asset classes including equities, fixed-income securities, and alternative investments, to foster resilience. Moreover, maintaining an ongoing outlook for emerging trends such as sustainable investments and technological advancements in portfolio management tools will be crucial for long-term growth and stability.

Comments