Hey there! If you've recently applied for a mortgage and are eager to check on the status, you're not alone. Many applicants find themselves wondering about the next steps, timelines, or any additional documents needed. In this article, we'll provide a handy letter template that will make your follow-up process smooth and stress-freeâso you can stay informed and confident. Ready to dive in? Let's get started!

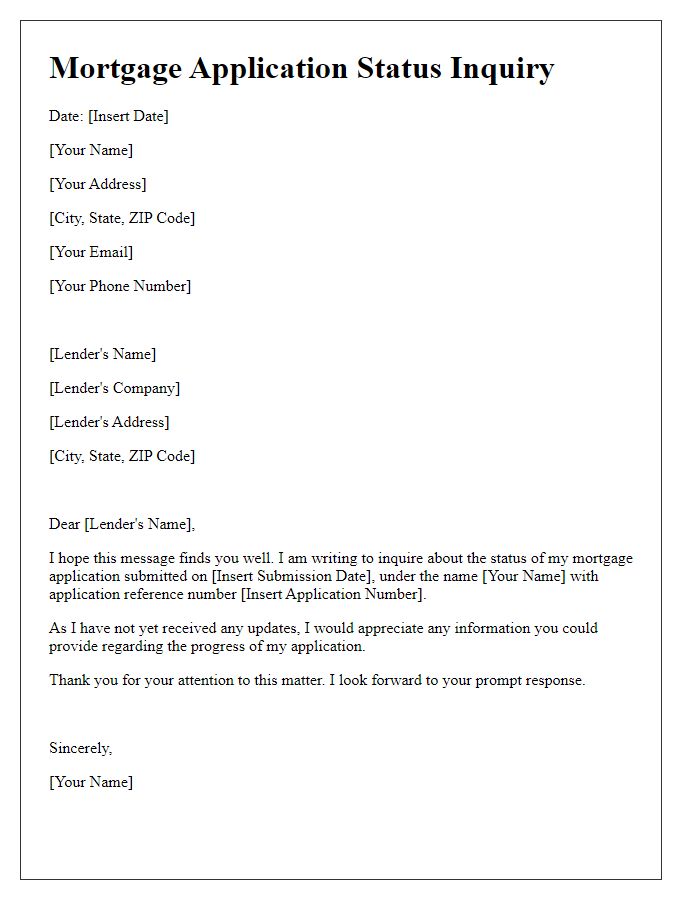

Applicant's Contact Information

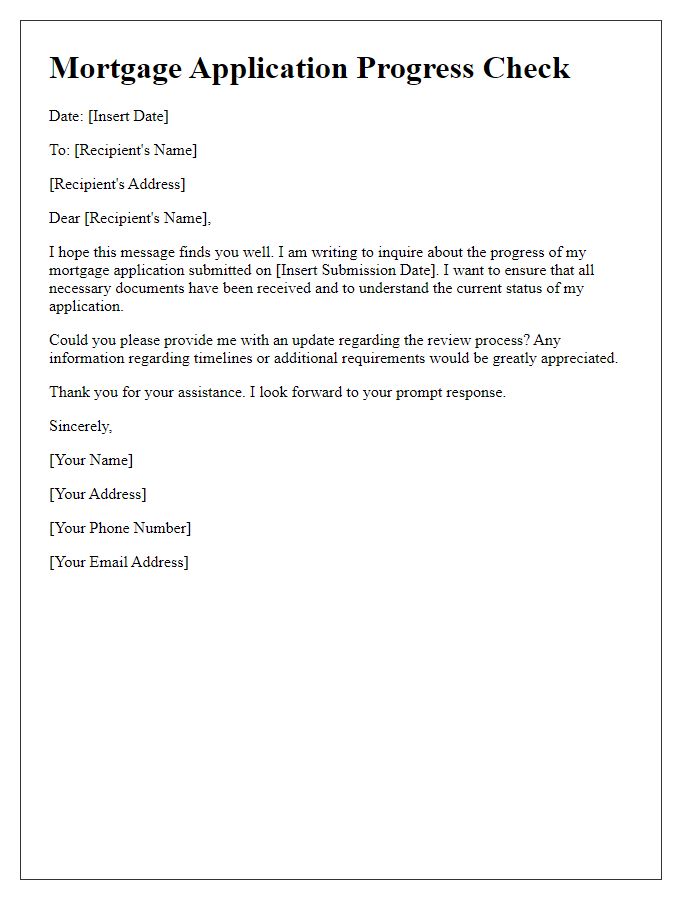

Mortgage application follow-up entails reaching out to the lending institution after submission of the application, ensuring clear communication between the applicant and the financial institution. The applicant's contact information, including full name, address, phone number, and email address, is crucial for efficient correspondence. This information facilitates quick updates on the application status, requests for additional documents, or notifications about approval timelines. Applicants should ensure that contact details are current and readily accessible to avoid delays in the mortgage process.

Lender's Contact Information

Following up on a mortgage application often requires clear communication with the lender. Providing detailed lender's contact information facilitates this process. Include specifics such as the lender's full name, lending institution name (e.g., Bank of America), office address (e.g., 123 Main St, Suite 100, New York, NY 10001), direct phone number (e.g., (555) 123-4567), and professional email address (e.g., lender@example.com). Essential elements boost the effectiveness of the follow-up communication and ensure timely responses regarding application status, potential documentation needed, and estimated timelines for approval. Having accurate information readily available can strengthen clarity in communications.

Subject Line: Mortgage Application Follow-Up

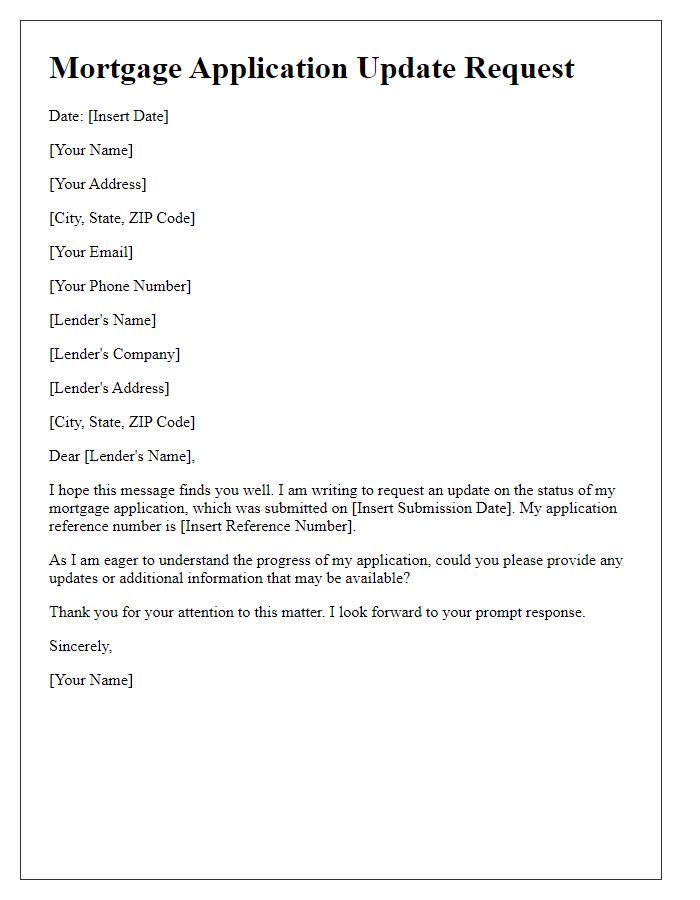

The mortgage application follow-up is a crucial step in the home loan process, particularly for potential homeowners seeking financing from banks or mortgage lenders. Timely communication (ideally within one week of submission) ensures candidates remain informed about application status. Key timelines include a typical underwriting period of 30 to 45 days, during which credit report reviews and income verifications occur. Buyers should refer to specific loan programs, such as FHA (Federal Housing Administration) loans or VA (Veterans Affairs) loans, which have distinct guidelines affecting approval chances. Clear, concise inquiries regarding appraisal results, or any needed documentation, help keep the momentum of the application moving forward. This proactive approach enhances the likelihood of successfully securing a mortgage agreement for the targeted property.

Applicant's Reference Number or Loan ID

The mortgage application follow-up process is crucial for applicants eager to secure financing for their property purchase. Applicants should reference unique identifiers, such as the Applicant's Reference Number or Loan ID, commonly issued by lending institutions like banks or credit unions. This number, typically ranging from 8 to 15 characters, facilitates efficient tracking of the application status. Timely follow-ups, usually within a week or two after submission, help keep the loan process on schedule, ensuring communication is maintained with loan officers. Additionally, a concise summary of required documentation, such as proof of income, credit reports, and asset verification, enhances transparency and expedites the approval timeline. Maintaining clear records of all submitted documents aids in preventing delays associated with missing information.

Request for Application Status and Next Steps

Mortgage applications undergo a thorough assessment process, typically taking several weeks for multiple evaluations. Lenders, such as banks and credit unions, need to review financial documents, property appraisals, and credit history before making a final decision. A first follow-up typically occurs three to four weeks post-application submission, asking for an update on the status. It is crucial to inquire about any pending documents or additional information needed to expedite the process. Understanding the estimated timeline for completion can help manage expectations, particularly for home purchases aligned with specific closing dates. Formalities involve ensuring communication with the appropriate loan officer or processing department.

Comments