Are you facing inaccuracies on your credit report and feeling overwhelmed on how to tackle the dispute process? It's more common than you might think, and knowing where to start can make a world of difference in restoring your financial standing. This article will break down the essential steps and provide a straightforward letter template you can use to effectively communicate with credit reporting agencies. So, let's dive in and empower you to take charge of your credit report!

Accurate Identification Information

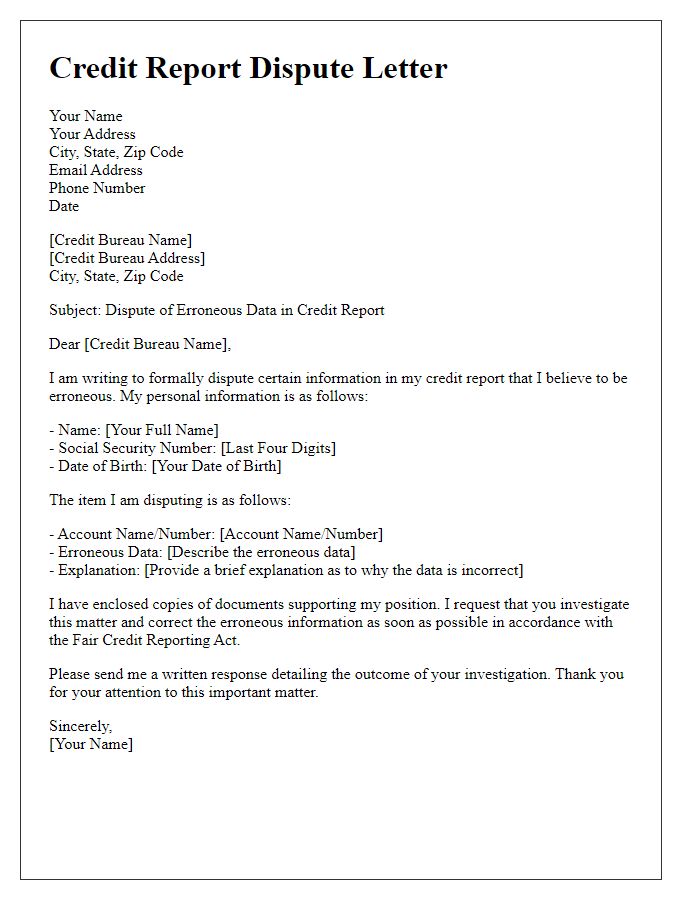

Accurate identification information is crucial when disputing errors on a credit report, particularly in the realm of consumer credit scoring systems like FICO and VantageScore. Key elements include the full name of the individual, current residential address (including zip code), date of birth, and Social Security Number (SSN) which consists of nine digits. Any discrepancies in this information can lead to delays or issues in processing disputes with credit reporting agencies such as Equifax, Experian, or TransUnion. Providing precise details ensures compliance with regulations set by the Fair Credit Reporting Act (FCRA), facilitating timely updates and corrections on the credit report. Proper identification aids in safeguarding against identity theft, a prevalent issue that affects millions annually, and maintains an individual's credit integrity for future financial endeavors.

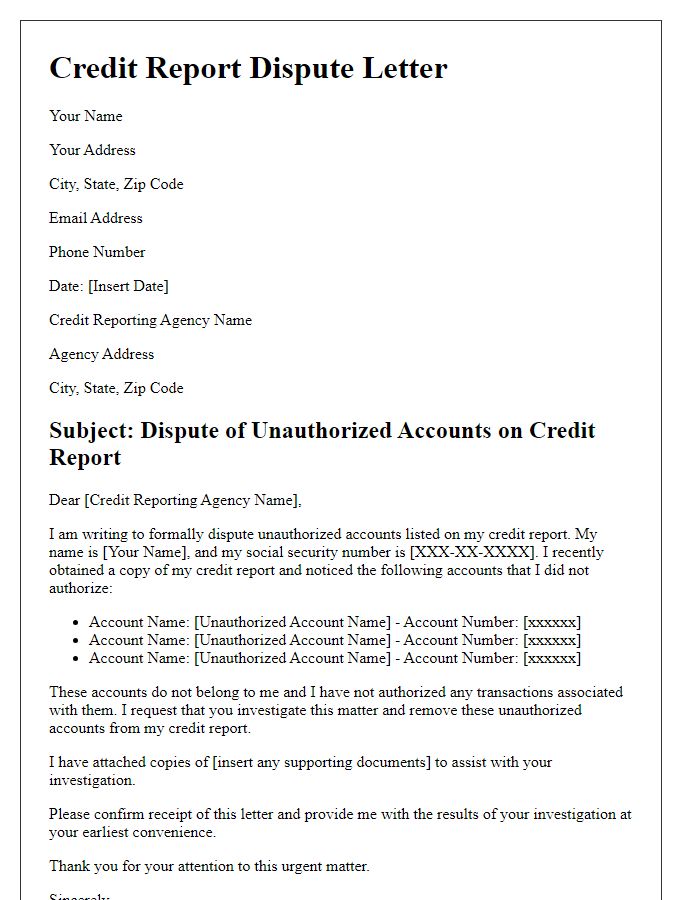

Detailed Account and Dispute Description

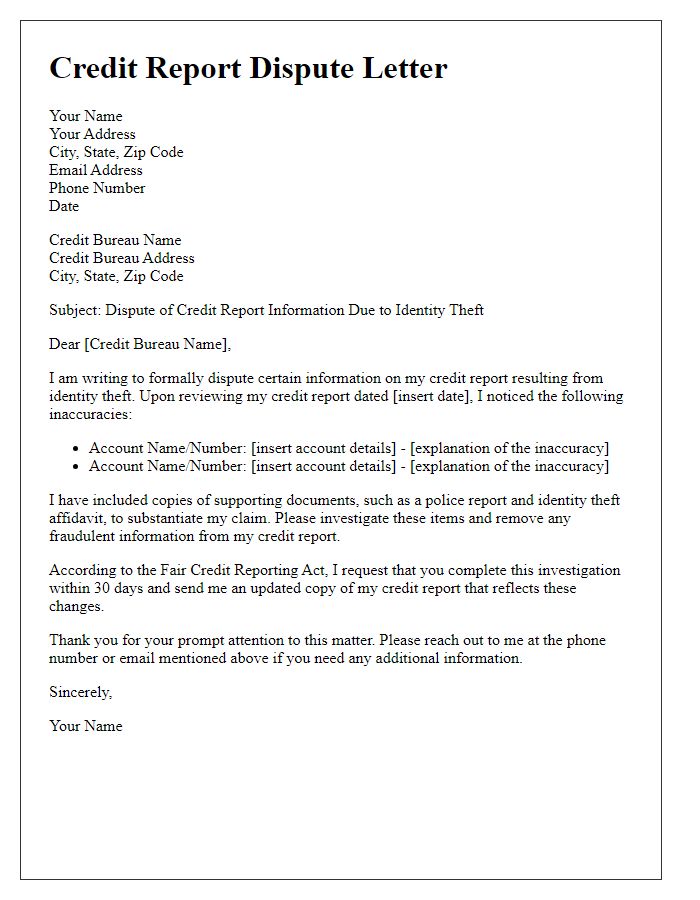

Credit report discrepancies can significantly impact financial health. Common issues include incorrect personal information, such as misspelled names or wrong addresses, and outdated account statuses (for example, a charged-off account inaccurately reported as active). For instance, a credit card account dated from 2019 may still reflect a balance that has been paid off. These inaccuracies can lower credit scores, affecting loan approvals and interest rates. To initiate a dispute, individuals should gather documentation, such as billing statements, proof of payments, and correspondence with creditors. Submitting a well-documented dispute to credit bureaus like Equifax, Experian, or TransUnion can lead to investigation and correction of the erroneous information, typically within 30 days as mandated by the Fair Credit Reporting Act.

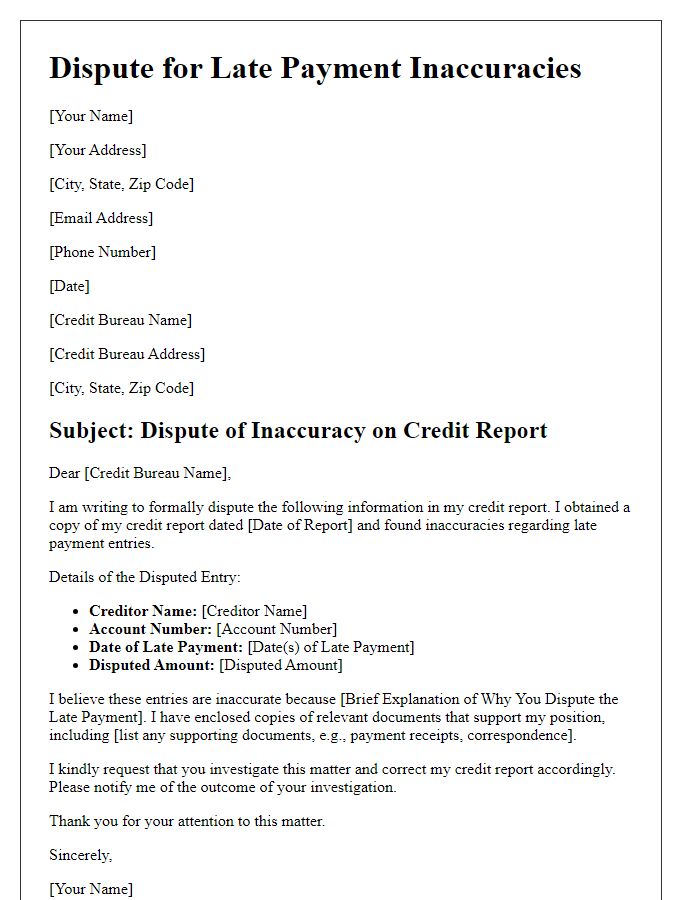

Specific Errors and Supporting Documentation

When disputing a credit report error, such as incorrect account information or payment history, it is essential to gather relevant documentation that supports your claim. Begin by identifying specific errors, such as a late payment entry dated January 15, 2023, for a credit card issued by XYZ Bank. Review your account statements to verify payment records. Collect supporting documents like bank statements, payment receipts, or written communication with creditors that affirm timely payments. This comprehensive approach strengthens your case, ensuring accuracy in your credit report, and enhances your chances of rectifying errors swiftly.

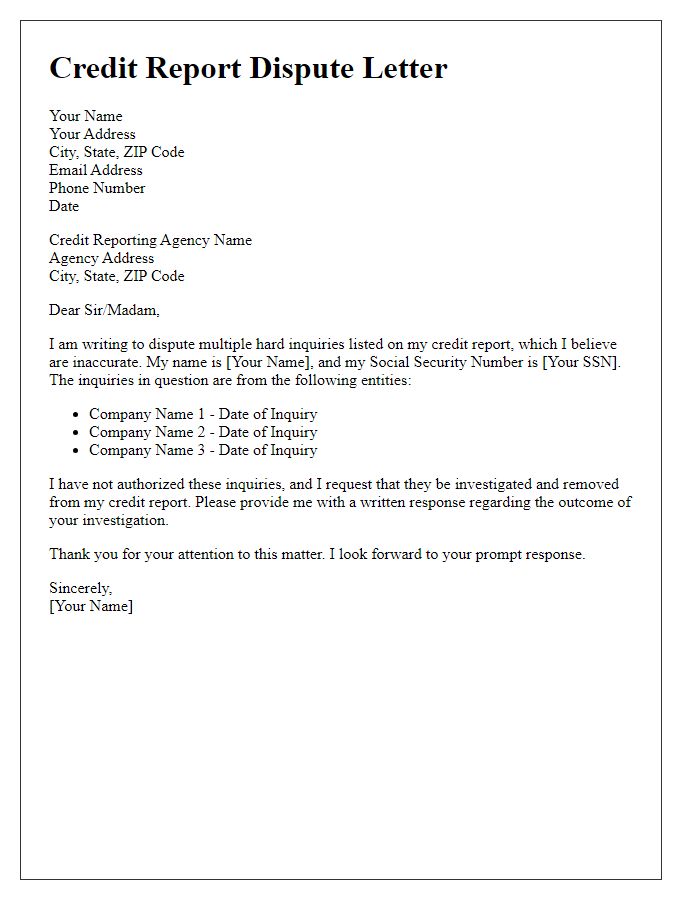

Request for Investigation and Correction

A credit report dispute involves a detailed process to ensure the accuracy of consumer credit information. Individuals can initiate a dispute through credit bureaus such as Experian, Equifax, or TransUnion, by submitting a written request, including their name, address, and Social Security number. The Fair Credit Reporting Act (FCRA) mandates that these bureaus investigate disputed items within 30 days, providing a resolution based on their findings. Accuracy is crucial, as credit reports influence loan approvals, interest rates, and employment opportunities. Disputes may involve inaccuracies related to account balances, payment history, or personal information, necessitating supporting documents such as payment receipts or correspondence with creditors. Upon completing the investigation, the bureaus must inform the consumer of the outcome, allowing for further disputes if necessary.

Clear Contact Information and Follow-up Details

When disputing a credit report, it is essential to include clear contact information to ensure effective communication. Provide your full name, current address, phone number, and email address prominently at the top of the dispute letter. Ensure that the address matches the one associated with your credit report. Following the contact information, state the purpose of your letter clearly and concisely, including details such as the date of the credit report, the specific account in question, and any inaccuracies noted. Include all relevant documentation, such as credit statements or correspondence, that supports your dispute. It's crucial to mention any deadlines by which you expect a response, typically within 30 days, as stipulated by the Fair Credit Reporting Act. Additionally, express your intent to follow up if you do not receive a timely response. This structured approach facilitates better tracking of updates and resolutions regarding your credit report discrepancies.

Letter Template For Credit Report Dispute Guidance Samples

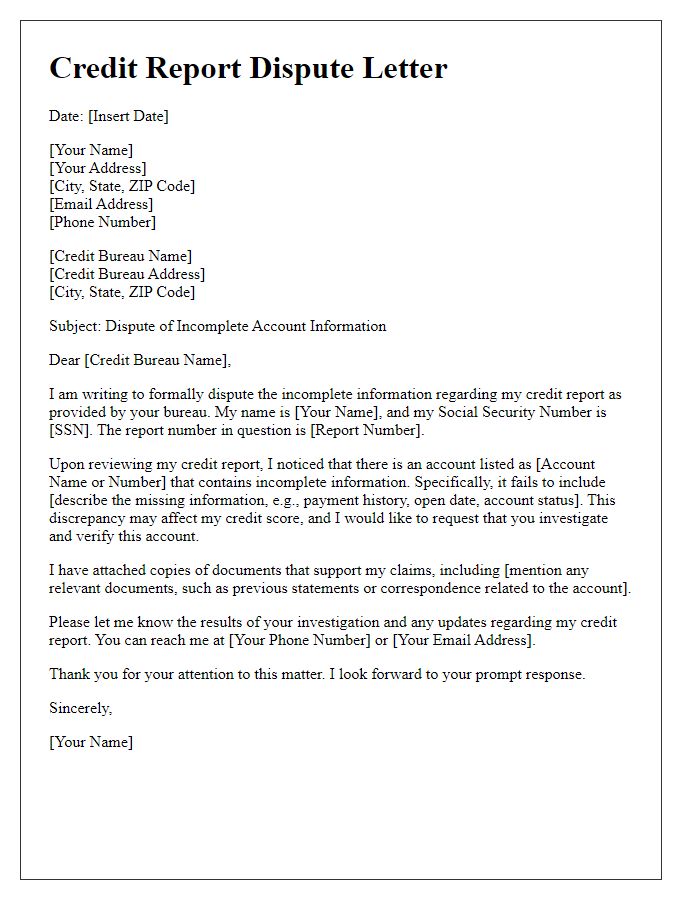

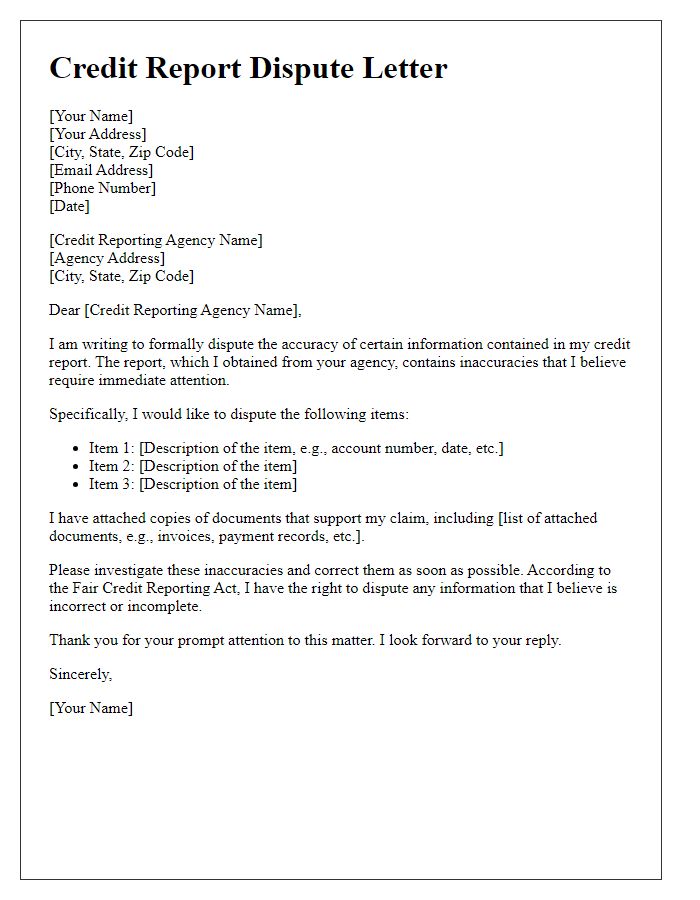

Letter template of credit report dispute for incomplete account information

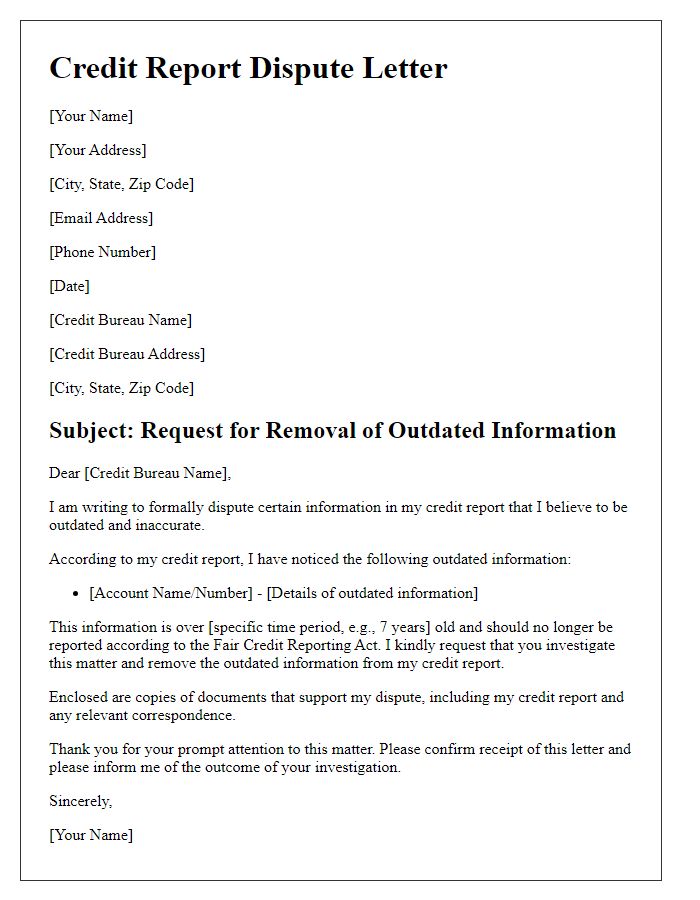

Letter template of credit report dispute for outdated information removal

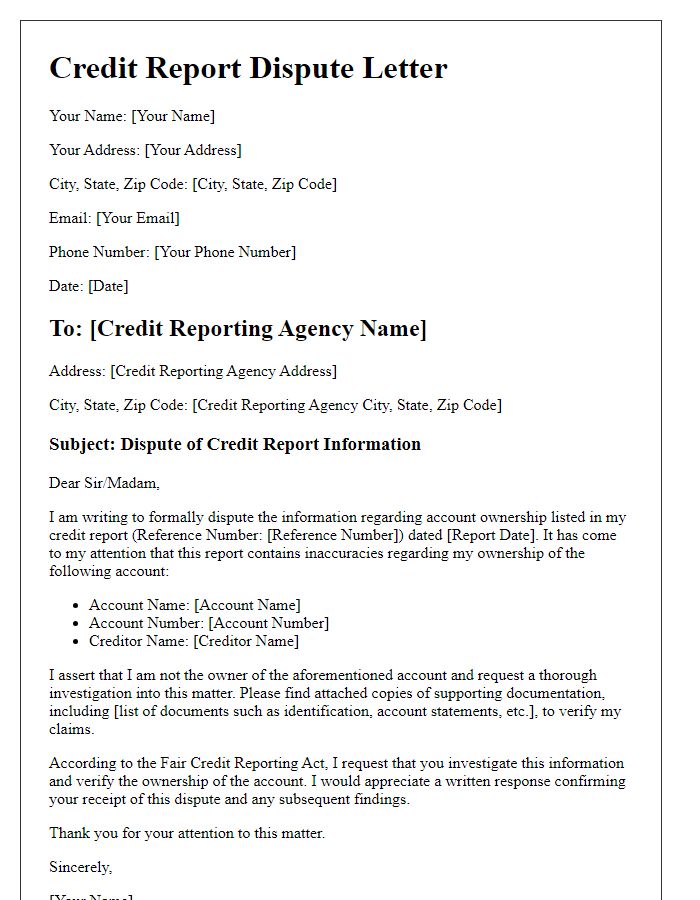

Letter template of credit report dispute for account ownership verification

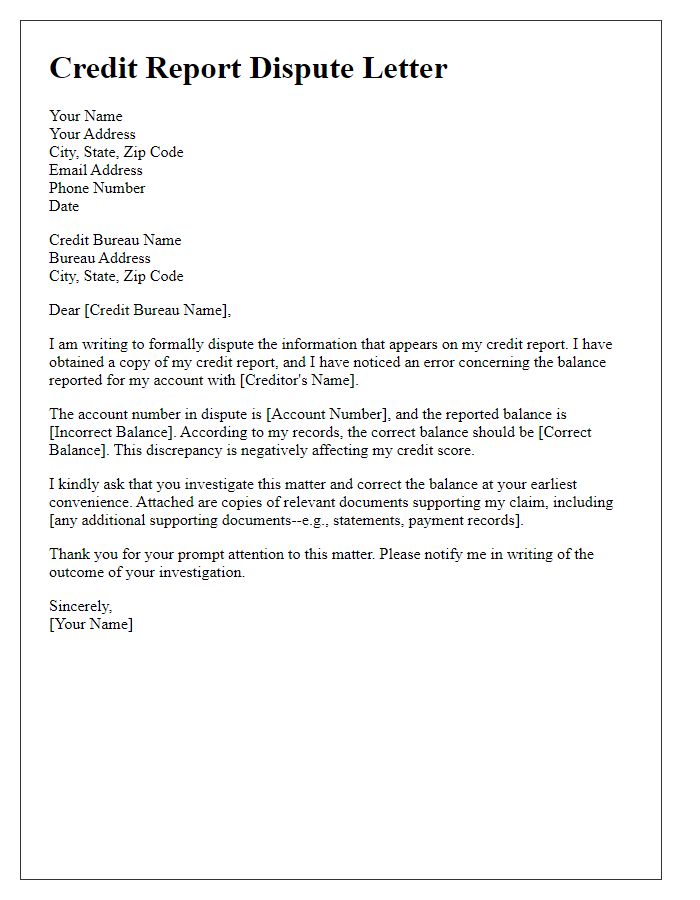

Letter template of credit report dispute for incorrect balance reporting

Letter template of credit report dispute for public records inaccuracies

Comments