Are you feeling a bit overwhelmed by health insurance policies? You're not alone! Many people find themselves puzzled by the intricate details of coverage options and benefits. In this article, we'll break down everything you need to know about crafting a clear and concise query regarding your health insurance policyâso stick around and let's make sense of it together!

Personal information (Name, address, contact details)

Health insurance policies often require precise personal information for queries. Full name, including middle initials, serves as the primary identifier in records. Current residential address, including city, state, and ZIP code, is essential for locating the policy. Contact details, such as mobile and home phone numbers, facilitate prompt communication. Email address additionally permits digital correspondence, crucial for receiving timely updates or responses. This specific information enables efficient handling of policy inquiries and ensures personalized service from the insurance provider.

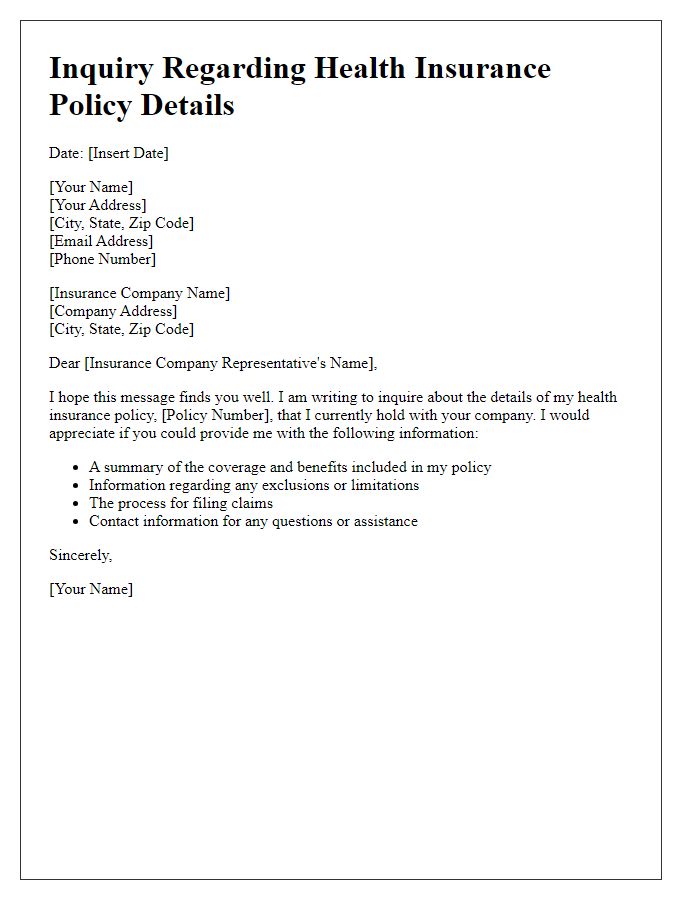

Policy details (Policy number, policyholder name)

Health insurance policies provide essential coverage for medical expenses. Key details include the policy number, a unique identifier for the insurance contract, and the policyholder's name, which represents the individual responsible for the insurance agreement. When inquiring about specific terms, coverage limits, or claims status, having this information readily available can expedite the process and ensure accurate communication with the insurance provider. This is crucial in navigating the complexities of health insurance, especially during critical events such as medical emergencies or routine health check-ups.

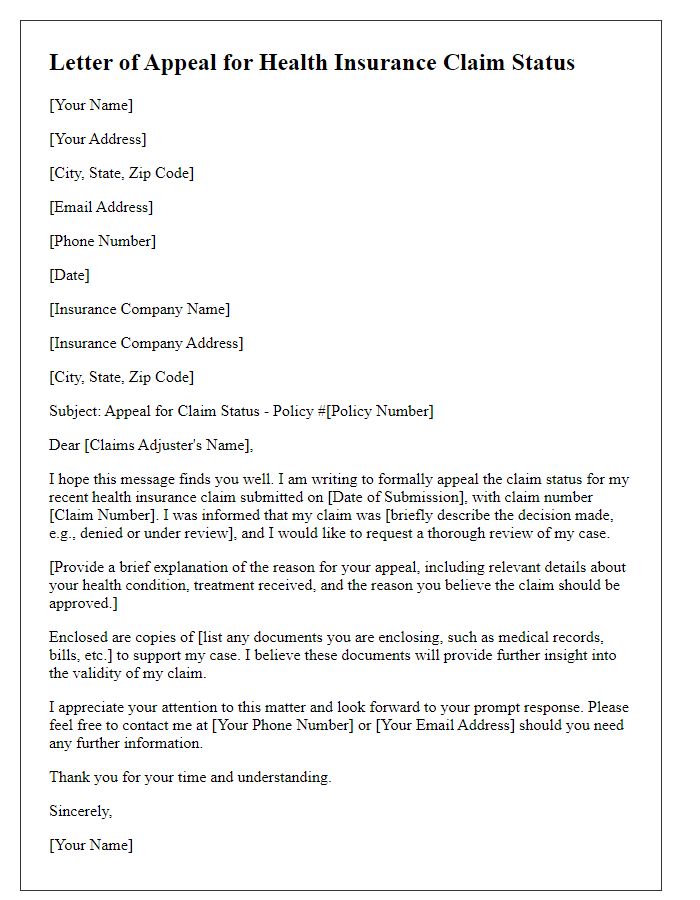

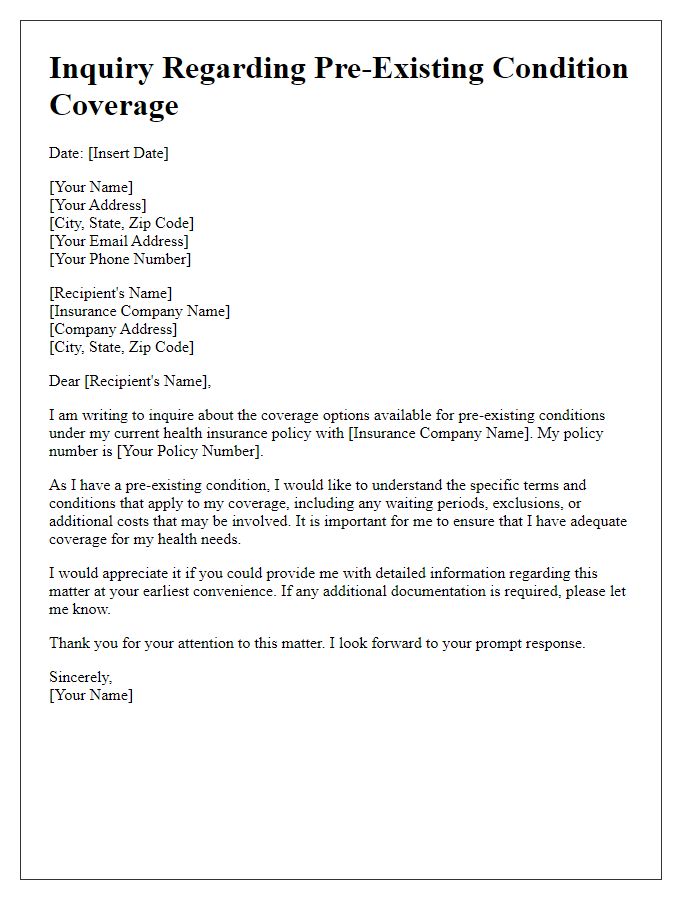

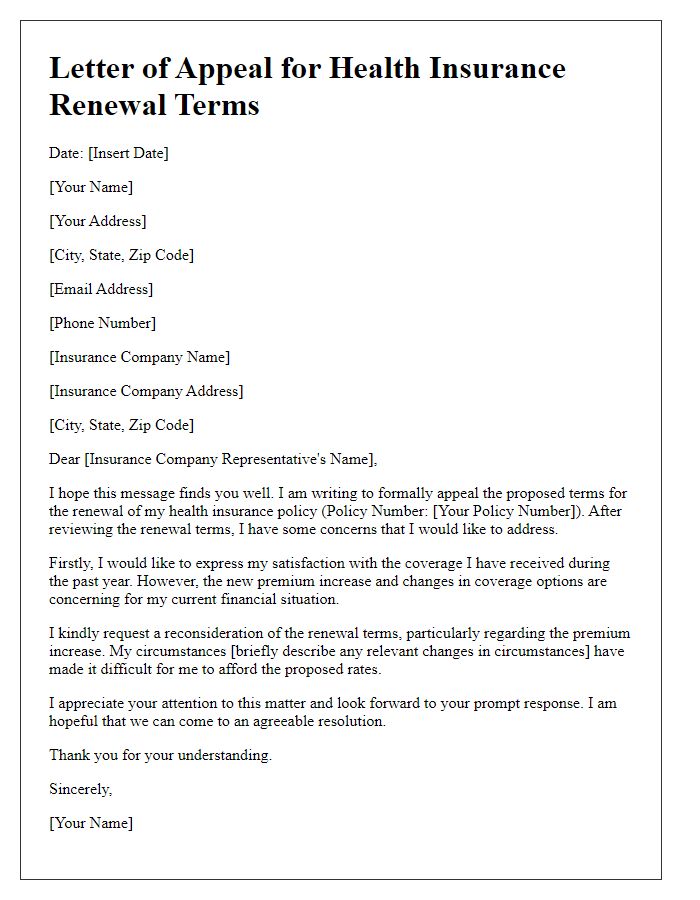

Specific query or concern (Coverage questions, claim issues)

Health insurance policies often present complex coverage regulations, especially regarding specific medical services or procedures. Queries may arise about coverage for pre-existing conditions, with many plans requiring a waiting period of up to 12 months, particularly in states like California. Claim issues frequently involve delays in reimbursement, which can range from several weeks to months, creating financial strain during critical health situations. Additionally, network restrictions can lead to confusion regarding preferred providers; for instance, in Arizona, utilizing out-of-network practitioners may result in higher out-of-pocket costs, often exceeding 50% of the service fee. Understanding these elements is crucial for effective navigation of health insurance benefits.

Supporting documentation (Previous correspondence, relevant forms)

When inquiring about a health insurance policy, it is crucial to provide supporting documentation, such as previous correspondence (emails, letters) related to the policy concerns, along with relevant forms (claim forms, coverage documents). These documents support clarification requests regarding benefits, claim denials, or policy terms. Providing a timeline of events, including dates and specific interactions with customer service, enhances the case review process. Additionally, including policy numbers, member identification numbers, and the insurer's contact information ensures a thorough response. Including a detailed summary of issues experienced can expedite resolution and assist in preventing future complications.

Request for response time-frame (Preferred method of communication)

Health insurance policies often leave customers seeking clarity on coverage details and response times. A common query involves the average duration for receiving replies concerning submitted claims or policy inquiries. For instance, companies like UnitedHealthcare or Aetna may vary significantly in their response times, typically spanning from a few days to several weeks. Preferred communication methods can impact speed, with email inquiries perhaps taking longer than phone calls. Understanding these parameters can guide customers in managing expectations and planning follow-up inquiries effectively.

Letter Template For Health Insurance Policy Query Samples

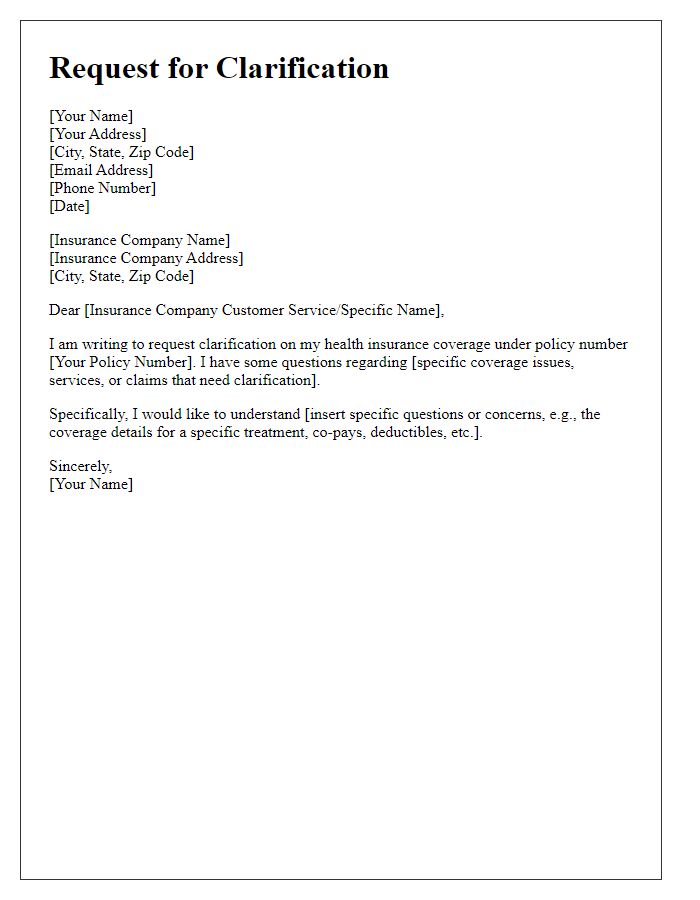

Letter template of request for clarification on health insurance coverage

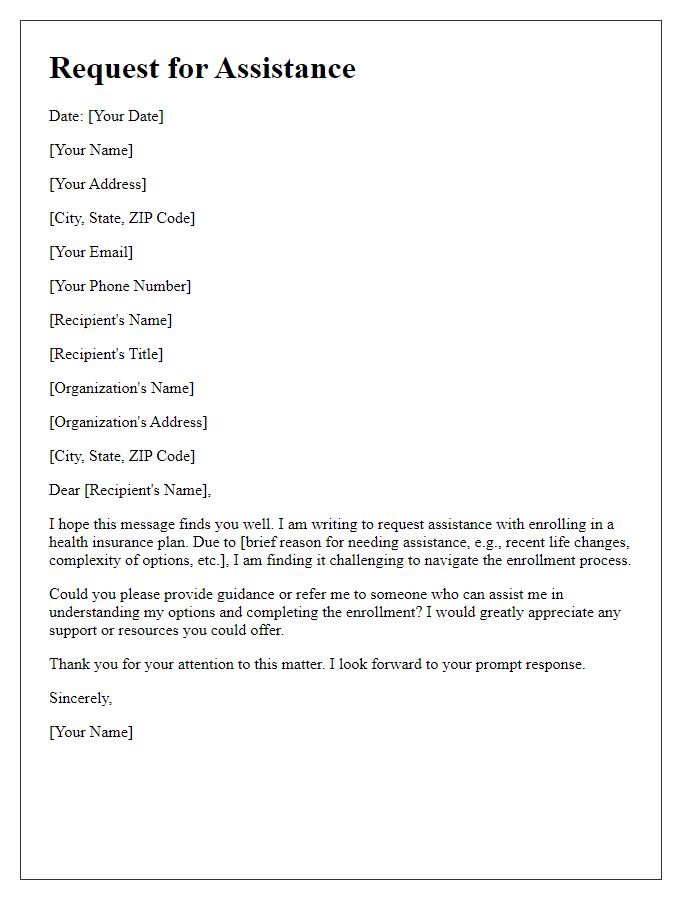

Letter template of request for assistance with health insurance enrollment

Comments