Have you ever found yourself staring at a bewildering credit card statement, questioning a charge that seems completely out of place? If you're nodding your head in agreement, you're not aloneâmany people encounter unexpected charges and feel unsure about how to address them. The good news is that disputing a credit card charge can be a straightforward process if you know the right steps to take. Join us as we explore a simple letter template that will help you effectively communicate your dispute to the credit card company.

Clear statement of dispute

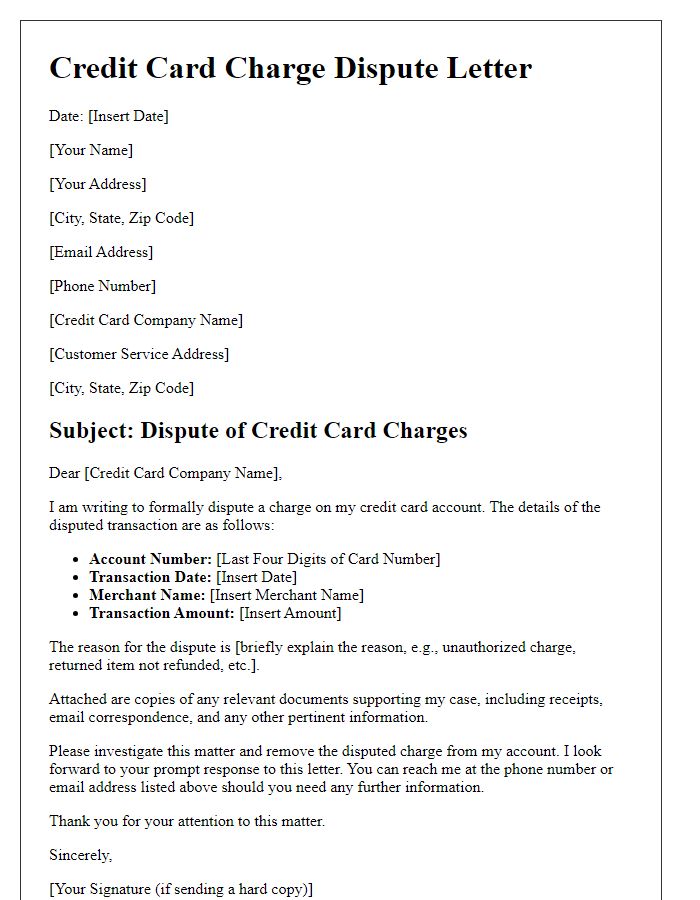

A clear statement of dispute regarding a credit card charge arises when an unexpected charge appears on a credit card statement, such as unauthorized purchases or billing errors from a merchant. The amount in question can range from a minor mistake, like a duplicate charge of $50 from a restaurant, to significant errors, such as a $1,200 charge for a service never rendered. The issuing bank, often a major financial institution like JPMorgan Chase or Bank of America, typically requires specific details, including transaction dates, transaction numbers, and the nature of the charge, for efficient resolution. It's crucial to maintain records of all communication with the bank and the merchant to support the dispute, as regulatory guidelines from the Fair Credit Billing Act (FCBA) protect consumers against billing errors.

Accurate transaction details

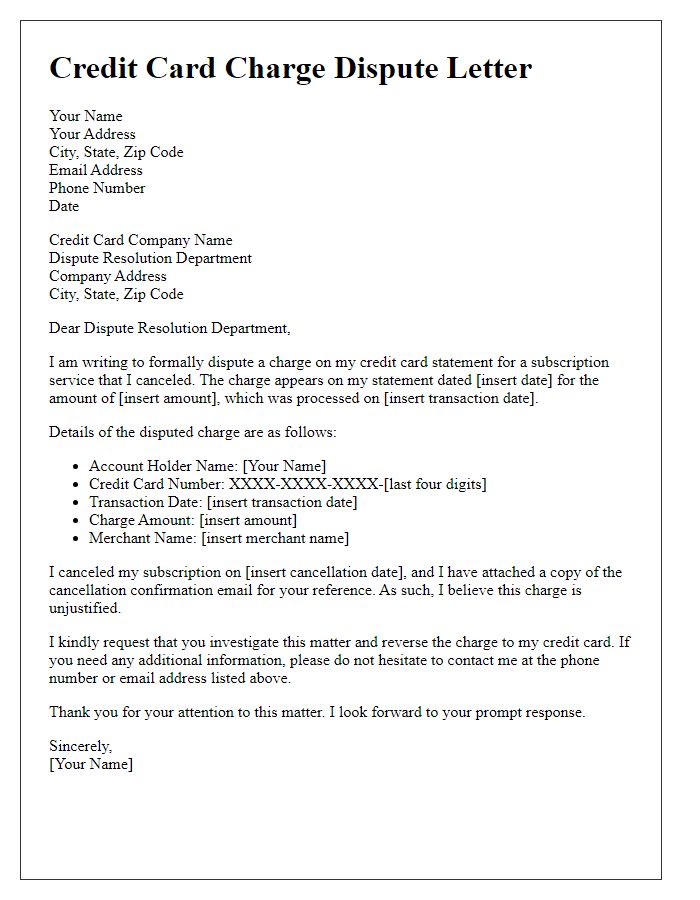

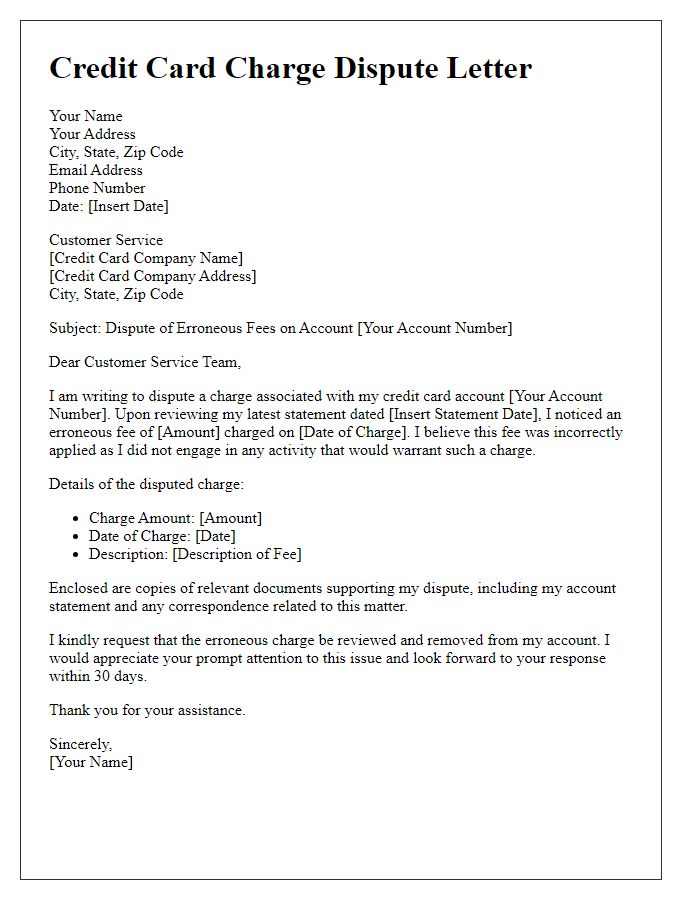

Disputing credit card charges often requires specific transaction details to facilitate a resolution. For instance, note the transaction date, which may be crucial for identifying the exact charge, such as a purchase made on March 15, 2023. Highlight the transaction amount, for example, $150.75, as this serves as a clear reference point for the dispute. Include the merchant's name, like "Tech Gadgets Inc.," to specify the seller associated with the disputed charge. Lastly, mention your credit card number, masking part of it for security, e.g., "XXXX-XXXX-XXXX-1234," for clarity on the account from which the charge originated. These details play a vital role in clarifying the nature of the dispute with the credit card issuer.

Supporting documentation

Disputing a credit card charge requires clear supporting documentation to substantiate your claim. Essential elements to include are transaction details, such as the date (for example, July 15, 2023), the merchant name (like Amazon), and the charged amount (for instance, $150.00). Providing a copy of your credit card statement highlighting the disputed charge (from the billing cycle ending July 31, 2023), along with proof of purchase, such as a receipt or order confirmation email, is critical. If applicable, gather correspondence evidence (emails or chat transcripts) between you and the merchant discussing the issue, which may include requests for refunds or clarifications. Documenting any reported discrepancies (such as unauthorized charges or billing errors) strengthens your case. Lastly, ensure to include your credit card account number (last four digits visible) and any relevant reference numbers to assist in processing your dispute efficiently.

Contact information

Disputing a credit card charge involves several important details that must be addressed. Initially, include your contact information such as the full name (as on the card), mailing address (including city, state, and ZIP code), phone number (direct line for urgency), and email address. Reference the specific credit card account number (last four digits can be used for security), along with the date of the charge in question (noting specific event dates can clarify issues). Document the transaction amount, and attach copies of billing statements (highlighting disputed charges) or receipts (providing evidence if applicable). Additionally, keep a record of communication dates, names of representatives spoken to, and any confirmation numbers obtained during the dispute process to ensure thorough tracking and follow-up.

Request for resolution adjustments

A dispute regarding unauthorized credit card charges often arises from transactions that appear on monthly statements without the account holder's consent. Commonly, these charges can range from subscription services, such as Netflix, to unexpected purchases from retailers like Amazon. Identifying the date of the charge, typically within the last billing cycle, is essential for clarity. Providing specific details, such as the charge amount, along with transaction references can significantly aid in the investigation process. The Federal Trade Commission (FTC) mandates that credit card issuers should respond to disputes within 30 days, making timely follow-up crucial for resolution. Effective communication with the bank, specifically the customer service department, can enhance the dispute process and lead to prompt adjustments to the account balance.

Letter Template For Dispute Of Credit Card Charge Samples

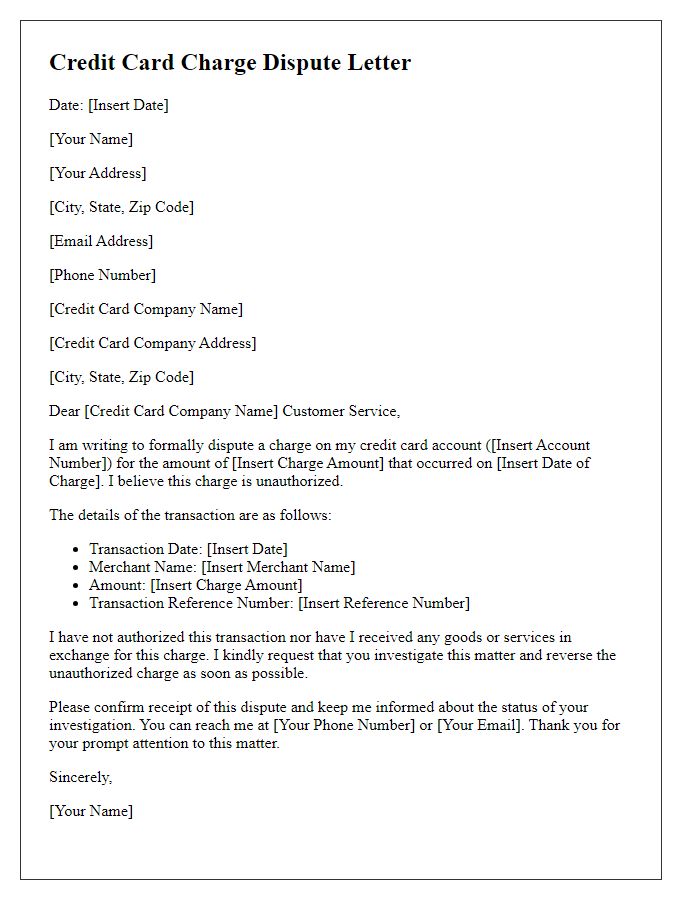

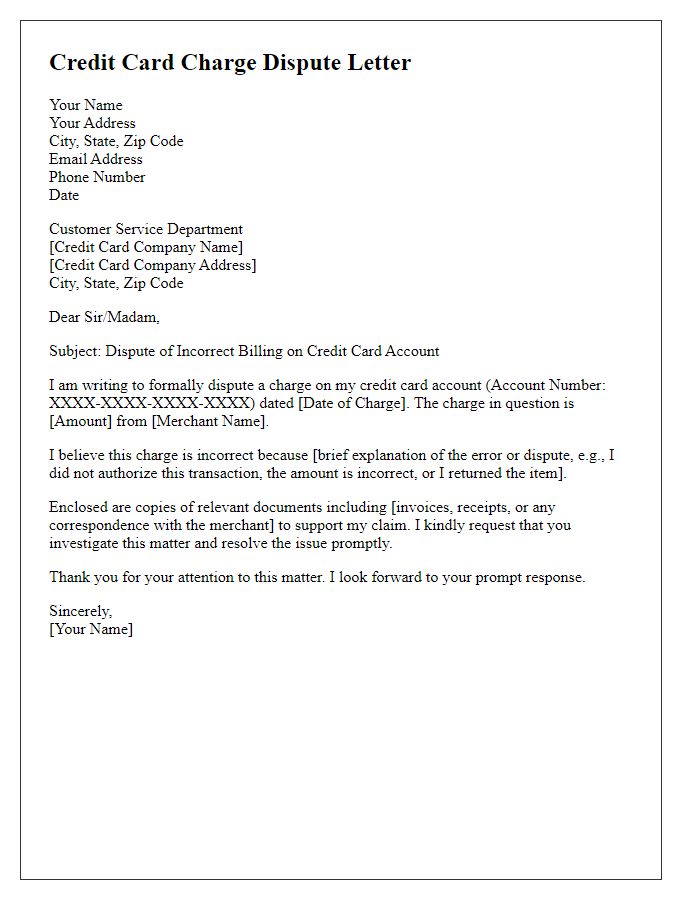

Letter template of credit card charge dispute for unauthorized transactions

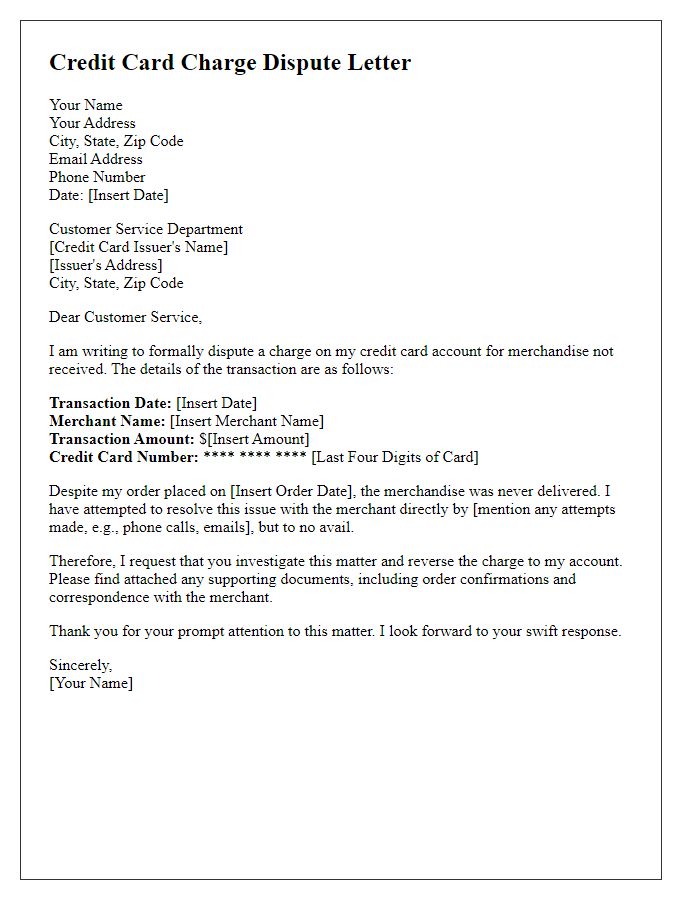

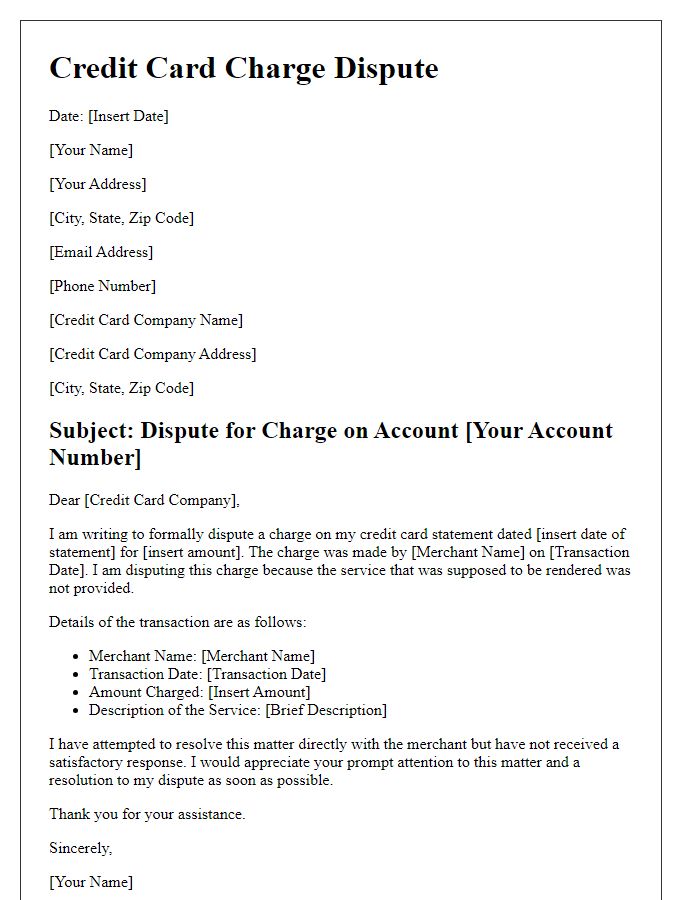

Letter template of credit card charge dispute for merchandise not received

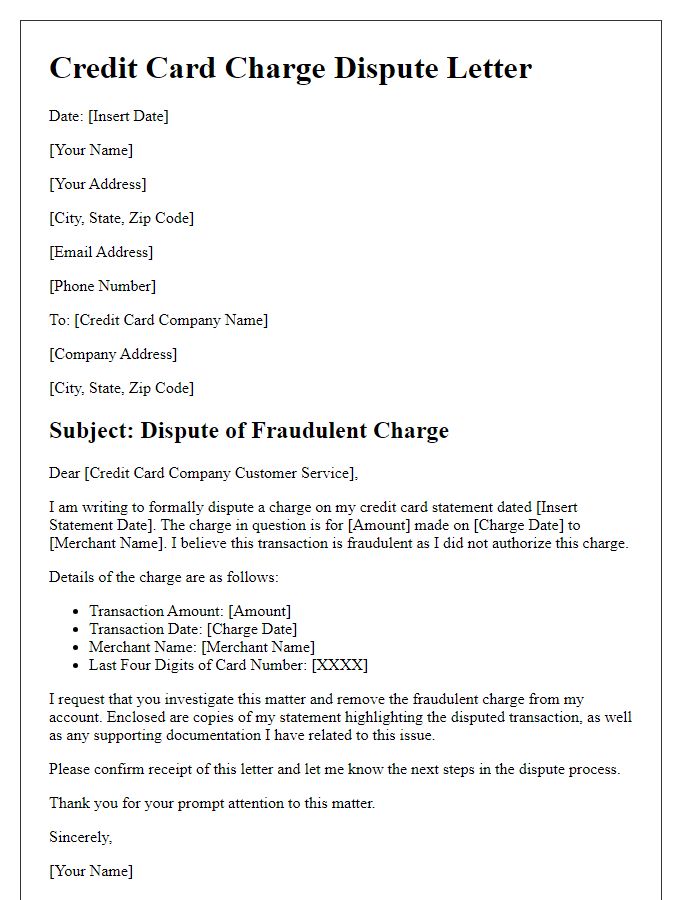

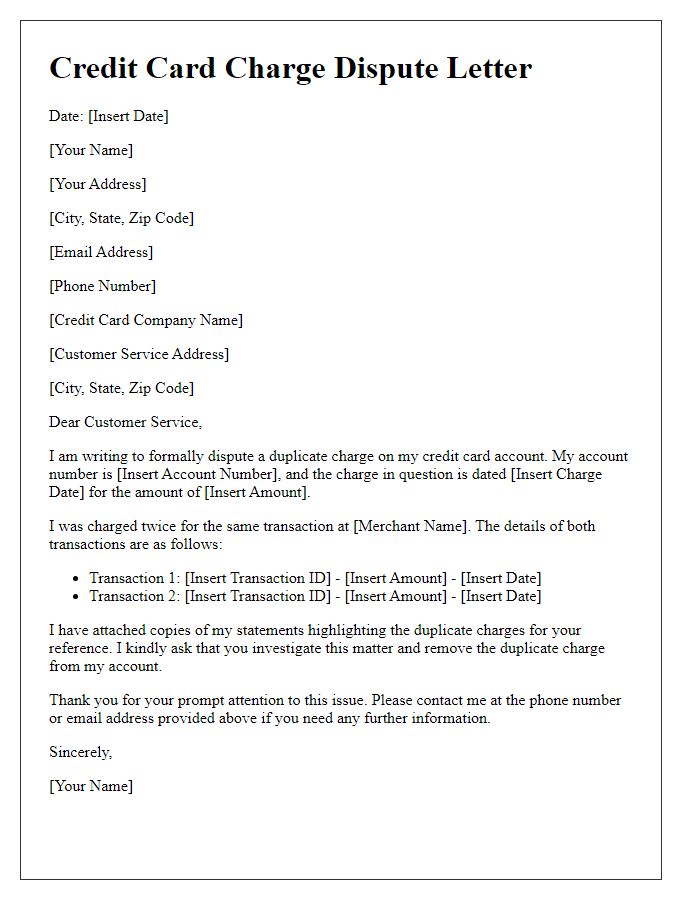

Letter template of credit card charge dispute for fraud protection claim

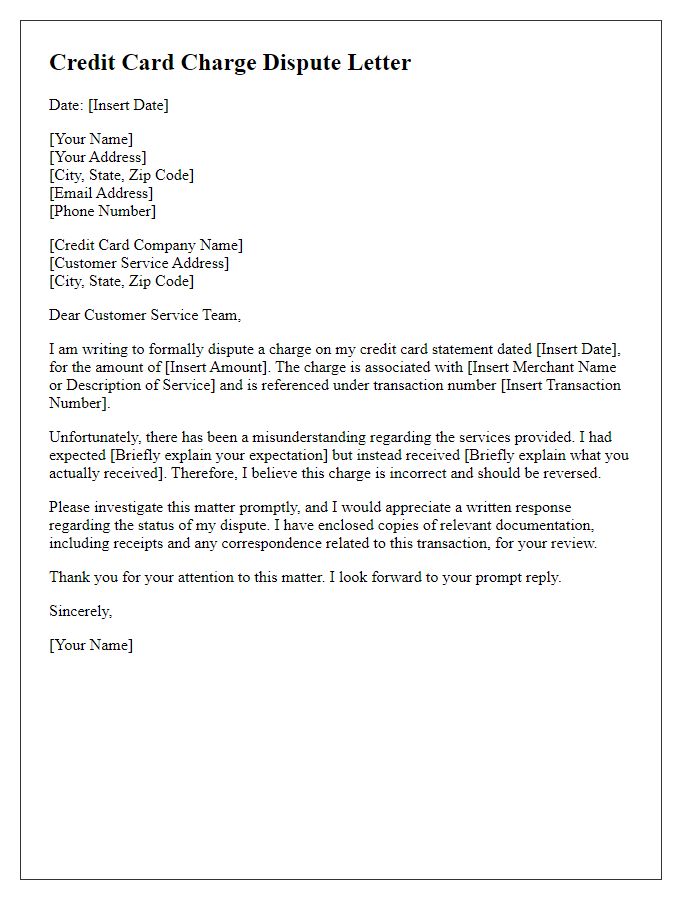

Letter template of credit card charge dispute for misunderstanding services

Comments