Hey there! We all know how managing a budget can sometimes feel like walking a tightrope. With unexpected expenses and financial commitments emerging, it's crucial to address any concerns head-on to ensure our financial health remains intact. In this article, we'll explore effective strategies for tackling budget-related issues while keeping your financial goals in sight. So, let's dive in and discover solutions together!

Clarity and Conciseness

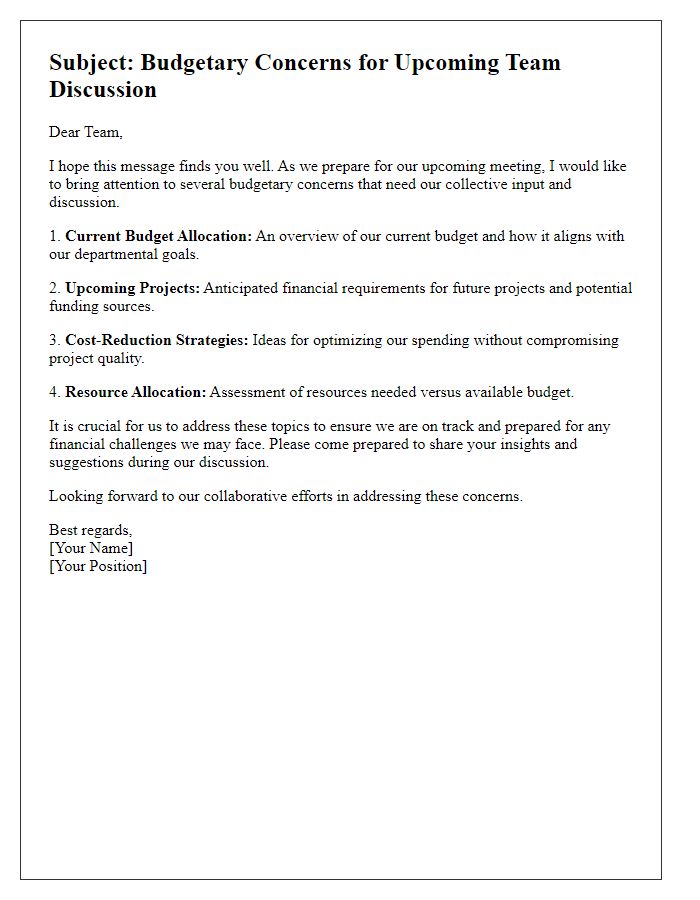

Budget constraints often hinder project execution and limit resource allocation in departments such as marketing or research and development. An annual financial review reveals a 15% decrease in funding compared to the previous year, impacting planned initiatives and operational capabilities. Transparent communication regarding available resources and projected outcomes is essential for stakeholders, including project managers and department heads. Addressing these concerns through clear budgeting strategies can enhance understanding and facilitate collaborative problem-solving, ultimately driving organizational efficiency and sustainability.

Specific Budget Details

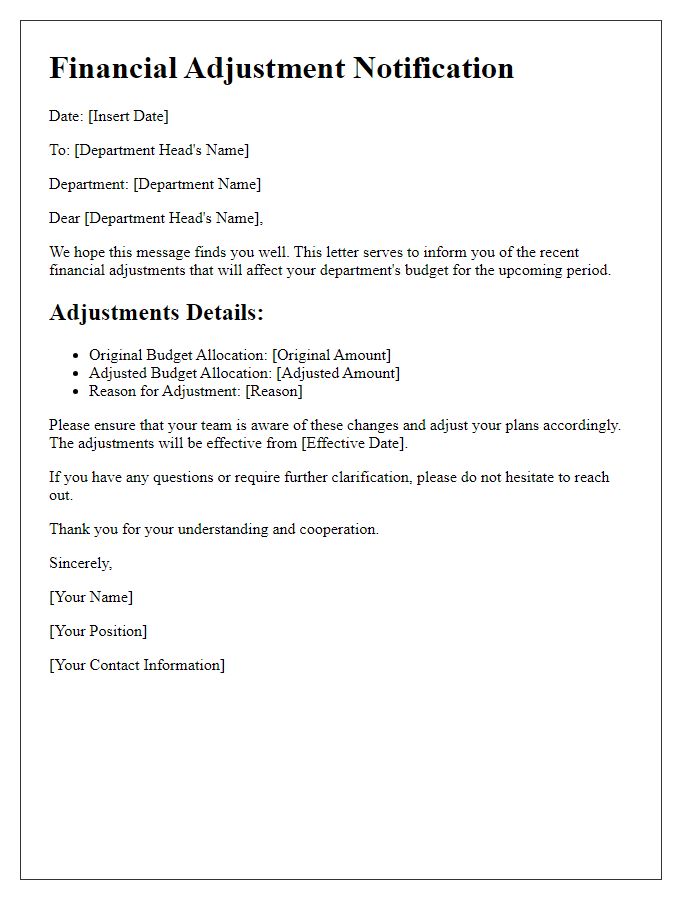

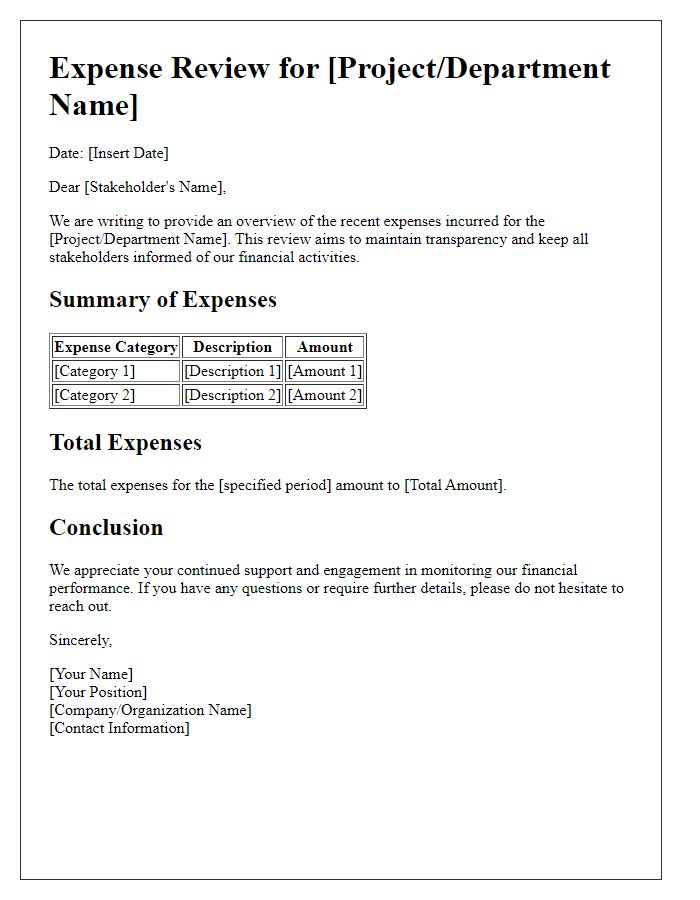

Budget constraints can significantly impact organizational operations, especially in large institutions such as universities or corporations. Limited financial resources, often outlined in detailed financial reports or spreadsheets, can hinder project funding and restrict personnel hiring. Additionally, specific budget items, such as salaries, operational expenses, and capital expenditures, must be prioritized based on departmental needs and strategic goals. Furthermore, budget reviews conducted quarterly by financial officers can reveal discrepancies or areas requiring adjustments, necessitating transparent communication about financial health and anticipated revenue streams, including grants or donations, to ensure sustainable growth and continuity in programs and services.

Justification for Concerns

Budget constraints can significantly impact operational efficiency in various sectors, including public and private organizations. A recent report from the National Bureau of Economic Research indicates that over 60% of organizations reported budget-related challenges in the fiscal year 2022. Insufficient funding can hinder project timelines, leading to delays in crucial initiatives such as technology upgrades or infrastructure enhancements. For example, a local government in California, facing a budget shortfall of $5 million, postponed necessary road repairs, affecting public safety and causing increased vehicle maintenance costs for residents. Staffing shortages may also arise due to budget cuts, impacting service delivery and employee morale. These factors underscore the critical importance of addressing budget concerns promptly to ensure sustainable growth and development.

Proposed Solutions or Adjustments

Budget constraints can significantly impact various sectors, including educational institutions, non-profit organizations, and corporate entities. Identifying areas for financial optimization requires evaluating current spending patterns, such as administrative expenses, employee salaries, and operational costs at an annual budget of $2 million. Proposed solutions may include reallocating funds towards essential programs while cutting back on non-essential expenditures, like travel budgets, which have accounted for 20% of spending in previous years. Implementing a temporary hiring freeze, particularly in departments that have shown overstaffing ratios, might save up to $150,000 annually. Additionally, exploring partnerships with local businesses for sponsorships or funding can create new revenue streams, thereby alleviating some financial pressure. Regular budget reviews and adjustments every quarter can ensure alignment with fiscal goals, maintaining the sustainability of essential services in the long run.

Professional and Respectful Tone

Budget constraints can significantly impact the operations of organizations and institutions, emphasizing the need for thorough financial planning and resource allocation. Addressing these concerns requires analyzing various factors, including projected revenues, expenses, and unexpected fluctuations in the market. For example, during economic downturns, funding sources such as government grants may decrease, causing a strain on essential services. Additionally, rising costs in materials and labor due to inflation can further challenge budgets. Careful examination of spending patterns alongside prioritization of necessary programs ensures better financial stability and continuity of operations over time. Stakeholder engagement in budget discussions can also bolster community support and transparency.

Comments