Are you feeling overwhelmed by the process of requesting prior authorization from your insurance company? You're not alone, as many people find navigating this aspect of healthcare daunting. Fortunately, having a well-crafted letter can make all the difference in securing the necessary approvals. In this article, we'll provide you with a template and tips to simplify your requestâread on to get started!

Patient Information

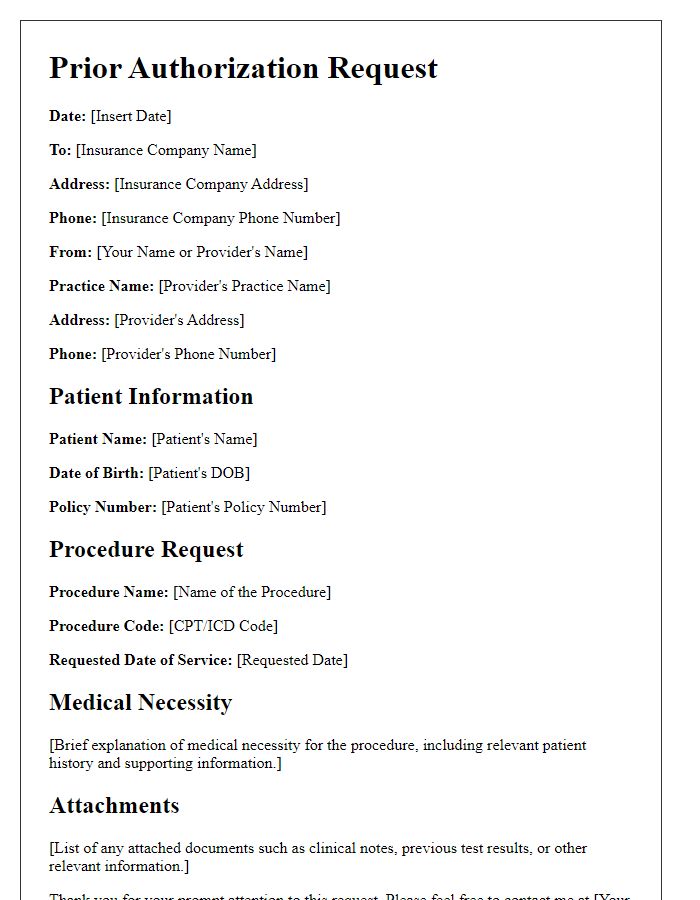

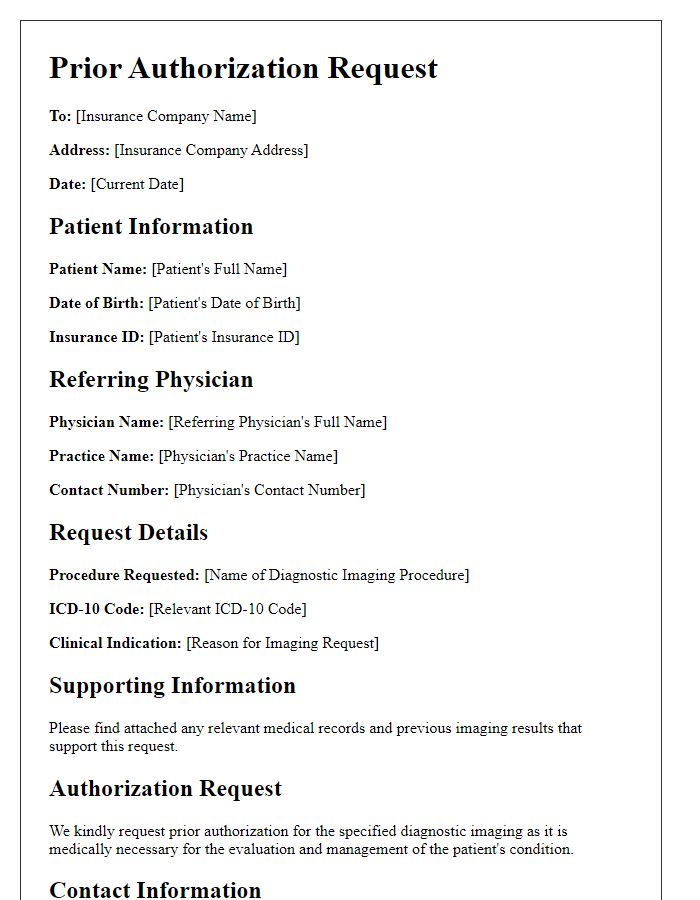

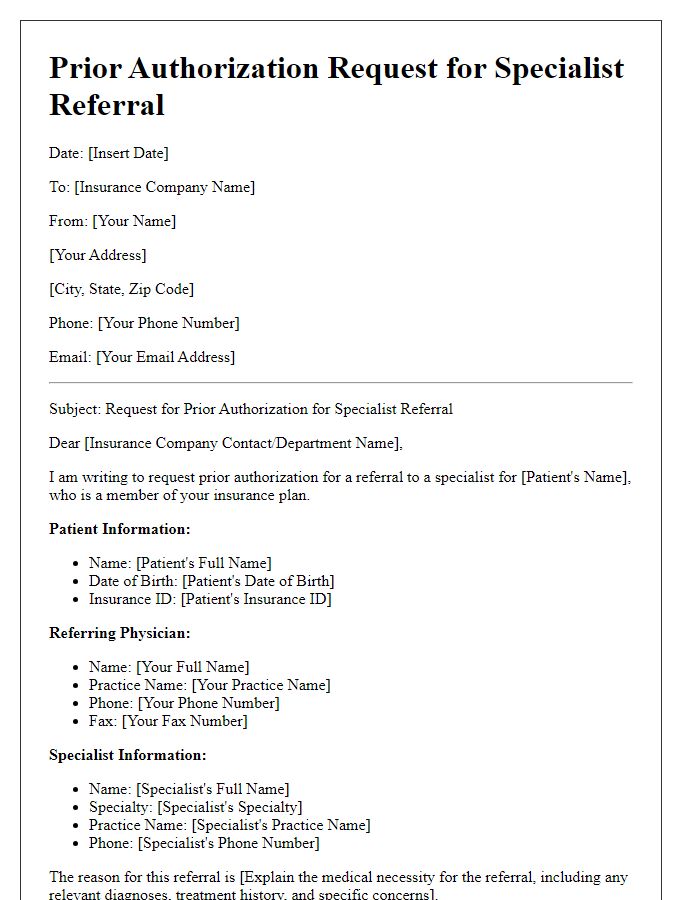

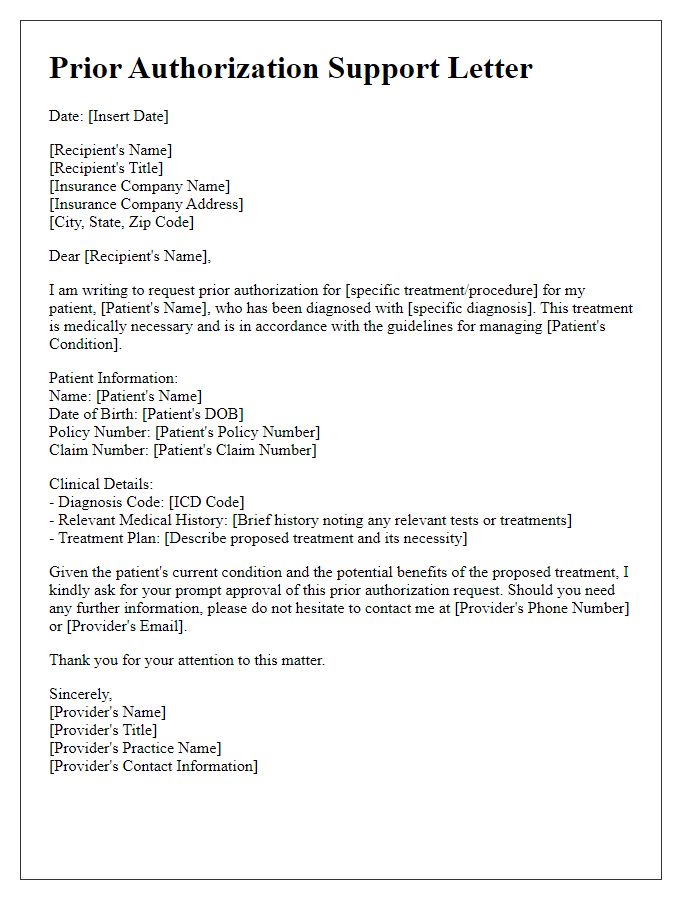

Requesting prior authorization from insurance companies often requires detailed patient information. Essential elements include the patient's name, such as John Smith, their date of birth, for example, January 15, 1985, and insurance details like policy number 123456789. Additional elements like the patient's contact information, including their phone number (555-123-4567) and address (123 Main St, Anytown, USA), are necessary. Medical history should highlight relevant conditions, such as type 2 diabetes diagnosed in 2020. The specific treatment requested, for instance, an MRI of the lumbar spine, must also be clearly outlined, along with the physician's name and contact information for follow-up on the authorization process.

Treatment/Procedure Details

Prior authorization requests are crucial for ensuring coverage for medical treatments or procedures. These requests often require detailed information, including treatment type (e.g., physical therapy, imaging procedures), specific diagnosis codes (such as ICD-10 codes), and provider details (including medical professionals or facilities involved). Conditions for which authorization may be necessary include preoperative assessments, high-cost medications, or specialized surgeries, which might require a comprehensive treatment plan outlining expected outcomes and alternatives. Additionally, insurance providers may require specific forms, verification of medical necessity, and supporting documentation such as previous treatment records or letters of medical necessity, which help establish the urgency and importance of the requested procedure or treatment.

Physician's Clinical Justification

In complex and challenging patient cases, obtaining prior authorization from insurance providers is crucial to ensure that necessary medical services are covered. Physicians often submit detailed clinical justifications outlining the medical necessity of specific treatments or procedures, such as MRI scans or surgical interventions. Key elements in these justifications include patient diagnosis codes (ICD-10), treatment history, and evidence-based guidelines that support the proposed interventions. For instance, a patient with a confirmed diagnosis of severe osteoarthritis (ICD-10 code M17.9) may require prior authorization for a total knee replacement surgery to alleviate chronic pain and improve mobility. Additionally, documentation such as imaging studies, lab results, and consultation notes strengthens the case for coverage by providing a comprehensive view of the patient's medical condition and the rationale behind the proposed care plan.

Supporting Documentation

Prior authorization requests can often hinge on the inclusion of supporting documentation to substantiate the medical necessity of a requested treatment or procedure. Essential documents may include clinical notes detailing the patient's medical history, diagnostic test results such as MRI or CT scans, and treatment plans that outline previous interventions. Specific forms, such as the insurance provider's prior authorization form (often available on their website), must be completed and submitted alongside the documentation. Additionally, relevant policy numbers, names of prescribing physicians, and the patient's insurance information are vital to ensure prompt review and approval. In some cases, peer-reviewed studies or literature that support the efficacy of the proposed treatment may also enhance the case for authorization.

Specific Insurance Policy Requirements

Obtaining prior authorization from insurance providers is crucial for securing coverage for specific medical treatments, procedures, or medications. Each insurance policy, such as those offered by Blue Cross Blue Shield or Aetna, may outline distinct requirements for prior authorizations. Documentation often must include patient information, medical necessity justification, procedure codes (like CPT codes), and physician credentials. Timely submission is vital, as approval processes can vary significantly; some may take several days, while others might be expedited for urgent requests. Following the specific guidelines laid out in each policy ensures compliance and aids in a smoother authorization process.

Letter Template For Requesting Prior Authorization From Insurance Samples

Letter template of insurance prior authorization request for medical procedure

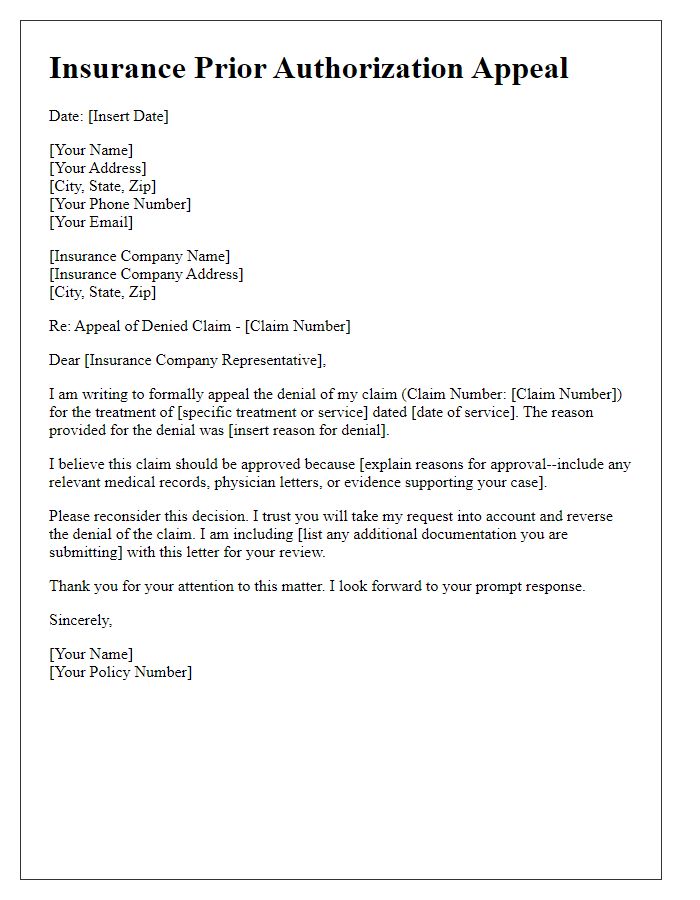

Letter template of insurance prior authorization appeal for a denied claim

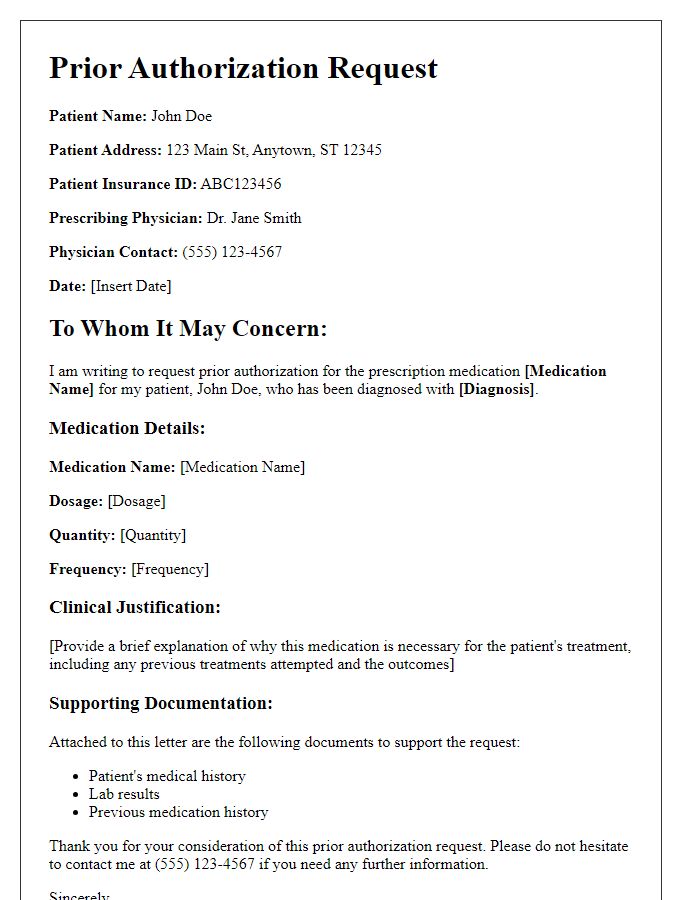

Letter template of prior authorization request for prescription medication

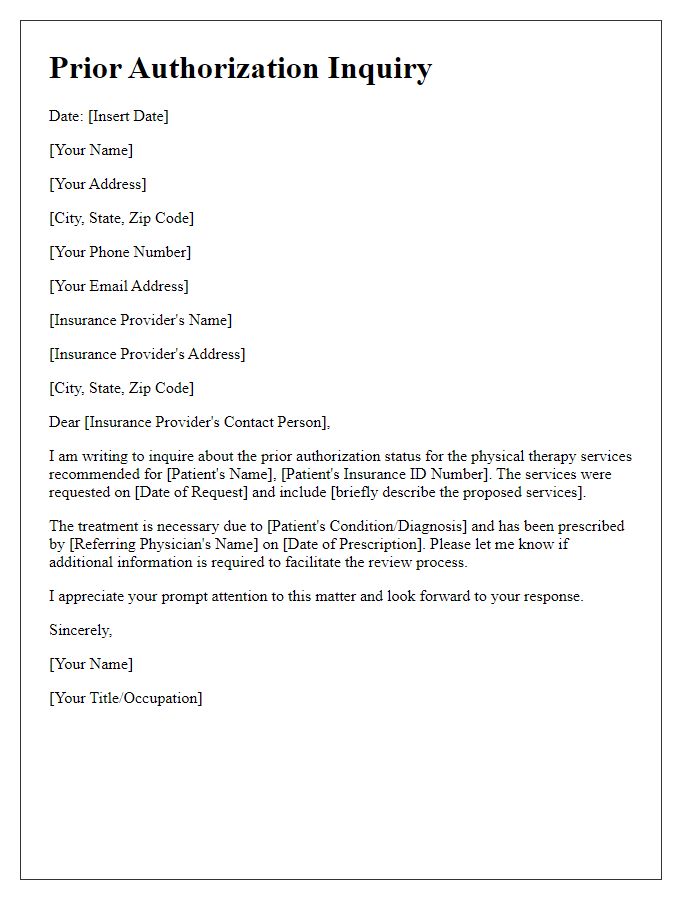

Letter template of prior authorization inquiry for physical therapy services

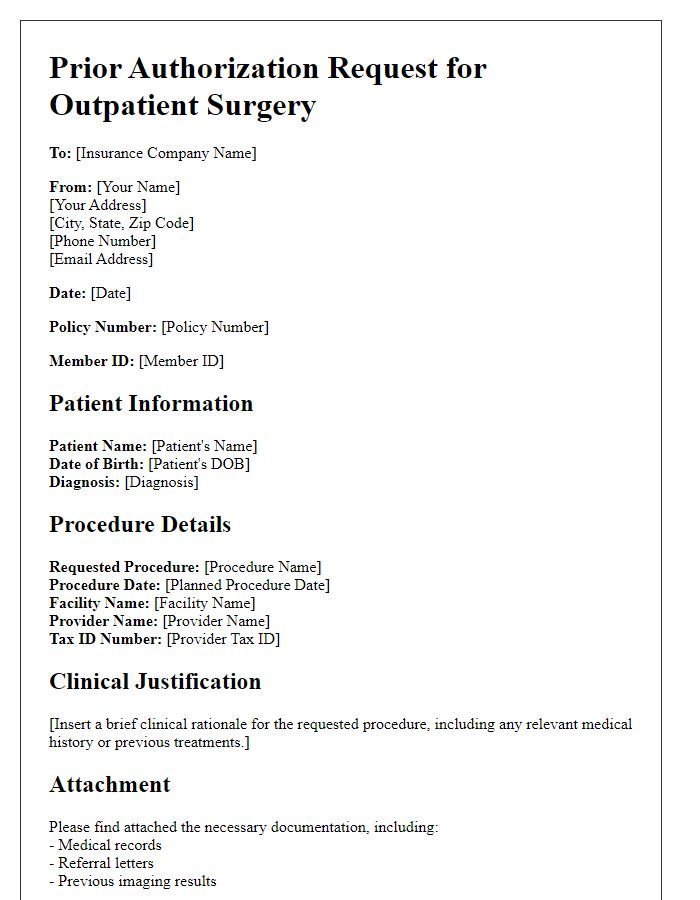

Letter template of insurance prior authorization request for outpatient surgery

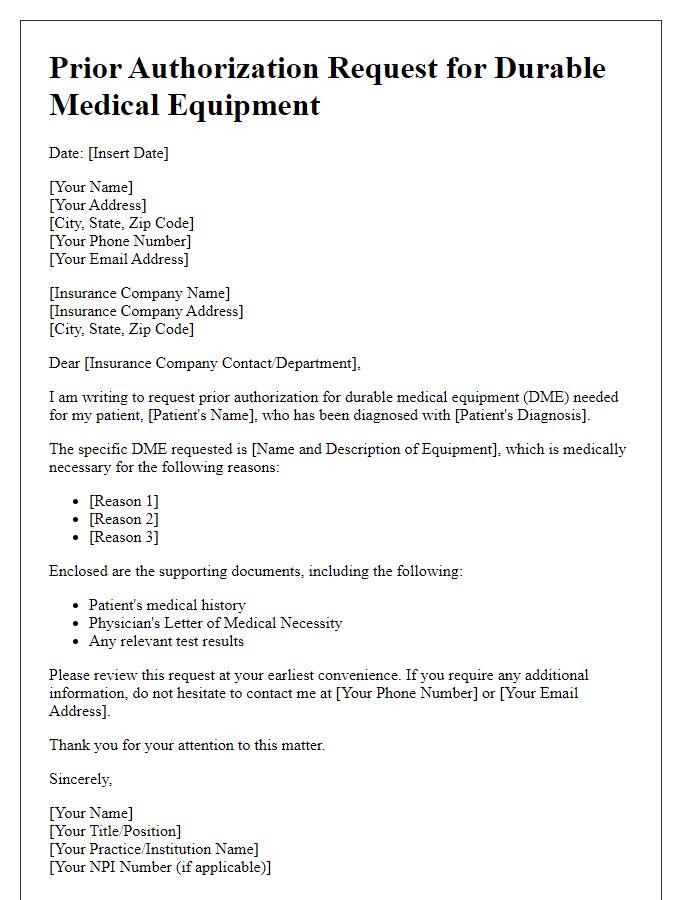

Letter template of insurance prior authorization for durable medical equipment

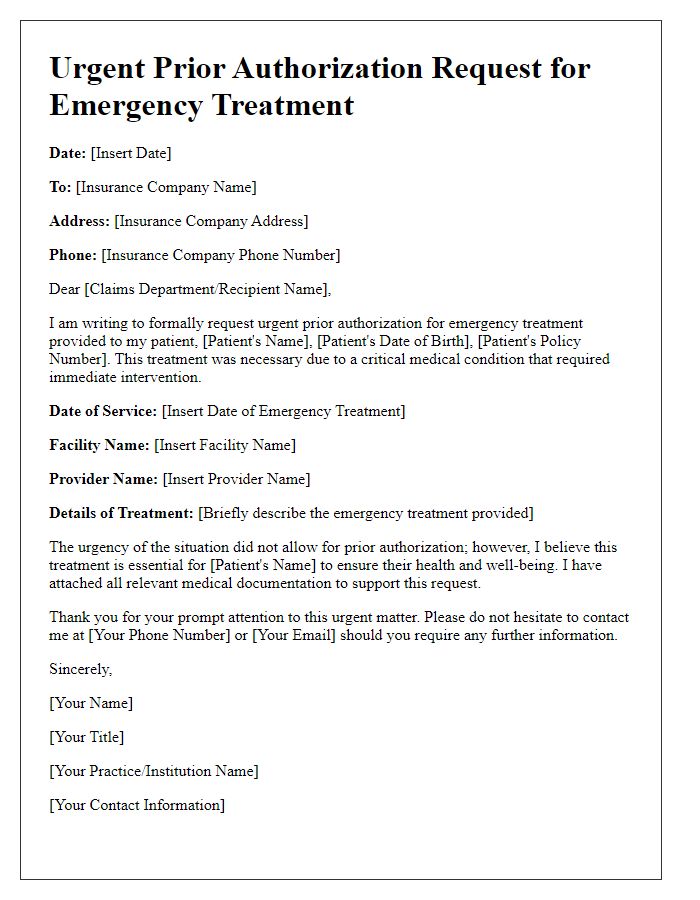

Letter template of urgent prior authorization request for emergency treatment

Comments