Are you feeling overwhelmed trying to navigate family health premiums? It's a common challenge for many, as understanding the intricacies of health coverage can be quite confusing. This article aims to simplify the process and provide you with essential insights on how to obtain the best premium details for your family's health needs. So, if you're ready to demystify family health premiums, keep reading for valuable tips and resources!

Personal Identification Information

Navigating the intricacies of health insurance policies can often feel overwhelming. Acquiring details regarding family health premiums typically involves specific personal identification information, such as Social Security numbers (nine digits) and birth dates (MM/DD/YYYY format). Family health insurance plans, offered by entities like Blue Cross Blue Shield and Aetna, often highlight key specifics regarding eligibility requirements and premium costs based on the coverage tier, which may range from individual to family options. Understanding these premiums, which might fluctuate based on factors like income and pre-existing conditions, ensures a competent approach when managing health-related finances.

Policy Number and Plan Details

To obtain family health premium details, including specific information about the policy number and plan details, it is essential to contact the insurance provider directly. Family health insurance plans typically encompass various coverage types, such as in-patient treatment, outpatient services, and preventive care, often tailored to specific demographics (e.g., age, region). Policy details usually include the total premium amount, individuals covered under the plan, and any applicable exclusions. Requesting this information from the company can clarify essential aspects like co-payment percentages, coverage limits per family member, and the extent of coverage in specific health facilities, such as hospitals and clinics. Always mention the policy number provided at enrollment for accurate assistance.

Specific Information Requested

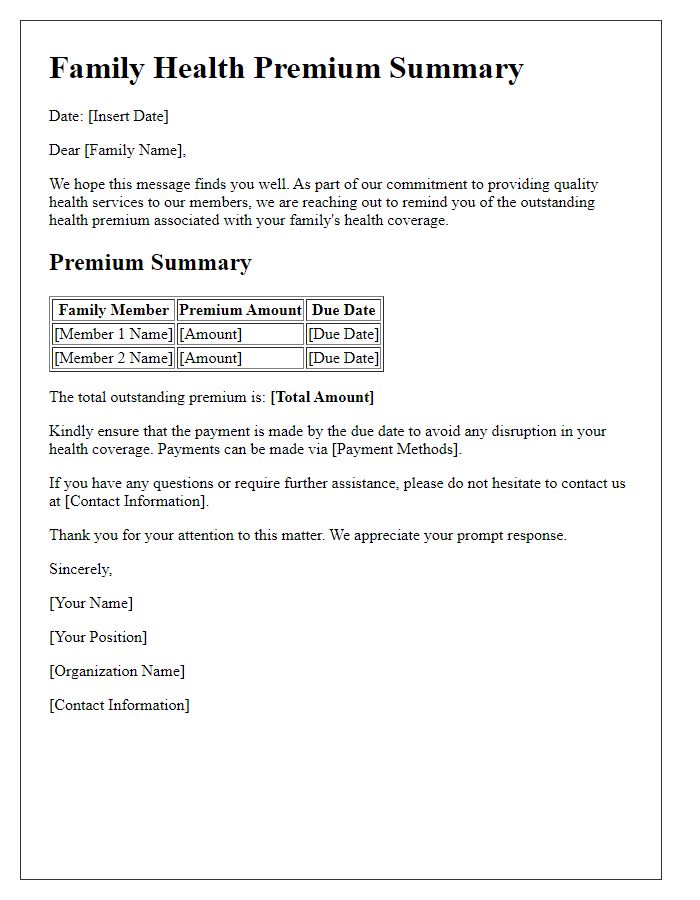

Obtaining family health premium details is essential for understanding insurance coverage. Families often seek information on specific policy premiums, which typically range from $300 to $1,500 per month, depending on factors such as location, coverage level, and insurer. Additionally, details regarding copayments, deductibles, and out-of-pocket maximums are crucial for evaluating financial responsibilities. It's important to consider variations between plans offered by providers, including major companies like Blue Cross Blue Shield and Aetna. Understanding these elements can help families make informed decisions about their healthcare options and budgeting for medical expenses.

Contact Information

Contacting your health insurance provider to obtain family health premium details is crucial for understanding coverage costs. Begin with your provider's customer service hotline, which typically operates during business hours, available on their official website. Provide personal identifiers such as your policy number and family member names for precise assistance. Additionally, consider submitting an inquiry through their secure messaging platform, often accessible through a member portal. If necessary, visit local offices for in-person consultations regarding premium breakdowns and family plan options.

Response Deadline and Follow-up Request

Subject to the health insurance provider's policies, timely access to family health premium details is essential for informed decision-making. Families rely on this information, especially for plans such as Affordable Care Act (ACA) compliant insurance that spans multiple states like California or Texas, where costs can vary significantly. It's crucial to request these premium details promptly, noting that the industry standard response deadline is often within 14 business days. In addition, if the requested information is not provided, following up through official channels (such as customer service hotlines or dedicated email addresses) can help expedite the process, ensuring families have necessary information to budget effectively for their healthcare coverage.

Letter Template For Obtaining Family Health Premium Details Samples

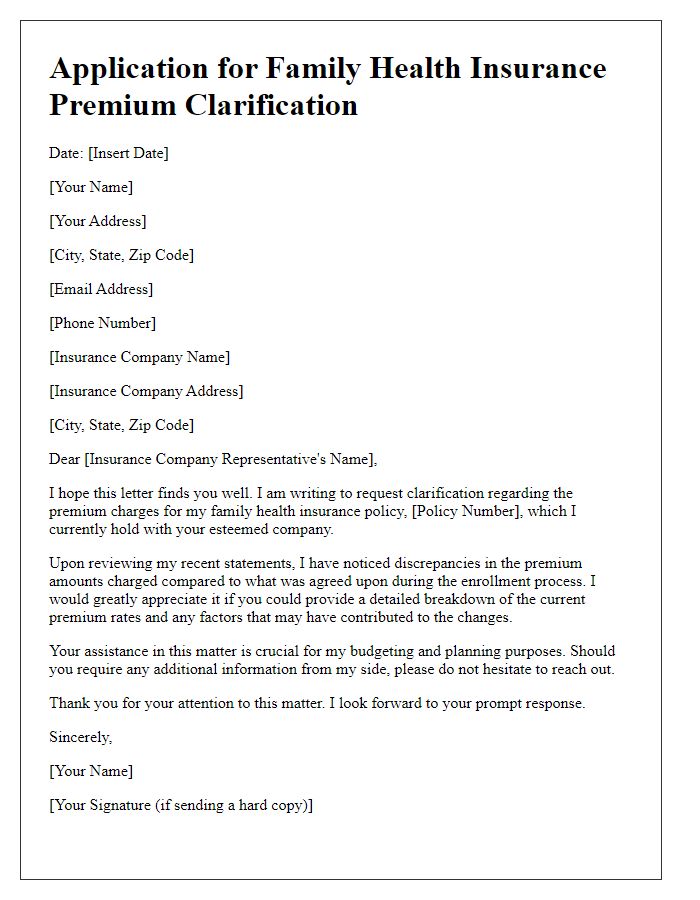

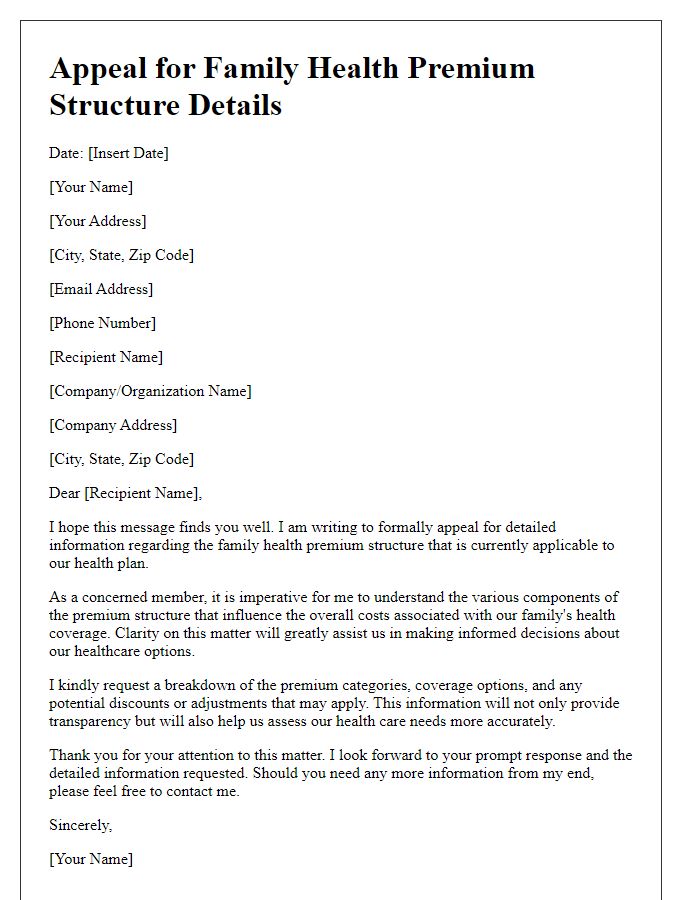

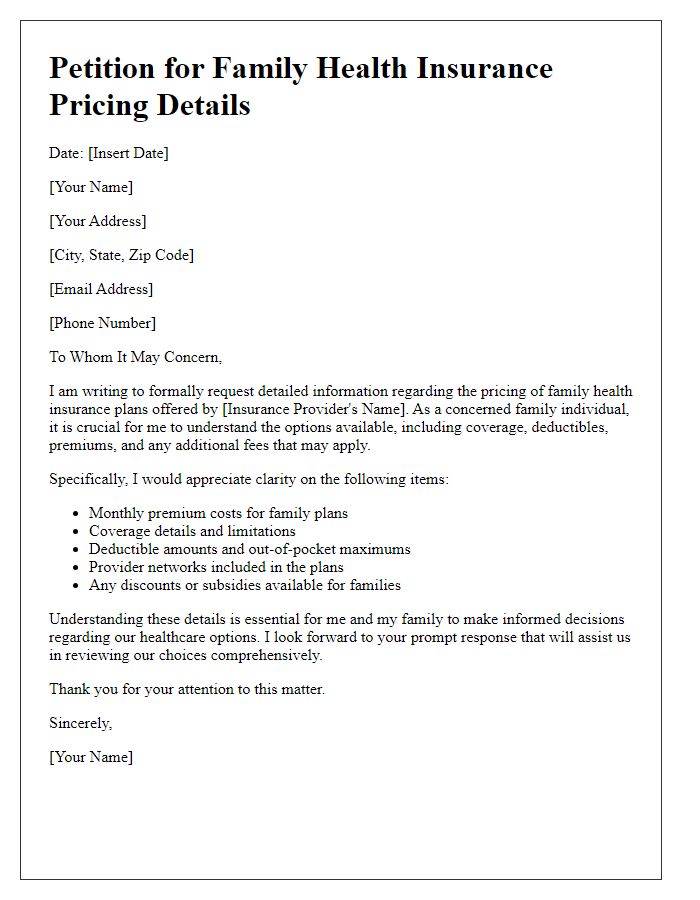

Letter template of application for family health insurance premium clarification

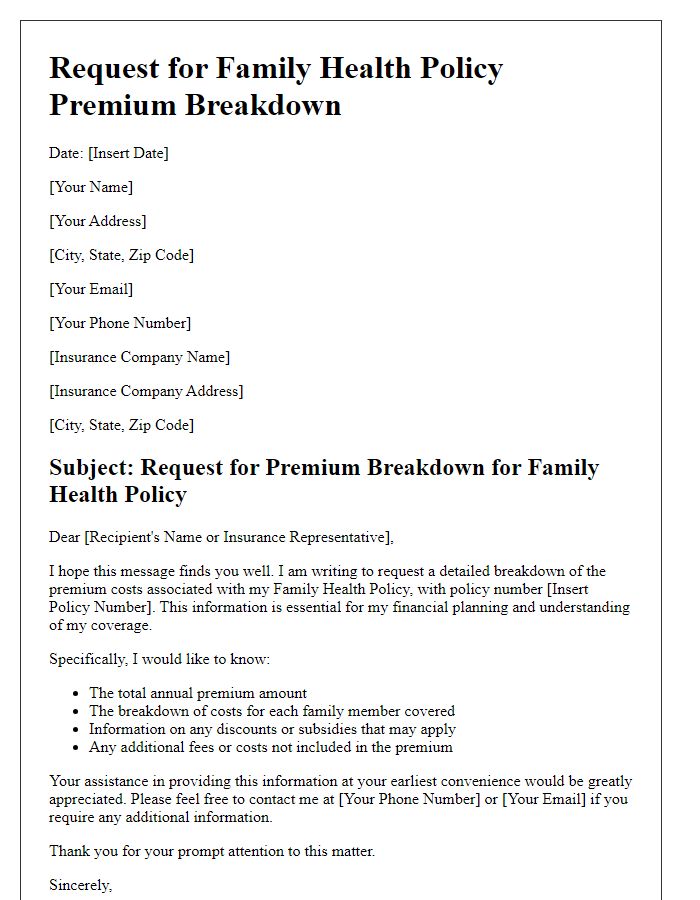

Letter template of solicitation for family health policy premium breakdown

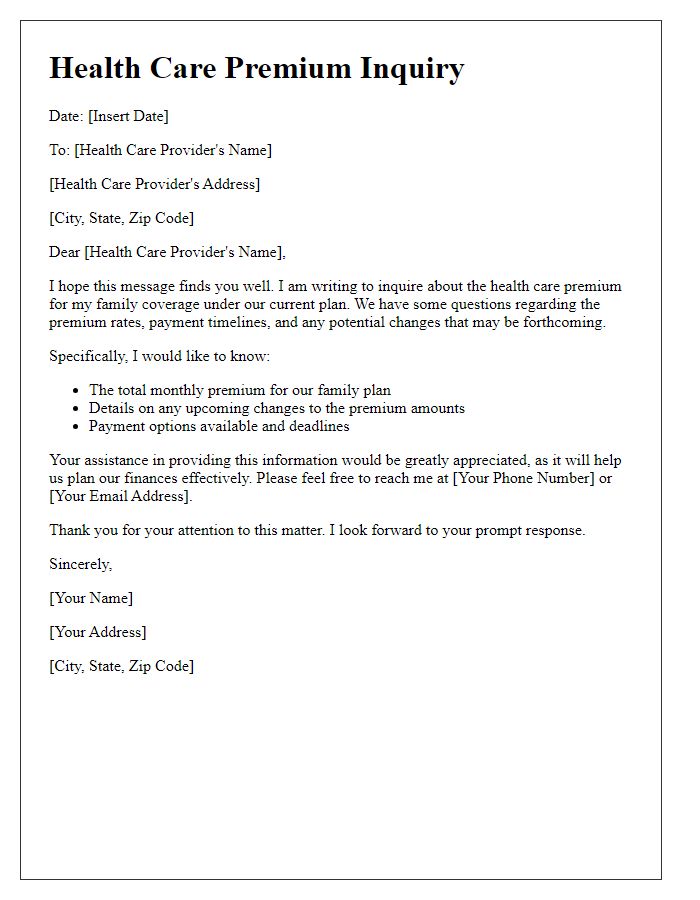

Letter template of correspondence for family health care premium inquiries

Letter template of notification request for family health coverage payment details

Comments