Are you ready to navigate the sometimes confusing waters of health insurance changes? If you've recently switched plans or providers, it's essential to inform your contacts about your new health coverage to avoid any hiccups down the road. In this article, we'll provide a simple and effective template for notifying others of your change in health insurance. So, let's dive in and explore how you can ensure everyone stays in the loop!

Policyholder's personal details

Health insurance policyholders must remain informed about their coverage and any changes related to their policy. Adequate notification about a change in health insurance coverage is crucial. Personal details, including the policyholder's name, date of birth, address, and contact information, should be clearly stated. These details help ensure the correct identification of the policy in question. The notice might also reference the policy number and the previous health plan provider as a means of contrasting it with the new insurance plan. Additionally, the effective date of the new policy should be noted to avoid any lapses in coverage. The notice could also provide essential details about new benefits, premiums, and claims processes to facilitate a smooth transition.

New insurance plan details

Health insurance transitions require clear communication regarding new policy details. Affected individuals, such as employees or policyholders, should be notified about the essential aspects of the new plan. The insurance provider, a critical entity in this context, must specify coverage levels, monthly premiums, deductibles, and out-of-pocket maximums in the notification. For instance, a monthly premium of $300 with a $1,500 deductible can significantly impact financial planning. Also, clarify in-network providers, essential for accessing medical services without incurring excessive costs. Important dates, such as the start date of the new plan, must be prominently highlighted to ensure all stakeholders understand enrollment timelines and any required actions.

Effective date of change

Effective date of change in health insurance can significantly impact individuals and families. Health plans, such as PPOs (Preferred Provider Organizations) and HMOs (Health Maintenance Organizations), often have specific effective dates that determine when coverage begins. Typically, changes in health insurance can take place during open enrollment periods or due to qualifying life events, such as marriage, childbirth, or job changes. For instance, enrolling in a new employer-sponsored health plan could result in an effective date of January 1st, immediately following the end of the previous coverage. It's crucial for members to understand their new policy details, including deductibles, copayments, and network providers, as these factors can influence healthcare access and expenses. In many cases, notifying healthcare providers and pharmacies about the new insurance coverage allows for seamless medical service transition and prescription management.

Contact information for inquiries

Notifying employees about changes to health insurance policies is crucial for maintaining clear communication. The company's human resources department will handle all inquiries regarding this update. For any questions or clarifications, employees can reach out via email at hr@companyname.com or call the HR hotline at (555) 123-4567, available Monday to Friday from 9 AM to 5 PM. Regular updates will be posted on the employee portal to ensure everyone remains informed about their healthcare options and any relevant deadlines.

Instructions for updating records

Health insurance policy changes mandate meticulous record updates to ensure continued coverage and compliance. Policyholders must inform their insurance provider, such as Anthem or Blue Cross Blue Shield, with relevant details including the effective date of the new plan, specific coverage adjustments, and any alterations in premium amounts. Documentation such as the policy number, individual identification details, and communication preferences should be included to facilitate seamless processing. Additionally, clients need to verify listed providers against the new network to prevent potential disruptions in care services, particularly for specialized treatment plans or ongoing prescriptions. Timely notification is crucial, ideally within 30 days of the change, to maintain uninterrupted benefits.

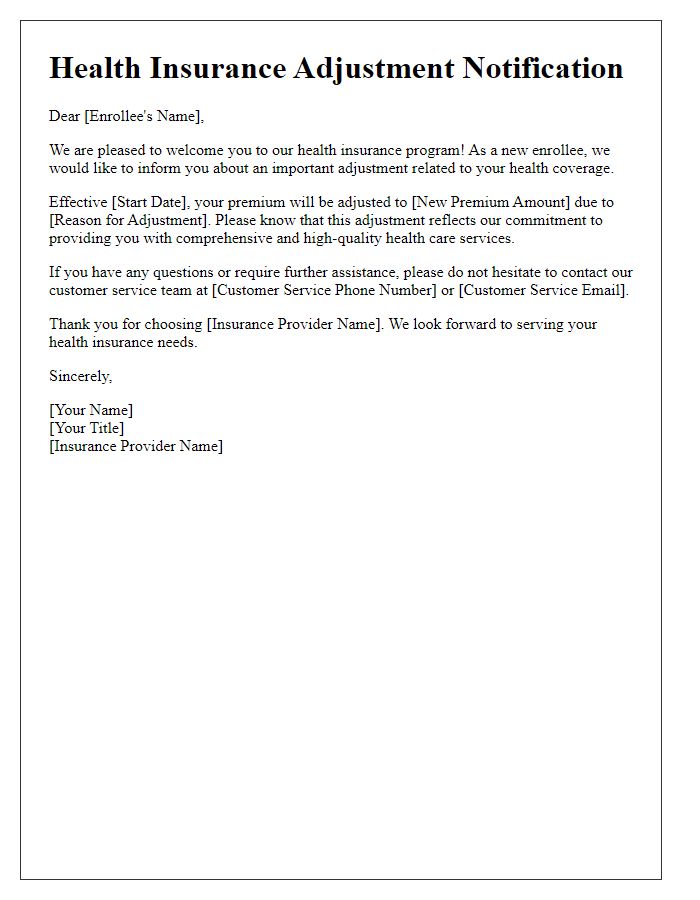

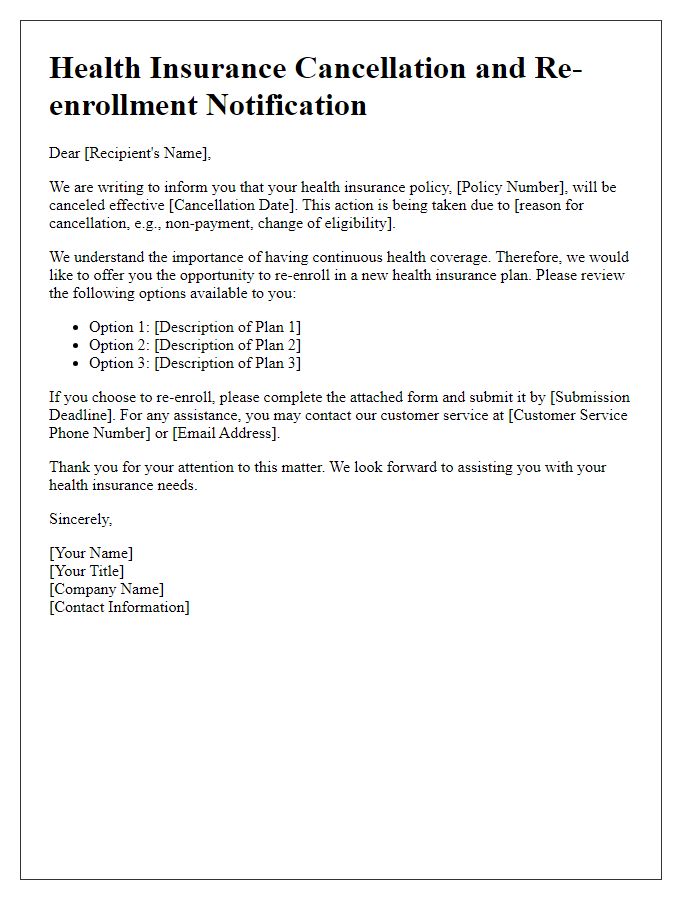

Letter Template For Notifying Change Of Health Insurance Samples

Letter template of health insurance modification for self-employed individuals

Letter template of health insurance plan change announcement for students

Letter template of health insurance provider switch notification for individuals

Letter template of health insurance policy change notice for business partners

Comments