Are you looking to extend your dental coverage but aren't quite sure how to ask for it? You're not alone; many people find themselves needing to navigate the tricky waters of insurance requests. Crafting a clear and polite letter can make all the difference in securing the coverage you need for those pearly whites. Let's explore how to effectively communicate your request and ensure you get the best possible outcome!

Personal Information

The request for dental coverage extension can stem from various circumstances, such as ongoing treatment or changes in personal circumstances. Specific details about the coverage, like policy number and previous benefits, are crucial for clarity. This extension often requires documentation including treatment plans from dental professionals, emphasizing the need for continued coverage due to ongoing procedures. Identifying the insurance company name and contact information for processing ensures a streamlined approach. Clearly stating the desired extension period, for example, an additional six months, assists in evaluating the request efficiently, ensuring comprehensive dental care continuity.

Policy Details

Dental coverage extensions can greatly assist in managing oral health needs under various insurance policies. Policy details usually include specific coverage limits, such as maximum benefit amounts per year, which typically range from $1,000 to $2,000 depending on the plan. Additionally, policies often outline procedures covered, including preventive treatments like cleanings and diagnostics, restorations such as fillings, and major work like crowns and bridges. Insurers may set waiting periods for certain procedures, often lasting six to twelve months. Furthermore, co-pays or coinsurance percentages, which might be 20% for basic services and 50% for major services, affect overall costs. Seeking an extension may hinge on demonstrating the necessity of ongoing coverage due to unforeseen dental expenses or chronic conditions, ensuring continued access to essential treatments.

Reason for Extension

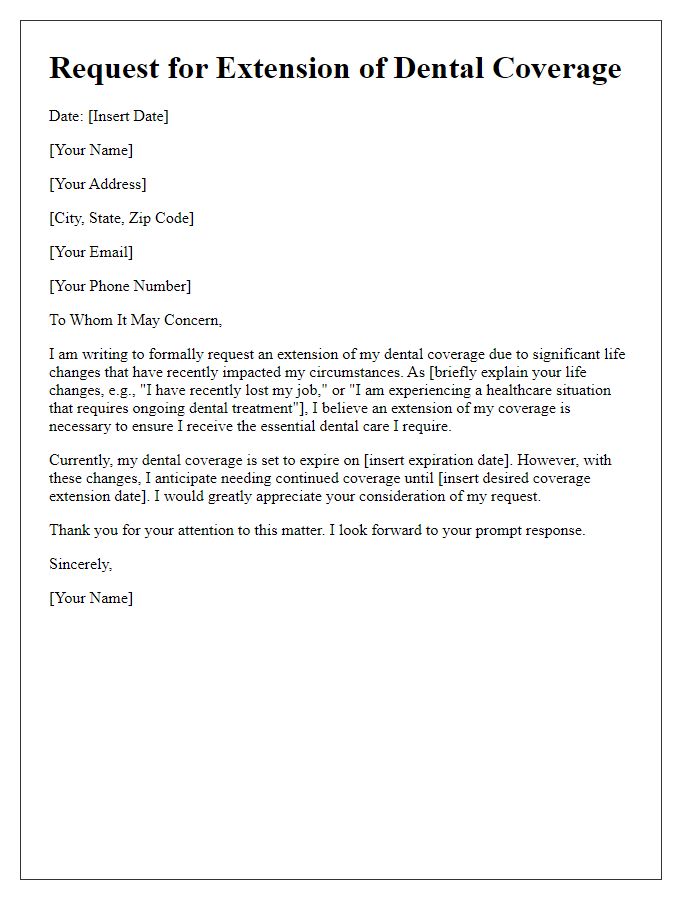

Dental coverage extensions can provide necessary support to individuals facing unexpected medical situations. For instance, unforeseen dental issues like severe tooth decay or gum disease may require ongoing treatment beyond the original coverage period. Patients may also encounter costly procedures such as root canals or dental implants, which often exceed standard coverage limits. Moreover, events like job loss or transition periods can lead to lapses in insurance, necessitating an extension to ensure continuous access to essential dental care. Rather than compromising oral health due to financial constraints, acquiring an extension can facilitate timely treatment and promote overall well-being.

Justification and Supporting Documents

Dental coverage extension requests often stem from various circumstances impacting individuals' ability to maintain regular dental care. In cases of prolonged illness, unexpected job loss, or significant life events such as pregnancy, accessing continued dental services is essential for overall health. Supporting documents might include medical records indicating treatment needs, termination letters from employers detailing loss of benefits, or pregnancy documentation showing the necessity for regular check-ups and care. Providing clear justifications along with these documents can strengthen the request for extending dental coverage, ensuring individuals maintain necessary dental health during challenging times.

Contact Information

Many individuals may seek a dental coverage extension to maintain their oral health, particularly in cases where prior coverage has lapsed. Dental insurance providers, like Delta Dental, frequently offer varying coverage plans that cover essential services, including routine exams, cleanings, fillings, and more complex procedures such as root canals or orthodontic treatments. These plans often specify waiting periods and annual limits, which may leave individuals vulnerable to high out-of-pocket costs for necessary treatments. Patients should be prepared to provide personal information, including their policy number and any relevant documentation, to facilitate the extension request process, ensuring direct communication with the insurance representative. Proper understanding of the specific terms and conditions of the insurance coverage is vital in order to navigate this process effectively.

Letter Template For Requesting Dental Coverage Extension Samples

Letter template of dental coverage extension request due to acute health needs.

Letter template of dental coverage extension request for ongoing treatment.

Letter template of dental coverage extension request for special circumstances.

Letter template of dental coverage extension request for orthodontic care.

Letter template of dental coverage extension request for dependent family member.

Letter template of dental coverage extension request due to financial hardship.

Letter template of dental coverage extension request for preventive services.

Letter template of dental coverage extension request related to a chronic condition.

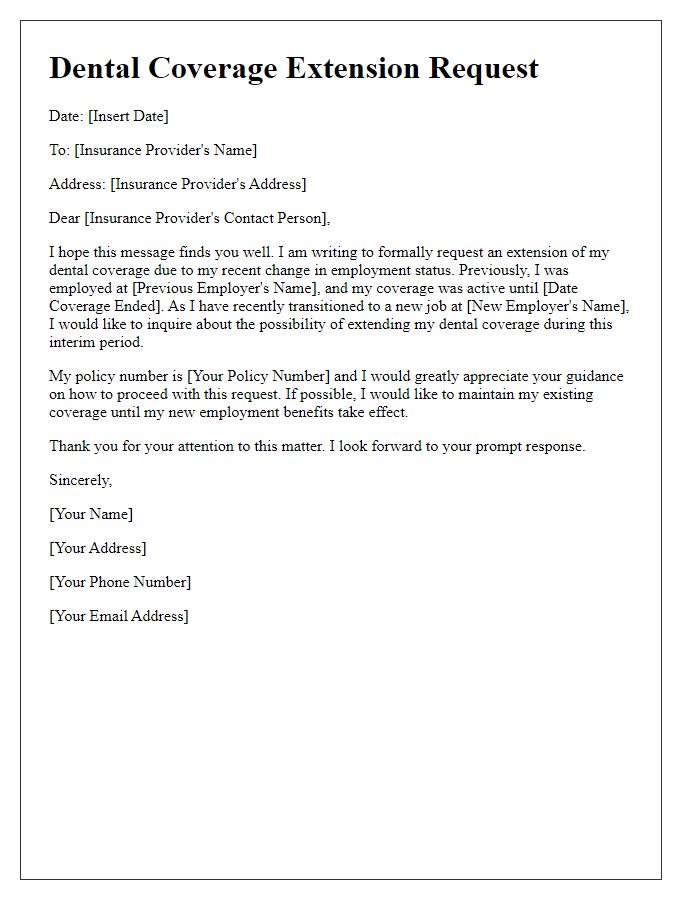

Letter template of dental coverage extension request for new employment status.

Comments