Are you seeking to confirm your nonprofit status but unsure where to start? Crafting a clear and concise letter that outlines your organization's mission and compliance with IRS regulations is crucial. In this article, we'll walk you through a step-by-step template that simplifies the process, ensuring you communicate effectively with your stakeholders. So, grab a cup of coffee and read on to empower your nonprofit journey!

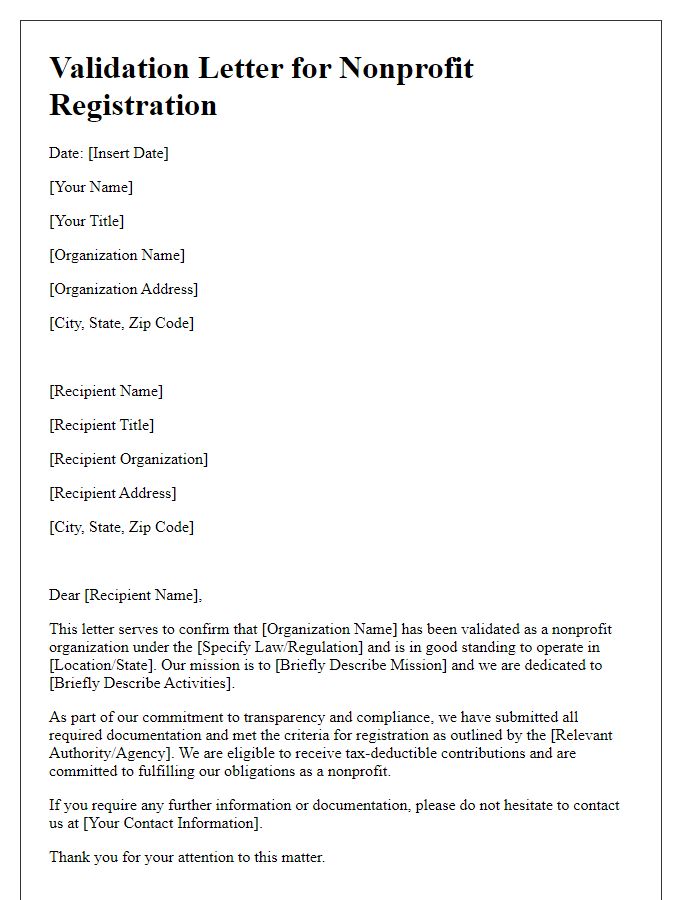

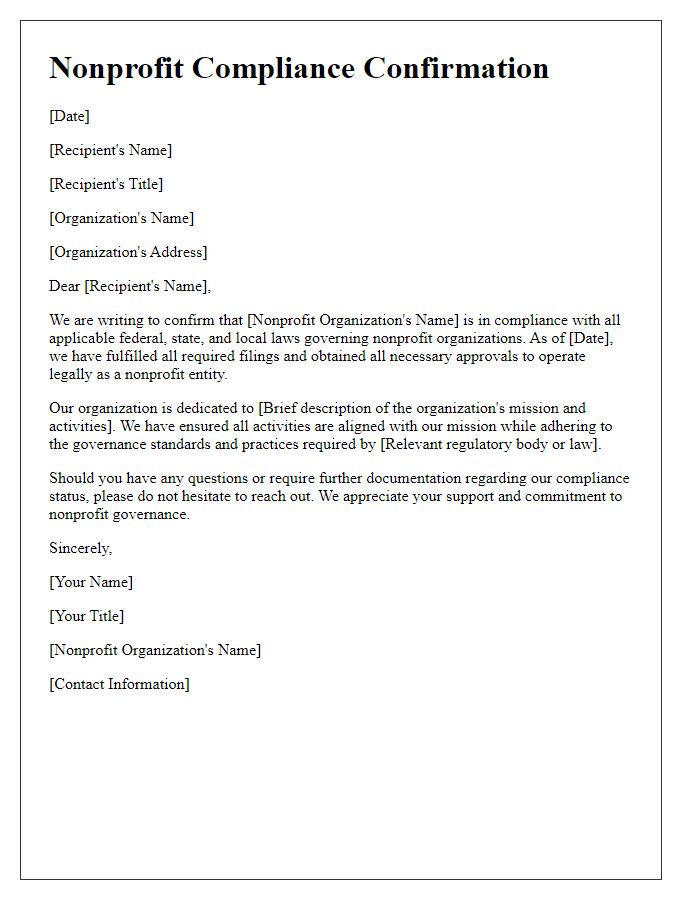

Organization Name and Contact Information

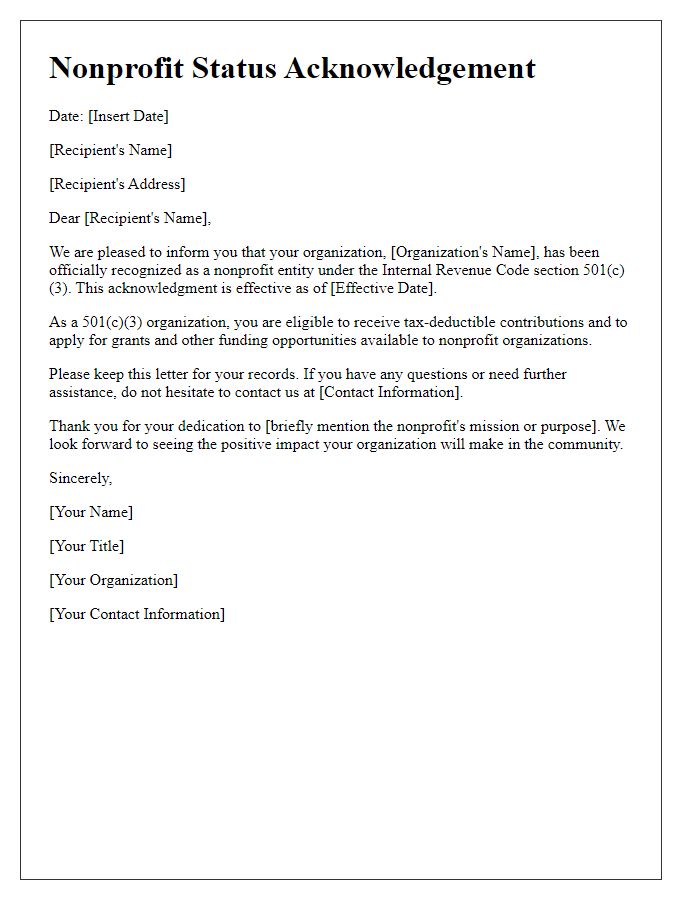

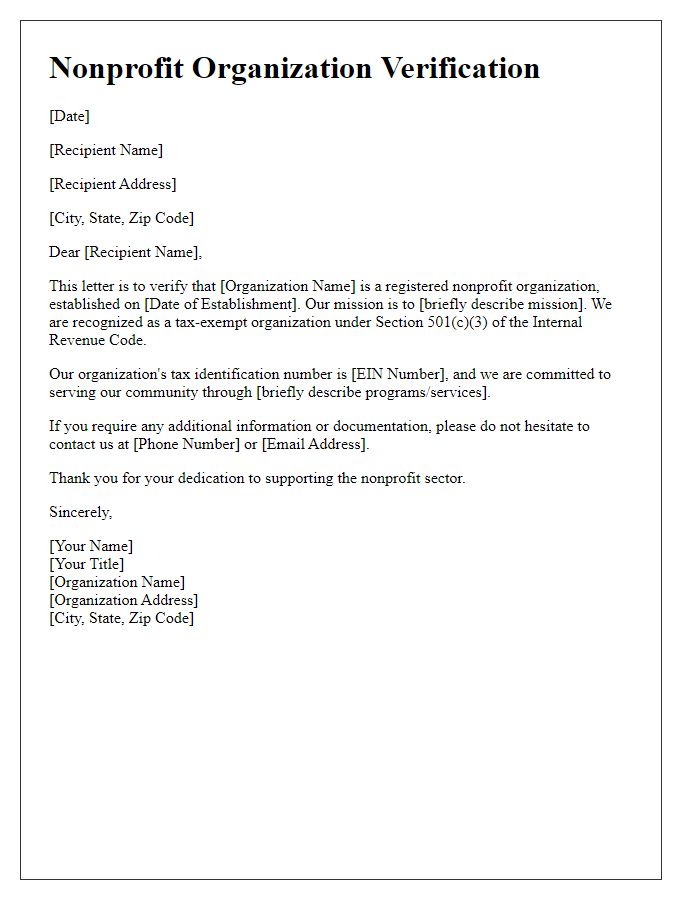

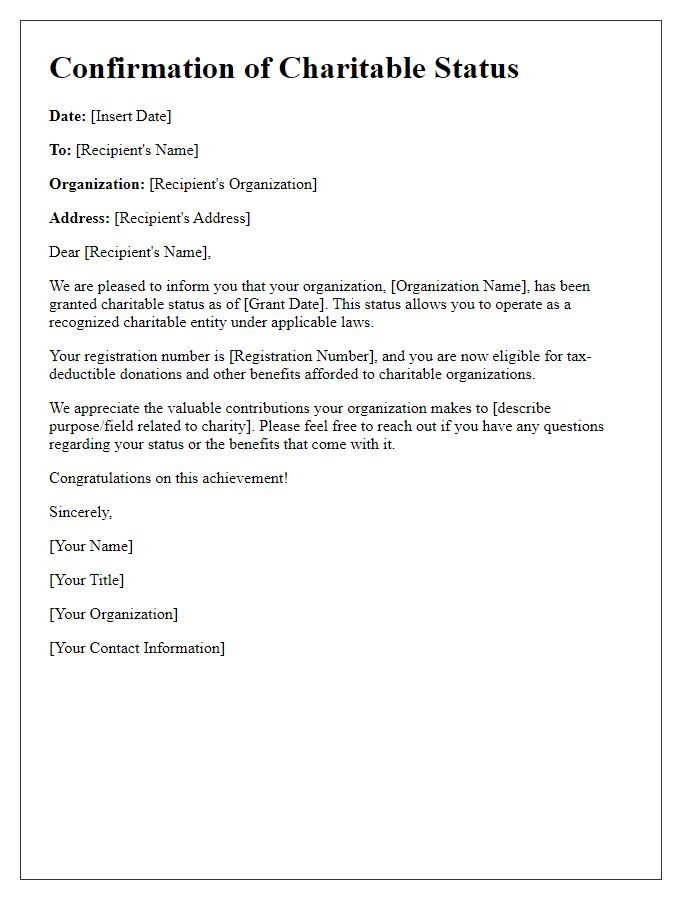

Nonprofit organizations often seek confirmation of their status for various purposes. Essential elements include the organization's name, ensuring clear identification. Contact information such as address, phone number, and email is vital for communication efficiency. Additionally, the confirmation letter might reference specific details like the date of IRS approval and tax identification number, which can be important for grants or funding applications. Verification of nonprofit status facilitates eligibility for tax exemptions and increases credibility with donors and the community. Organizations may also need to include their mission statement or key initiatives to highlight their purpose and impact.

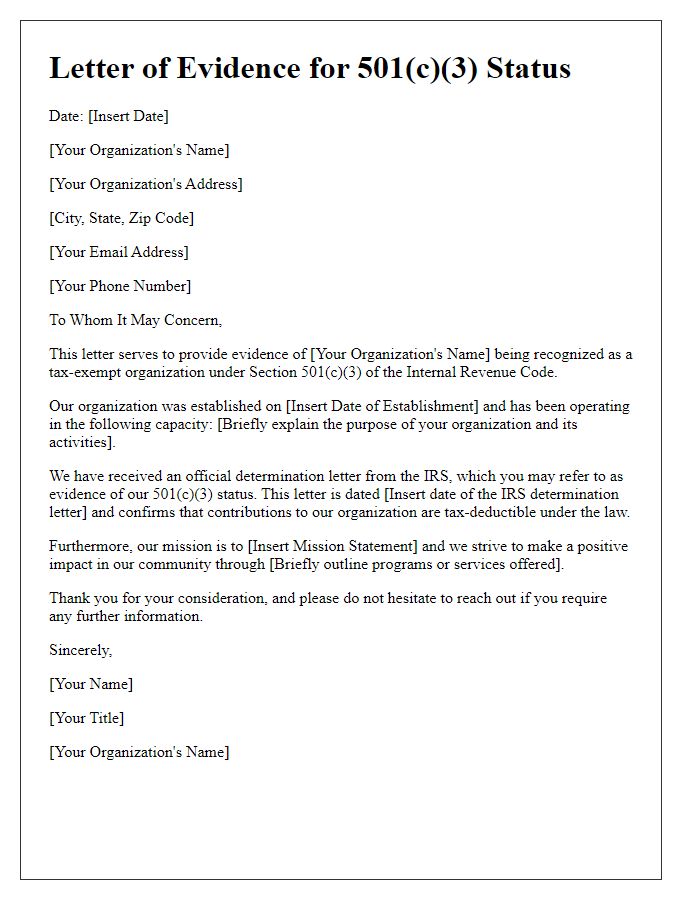

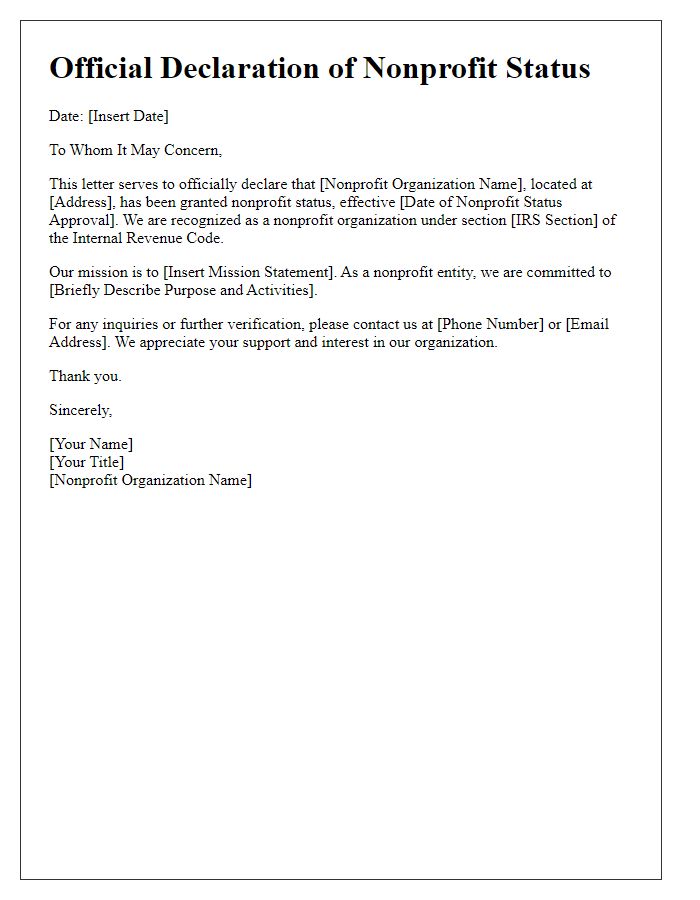

IRS Determination Letter Reference

Nonprofit organizations seeking IRS tax-exempt status must receive an IRS Determination Letter, which officially confirms their eligibility as a 501(c)(3) status. This letter is crucial for confirming the organization's exemption from federal income taxes and enabling donors to claim tax deductions for contributions made. The IRS Determination Letter typically includes the organization name, Employer Identification Number (EIN), and effective date of exemption. Nonprofits often need this letter to apply for grants, open bank accounts, and reassure stakeholders of their compliant status according to the Internal Revenue Service regulations. Failure to present this documentation could hinder an organization's funding opportunities and credibility in the nonprofit sector.

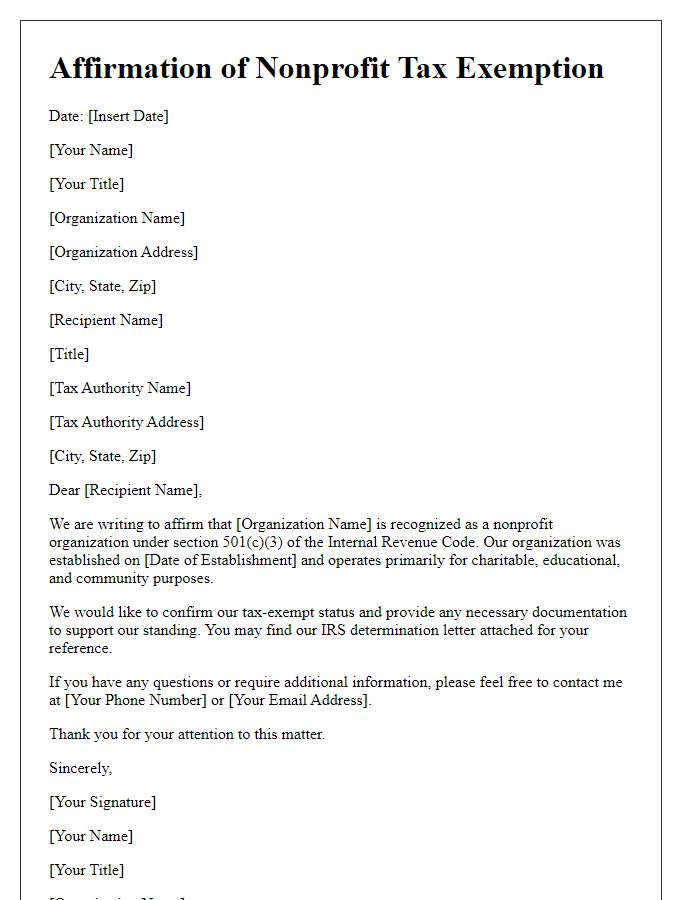

Tax-Exempt Status Verification

Nonprofit organizations must maintain their tax-exempt status under the Internal Revenue Code, specifically Section 501(c)(3). To confirm this status, they often require a verification letter from the IRS, which includes the organization's Employer Identification Number (EIN), the date of tax exemption approval, and the specific section under which the exemption is granted. Organizations should also ensure compliance with annual filing requirements (Form 990) to retain tax-exempt status. Documentation of donations received during the fiscal year can further substantiate their ongoing commitment to charitable activities. Such verification is crucial for eligibility to receive tax-deductible contributions, essential for sustaining nonprofit operations and funding community programs.

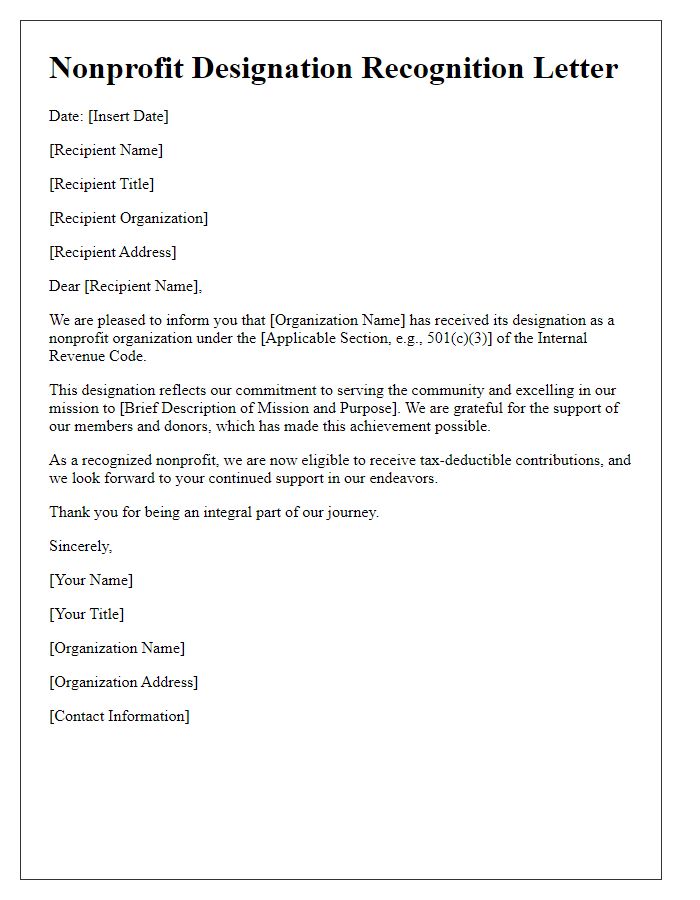

Official Letterhead and Signatory Details

Nonprofit organizations, such as charitable foundations, often require confirmation of their nonprofit status for various purposes, including grant applications, tax exemptions, and community outreach efforts. The official letterhead typically includes the organization's name, logo, address, and contact information prominently at the top. Below the letterhead, the signatory details consist of the name, title, and any relevant qualifications of the individual authorized to certify the nonprofit status. The date of the letter and recipient information (including name and address of the entity receiving the correspondence) are essential components. Finally, the closing includes a formal sign-off and the signature of the authorized representative, reinforcing the authenticity of the document.

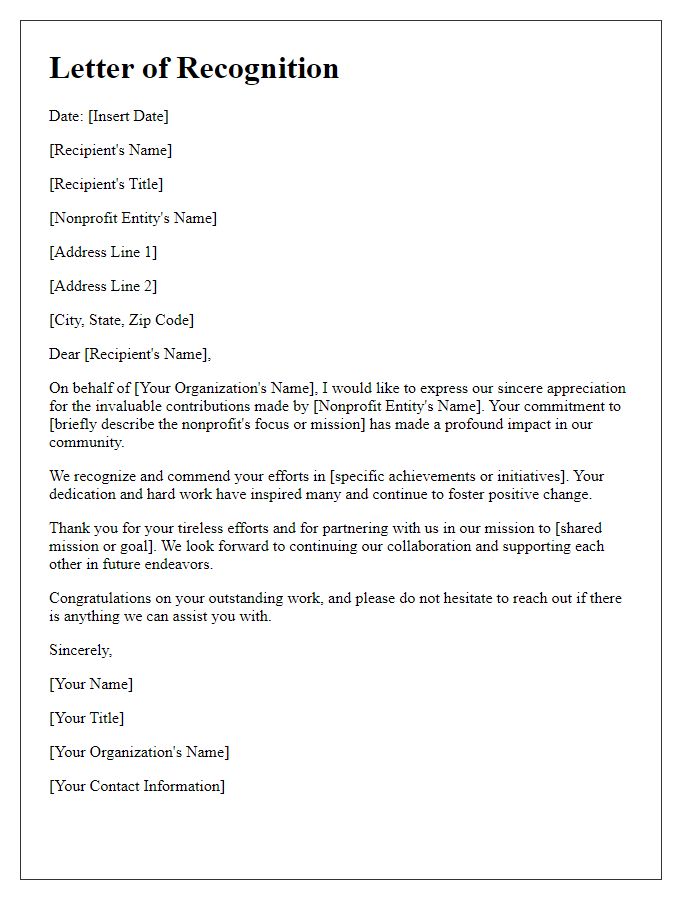

Mission and Purpose Statement

Nonprofit organizations with a clear mission and purpose statement focus on community service, education, or social welfare. A well-defined mission, typically no more than a few sentences, articulates the organization's goals. Purpose statements elaborate on the specific activities undertaken to achieve these goals. For example, an organization dedicated to environmental conservation may state its mission as "to protect and restore natural habitats" while detailing initiatives such as reforestation projects, community clean-up events, and educational workshops. This clarity fosters transparency and effectiveness in securing funding, attracting volunteers, and engaging stakeholders in meaningful ways. Furthermore, compliance with IRS regulations for obtaining nonprofit status requires that the mission directly supports charitable objectives, ensuring accountability and alignment with the organization's overarching vision.

Comments