Receiving a tax audit notice can be a nerve-wracking experience, but it doesn't have to be overwhelming. It's essential to approach this situation with a level head and the right information at your fingertips. Understanding the audit process and knowing what to expect can make a significant difference in how you navigate the task ahead. If you're ready to learn more about how to effectively respond to a tax audit notice, keep reading to find valuable tips and insights!

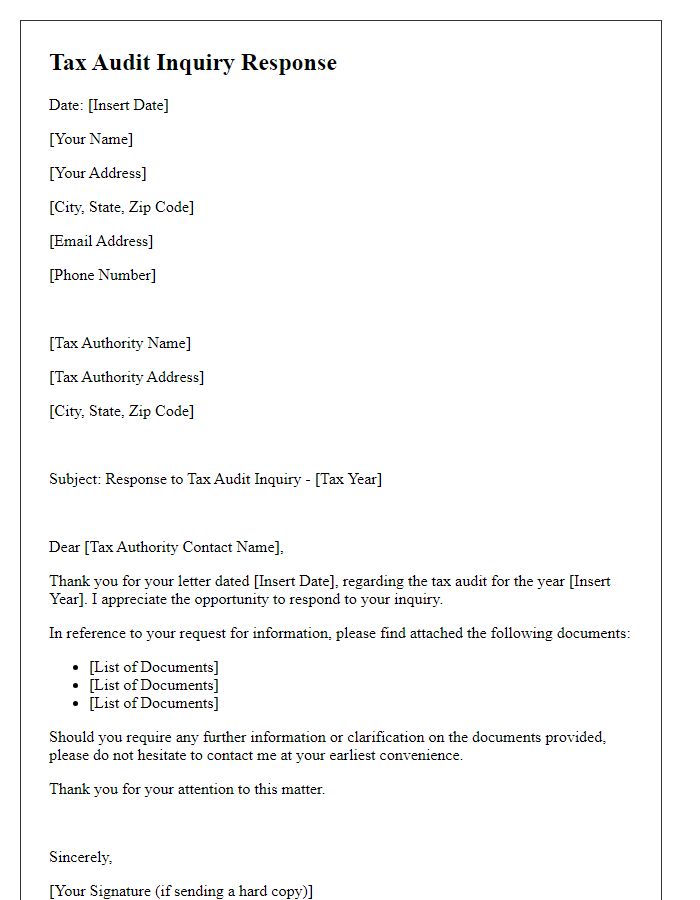

Taxpayer's Identification Information

Tax audit notices require detailed taxpayer identification information for accurate processing. Taxpayer Identification Number (TIN), a unique identifier assigned by tax authorities, is essential for individual or business accounts. Additionally, full name, including middle initial, and complete mailing address ensure proper communication regarding the audit process. Date of birth (DOB) and Social Security Number (SSN) are crucial for individual taxpayers, while Employer Identification Number (EIN) is applicable to businesses. This information establishes the taxpayer's identity and facilitates a smooth audit procedure by the Internal Revenue Service (IRS) or relevant government agency.

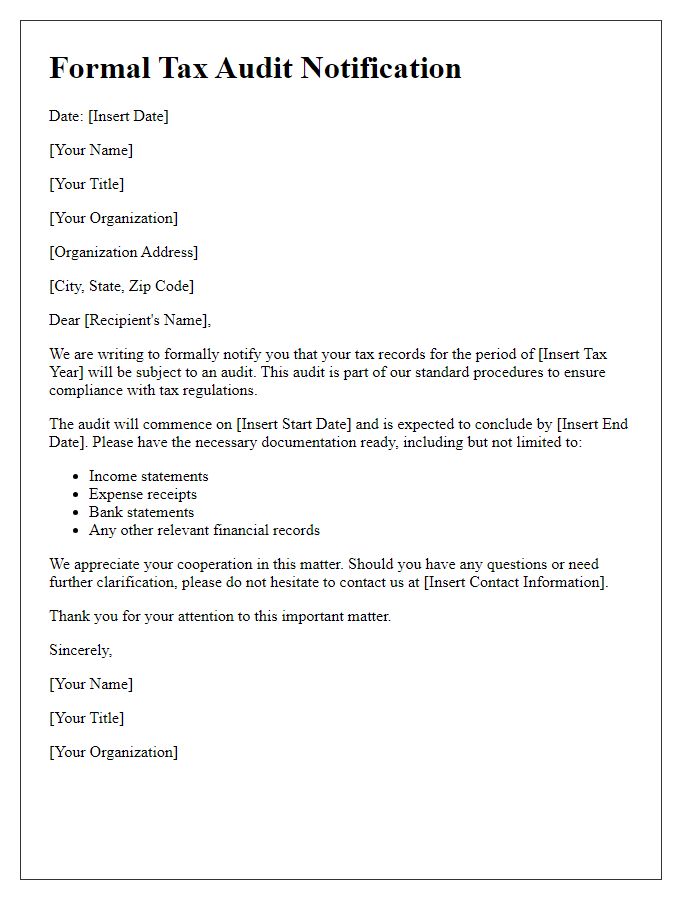

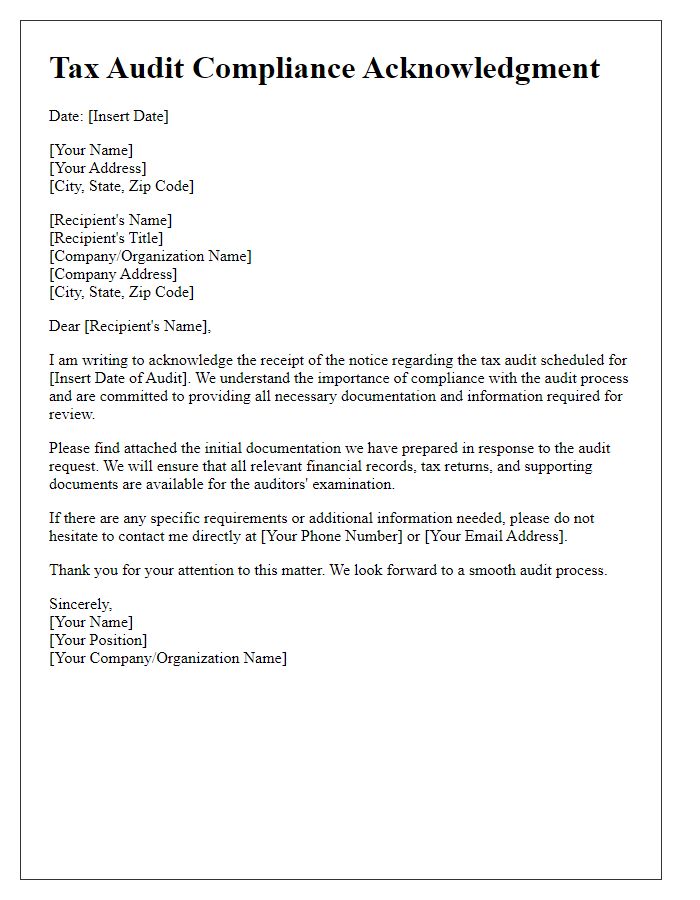

Audit Scope and Purpose

Tax audit notices serve as formal notifications from revenue authorities, such as the Internal Revenue Service (IRS) in the United States, regarding the examination of an individual's or entity's financial records. The purpose of this audit typically includes verifying compliance with tax laws, ensuring the accuracy of reported income, deductions, and credits, and identifying any discrepancies or understatements in tax liabilities. The audit scope may encompass a range of years, often covering three to six previous tax filings, depending on the specific triggers for the audit, such as significant changes in income or suspicious claims. Areas of focus might include business expenses, reported income from various sources, and potential unreported earnings. Notably, taxpayers are encouraged to maintain thorough documentation of their financial activities, as this can facilitate a smoother audit process and reduce potential penalties arising from non-compliance.

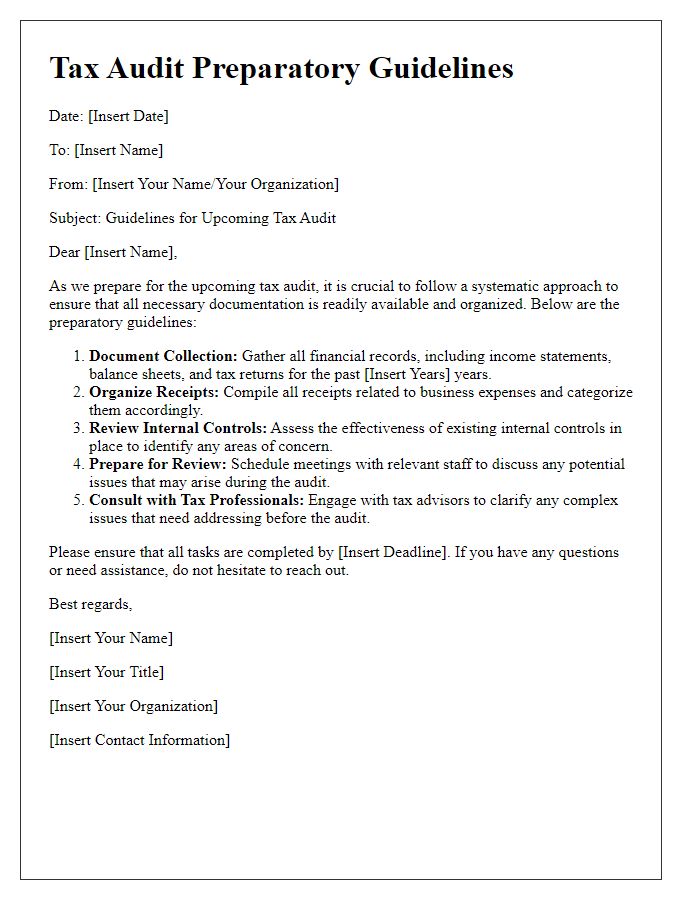

Required Documentation and Deadline

A tax audit notice requires specific documentation and adherence to strict deadlines to ensure compliance. Taxpayers must gather essential records, including W-2 forms (documenting wage and tax information), 1099 forms (reporting various types of income received), and receipts for deductible expenses (such as charitable contributions or business expenses). Additional documentation may include bank statements and records of any significant transactions that occurred during the audit period, often spanning the last three years. The deadline for submission is typically set at 30 days from the date of the notice, emphasizing the importance of timely compliance to avoid potential penalties. Understanding this process is crucial for successful tax management during audits imposed by the Internal Revenue Service (IRS) or state tax authorities.

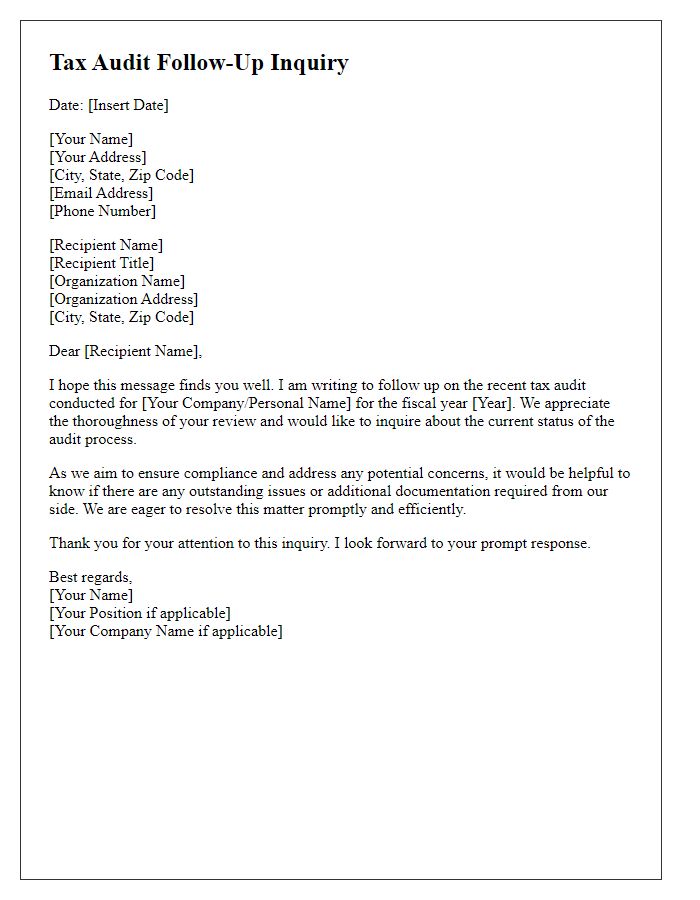

Contact Information for Audit Officer

A tax audit notice typically includes crucial contact information for the audit officer assigned to a taxpayer's case, ensuring effective communication during the auditing process. The contact information usually details the full name of the audit officer, such as John Smith, along with the official title, such as Senior Tax Auditor. The notice should also provide the official mailing address for the audit officer's department, often located at specific government buildings, such as the Internal Revenue Service office at 500 W. Madison St, Suite 2100, Chicago, IL. Additionally, the notice should include the audit officer's direct phone number, such as (312) 555-0199, and an official email address, like john.smith@irs.gov, which facilitates quick correspondence and clarifications regarding the audit. Hours of availability for communication should be specified, typically between 9 AM to 5 PM, Monday to Friday, ensuring taxpayers know when to reach out for assistance.

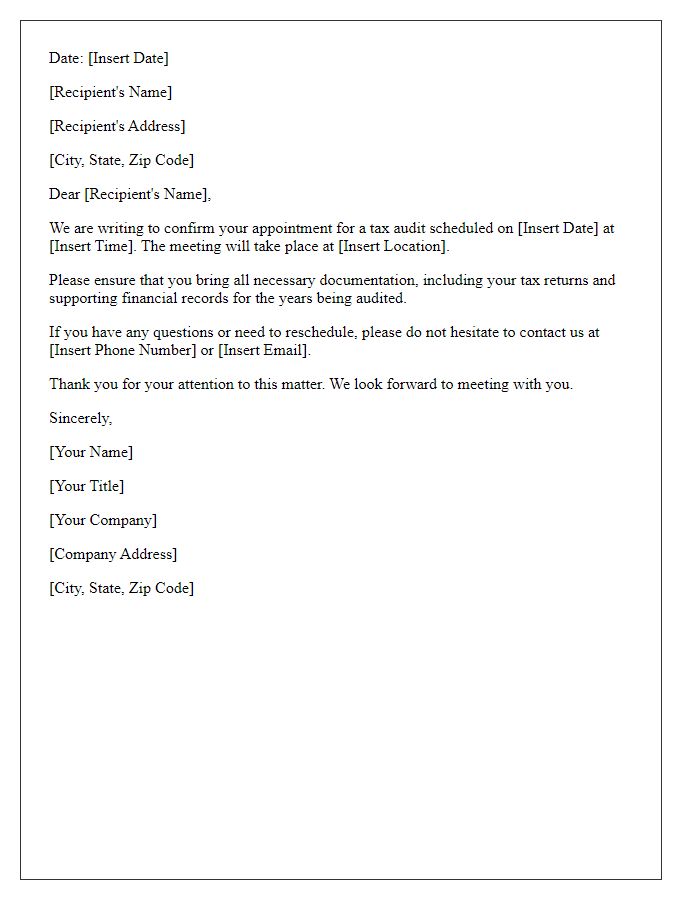

Rights and Responsibilities of the Taxpayer

Tax audits can significantly impact an individual's financial responsibilities and legal standing. Taxpayers, such as individuals or businesses, have specific rights during an audit process. These rights include the ability to receive clear information about the audit timeline, payment structures, and the right to contest findings, often under Internal Revenue Service (IRS) regulations. Responsibilities include providing accurate financial documentation, timely responses to audit requests, and compliance with relevant laws. Understanding these dynamics ensures taxpayers navigate audits effectively, protecting financial interests and adhering to legal obligations.

Comments