As your insurance policy approaches its renewal date, it's essential to stay informed and ensure you're adequately covered for the coming year. Navigating the renewal process can feel overwhelming, but it doesn't have to be. This is a great time to assess your current coverage and make any necessary adjustments to fit your evolving needs. Ready to learn more about how to seamlessly renew your insurance policy? Let's dive in!

Policy Details and Coverage Summary

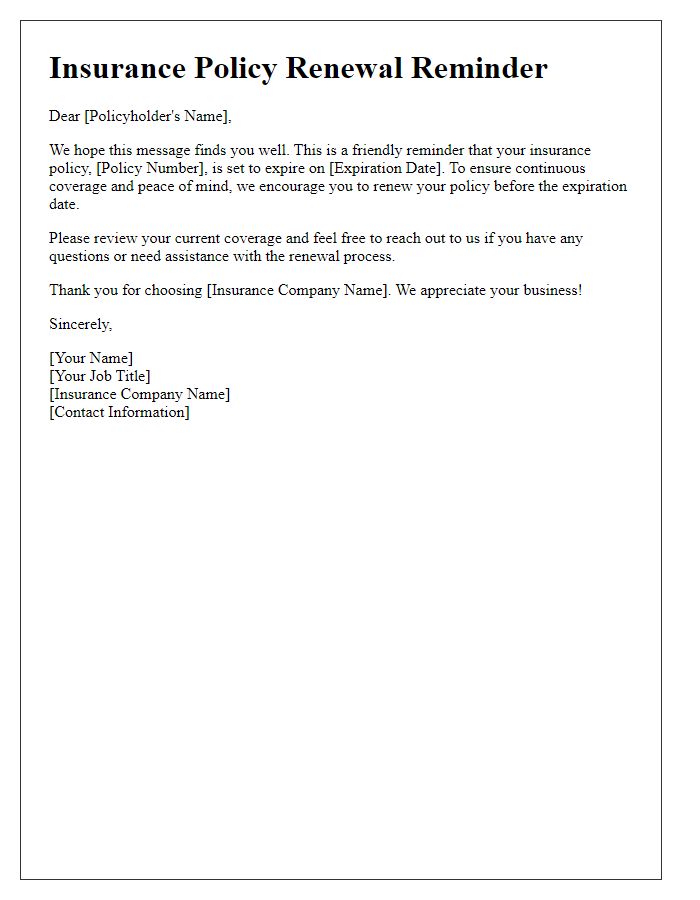

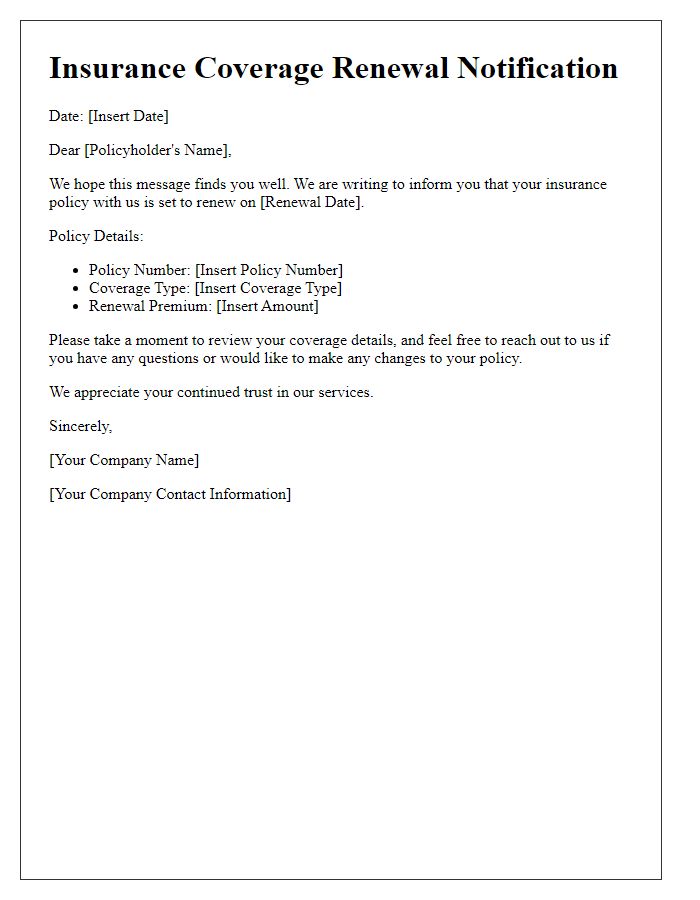

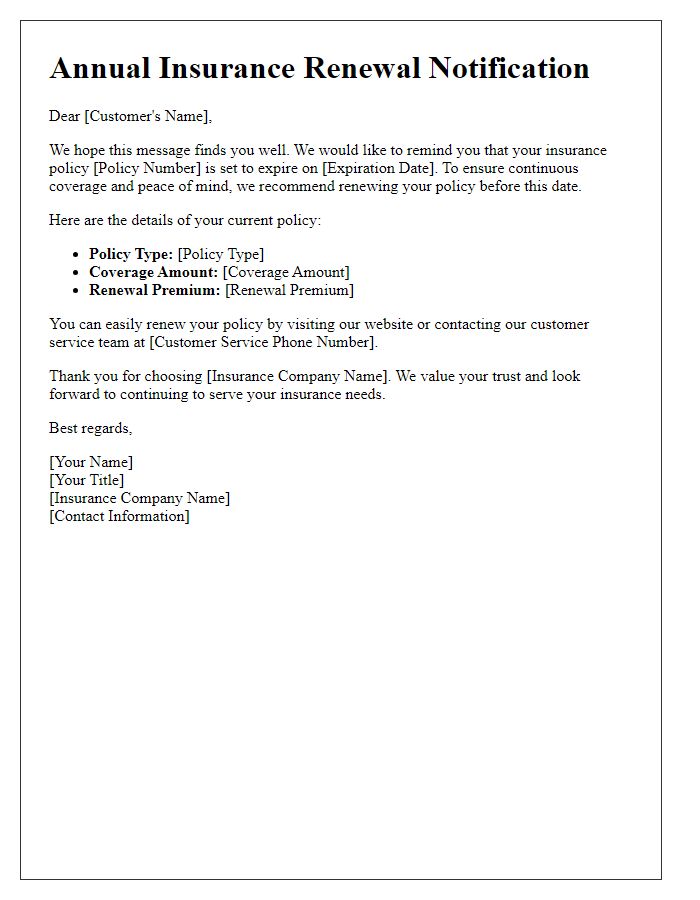

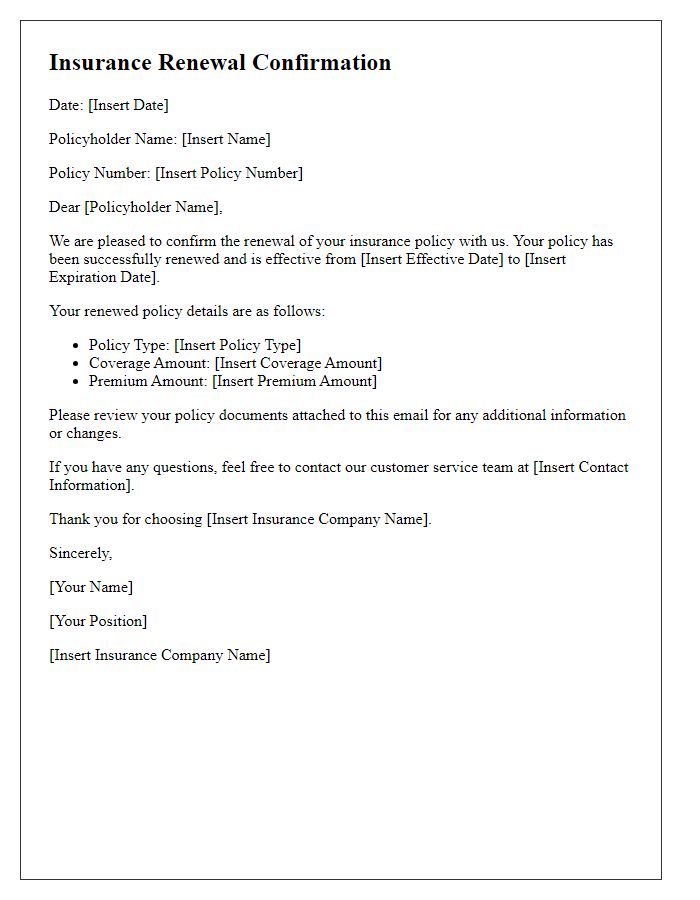

Insurance policy renewal notices serve as important reminders for policyholders about their current coverage and terms. The document typically includes critical details such as the policy number, which uniquely identifies the agreement between the insurer and the insured. Coverage summary encompasses various aspects such as liability limits, deductible amounts, and specific inclusions or exclusions relevant to the policy type, whether it is auto, home, or health insurance. Renewal date, usually indicated clearly, signifies the last day of the current coverage period and emphasizes the necessity to confirm renewal to avoid lapses in protection. Premium amount due is another essential detail, outlining the cost associated with the policy coverage, often reviewed annually to reflect changes in risk or claims history. Additionally, changes in terms or conditions may be highlighted to inform the policyholder of any adjustments that could impact their coverage.

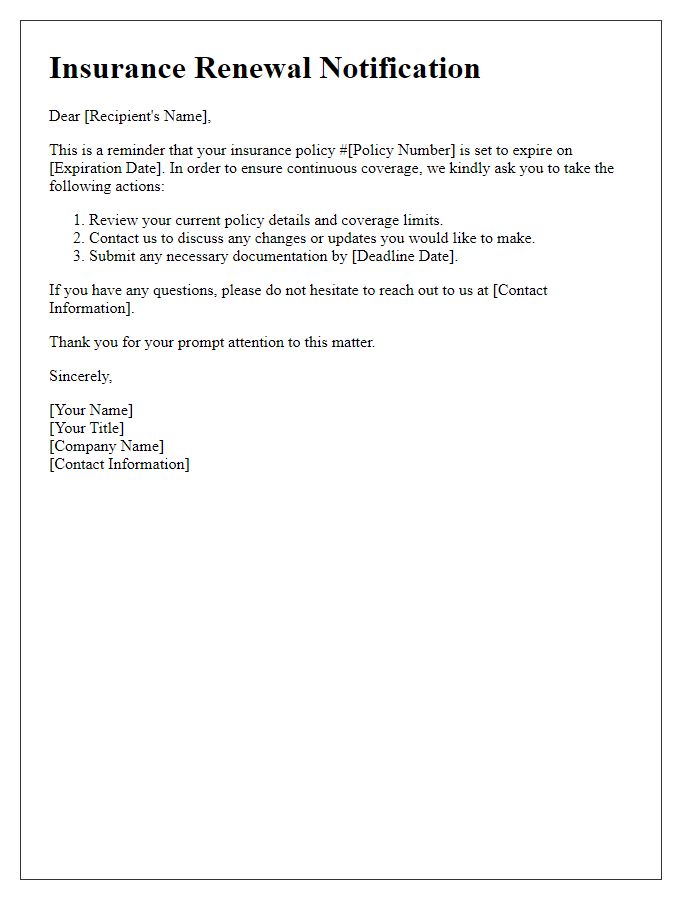

Renewal Premium and Payment Options

Insurance renewal notices typically include essential details regarding the renewal premium along with various payment options available for policyholders. The renewal premium amount, which is often subject to change based on factors like claims history and risk assessment, should be clearly stated. Payment options can vary significantly; common choices include a one-time full payment, monthly installments, or quarterly payments, allowing flexibility for policyholders. The notice may also mention deadlines for payment to avoid any lapses in coverage and indicate methods of payment, such as online bank transfers, credit card payments, or traditional checks sent via postal service, ensuring easy accessibility for customers. Contact information for customer support should be provided, allowing policyholders to address questions or concerns efficiently.

Renewal Terms and Conditions

Insurance renewal notices typically outline key aspects related to the renewal process, including policy coverage, premium amounts, and changes in terms and conditions. As the renewal date approaches, policyholders receive detailed information regarding the premium due, which may vary based on factors such as claims history, risk assessment, and coverage limits. For instance, a homeowner's insurance policy may see an increase in premium after a claim related to fire damage or significant natural events in the area. Renewals also include updates on any modifications to coverage terms or exclusions, ensuring clients are aware of essential aspects that impact their protection. It is crucial for insured individuals to review these notices carefully, as lapses may result in coverage gaps and potential financial losses.

Contact Information for Queries

Insurance renewal notices often include essential contact information for queries, facilitating clear communication between policyholders and insurance providers. Customer service numbers, such as toll-free lines for immediate assistance, and dedicated email addresses ensure that clients can receive prompt responses to their questions regarding policy updates, payment options, or changes in coverage. Additionally, physical office addresses may be provided for clients who prefer in-person consultations. Comprehensive FAQs on company websites serve as a valuable resource, addressing common concerns related to policy renewals. Lastly, including hours of operation is critical, with many providers operating during standard business hours, typically 9 AM to 5 PM local time, ensuring clients know when support is available.

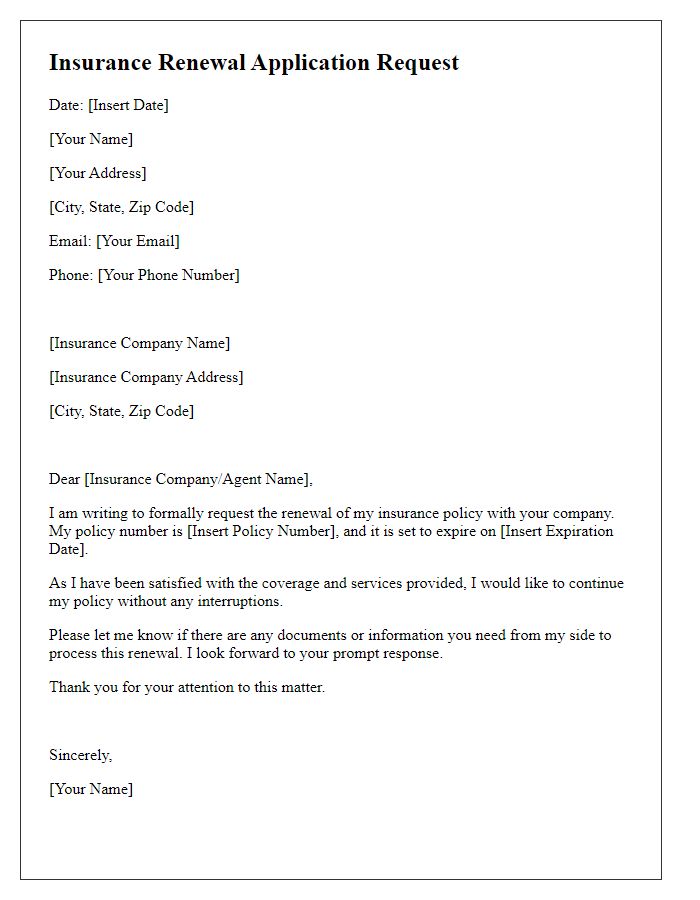

Call to Action for Renewal Confirmation

Insurance renewal notices serve as crucial reminders for policyholders to maintain their coverage and avoid any lapse in protection. Customers typically receive these notices 30 days prior to their renewal date, prompting them to review policy details and confirm renewals. The notice may specify important information such as the policy number, premium amount, and coverage limits. In addition, it often highlights changes in terms or conditions that may have occurred since the last renewal. Insurers may include a call to action, urging customers to visit their online portal or contact customer service to confirm their renewal. This proactive approach ensures customers remain informed and engaged, ultimately leading to a smoother renewal process.

Comments