When it comes to making a difference in our community, every contribution counts, and tax-deductible donations play a vital role in supporting valuable causes. If you've recently made a generous gift, it's essential to receive a confirmation letter that not only acknowledges your support but also outlines the tax benefits associated with your donation. This letter serves as an important record for your tax filings, ensuring you can maximize your tax savings while making a positive impact. Curious about how to craft the perfect confirmation letter? Keep reading to discover our handy template!

Donor's full name and address

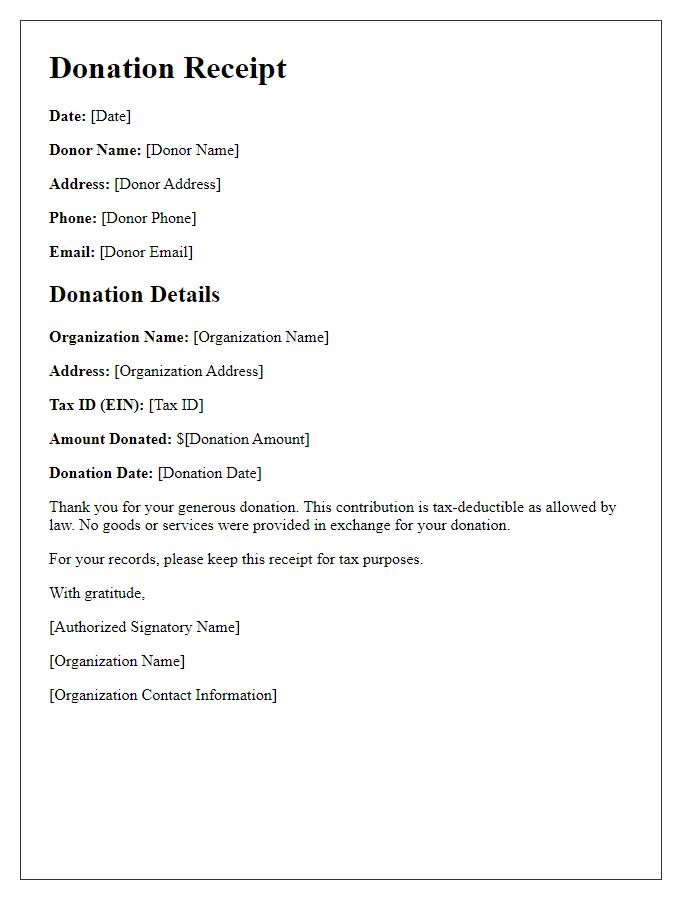

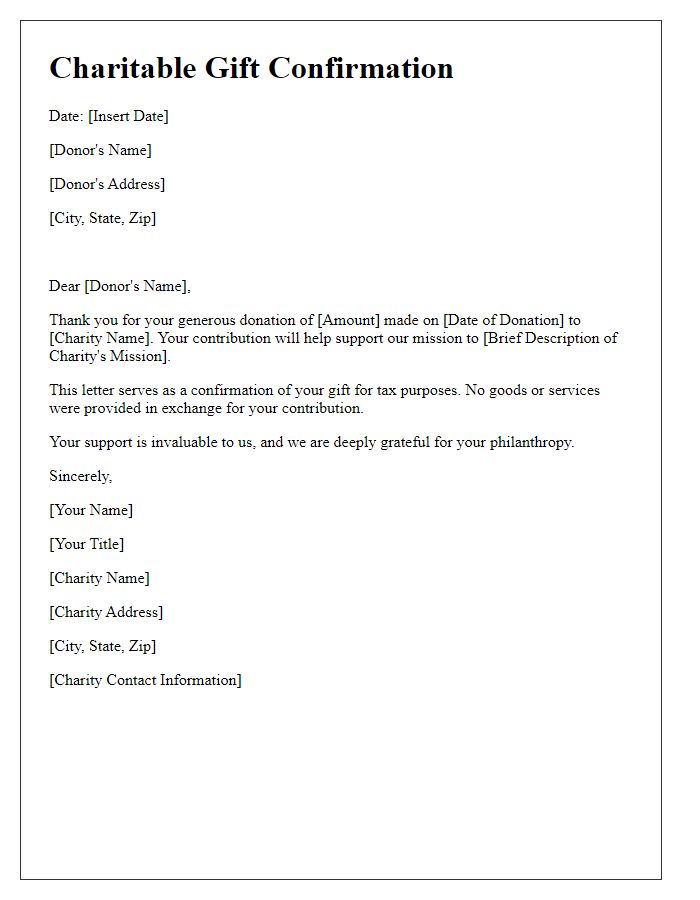

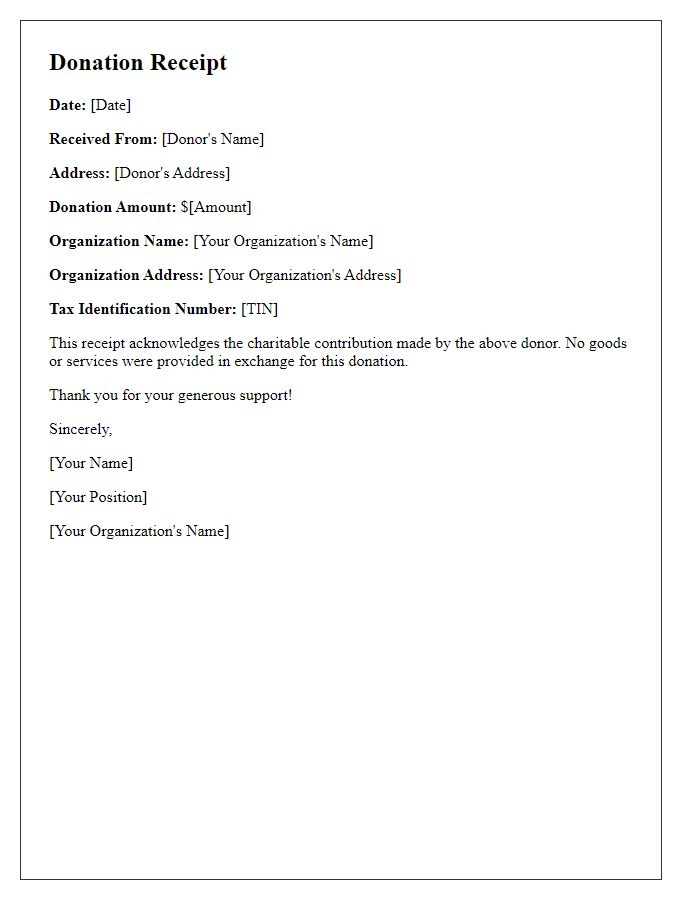

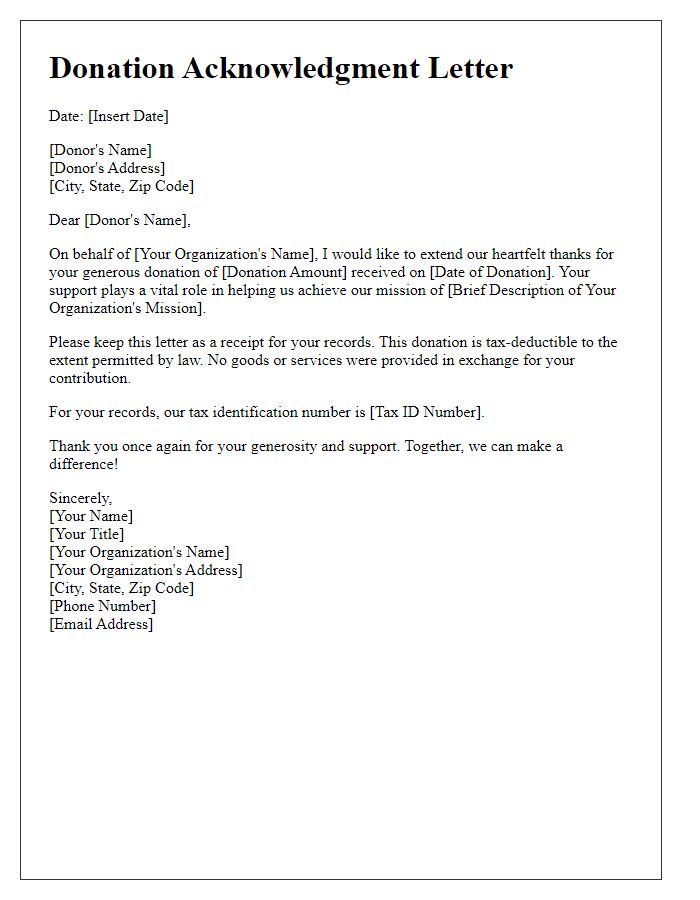

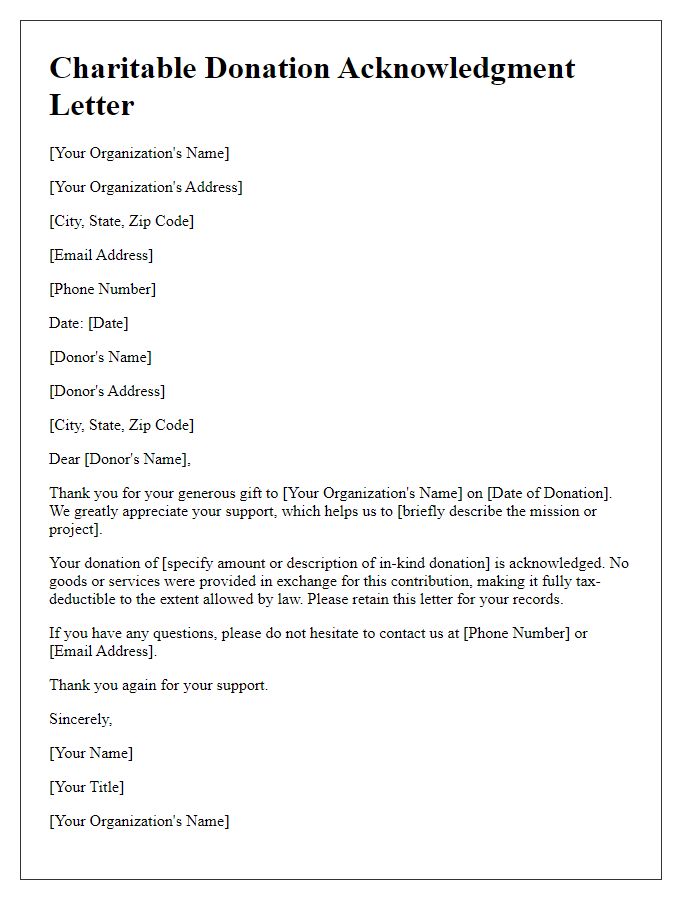

Tax-deductible donations provide essential support for nonprofit organizations, allowing them to continue their vital missions. For individuals making contributions, it is important to receive official confirmation, which includes the donor's full name, such as "John Doe," and complete address, like "123 Maple Street, Springfield, USA." This information not only validates the transaction but also ensures compliance with Internal Revenue Service (IRS) regulations regarding charitable contributions. Donors must retain this documentation for their tax records, allowing them to claim deductions on their annual tax returns accurately. Clarity and correctness of this information are crucial for both the organization and the donor's financial and legal records.

Donation amount and date

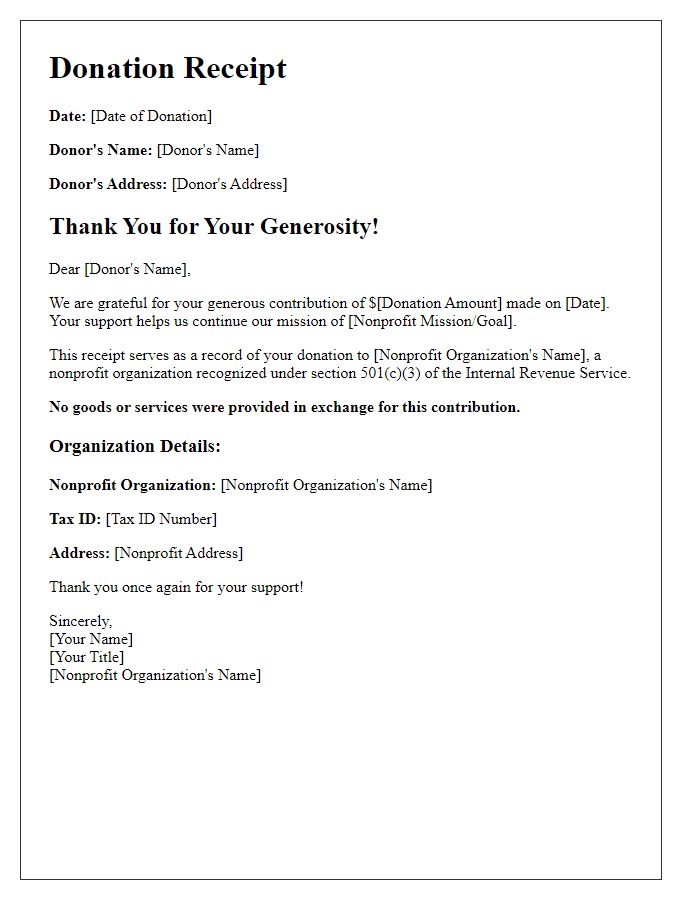

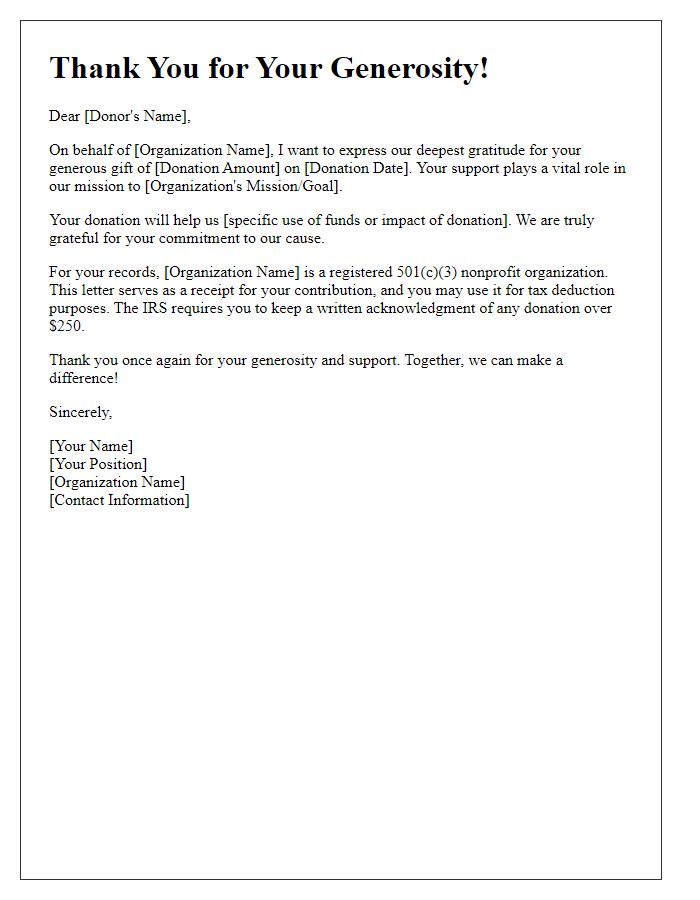

A tax-deductible donation confirmation receipt contains essential details such as the donation amount, which can substantially impact the donor's tax return, and the date of the donation, which establishes eligibility for tax benefits. Organizations typically include the recipient's legal name, status (501(c)(3) in the U.S. for non-profit entities), and a statement affirming that no goods or services were exchanged for the donation. Including the organization's tax identification number helps streamline the donation process. Proper documentation ensures compliance with IRS regulations, assisting donors in maximizing their potential deductions during tax filing periods.

Organization's tax-exempt status and ID

The organization, XYZ Charity, holds a 501(c)(3) tax-exempt status, confirmed by the IRS, allowing donations to be tax-deductible for contributors. The organization's Tax Identification Number (EIN) is 12-3456789, which affirms its eligibility for tax-deductible contributions. XYZ Charity engages in various community initiatives aimed at improving education for underprivileged children in Chicago, Illinois, serving over 1,000 families annually. Donations received support vital programs including after-school tutoring, literacy workshops, and college readiness seminars. Each contribution empowers local youth to achieve their educational goals and fosters a brighter future for the community.

Description of donation purpose

A tax-deductible donation confirmation serves as a formal acknowledgment for contributions made to nonprofit organizations. This confirmation includes essential details, such as the donor's name and address, the donation amount, and the date of the contribution (often the fiscal year). The document also describes the purpose of the donation, which may support specific programs, community events, ongoing projects, or operational costs. Nonprofits, like educational institutions or humanitarian organizations, often specify how funds will be used to promote transparency and accountability. This clarification helps donors understand the impact of their support and reinforces their commitment to charitable initiatives.

Statement confirming no goods or services received

Tax-deductible donations play a crucial role in supporting charitable organizations. A receipt for such contributions typically includes a statement confirming that no goods or services were provided in exchange for the donation. This statement ensures compliance with IRS regulations, particularly for donations over $250, emphasizing the donor's eligibility for tax deductions. The confirmation document specifies essential details such as the donation amount, the organization's name (e.g., The American Red Cross), the date of the donation, and the purpose of the contribution, reinforcing transparency and trust between the donor and the organization. This acknowledgment not only fulfills legal requirements but also enhances the donor's experience, encouraging future contributions.

Letter Template For Tax-Deductible Donation Confirmation Samples

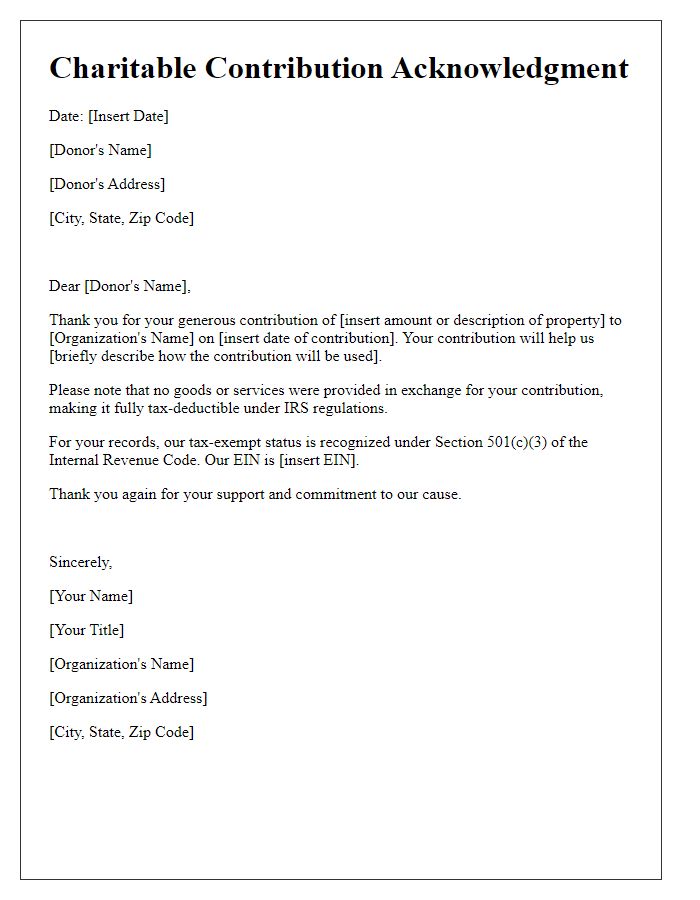

Letter template of charitable contribution acknowledgment for tax purposes

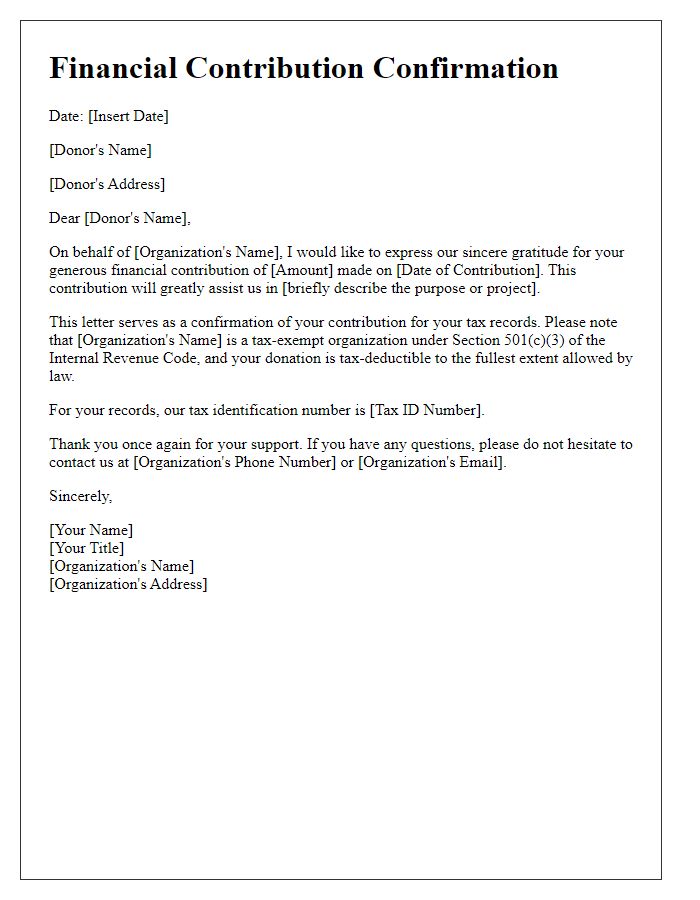

Letter template of financial contribution confirmation for tax deduction

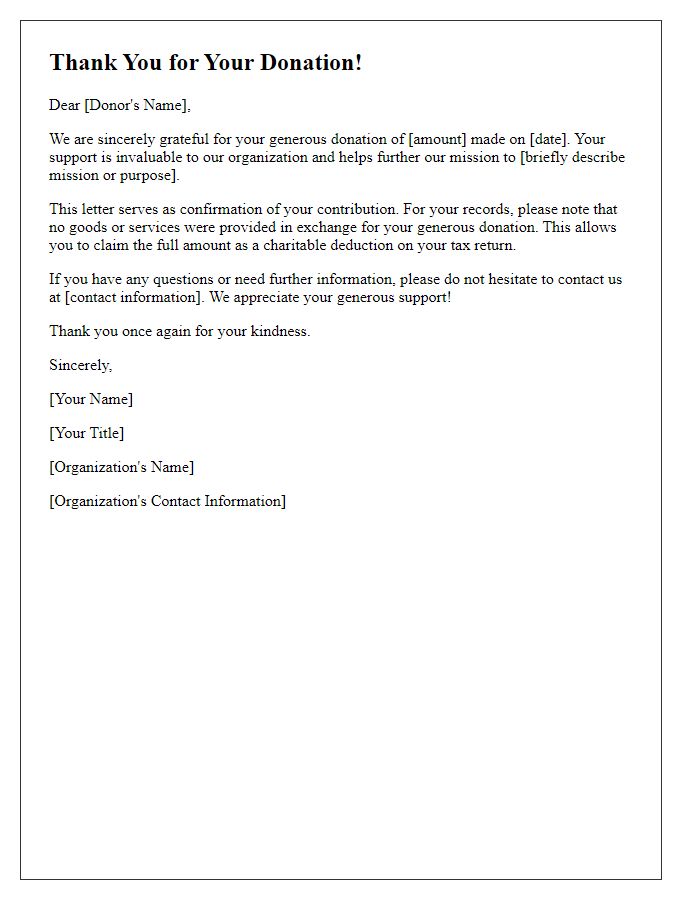

Letter template of thank you donation confirmation for tax documentation

Comments